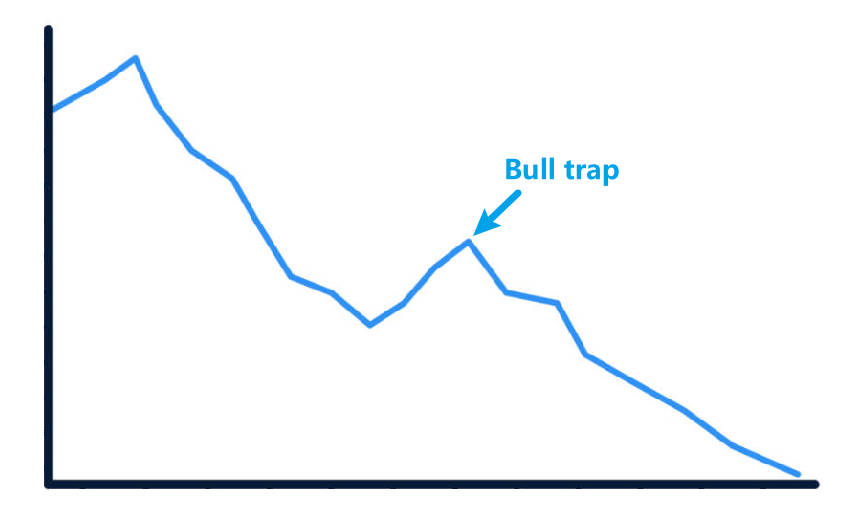

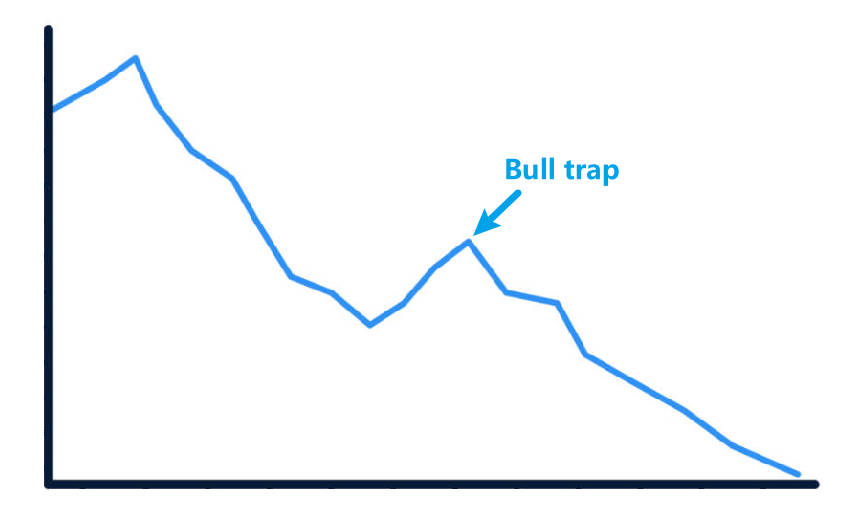

A bull trap occurs when a market appears to break higher, drawing in buyers, only for the price to reverse sharply and decline.

It's a deceptive pattern that catches traders off guard, turning optimism into sudden loss. Understanding the bull trap meaning is essential for anyone who trades in volatile markets.

This article explains why bull traps form, how to identify them with technical and behavioural cues, and how prudent traders mitigate risk or exploit the reversal.

What a Bull Trap Means

A bull trap occurs when an apparent breakout above a resistance level or a convincing upward move induces market participants to take long positions, only for the price to reverse rapidly and decline.

The term emphasises the entrapment of bullish traders who commit capital under the false impression that a bullish trend has resumed or established itself.

Key characteristics of a bull trap:

A breakout or strong upward move that attracts buying interest.

Relative weakness beneath the surface, typically evidenced by low volume or negative momentum divergence.

A subsequent rapid reversal that invalidates bullish positions and often accelerates selling.

This definition highlights that a bull trap is not merely a pullback; it is a specific pattern in which mean expectations of continuation are violated and result in losses for those who enter on the apparent strength.

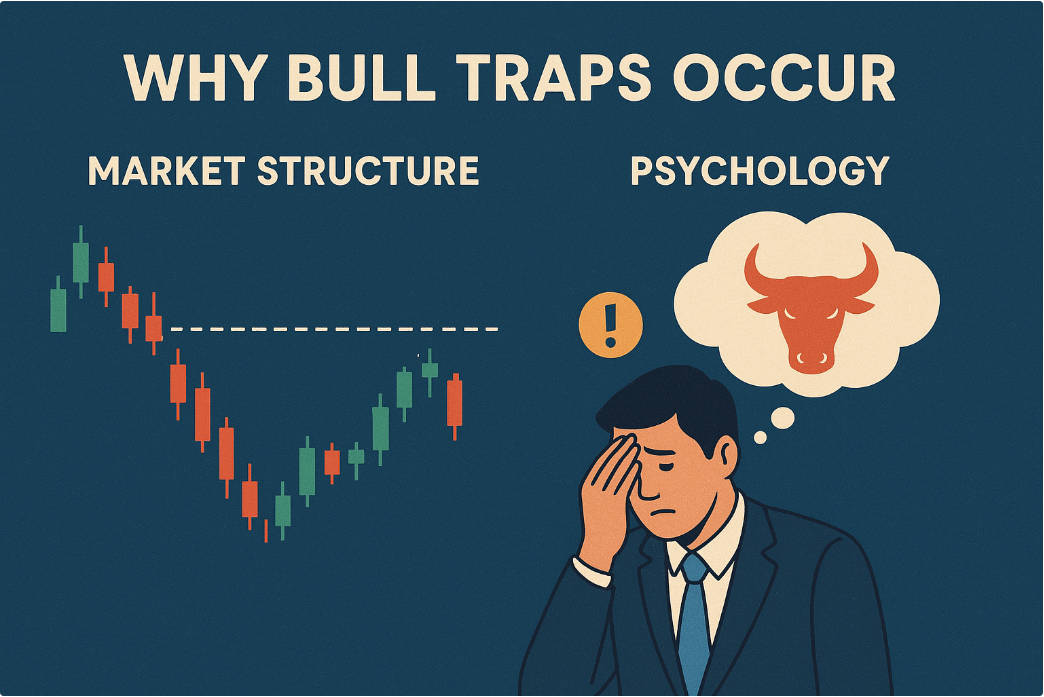

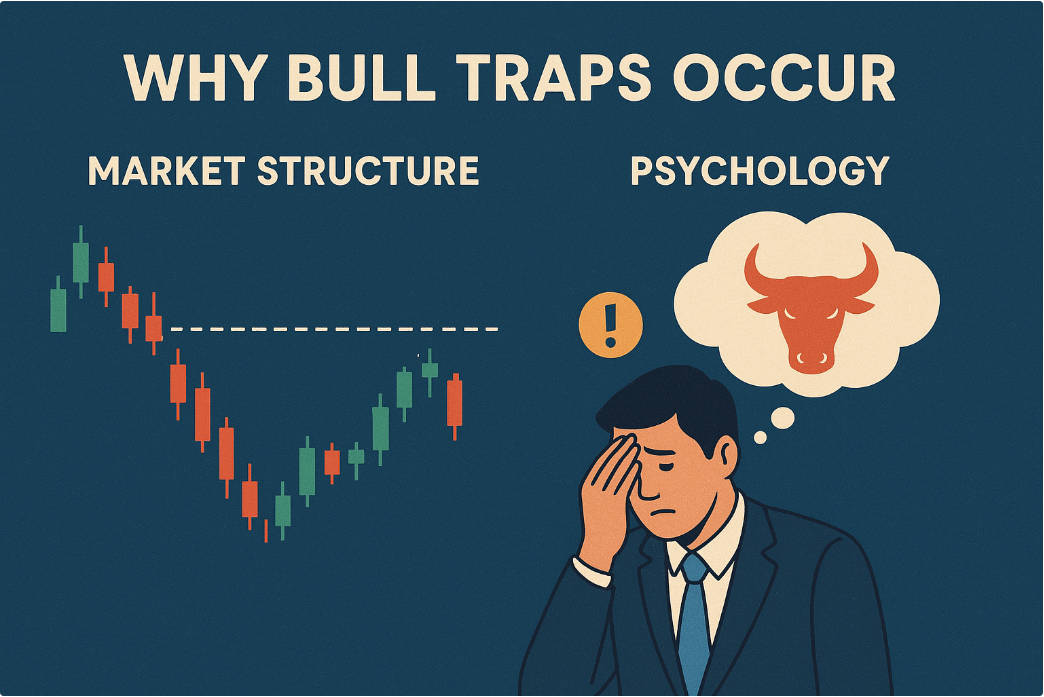

Why Bull Traps Occur: Market Structure and Psychology

Bull traps arise from a combination of market structure and participant psychology.

1. Market structure factors

Downtrends and consolidations produce frequent false breakouts because supply remains higher than demand, even when price moves briefly above resistance.

Low liquidity or thin trading during the breakout permits a small number of buyers to lift price temporarily without broad-based participation.

News events or algorithmic activity can produce rapid spikes that lack sustained follow-through.

2. Behavioural drivers

Fear of missing out leads traders to enter on breakouts without adequate confirmation.

Confirmation bias prompts traders to interpret ambiguous signals as support for a bullish view.

Herd behaviour amplifies initial buying, creating a superficial appearance of strength.

Understanding these causes is essential because they determine both the signal quality of a breakout and the means by which traders should validate or dismiss it.

How to Identify a Bull Trap: Technical and Contextual Signals

Identification combines technical indicators with contextual assessment. No single indicator is definitive; rather, effective identification rests on a convergence of warning signs.

1. Technical signals

Volume profile:

Breakouts that occur on lower-than-average volume are suspect. A legitimate breakout typically coincides with increased volume signalling widespread participation.

Momentum divergence:

When the price makes a higher high but momentum indicators, such as RSI or MACD, fail to confirm, the breakout may lack strength.

Failed retest:

A common pattern is a breakout followed by a rapid decline below the breakout point after a weak or failed retest.

Candle structure:

Long wick or shooting-star style candles following a breakout indicate rejection of higher prices.

2. Contextual signals

Macro backdrop:

Weak macro data or tightening liquidity often supports the probability of false breakouts.

Sector leadership:

If the breakout occurs in a lagging sector or stock without sectoral confirmation, the risk of a bull trap increases.

News quality:

Headlines that are ambiguous, non-fundamental, or short-lived (for example, rumours) are less likely to produce sustainable moves.

Checklist to identify a bull trap

| Signal Category |

Positive confirmation for breakout |

Warning sign for bull trap |

| Volume |

Increasing volume on breakout |

Low or declining volume |

| Momentum |

Indicator confirms higher highs |

Divergence or weakening momentum |

| Price action |

Clean breakout and sustained retest |

Rejection candles, failed retest |

| Context |

Supportive macro and sector data |

Weak economy or ambiguous news |

Practical Example: a Step-by-step Bull Trap Case Study

The following is a representative scenario used to explain mechanics and decision points.

1. Preceding context

2. Breakout event

3. Initial reaction

4. Warning signs emerge

5. Reversal

6. Outcome

This stepwise account emphasises the importance of volume confirmation, momentum alignment, and the utility of stops and position sizing.

Strategies to Avoid Being Caught in a Bull Trap

Risk management and entry discipline are primary defences against bull traps.

1. Require confirmation

Wait for a retest of the breakout level that holds as support or for a second session of strong volume before initiating a full-sized position.

2. Adopt scaled entries

Enter immediately with a small initial position and scale in only after verification of strength.

3. Use defined stop-losses

Place stops at levels that reflect technical invalidation rather than arbitrary percentages. For example, beneath the breakout candle low or beneath a structural support level.

4. Assess trade-to-risk ratio

Accept only trades where the potential reward sufficiently exceeds the defined risk.

5. Monitor liquidity and news flow

Avoid initiating positions on breakouts that coincide with ambiguous or unverified news and in low-liquidity environments.

These practices reduce the likelihood and impact of entries that coincide with false breakouts.

How professional traders may exploit bull traps

Experienced traders treat failed breakouts as actionable events. Typical approaches include:

1. Shorting the failed breakout

Enter a short position once price falls back below the breakout level and confirms weakness, with a stop above the recent high.

2. Put purchase or options strategies

Use options to limit downside risk while capitalising on an expected decline.

3. Use of confirmation tools

Employ volume-weighted average price (VWAP), order flow, or market profile to confirm the exhaustion of buyers before initiating a short.

Exploitation requires strict risk control because the market can reassert bullish strength; therefore, these strategies should be implemented with disciplined stops and position sizing.

Bull Trap versus Bear Trap

| Feature |

Bull Trap |

Bear Trap |

| Direction of initial move |

Upwards past resistance |

Downwards below support |

| Trapped participants |

Long buyers |

Short sellers |

| Typical market context |

During downtrends or range-bound markets |

During uptrends or corrective rallies |

| Identification |

Low volume, momentum divergence |

Low volume on sell-off, lack of follow-through on downside |

| Typical exploitation |

Short after confirmation |

Long after confirmation |

Conclusion

A bull trap is a defined market phenomenon in which an apparent bullish breakout proves illusory and reverses, inflicting losses on traders who entered on the breakout.

Professional handling of breakouts requires a combination of technical confirmation, contextual analysis, disciplined risk management, and clearly defined trade rules.

By adopting rigorous verification standards and appropriate trade management techniques, traders can reduce their vulnerability to bull traps and, where appropriate, convert failed breakouts into profitable opportunities.

Frequently asked questions (FAQ)

Q1: What exactly causes a bull trap to form?

A bull trap typically forms when insufficient buying power supports a breakout. Contributing factors include low volume, transient algorithmic or news-driven spikes, and prevailing bearish sentiment that reasserts itself after an initial move.

Q2: How can volume be used to distinguish a genuine breakout from a bull trap?

A genuine breakout is normally accompanied by a noticeable increase in traded volume relative to recent averages, which indicates broad participation. Conversely, breakouts on below-average volume suggest the move is not broadly supported and therefore more likely to fail.

Q3: Should I always wait for a retest before entering a breakout trade?

Waiting for a retest improves the probability that the breakout is genuine, but it is not mandatory. Traders with shorter time horizons may scale into positions or use smaller initial sizes. The crucial element is to have clear entry rules, defined stops, and a rationale for the chosen approach.

Q4: Can algorithmic traders create bull traps, and how should retail traders respond?

Yes, algorithms can exacerbate false breakouts through rapid execution and liquidity-taking behaviours. Retail traders should respond by demanding higher confirmation standards, avoiding entries based on single-session spikes, and respecting liquidity and order-flow signals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.