Currency trading is gaining traction among Indian investors as an alternative to traditional stock and commodity markets. It offers the opportunity to profit from fluctuations in exchange rates between currencies.

While it can be rewarding, currency trading also requires knowledge, strategy, and discipline. For Indian traders, understanding the unique dynamics of the local market is essential to succeed.

This comprehensive guide outlines 10 expert tips to help you make money with currency trading in India. Regardless of whether you're a beginner or aiming to enhance your abilities, these insights will steer you towards more lucrative choices.

Currency Trading in India: 9-Step Guide to Make a Profit

1. Understand the Forex Market Structure in India

Before executing your initial trade, it's vital to grasp how the forex market functions in India. In contrast to global markets that operate 24/5, currency trading in India is regulated and permitted solely through currency derivatives on approved exchanges.

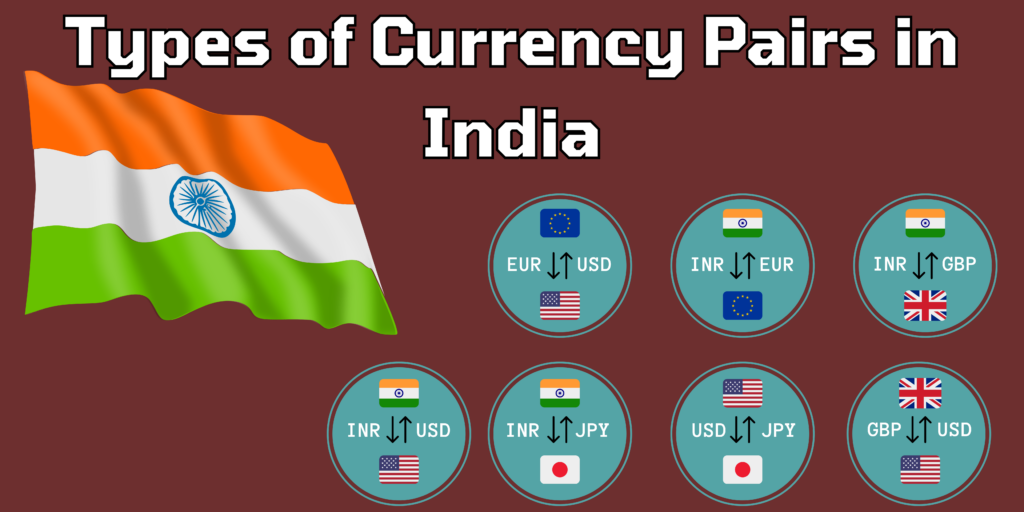

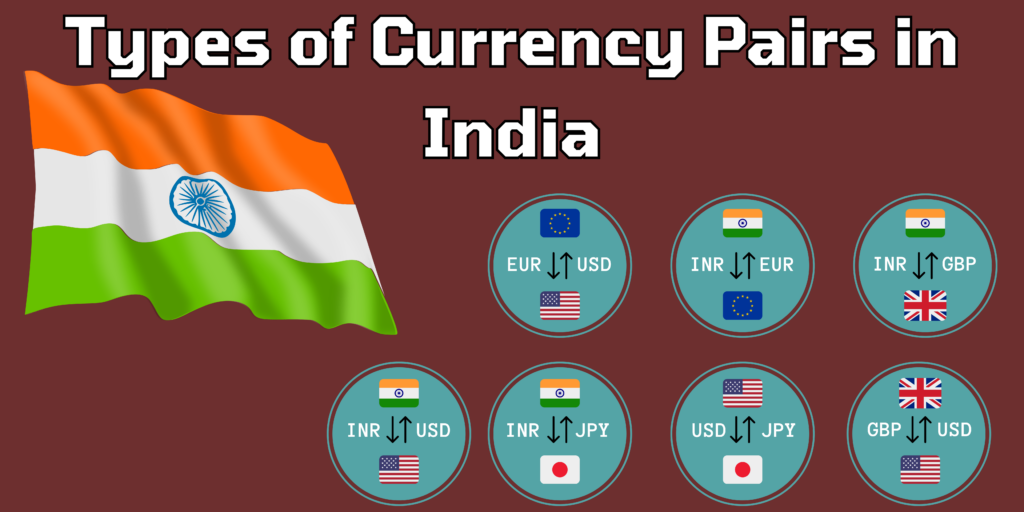

Indian residents can only trade in INR-based currency pairs, such as:

USD/INR

EUR/INR

GBP/INR

JPY/INR

To trade legally and safely, open a forex Trading Account with a regulated broker offering access to these Indian exchanges.

2. Start with a Currency Trading Demo Account

Every successful trader begins with practice. Opening a demo account allows you to experience live market conditions without risking real money. Most registered brokers offer demo platforms with real-time quotes and market functionality.

Use your demo account to:

Spending a few weeks or even months on a demo account helps build confidence and familiarity with how currency markets behave in different scenarios. It's a crucial first step before transitioning to live trading.

3. Choose the Right Currency Pair to Trade

Not all currency pairs behave the same way. In India, you are limited to INR-based currency pairs for legal trading. However, each pair has its unique characteristics.

USD/INR: This is the most liquid and widely traded pair in India. Ideal for beginners due to higher volatility and tighter spreads.

EUR/INR and GBP/INR: These pairs are affected by European market factors and can provide excellent chances with favourable news or trends.

JPY/INR: The yen is considered a safer currency and functions differently, often driven by risk sentiment and economic news from Japan.

Choose a currency pair that aligns with your trading style, risk appetite, and available market research. Sticking to one or two pairs can also help you understand their price behaviour more thoroughly.

4. Focus on Economic News and Events

Macroeconomic elements mainly affect Currency. Indian traders must pay attention to both domestic and international economic events. The following reports often impact forex markets:

RBI monetary policy announcements

Indian GDP growth, inflation, and interest rate data

US Federal Reserve rate decisions

Non-farm payroll (NFP) reports from the US

Eurozone inflation or trade data

Geopolitical tensions or oil price fluctuations

News trading can be risky due to volatility, but understanding the cause-and-effect relationships behind currency movements can improve your timing and profitability.

Stay updated with reliable news platforms. Economic calendars are also essential tools for every forex trader.

5. Develop a Solid Currency Trading Strategy

Jumping into the market without a strategy is one of the fastest ways to lose money. A trading strategy helps you stay consistent and disciplined. Your strategy should outline:

Popular strategies for beginners include:

Trend following: Identifying and trading in the direction of prevailing trends using moving averages or trendlines.

Breakout strategy: Entering trades when the price breaks through significant support or resistance levels.

Range-bound strategy: Capitalising on price movement within defined levels during low-volatility periods.

Select a tactic that aligns with your character, availability, and financial resources. Backtest it in demo conditions before applying it to real trades.

6. Manage Risk Like a Professional

In trading, protecting your capital is just as important as making profits. Poor risk management is the leading reason why beginner traders fail. Here's how to control risk effectively:

Always use a stop-loss order to limit potential losses on each trade.

Never risk more than 1–2% of your capital on a single trade.

Use leverage cautiously. While leverage can magnify gains, it also increases losses. Most brokers offer leverage up to 1:50 on forex derivatives in India.

Avoid overtrading or revenge trading, especially after losses.

Stick to your plan and review your risk settings regularly. In volatile markets, consider tightening stop losses or reducing position sizes.

7. Use Technical Analysis to Refine Your Entry Points

Most Indian forex traders rely on technical analysis. Technical analysis involves studying charts, price patterns, and indicators to forecast potential moves.

Popular indicators for currency trading include:

Relative Strength Index (RSI): Helps identify overbought or oversold conditions.

Moving Averages (MA): Shows trend direction and dynamic support/resistance.

MACD: A momentum-based indicator useful for identifying trend reversals.

Bollinger Bands: Help visualise volatility and potential breakout zones.

Combining technical tools with fundamental insights often yields better results. Avoid cluttering your chart with too many indicators. In the long term, consistency and simplicity prevail.

8. Keep a Trading Journal and Learn from Mistakes

To grow as a currency trader, treat your activity like a business. Maintaining a trading journal is among the most beneficial practices. Log every trade with details such as:

Examine your journal on a weekly or monthly basis to identify trends in your actions. Are you closing trades too early? Are certain strategies more successful than others?

This feedback loop is crucial for continuous improvement. Even professional traders rely on journals to refine their edge.

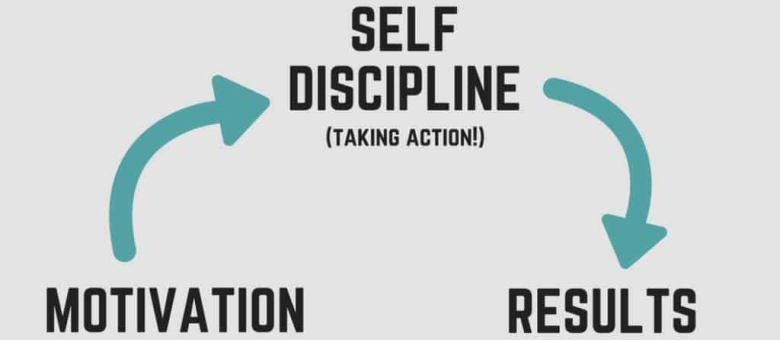

9. Be Patient, Disciplined, and Realistic

Forex trading is not a get-rich-quick scheme. Many Indian traders quit early because they expect instant profits. In reality, trading success takes time, patience, and emotional discipline.

Avoid common pitfalls such as:

Chasing trades after losses

Over-leveraging your account

Following the tips without analysis

Ignoring risk-reward ratios

Trading during low liquidity hours

Set realistic expectations. Even a consistent return of 3–5% per month is considered outstanding in trading. Focus on building a repeatable process rather than aiming for jackpot trades.

Discipline in following your strategy, cutting losses, and learning continuously is the secret to long-term success.

Conclusion

In conclusion, currency trading in India has opened up new opportunities for retail investors and traders looking to diversify beyond equities. However, success in forex markets requires more than intuition. It requires careful planning, specialised skills, risk management, and emotional strength.

Start with education. Engage in a demo account. Be cautious with leverage. And always remember: the real edge in trading comes not from predicting the market, but from managing yourself.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.