The Singapore dollar perched at a more than one-month high though the MAS cut

loosened its monetary policy for the first time in nearly five years. The dollar

clocked its weakest week since November 2023 last week.

The MAS revised its forecast lower for core inflation to average 1%-2% this

year from a previous estimate of 1.5%-2.5%, reflecting the return to low and

stable underlying price pressures.

It allows the currency to move within a band, making adjustment as needed.

Economists pointed out that the policymakers no longer explicitly flag the

''two-way” risks on inflation.

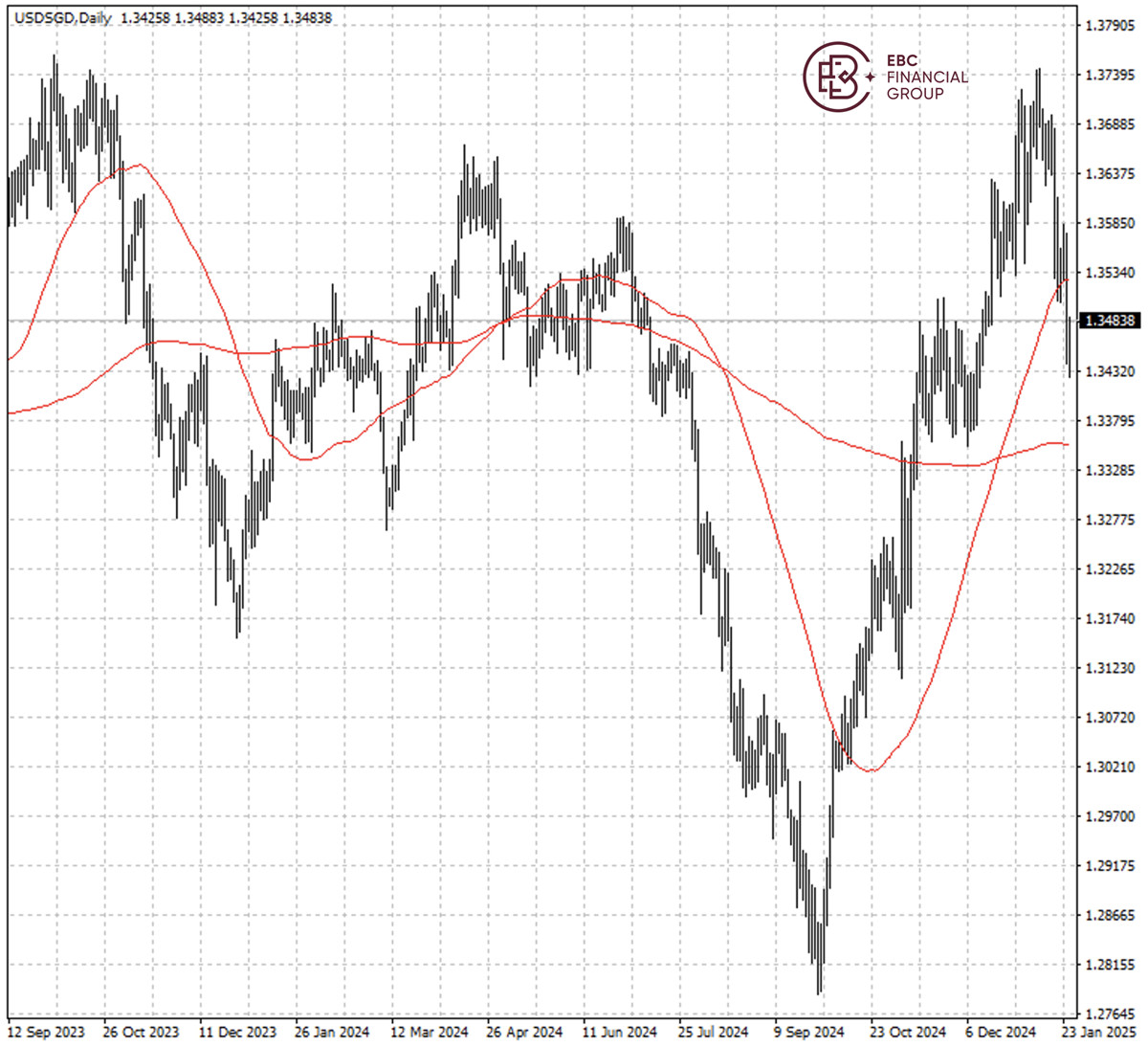

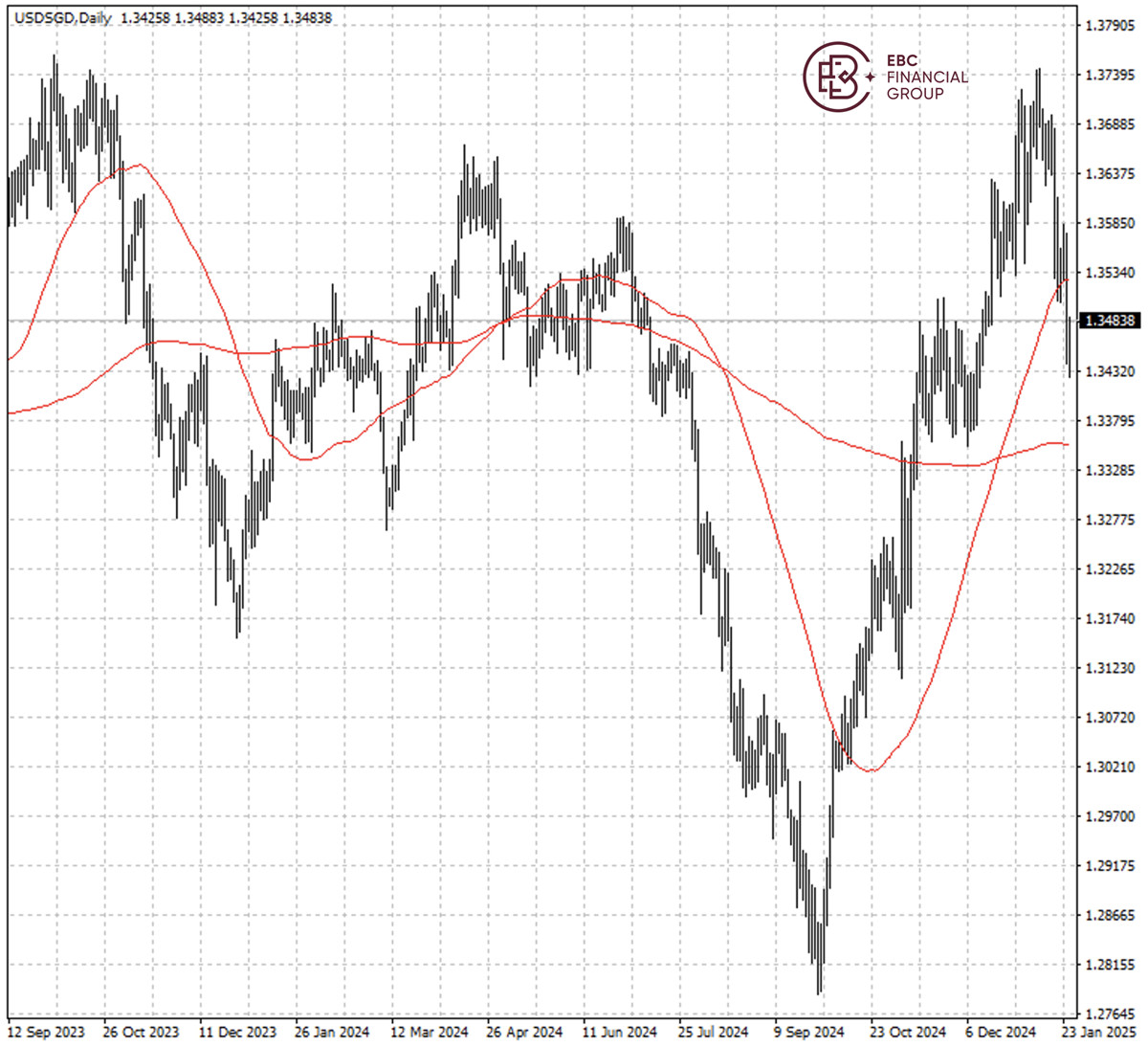

Goldman Sachs Group sees the Singapore dollar at 1.38 on a six-month horizon,

while MUFG predicts it will touch that mark in Q1.Barclays puts it at 1.39 by

year-end, DBS sees it touch thelevel in Q2.

Singapore's small and open economy is highly exposed to global trade and

hence concerns about Trump's proposed tariffs. GDP is projected to grow at 1%-3%

over 2025, according to the MAS.

A special economic zone straddling Singapore and Malaysia has been designed

to help the pair withstand toughereconomic conditions. The neighbours have

talked about closer collaborations on a range of areas.

The Singapore dollar has strengthened above the resistance at 50 SMA. There

is little which can stop it from heading into the next hurdle around 200 SMAfor

now.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.