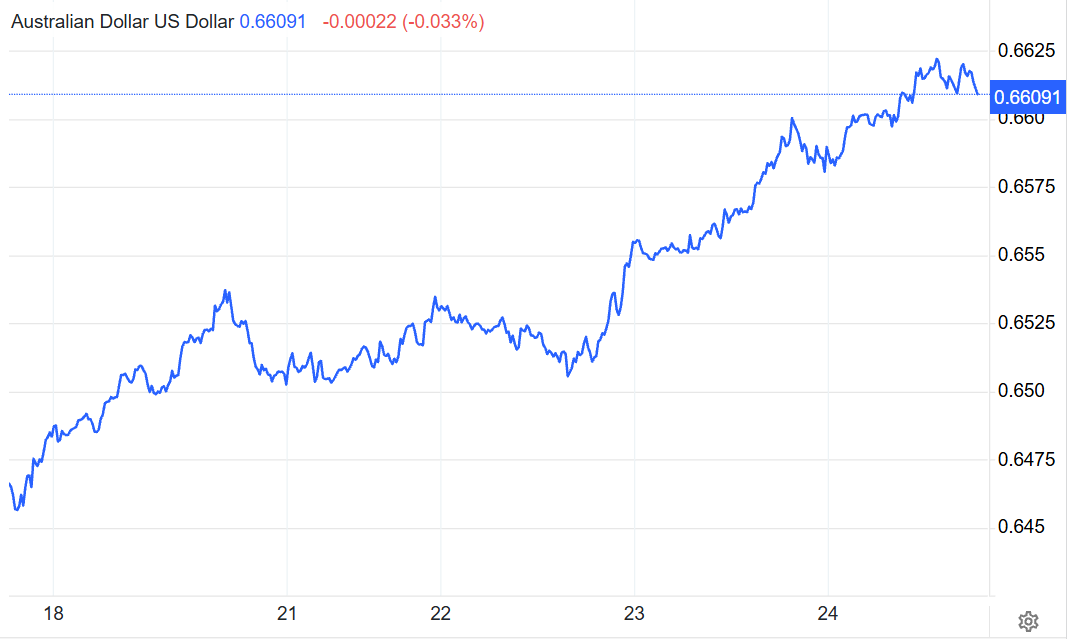

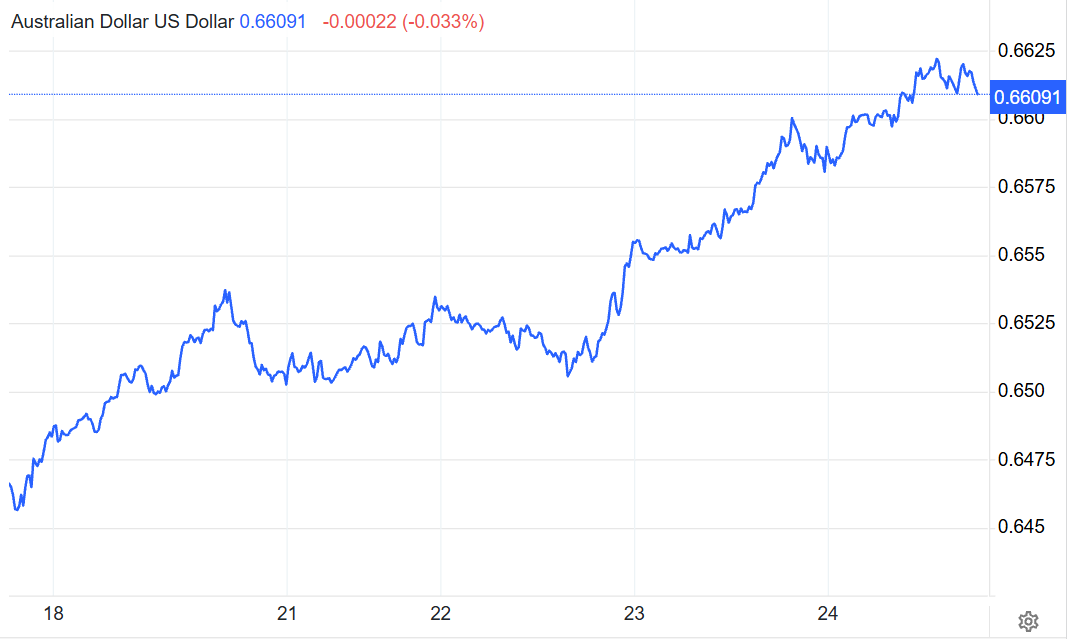

In recent trading sessions, the AUD to USD pair has shown a surprising streak of strength, climbing for three consecutive days and reaching 0.6583 on Wednesday, its highest level since mid-July. This momentum comes despite a broader decline in global risk appetite ahead of looming tariff deadlines. So, what's fuelling the Australian dollar's resilience against the greenback — and could this rally continue in the weeks ahead?

A Weaker Dollar and Trade Optimism Fuel AUD Strength

The primary driver behind the recent appreciation of the AUD to USD exchange rate lies in the weakening US dollar. Mounting concerns over a possible impasse in US-EU trade negotiations have undermined confidence in the greenback. US President Donald Trump recently threatened to impose tariffs of 15% or more on most European imports, prompting the EU to prepare retaliatory measures — including taxes on US tech firms, limits on American investments, and restrictions on public contract bids. These rising tensions have raised fears of a broader economic slowdown in the United States.

The primary driver behind the recent appreciation of the AUD to USD exchange rate lies in the weakening US dollar. Mounting concerns over a possible impasse in US-EU trade negotiations have undermined confidence in the greenback. US President Donald Trump recently threatened to impose tariffs of 15% or more on most European imports, prompting the EU to prepare retaliatory measures — including taxes on US tech firms, limits on American investments, and restrictions on public contract bids. These rising tensions have raised fears of a broader economic slowdown in the United States.

Goldman Sachs has responded by raising its forecast for US reciprocal tariffs to 15% and warned of a protracted period of sluggish growth. Wall Street's consensus now sees US GDP expanding by just 1.1% this year, increasing downward pressure on the dollar.

Meanwhile, improved sentiment around US-China relations has also offered support for the Australian dollar. US Treasury Secretary Bessent is set to meet Chinese Finance Minister Lan Fuoan next week, with the possibility of postponing the August 12 tariff hike on the table. President Trump further stoked optimism by announcing plans for a potentially "milestone" visit to China to address ongoing trade and security issues between the two countries.

China's Stimulus and Infrastructure Drive Add Tailwinds

In parallel, several domestic developments in China — Australia's largest trading partner — have bolstered the case for a stronger AUD to USD rate. Chief among them is Beijing's renewed commitment to curbing "involution" — a term referring to destructive competition within saturated markets — by stimulating domestic demand and cutting overcapacity.

China's announcement of a massive infrastructure project on the Yarlung Tsangpo River, with a budget of 1.2 trillion RMB (approx. USD 167 billion), has sparked expectations of rising demand for iron ore. As a result, Singapore iron ore futures surged to a two-month high, further reinforcing support for the Australian dollar, which is closely linked to the country's export-driven mining sector.

RBA's Policy Dilemma: Inflation and Jobs in Focus

The Reserve Bank of Australia (RBA) recently surprised markets by holding its cash rate steady at 3.85% on 8 July, defying expectations of a 25-basis-point cut. However, meeting minutes released later revealed that the central bank remains divided. Some officials cited persistent risks from slowing global growth and decelerating domestic GDP, while others noted stronger-than-expected economic performance as a reason for caution.

The consensus within the RBA appears to be that further easing is "reasonable" over time, though any decision will be data-dependent. The labour market is showing signs of stress, with the unemployment rate jumping to 4.3% in June — the highest since late 2021 — and employment growth underwhelming. Participation ticked higher to 67.1%, but total hours worked declined by 0.9%, hinting at structural fragility in job quality.

On the inflation front, the latest data paints a similarly subdued picture. May's year-on-year CPI growth slowed to 2.1% from April's 2.4%, while core inflation dropped to 2.4%, its lowest since November 2021. Should July's inflation data — due on 30 July — show continued weakness, markets are already pricing in the possibility of a significant rate cut, potentially up to 50 basis points, which could pressure the Aussie dollar.

External Risks: Japan's Political Landscape and Bond Market Shockwaves

Investors should also keep an eye on developments in Japan. A recently struck US-Japan trade agreement includes a 15% tariff rate and USD 550 billion of Japanese investment in the US. Political instability is brewing as speculation mounts over the potential resignation of the Japanese Prime Minister. Although denied by key political figures like Shigeru Ishiba, the uncertainty has rattled markets.

Japan's bond market is also under strain. The 10-year JGB yield rose sharply by nine basis points to 1.57%, the highest in recent years. Should Japanese yields continue rising, it could tighten global liquidity and weigh on investor appetite for US and European bonds — indirectly affecting broader forex market dynamics, including AUD to USD.

Technical Outlook: 0.6700 Within Reach?

From a technical standpoint, AUD to USD has remained in a gradual uptrend since April. After a brief consolidation phase from May to mid-July, the pair appears to have found solid support around the 0.6500 level. As bulls regain control, the next resistance levels are seen at 0.6620 and 0.6710.

From a technical standpoint, AUD to USD has remained in a gradual uptrend since April. After a brief consolidation phase from May to mid-July, the pair appears to have found solid support around the 0.6500 level. As bulls regain control, the next resistance levels are seen at 0.6620 and 0.6710.

However, traders should be cautious. A decisive drop below 0.6480 could invalidate the bullish outlook and trigger a renewed downtrend. Key dates to watch include early August, particularly around the 6th, when potential macro shifts and central bank cues could drive sharp moves.

Conclusion

The recent surge in AUD to USD reflects a confluence of factors — a weaker dollar, tentative trade optimism, China's economic stimulus, and Australia's evolving monetary policy stance. While the path to 0.6700 remains open, much depends on upcoming data and policy announcements. With volatility likely to pick up in early August, traders and investors should stay alert for catalysts that could either reinforce or reverse the Australian dollar's current momentum.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The primary driver behind the recent appreciation of the AUD to USD exchange rate lies in the weakening US dollar. Mounting concerns over a possible impasse in US-EU trade negotiations have undermined confidence in the greenback. US President Donald Trump recently threatened to impose tariffs of 15% or more on most European imports, prompting the EU to prepare retaliatory measures — including taxes on US tech firms, limits on American investments, and restrictions on public contract bids. These rising tensions have raised fears of a broader economic slowdown in the United States.

The primary driver behind the recent appreciation of the AUD to USD exchange rate lies in the weakening US dollar. Mounting concerns over a possible impasse in US-EU trade negotiations have undermined confidence in the greenback. US President Donald Trump recently threatened to impose tariffs of 15% or more on most European imports, prompting the EU to prepare retaliatory measures — including taxes on US tech firms, limits on American investments, and restrictions on public contract bids. These rising tensions have raised fears of a broader economic slowdown in the United States. From a technical standpoint, AUD to USD has remained in a gradual uptrend since April. After a brief consolidation phase from May to mid-July, the pair appears to have found solid support around the 0.6500 level. As bulls regain control, the next resistance levels are seen at 0.6620 and 0.6710.

From a technical standpoint, AUD to USD has remained in a gradual uptrend since April. After a brief consolidation phase from May to mid-July, the pair appears to have found solid support around the 0.6500 level. As bulls regain control, the next resistance levels are seen at 0.6620 and 0.6710.