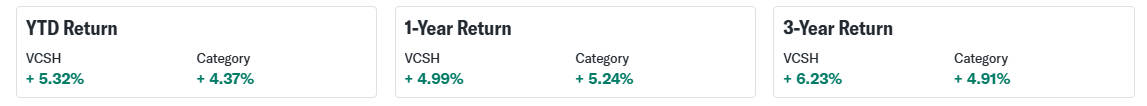

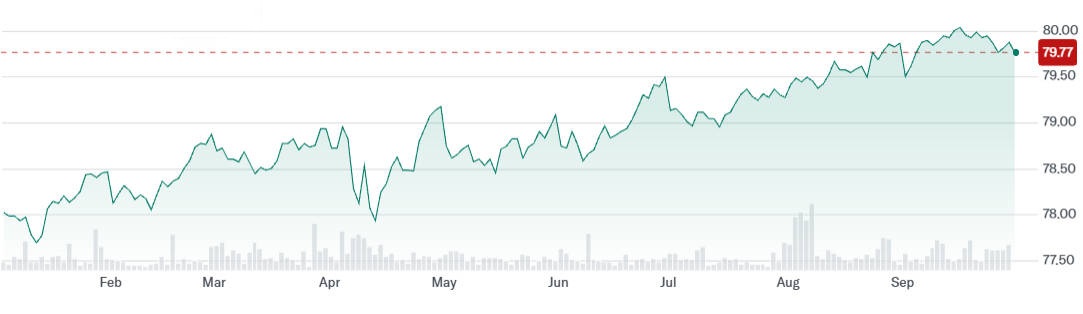

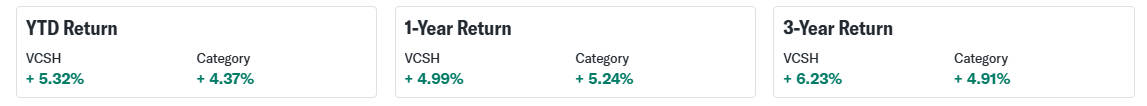

Vanguard Short-Term Corporate Bond ETF (VCSH) is a low-cost, investment-grade corporate bond ETF designed to give investors a "cash-plus" yield with limited interest-rate sensitivity — it charges just 0.03% and, as of late September 2025. produces a YTD yield around 5.3%, outperforming the category average of 4.3%.

Below we explain exactly what those figures mean, show the portfolio inside VCSH, compare it with practical alternatives, and examine risks and likely behaviour in different market scenarios.

What this article will break down:

What VCSH is and how it operates.

The actual holdings, credit mix and key statistics (clean tables).

How VCSH behaves in different market environments (interest rates, credit stress).

Practical portfolio uses and trade-offs.

A clear comparison with similar ETFs.

What is the VCSH ETF and why should investors care?

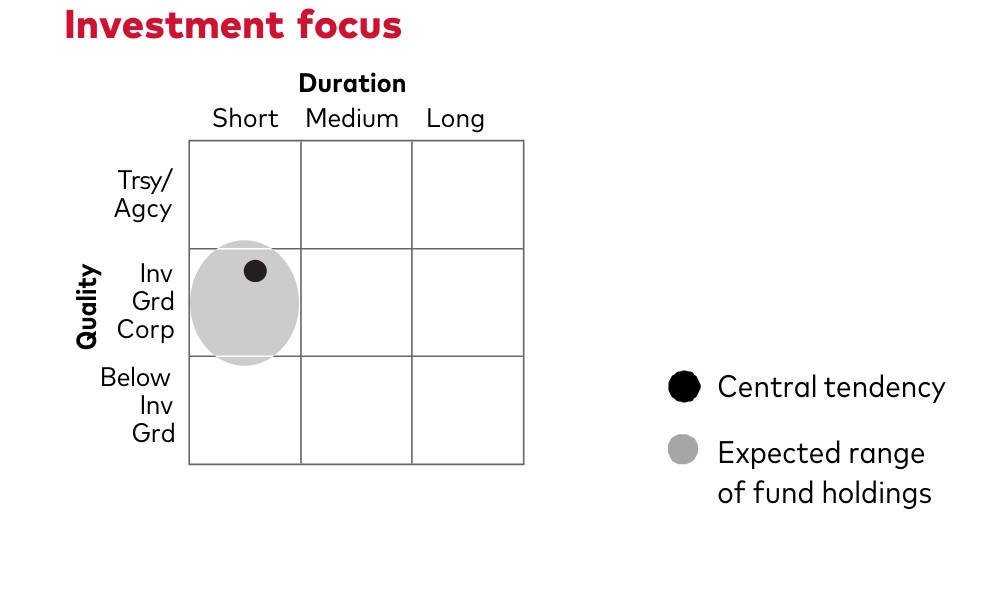

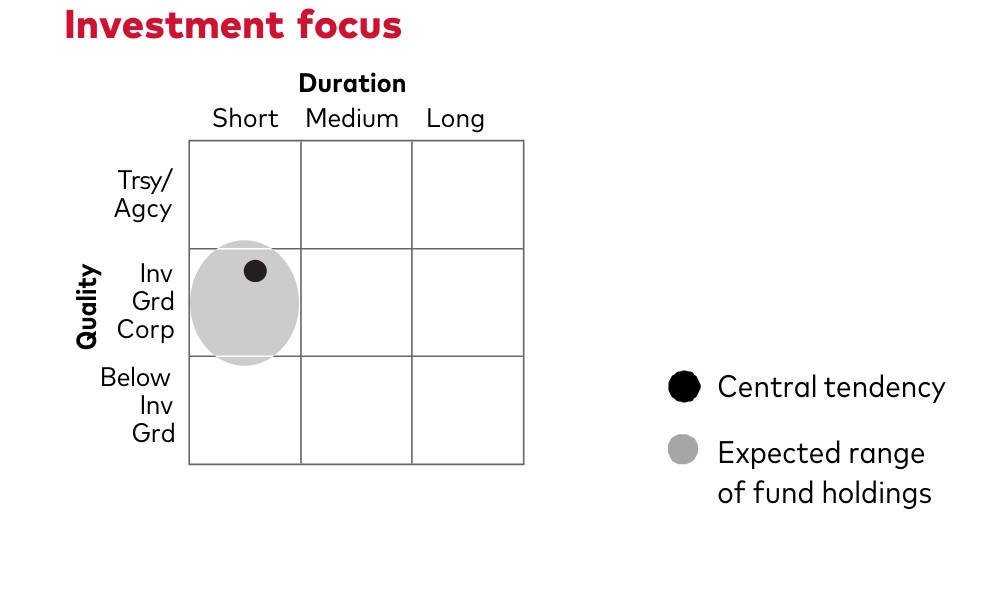

VCSH (ticker: VCSH) is the Vanguard Short-Term Corporate Bond ETF. It seeks to track the Bloomberg U.S. 1–5 Year Corporate Bond Index, providing diversified exposure to U.S. dollar-denominated, investment-grade corporate bonds that mature roughly within 1–5 years.

Core attraction:

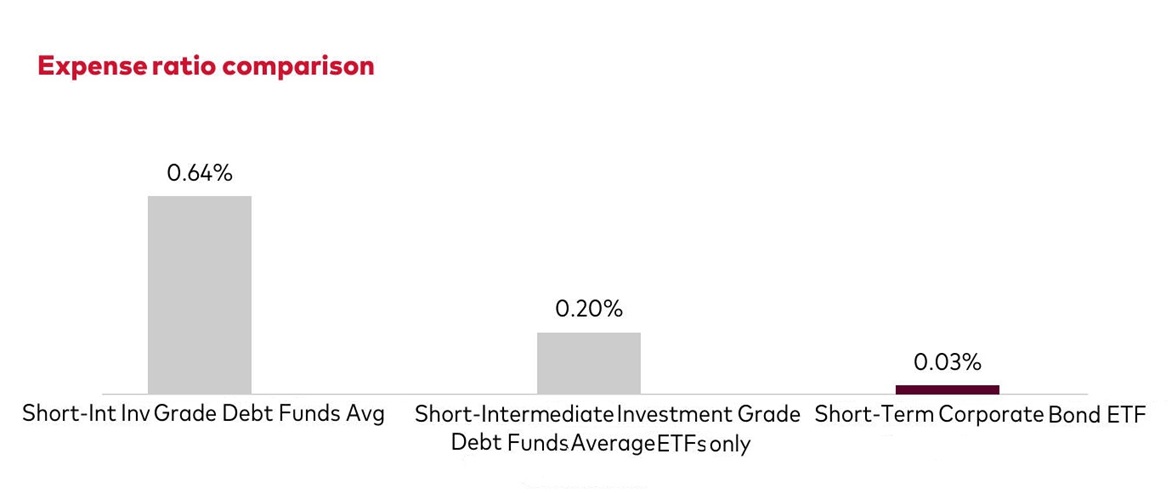

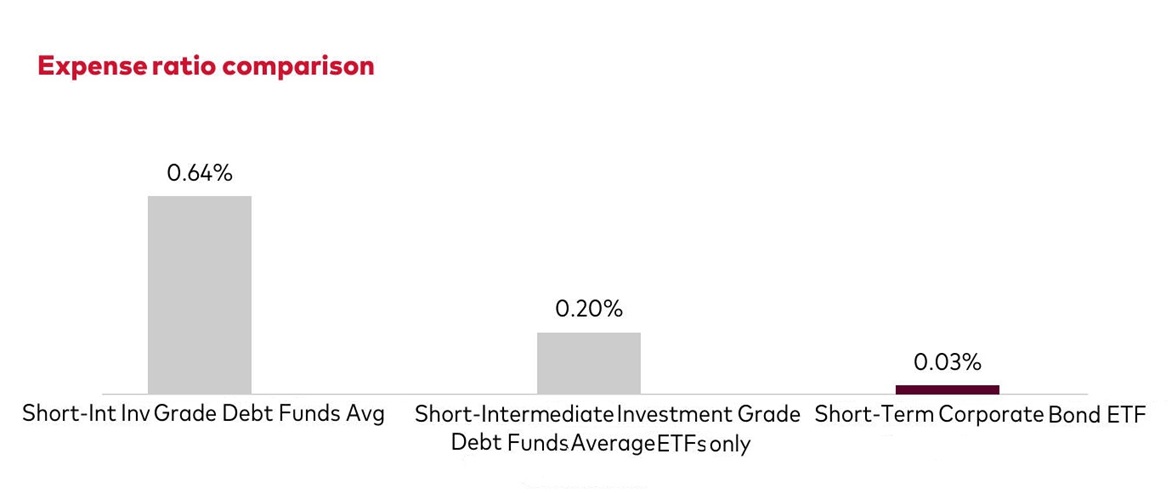

Low cost: expense ratio 0.03%, which helps returns compound more effectively.

Income with modest duration: short effective duration (≈2.7 years) limits sensitivity to interest-rate moves compared with longer bond funds.

Corporate credit exposure: higher yield than Treasuries/money market products while remaining primarily investment-grade.

Who typically considers VCSH: conservative income investors, advisers seeking a cash-plus instrument, and portfolios that want short corporate credit exposure without meaningful duration risk.

How does the VCSH ETF actually work?

1) Index and replication:

VCSH follows the Bloomberg U.S. 1–5 Year Corporate Bond Index and uses a representative-sampling index approach (not full physical replication of every bond in the index).

That means the fund holds a large, representative selection of the index to match risk-factor exposures.

2) Structure & trading:

It is an ETF listed on NASDAQ. Shares trade throughout the day; market liquidity is supported by creation/redemption mechanisms and a large asset base (see the table for AUM notes).

3) Distributions & frequency:

VCSH pays distributions monthly. Investors receive income in cash (or via automatic reinvestment where available).

What's inside VCSH?

Below are the key statistics investors check first. Numbers are given with the source and the snapshot date shown.

VCSH ETF Overview

| Metric |

Value (snapshot) |

| Expense ratio |

0.03% |

| 30-day SEC yield |

~4.18% (Vanguard published figure) |

| ETF total net assets (Vanguard fact sheet) |

$34,397 million (≈$34.4bn) — as of 30 Jun 2025 |

| AUM (market data snapshot) |

~$39.5bn (ETFDB/market data; varies by date) — late Sep 2025 |

| (Alternative published AUM) |

$46.0bn (Schwab snapshot, 29 Sep 2025) — differing data windows |

| Average duration |

2.7 years (effective duration) |

| Average effective maturity |

~3.0 years |

| Number of bonds in portfolio |

≈2,600 (fund holdings) |

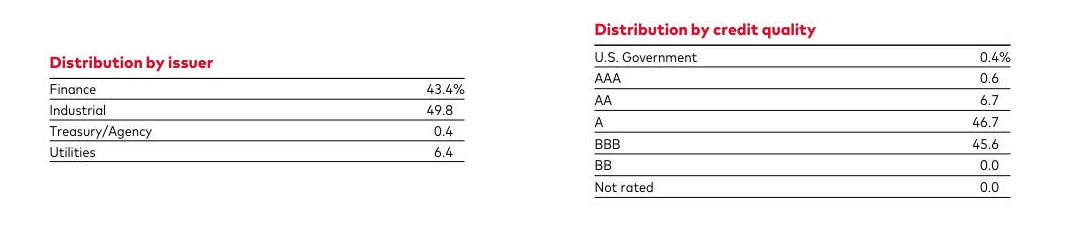

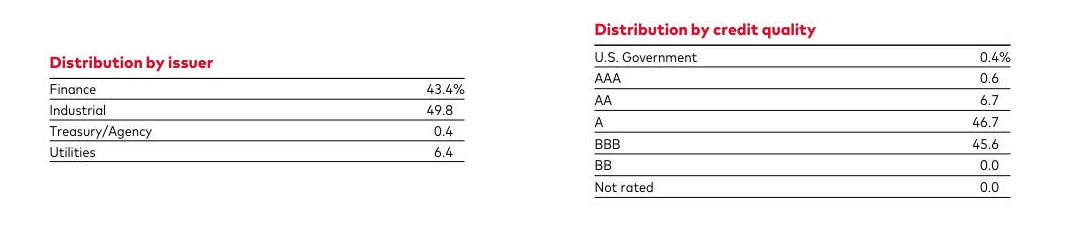

| Credit quality (distribution) |

A: 46.7% ; BBB: 45.6% ; AA: 6.7% ; AAA: 0.6% ; US Gov’t: 0.4% |

| Sector concentration |

Industrial ≈49.8% ; Finance ≈43.4% ; Utilities ≈6.4% |

AUM reminder:

Reported assets under management can vary depending on the reporting date and whether the figure refers to ETF shares or the entire fund. Always verify the most recent data from the provider before making any investment decisions.

What bonds and sectors dominate the VCSH portfolio?

1) Credit mix:

The fund is heavily weighted to the mid/high investment-grade band — nearly half A-rated and almost half BBB — which explains the yield premium versus Treasuries but also signals exposure to lower investment-grade credit risk.

2) Maturities:

Most holdings sit in the 1–5 year maturity bucket; effective maturity is around 3.0 years and effective duration ≈2.7 years. That maturity profile keeps the fund less sensitive to long-term rate moves.

3) Top sectors and common issuers:

Industrials and finance issuers dominate. Top individual bond holdings are relatively small weights (the portfolio is very broad), so concentration risk is low compared with many single-issuer bond funds.

ETFdb and Vanguard's holdings data show the largest issuer weights are generally well under 1% per bond.

Is VCSH really "low risk"? — The trade-offs explained

Lower interest-rate risk than longer bond funds, but measurable credit risk compared with Treasuries.

1) Interest-rate sensitivity:

With an effective duration of ≈2.7 years, VCSH's market value will typically move by about 2.7% for a 100 basis-point parallel move in interest rates (rough rule: duration × Δrate). That is modest relative to intermediate- or long-term funds.

2) Credit risk:

Because ~46.7% of assets are in A-rated and ~45.6% in BBB, VCSH carries corporate credit exposure. If credit spreads widen materially (stress or recession), VCSH could decline even if Fed policy pauses.

3) Liquidity and ETF mechanics:

ETF structure provides intraday liquidity and generally tight bid-ask spreads for VCSH (high AUM and heavy daily volume). However, underlying corporate bonds vary in liquidity.

In acute stress, ETFs can trade at a discount/premium to NAV; be mindful of that when trading large size.

4) Historical behaviour:

The fund has generally delivered steadier returns and smaller drawdowns than longer-duration or high-yield bond choices, but its performance depends on the interaction of rates and corporate spreads.

Vanguard's fact sheet shows recent returns and how they compare with the benchmark.

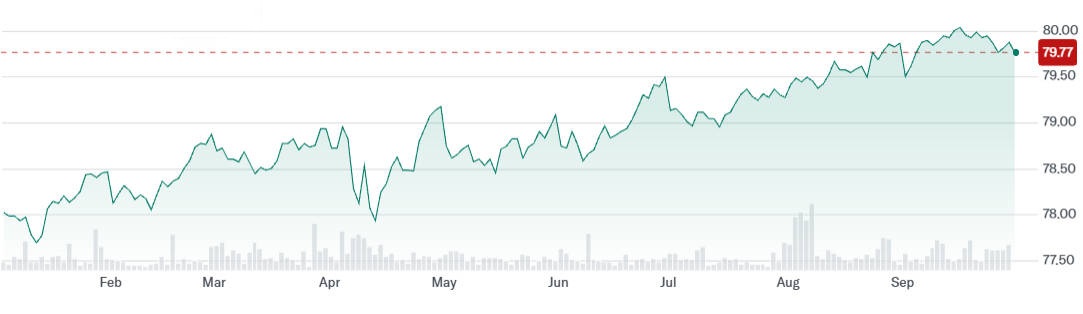

Performance and yield — what the numbers say

VCSH ETF Returns Overview:

Yield measures:

What this means practically:

In 2024–2025's higher-rate environment, short-term corporate exposure has produced attractive income/cash-plus returns relative to money market and short Treasury alternatives — but remember that portion of that extra yield compensates for credit risk.

When does VCSH make sense in a portfolio?

VCSH versus two common alternatives

VCSH vs BSV vs SHY

| ETF |

Primary exposure |

Expense ratio |

30-day SEC yield (recent) |

Effective duration (approx) |

Notes / when preferred |

| VCSH (Vanguard) |

Short-term investment-grade corporate bonds |

0.03% |

~4.18% (25 Sep 2025) |

~2.7 yrs |

Best for cash-plus corporate yield. |

| BSV (Vanguard Short-Term Bond ETF) |

Mixed short-term gov’t & corporate (broader short term) |

0.03% |

~3.85–3.9% (varies) |

approx 2–3 yrs |

Broader, a touch safer (more Treasuries) than pure corporate. |

| SHY (iShares 1–3yr Treasury) |

U.S. Treasuries (1–3yr) |

0.15% |

~3.82% (iShares fact sheet) |

~1.8 yrs |

Safer credit (Treasury), lower yield; preferred when credit risk must be negligible. |

How to read the table:

VCSH usually yields more than pure-Treasury funds like SHY due to corporate credit exposure. Compared with BSV, it's more corporate-focused, offering higher yield but greater credit sensitivity.

Practical risks and how to monitor them

Serial checklist (daily/weekly/monthly monitoring):

SEC yield & distribution dates — changes affect income expectations.

Effective duration / average maturity — confirm whether the fund is shortening or lengthening (duration creep changes risk).

Credit spreads (corporate OAS) — widening spreads signal elevated credit risk and potential mark-to-market losses. (Use market data sources.)

Fund flows & AUM — rapid outflows can strain ETF liquidity dynamics; large AUM is generally reassuring.

Macro cues — central bank guidance and recession indicators usually drive spread moves; keep an eye on policy updates.

Final verdict — who should buy VCSH, and who should not?

Good candidates for VCSH:

Investors seeking higher income than cash with low interest-rate risk.

Advisers building a short corporate sleeve to improve yield in a conservative portfolio.

Traders needing short-duration corporate exposure for tactical plays.

Who should avoid VCSH:

Investors who require principal preservation at all costs (they should prefer Treasury bills or money markets).

Those who cannot tolerate any credit risk (choose Treasury-only funds).

Long-duration bond investors who need sensitivity to falling yields.

Frequently Asked Questions

1. What does VCSH invest in?

Primarily investment-grade U.S. dollar corporate bonds with maturities between 1 and 5 years, sampled to track the Bloomberg U.S. 1–5 Year Corporate Bond Index.

2. How safe is VCSH compared with Treasuries or a savings account?

Safer than longer-duration corporate funds, but not as "credit-safe" as Treasuries. It has meaningful BBB exposure, so credit stress can produce losses. For capital guarantee or principal safety, Treasuries/money markets are superior.

3. What yield can I expect from VCSH today?

The 30-day SEC yield reported by Vanguard was ≈4.18% (25 Sep 2025). Yields move; always check the provider's page before making decisions.

4. How liquid is VCSH?

Very liquid at the ETF level (large average daily volume and high AUM). Underlying bond liquidity varies, which can impact ETF behaviour in stress.

5. How does VCSH perform when rates rise?

Shorter duration limits rate sensitivity: a modest price decline vs longer bond funds when rates rise, but corporate spread widening can add an additional drag.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.