Oil prices were little changed on Friday after settling lower in the previous

session, the day after the Fed cut interest rates for the first time this year,

due to worries about fuel demand in the US.

Joblessness claims data released this week indicated the US labour market has

softened, with both demand for and supply of workers falling. But at 54.6 in

August, composite PMI indicated solid growth.

US commercial crude oil inventories fell by 9.3 million barrels in the week

ending 12 September, according to data from the EIA, defying market expectations

of a 1.4 million-barrel increase.

Russia's Finance Ministry announced a new measure to shield the state budget

from oil price fluctuations and Western sanctions, easing some supply

concerns.

Surprisingly Japan pushed back against a US call to ramp up pressure on Putin

to end the war in Ukraine by imposing higher tariffs on China and India for

importing Russian oil.

China is set to continue its crude stockpiling throughout next year, but even

the buying spree would not be sufficient to support oil prices into the $60s per

barrel as a major glut looms over the market in the coming months.

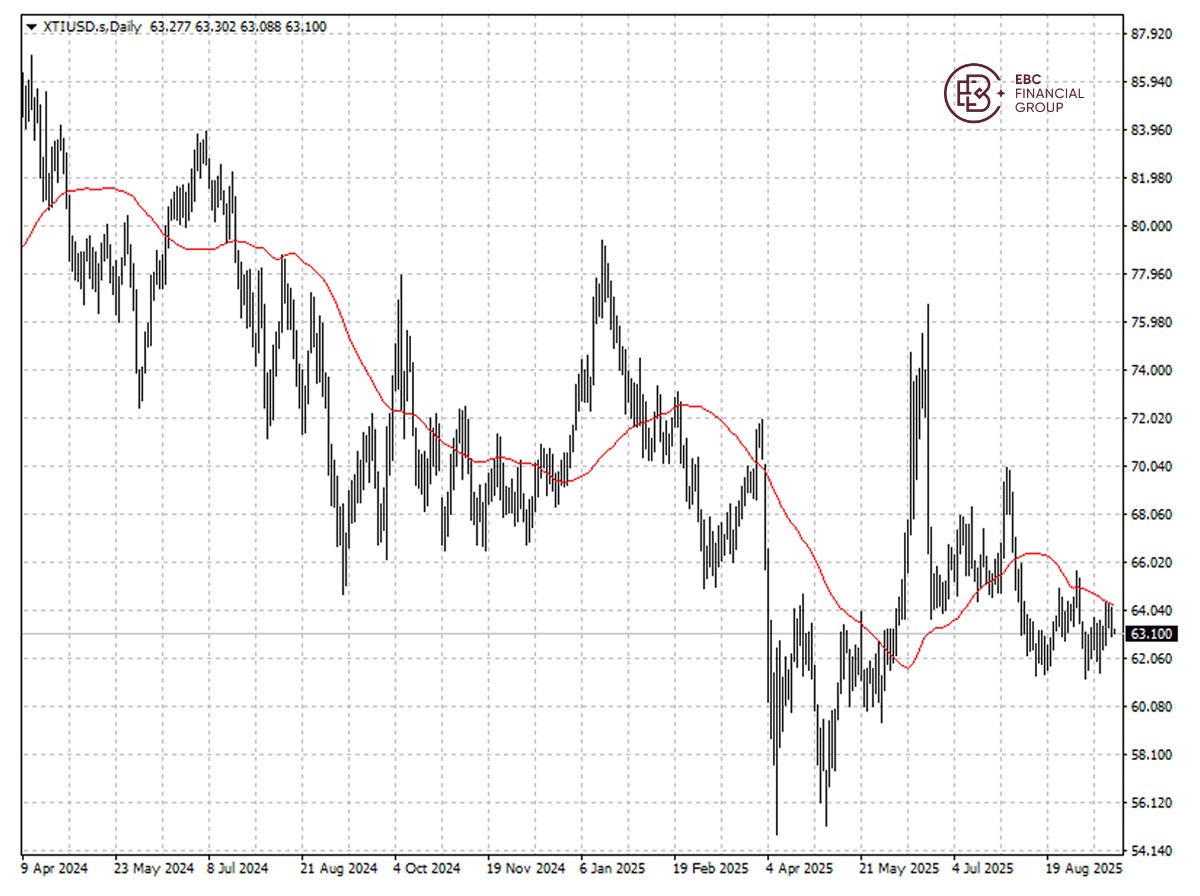

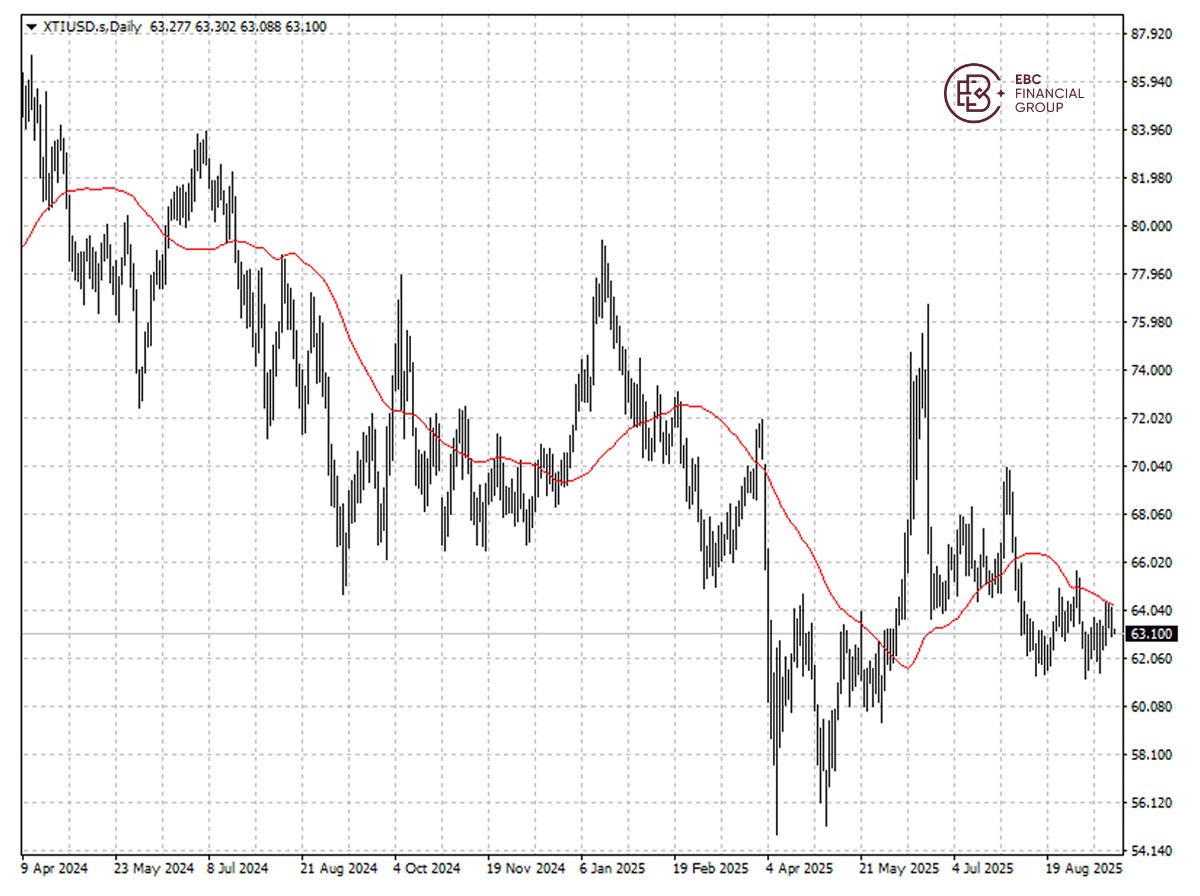

WTI crude shows bearish flag, which means a push blow $63 is around the

corner. It may need to breach the resistance at 50 SMA to negate the bearish

bias.

The Australian dollar slid towards the neckline of 0.6630 after a head and

shoulders pattern was formed. The next support of 0.6620 will be exposed if the

downside momentum stays.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.