Oil prices edged up on Friday, on track to rise at their steepest rate since

early June as Ukraine's attacks on Russia's energy infrastructure had let to

restriction of fuel exports and close to cutting crude output.

Russian Deputy Prime Minister Alexander Novak said on Thursday the country

would introduce a partial ban on diesel exports until the end of the year and

extend an existing ban on gasoline exports.

Both benchmarks reached their highest levels since 1 August this week, driven

by a surprise drop in US weekly crude inventories in addition to concerns about

supply disruption amid rising geopolitical tensions.

Trump said Tuesday afternoon that he thinks Ukraine, with help from the EU,

could win back its territory from Russia and return the country to its original

borders – a major shift from his long-held stance.

Commercial crude oil stocks were down by a more-than-expected 607,000 barrels

in the week ended 19 September, and were about 4% below the five-year average

for the time of year, the EIA said.

US GDP increased at an upwardly revised 3.8% annualized rate last quarter,

powered by an increase in consumer spending. That marked the fastest growth

since the third quarter of 2023.

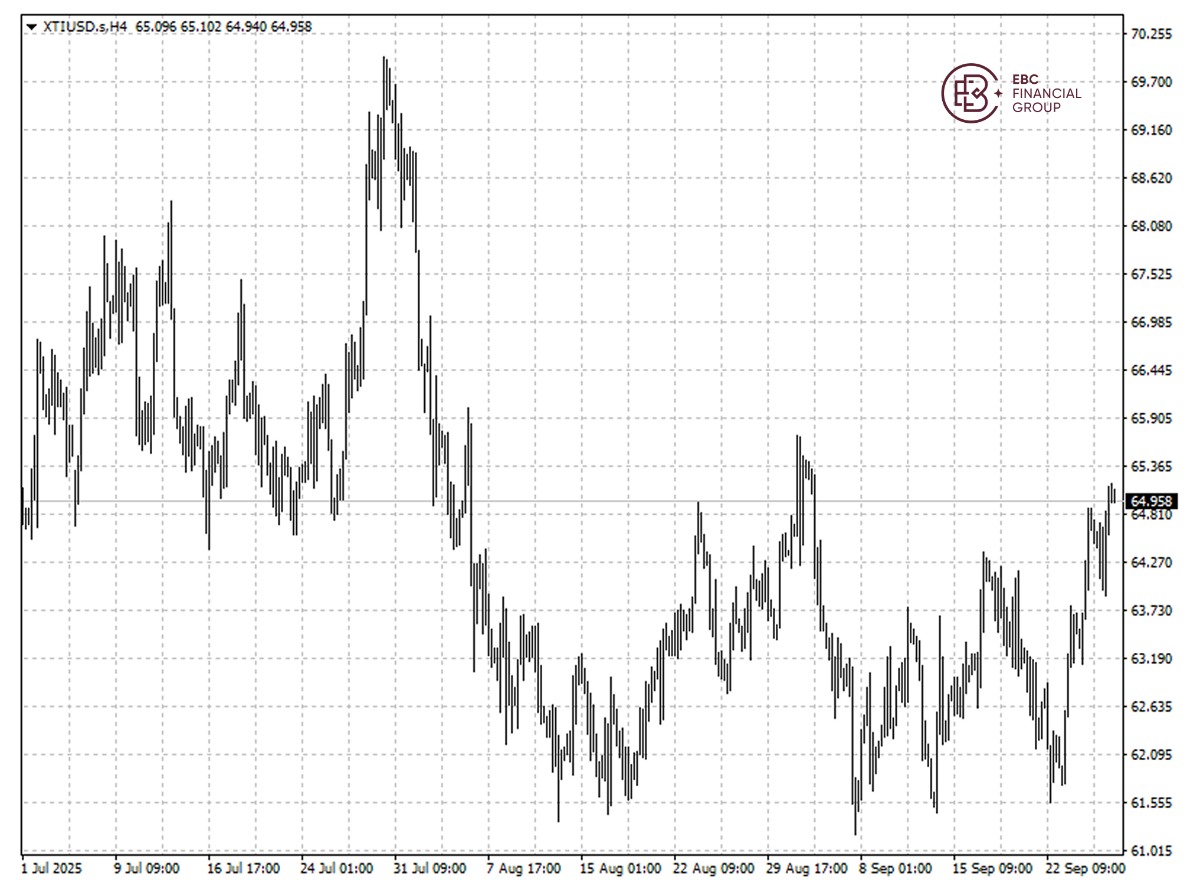

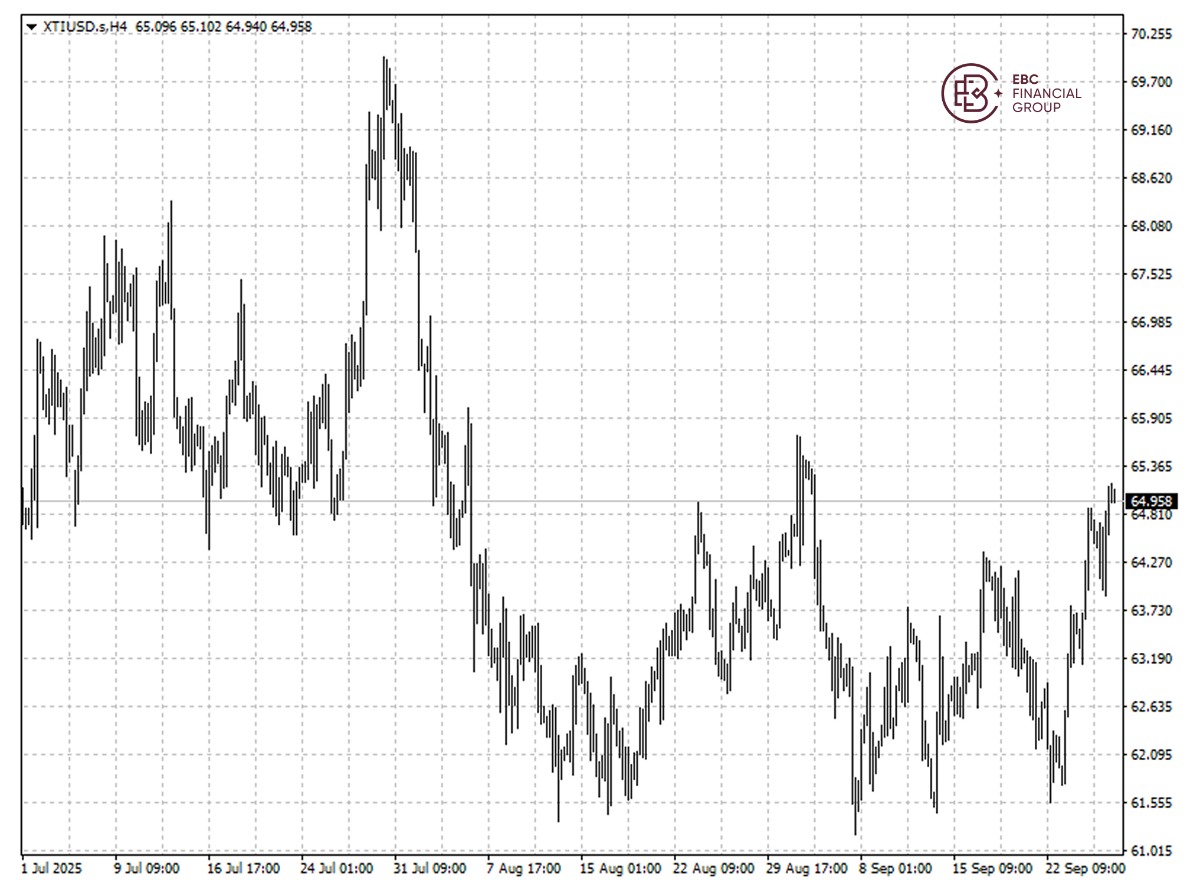

WTI crude has decisively broken above the resistance of $64.94, but it may

need to overcome $65.7 to reverse the medium-term downtrend. It could lose

momentum above $65.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.