Analyzing the RIVN Stock Momentum Shift

Rivian has entered one of its strongest momentum phases in over a year, with buyers returning aggressively after its surprise Q3 gross profit milestone and accelerating software revenue. The stock's recent performance speaks for itself.

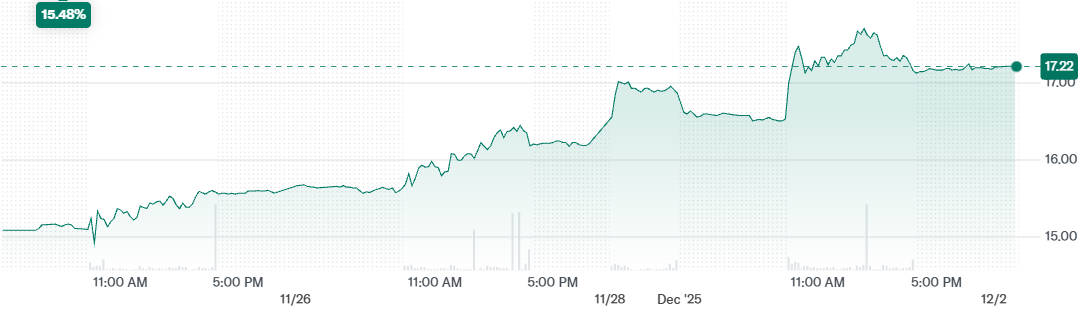

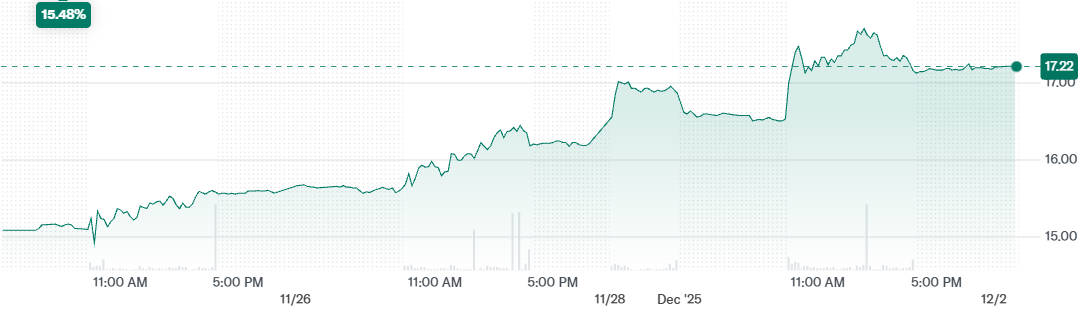

In just the past week, RIVN climbed more than 15%, extending a powerful 26% run over the last month. These sharp gains have pushed two central questions to the forefront: What triggered the rally, and can this uptrend continue as Rivian heads toward its critical 2026 R2 launch cycle?

Below, this article will unpack the fundamentals, the chart, the scenarios for 2026. and the key risks that could flip sentiment back overnight.

Immediate Fundamental Catalysts Driving the RIVN Surge

1. The Profitability Milestone: Breaking Down Rivian's Q3 2025 Earnings

The single most market-moving datum was Rivian reporting $24 million of consolidated gross profit for Q3 2025 — a symbolic inflection after years of headline losses and one of the clearest signals that unit economics are moving in the right direction.

That gross-profit print matters because it converts narrative into numbers: investors who had been buying "promise" suddenly saw evidence that production improvements, cost controls and higher-margin revenue streams are beginning to show up on the income statement.

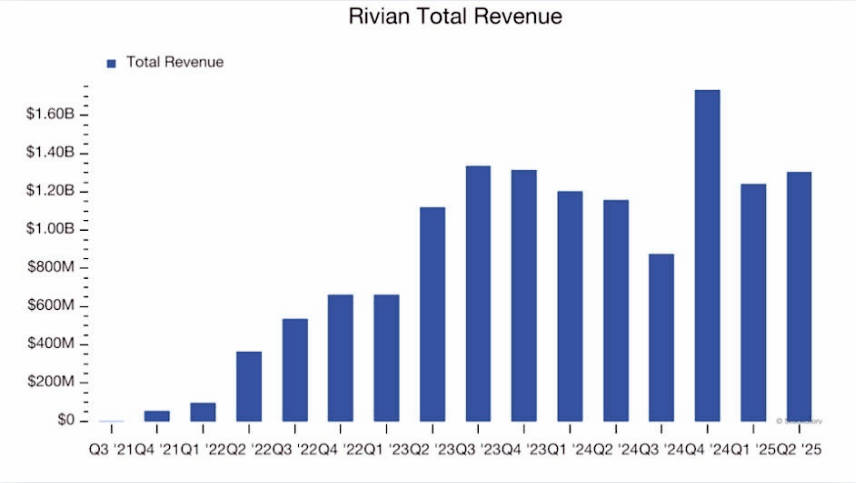

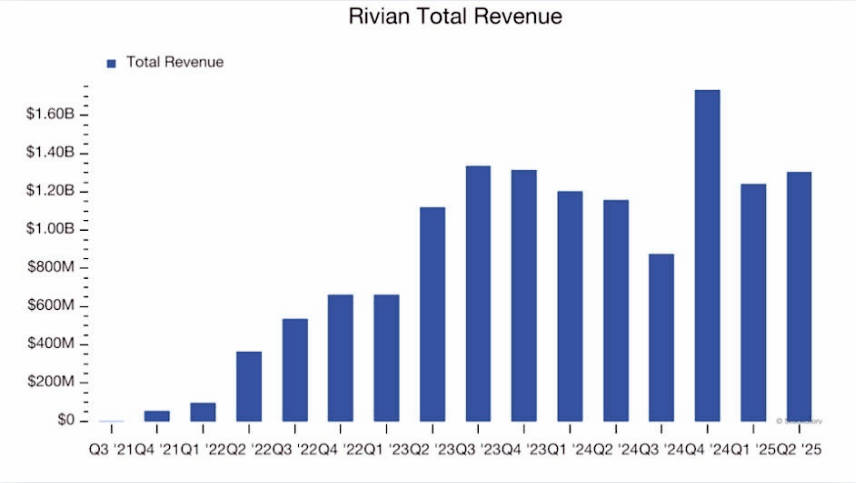

Alongside the gross-profit headline, Rivian reported strong top-line growth: total revenue jumped year-over-year (reported ~78% growth to roughly $1.56B), and vehicle deliveries reached Rivian's highest quarter in 2025, confirming the company is improving factory throughput and fulfillment execution.

Those operational datapoints reduced one of the market's largest uncertainties: can Rivian actually scale volume without cratered margins? For several investors, Q3 provided a tentative "yes."

Key Financial Highlights

| Metric |

Q3 2025 Result |

Why It Matters |

| Consolidated Gross Profit |

24 million USD |

First positive gross profit, signaling real progress in cost efficiency |

| Total Revenue |

Approximately 1.56 billion USD |

Strong year over year growth driven by better deliveries |

| Software and Services Revenue |

About 416 million USD |

High margin revenue source supporting long term profitability |

| Year over Year Software Revenue Growth |

324 percent |

Demonstrates the effectiveness of the Volkswagen software partnership |

2. The Capital & Confidence Boost: Volkswagen Partnership & Software Licensing

Crucially, software and services revenue exploded, reported at about $416 million for the quarter, up approximately 324% year over year, driven materially by Rivian's technology partnership with Volkswagen.

Reports indicate a sizable chunk of that software revenue (roughly $200M+) came directly from VW-related licensing and JV activity. This isn't just a nice-to-have: software revenue improves gross margin per vehicle and creates recurring, high-margin cash flows that change the growth-economics picture.

Markets rewarded Rivian for demonstrating that its software strategy already generates meaningful dollars today rather than being a distant hope.

The VW relationship also provides strategic optionality, offering a near-term revenue floor and the potential to fund R2 scale-up without excessively dilutive equity raises if the deal continues to expand.

Technical Analysis on the RIVN Stock Price Momentum

1. The Bullish Breakout and Volume Confirmation

Technically, the price action accompanying the Q3 release looked like a textbook breakout: a strong 14–25% day (depending on the session you measure) closed above several near-term resistance levels on higher than average volume, which is important because volume confirms conviction (often institutional buying) rather than a retail-only short squeeze. That combination turned what might have been a one-day "earnings pop" into a structural reassessment of trend.

2. Key Price Levels: Support, Resistance, and Moving Averages

The most relevant technical facts for traders:

-

200-day moving average:

The stock crossing and holding above the 200-day MA is often viewed as a move from a longer-term bearish regime to the early stages of a bull trend.

When a price crosses that moving average on strength, it draws attention from trend-following funds and system traders. (Check your charting platform for the exact price where the MA sits on the day you trade.)

-

New support:

The old multi-month ceiling that the price cleared now functions as the immediate support base; a decisive re-test and hold would increase the probability the breakout sticks.

-

Immediate resistance:

Look to the recent intraday and multi-week highs for the next selling test. If those give way on volume, the next leg higher becomes more plausible.

Note: Exact numeric moving averages and support or resistance levels change intraday, so use the current live RIVN chart to set concrete levels before trading.

3. Indicator Signals: RSI and MACD

-

RSI:

After a 14–25% surge, short-term RSI frequently moves into overbought territory (above 70). That suggests the risk of a near-term pullback or consolidation, which is healthy and normal following a violent move. A pullback that holds above the breakout support would be constructive.

-

MACD:

The Q3 move typically coincided with a bullish MACD crossover (fast MA crossing above slow MA), reinforcing that momentum components are aligned in the near term.

Technicals therefore back the thesis that the move is more than noise, but they also warn traders to expect volatility and possible short-term profit-taking.

The Long-Term Forecast of Rivian Stock

1. The 2026 Growth Engine: The R2 SUV and the Mass Market Pivot

Rivian's roadmap centers on the R2. a smaller SUV targeting the mass market with a price below $50.000 and first deliveries planned for the first half of 2026.

If Rivian hits the R2 timeline and demonstrates materially better unit economics from the smaller platform (lower BOM costs, simpler assembly, higher factory utilization), the company's TAM (total addressable market) expands massively and valuation multiples could re-rate meaningfully versus the R1 premium/utility niche.

The market is effectively pricing in a path where R2 scales like a Model-Y competitor at a lower cost base.

2. Wall Street Analyst Consensus and Price Target Scenarios

Following Q3. analysts moved to re-evaluate targets and ratings; some firms upgraded or raised price targets, while consensus sentiment shifted modestly toward optimism (a mix of Buy/Hold views remains). The realistic way to think about targets is scenario-based:

-

Bull case:

Smooth R2 ramp + continued software licensing growth → multiple expansion as revenues scale; stock could chase to levels implied by a high-growth EV manufacturer (specific numeric targets vary by analyst).

-

Base case:

R2 achieves reasonable scale by late-2026. margins improve slowly — stock trades higher but remains volatile.

-

Bear case:

R2 delays, or unit economics miss, or competitive price wars compress margins — the re-rating reverses and RIVN retreats toward pre-earnings levels.

Quantitatively, different analysts publish widely varying 12-month targets; investors should examine model assumptions (R2 volumes, gross margins, software revenue penetration) rather than relying on a single point estimate.

3. Financial Fundamentals: Sustaining Unit Economic Improvement

For the uptrend to persist beyond sentiment and technical rotation, vehicle gross margins must sustainably improve. That requires: components cost reduction, fixed-cost absorption via higher production, and recurring software revenue continuing to scale.

2026 is the execution year: if R2 delivers on price and margin improvements and software monetization continues, those fundamentals will validate the optimism. If not, the stock will be highly sensitive to each piece of news.

Fundamental Headwinds and Risks to RIVN Stock Price Momentum

1. Persistent Cash Burn and Liquidity Pressure

Even with improved gross profit, Rivian still spends heavily on R&D, SG&A and capex for R2 scale. The company's cash runway will remain a critical metric; any indication that Rivian must raise capital sooner than planned (dilution) would sap the rally's momentum quickly.

2. Market Saturation and EV Price Wars

The EV landscape remains intensely competitive. Legacy OEMs and Tesla retain scale advantages and pricing flexibility. Aggressive price moves from competitors to protect share could compress Rivian's potential margins for R2 and slow adoption.

3. Valuation vs. Reality: Pricing in Future R2 Success

Much of the recent rally reflects future optionality, as the market is paying today for a successful R2 execution. That makes RIVN highly binary: execution beats could lead to outsized gains, while execution misses could trigger sharp declines. Investors must be comfortable with high execution risk.

Frequently Asked Questions

Q1: What was the main reason for Rivian stock's recent jump?

The rally followed Q3 2025 results that showed a consolidated $24M gross profit, revenue growth and surging software revenue — plus confirmation that the R2 program remains on track, prompting renewed institutional buying.

Q2: Is the RIVN uptrend expected to last into 2026?

It can, but only conditionally. Longevity depends on flawless R2 execution in H1 2026. expanding software margins, and avoiding dilutive capital raises. Misses would likely reverse the gains.

Q3: What is the biggest risk for Rivian's stock price?

Execution risk from delays or cost overruns on R2. along with margin pressure from EV price competition and potential future cash needs that trigger dilutive capital raises, could rapidly erode investor optimism.

Q4: How does the R2 change Rivian's market position?

R2 targets a sub-$50k mass-market SUV, vastly expanding the addressable market and improving unit economics if produced at scale, potentially transforming Rivian from a niche premium player to a mainstream competitor.

Conclusion

Rivian's recent surge was grounded in tangible progress: a small but symbolic Q3 consolidated gross profit, recordish deliveries and a huge jump in software revenue — plus a technical breakout on volume. Those facts earned Rivian a reprieve from pure speculation and put the spotlight squarely on 2026 execution.

The uptrend will last only if Rivian delivers reliable R2 timing, improving unit economics, and continued software monetization. Fail at any one of those and the market will quickly re-price the stock.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.