Argentina has long been known for its turbulent economic history, marked by inflation, debt crises, and abrupt policy shifts. As 2025 unfolds, the simple question — what currency does Argentina use — has a surprisingly complex answer.

While the Argentine peso remains the country's official currency, the real story involves parallel exchange rates, widespread dollar use, and persistent instability in the financial system.

What Currency Does Argentina Use?

To answer directly: the Argentine peso (ARS) is still the legal currency in Argentina. It is issued by the Central Bank of Argentina and is used for all government payments, salaries, taxes, and public transactions. Most everyday purchases are priced in pesos, and it remains the unit of account for contracts and retail activity.

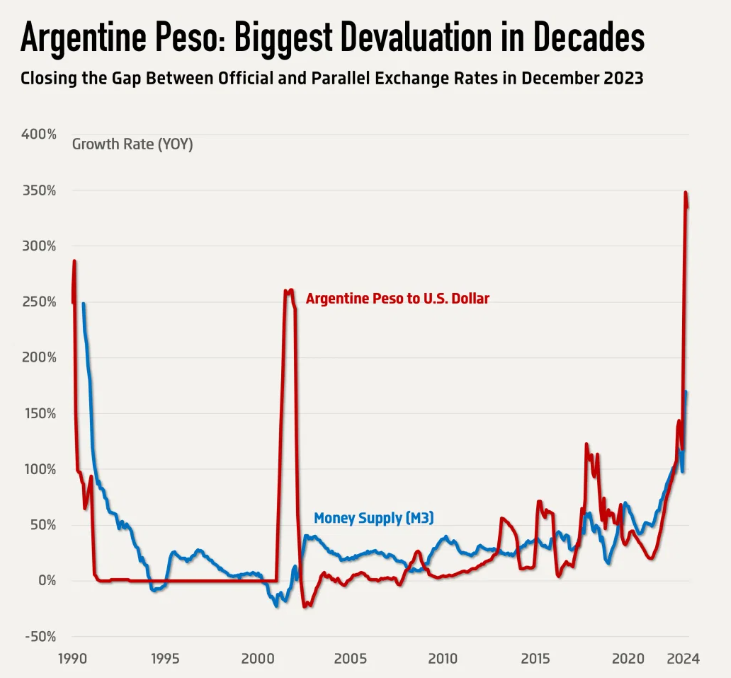

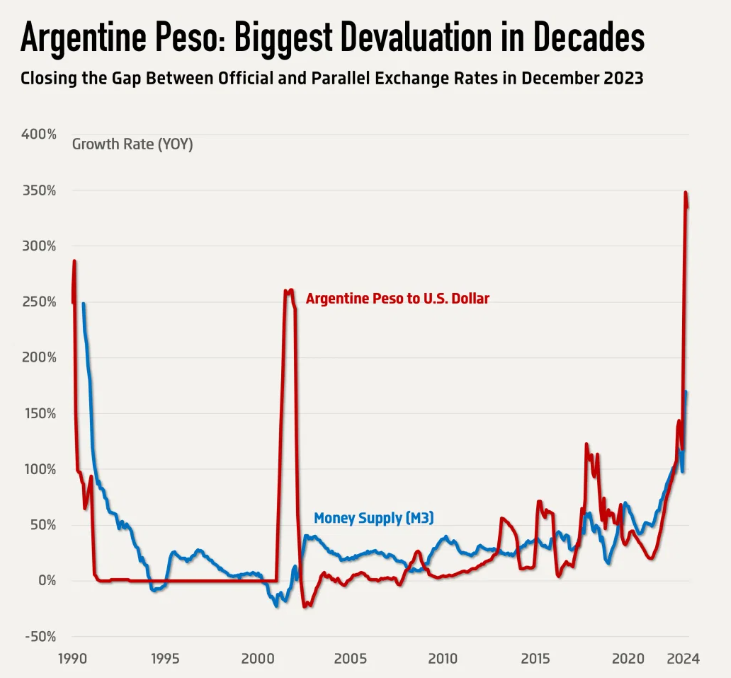

However, the more important question in 2025 is not just what currency does Argentina use by law, but what currency holds trust among its citizens. The answer is less straightforward, especially when inflation has surpassed 200 percent year-on-year and the purchasing power of the peso continues to erode.

The peso's exchange rate against the US dollar has depreciated sharply, despite government attempts to stabilise it. Price tags in many shops change weekly, sometimes daily. High-value transactions are rarely conducted in pesos without immediate conversion to a more stable currency, typically the US dollar. This creates a dual-currency reality within the Argentine economy.

The US Dollar: The Parallel Currency in Daily Life

If the official answer to what currency does Argentina use is the peso, the unofficial but widely accepted answer is the US dollar. Dollarisation in Argentina is not new, but it has deepened further in 2025. The dollar is not legal tender, but it plays a dominant role in real estate, car sales, savings, and even rent payments in major cities like Buenos Aires and Córdoba.

In practical terms, the Argentine economy operates on a split between the peso for day-to-day expenses and the dollar for store-of-value and major asset transactions. This is largely due to the public's lack of trust in the peso's long-term value. Many Argentines immediately convert their salaries into dollars to avoid the effects of devaluation.

So, while technically the answer to what currency does Argentina use is the peso, the functioning economy tells a different story — one where the dollar serves as a shadow currency, dictating the real value of goods, services, and wealth.

The Blue Dollar and Argentina's Multiple Exchange Rates

A unique feature of Argentina's currency system in 2025 is the presence of multiple exchange rates. There is the official government rate, the “blue dollar” rate (an informal but widely used black market rate), and other specialised rates for specific sectors or imports.

This system complicates the seemingly simple question: what currency does Argentina use? Businesses often face challenges importing goods at one rate and selling them at another. Tourists are often encouraged to exchange money through informal channels to get a fairer rate, even though doing so is technically illegal. The blue dollar rate frequently trades at nearly twice the official rate, reflecting the market's true demand for a stable store of value.

This divergence between official policy and market reality illustrates how far removed the official currency has become from public confidence. In a climate like this, understanding what currency Argentina uses must go beyond banknotes — it requires understanding behavioural economics, distrust in policy, and inflation psychology.

Cryptocurrency and Alternative Stores of Value

Another wrinkle in answering what currency does Argentina use is the growing adoption of cryptocurrency. Faced with currency controls and inflation, more Argentines are turning to digital assets like Bitcoin and USDT (Tether) to protect their savings. Cryptocurrency is not officially recognised as legal tender, but it has become part of the financial ecosystem, especially among younger and tech-savvy populations.

Crypto wallets, peer-to-peer exchange platforms, and stablecoin apps have become increasingly common as a way to circumvent banking restrictions and maintain access to US-dollar denominated value. While these tools are not mainstream across the entire population, their rising presence contributes to the complexity of Argentina's monetary landscape in 2025.

So again, what currency does Argentina use? The legal answer remains the peso, but the functional answer includes the US dollar and, increasingly, cryptocurrencies.

What the Future Holds for the Peso

There have been calls within Argentina's political circles to fully dollarise the economy, replacing the peso altogether. While such a move would simplify the answer to what currency does Argentina use, it would also mean surrendering control over monetary policy to the US Federal Reserve — a controversial and politically sensitive step.

In the meantime, the government continues to implement foreign exchange controls, limit dollar purchases, and raise interest rates in an attempt to support the peso. However, these policies often create distortions that drive more people into informal markets.

For now, the peso remains in circulation, but unless inflation is brought under control and confidence in domestic policy is restored, the Argentine public will likely continue to rely on the dollar and digital alternatives for security and savings.

Conclusion

To summarise, what currency does Argentina use in 2025? Officially, it is still the Argentine peso. Practically, however, the economy functions on a dual-currency basis, where the US dollar holds dominance in high-value and long-term transactions. With the blue dollar market thriving and cryptocurrency adoption on the rise, the peso's role continues to shrink in terms of public confidence and financial reliability.

Understanding what currency Argentina uses requires looking at more than just legal definitions. It means understanding how people adapt to inflation, how markets respond to control measures, and how alternative systems emerge when faith in traditional structures is lost.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.