The Smart Money Concepts (SMC) trading strategy has become increasingly prominent among advanced traders, primarily due to Michael Huddleston, founder of Inner Circle Trader (ICT).

SMC distinguishes itself from other technical trading approaches by emphasising price action, market structure, and institutional logic rather than relying on lagging indicators. This guide presents the fundamental principles of SMC, analyses its operational mechanisms, and describes the methods traders use to implement this strategy.

Practically, SMC serves as a 'liquidity and structure lens' for navigating contemporary markets. This perspective is particularly relevant in an environment where global over-the-counter foreign exchange (FX) turnover reached $9.6 trillion per day in April 2025, with trading activity increasingly concentrated around major sessions and event-driven risks that can swiftly reprice liquidity.

What Is the SMC Trading Strategy?

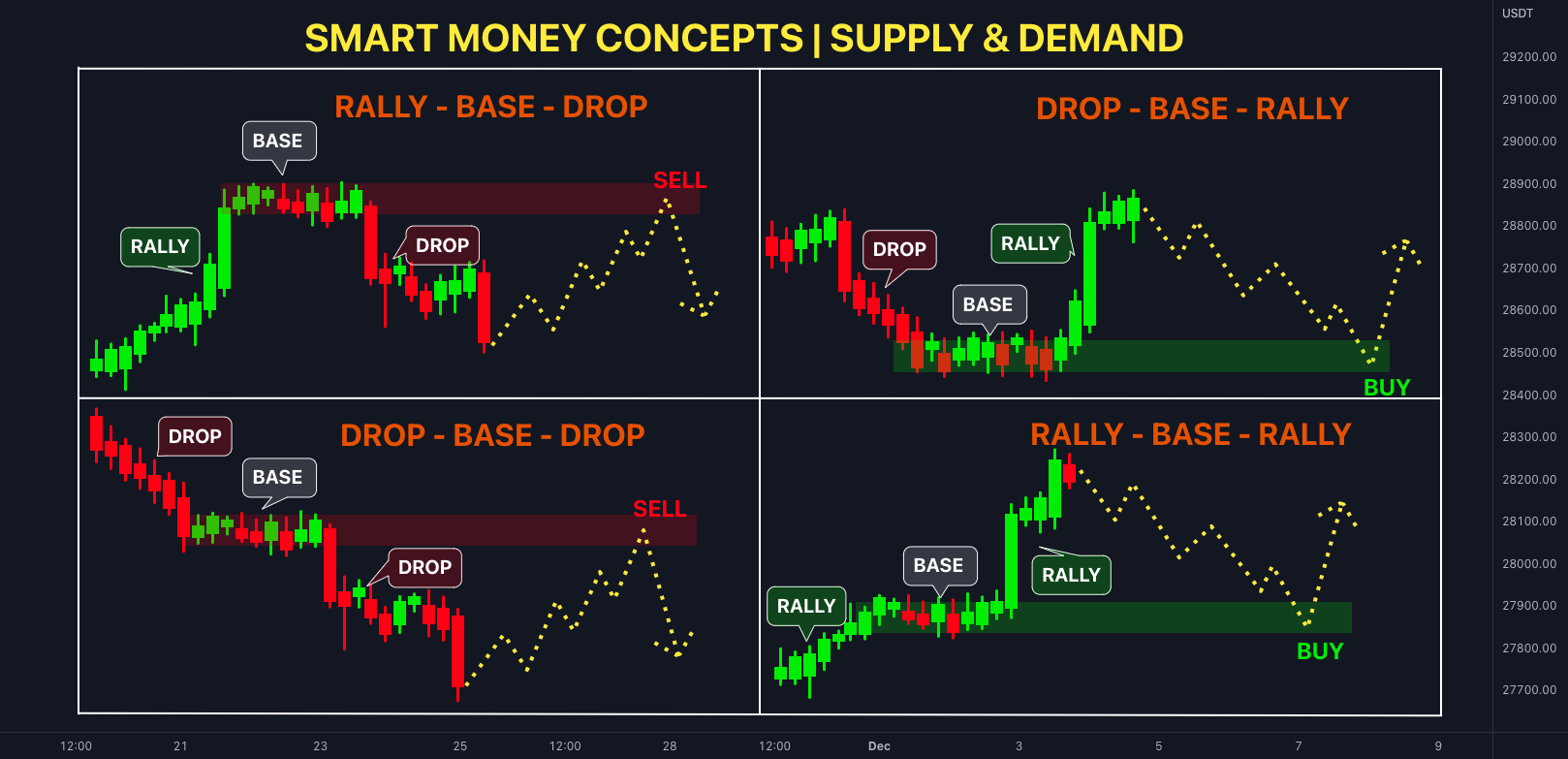

Smart Money Concepts, often referred to simply as SMC, is a structured trading methodology that focuses on understanding and following institutional order flow. Unlike traditional technical approaches that often rely on indicators, SMC interprets price action in terms of order blocks, price structure, and liquidity mechanics. Its framework enables traders to speculate alongside the deep-pocketed institutions driving major price movements.

SMC is based on the premise that identifying institutional footprints, such as consolidation preceding significant breakouts, enables traders to operate with greater conviction.

The Key Pillars of SMC Trading Strategy

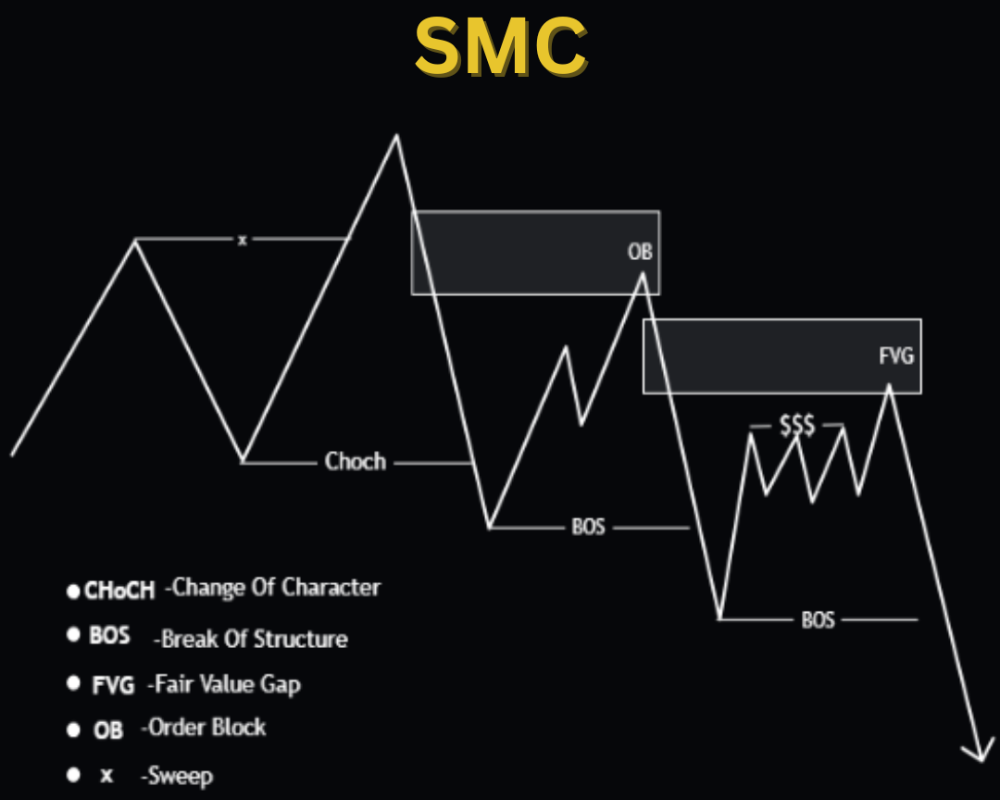

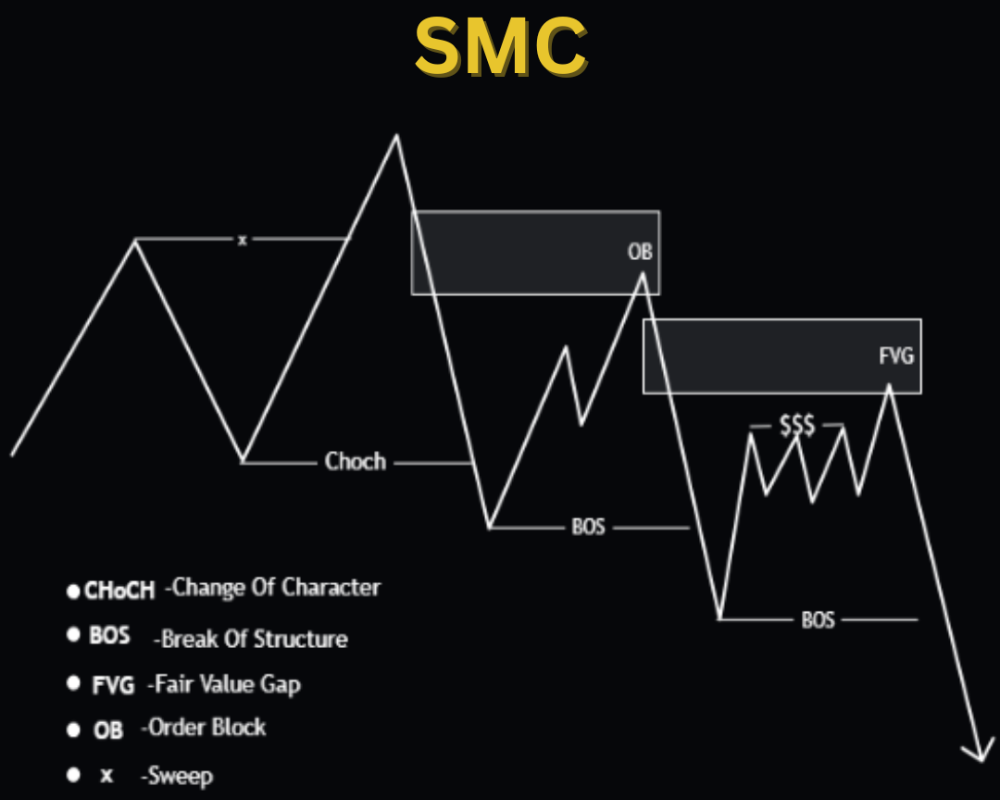

At the heart of Smart Money Concepts are several key structural elements.

1) Order Blocks

2. Breaker Blocks

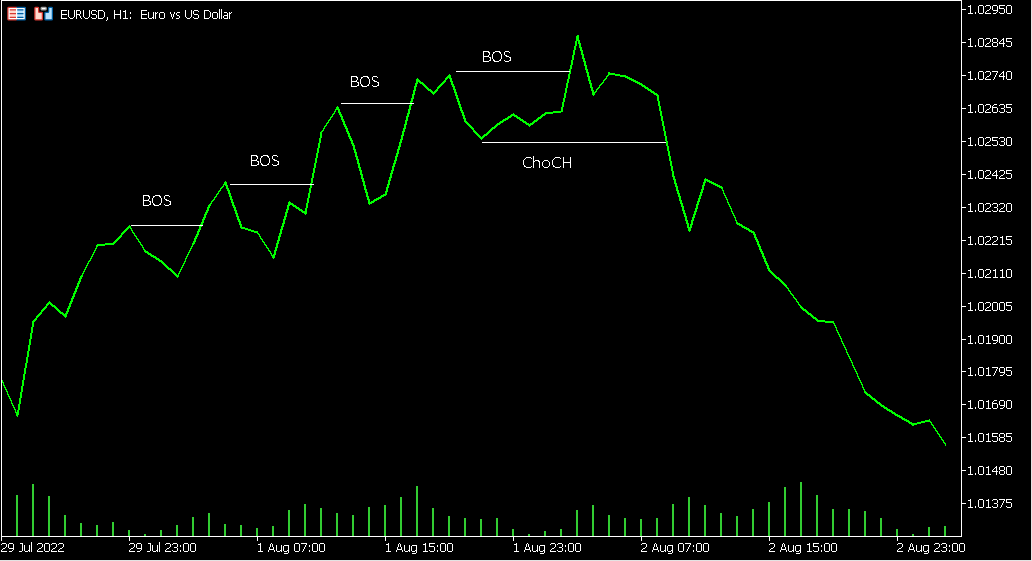

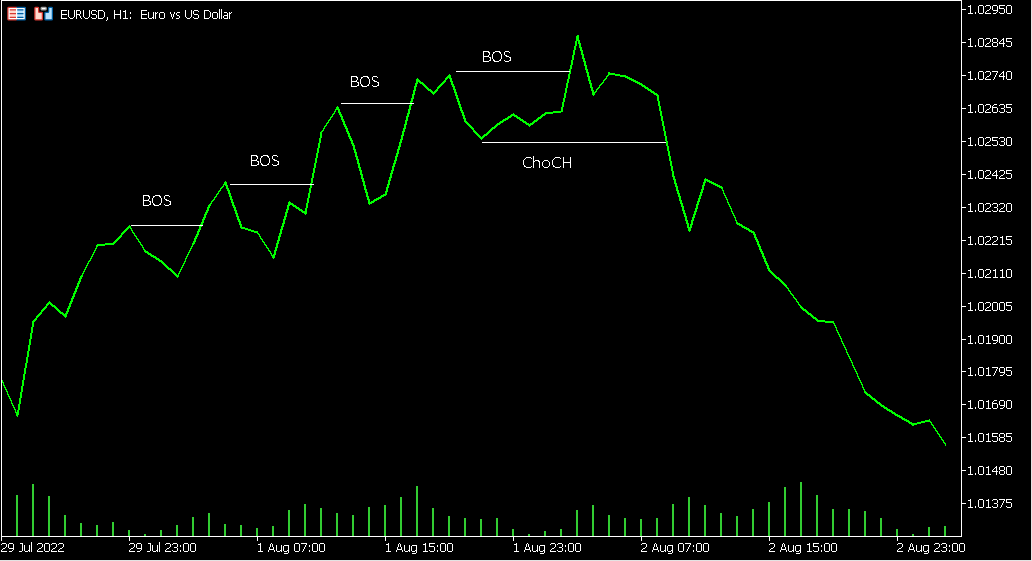

3. Breaks of Structure (BOS)

4. Change of Character (CHoCH)

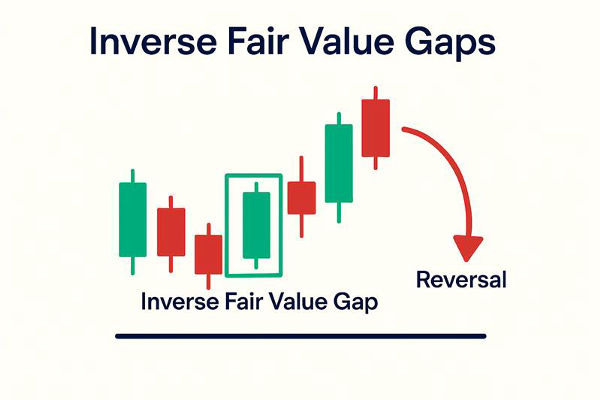

5. Fair Value Gaps (FVG)

6. Liquidity Grabs & Mitigation Blocks

Many SMC practitioners also incorporate optional elements when appropriate, such as premium and discount framing relative to a dealing ranthat identify impulsive candles indicating participation, and session timing focused on the participation, and market session timing focused on the London and New York market opens.

How Does the SMC Strategy Work?

SMC is a process-oriented trading method with four key steps:

1) Identify Market Structure

Evaluate daily/weekly charts to determine trend or range

2) Mark Zones

Plot order blocks, fair value gaps, and breaker blocks on the chart

3) Wait for Liquidity Events

Monitor for Breaks of Structure (BOS), Change of Character (CHoCH), or liquidity grabs occurring near key zones, as these may indicate institutional activity.

4) Enter with Confluence

Look for confirmation signals: bullish engulfing, volume increase, confluence with major session levels

A practical “execution checklist”

| Step |

What you’re validating |

What invalidates the idea |

| Bias |

Higher timeframe structure (trend/range) |

Clear break against bias with follow-through |

| Location |

Price at OB / FVG / prior swing liquidity |

No reaction, or closes through the zone |

| Event |

Sweep, CHoCH, or displacement |

“Wick only” with no confirmation |

| Trigger |

Retest + rejection, or clean continuation break |

Entry taken mid-range with no structure |

A Practical Example of SMC in Action

Imagine a daily chart trending upward. Price forms a bullish order block between $100 and $102, then rallies to $110. Later, it retraces to $101.

Plot zone: $100–$102 order block

Wait: Look for BOS above $102 or a bullish candle in that range

Trigger: A bullish engulfing candle forms at $101 on a volume spike = entry

Stop: Set below $100; Target: previous swing high at $110

This represents a classic SMC entry, characterised by alignment with institutional behaviour and the structural market context.

SMC vs Other Strategies

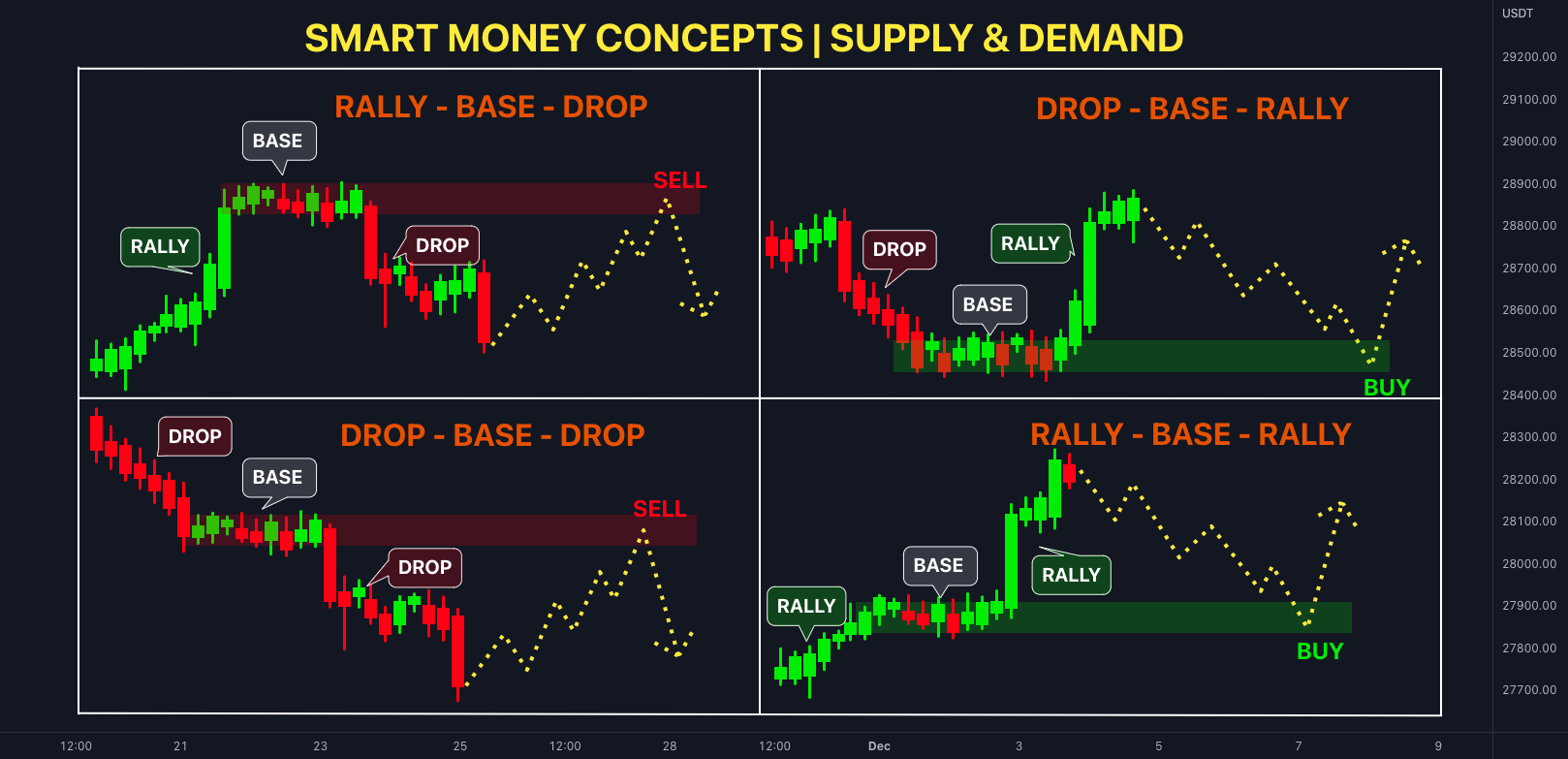

In many ways, SMC is a refined subset of price-action trading. Both approaches use order blocks or supply-demand zones. Traditional price action relies on recognisable candlestick patterns and support and resistance levels. SMC, however, adds institutional context, highlighting where major players likely operate and how they structure liquidity events. This institutional perspective differentiates SMC. It explains why structures such as breaker blocks exist, which would otherwise appear as simple horizontal lines in price action analysis.

Moreover, SMC actively tracks liquidity sweep traces before reversals, a subtlety often overlooked by broader strategies.

Adapting SMC Across Markets and Timeframes

A key advantage of SMC is its versatility across markets, including forex, equities, commodities, and futures. SMC zones are applicable across multiple timeframes, from 15-minute intervals to daily and weekly charts, enabling traders to align setups with their preferred time horizon and risk tolerance.

Traders may analyse zones on multiple timeframes (e.g., daily and one-hour) to ensure structural alignment. Some SMC elements, such as liquidity grabs or fair-value gaps, may require volume data, making advanced platforms more beneficial.

Benefits and Limitations of SMC

| Benefits of SMC |

Limitations of SMC |

| Helps traders align with institutional order flow, increasing trade accuracy |

Has a steep learning curve; beginners may struggle with complex concepts |

| Offers high-probability zones like order blocks and fair value gaps |

Can be time-consuming to analyze multiple zones across different timeframes |

| Provides a clear structure for trade entries, exits, and risk management |

Requires strong chart-reading skills and precise execution |

| Avoids lagging indicators by focusing on real-time price action |

May not perform well in news-driven or erratic markets |

| Works across multiple markets (forex, stocks, indices, crypto) |

Can be difficult to verify or backtest systematically due to discretionary elements |

| Encourages disciplined trading through structure and confirmations |

Mislabeling zones or BOS can lead to false setups and emotional decision-making |

Common Mistakes Traders Make With SMC

Forcing structure in a range: Labeling every minor swing as BOS/CHoCH creates overtrading and poor location.

Treating every liquidity sweep as a reversal: Sweeps can also be continuation mechanics, especially in strong trends.

Ignoring session timing: Many clean displacement moves cluster around London and New York opens; low-liquidity periods can distort signals.

No clear invalidation: If a setup has no obvious “thesis break” level, risk management becomes guesswork.

Is SMC Trading Strategy Right for You?

Traders who favor rapid, indicator-based systems may perceive SMC's multi-layered logic as complex. However, SMC rewards those who invest time in developing chart analysis skills, exercise patience in trade execution, and maintain rigorous risk management.

For individuals who prioritize analytical depth, structural insights, and disciplined frameworks over speed and reliance on indicators, SMC may offer significant value.

Frequently Asked Questions (FAQ)

1. What is the SMC trading strategy in simple terms?

SMC is a price-action framework that focuses on market structure and liquidity. Traders map where liquidity clusters (highs/lows), identify institutional-style zones (order blocks, FVGs), then wait for confirmation (CHoCH/BOS) to time entries with defined invalidation.

2. What is the difference between CHoCH and BOS?

CHoCH (Change of Character) is often treated as an early sign that control may be shifting, usually after a break of a prior structural point. BOS (Break of Structure) is more commonly used to confirm structure continuation once price breaks and holds a key swing in the trend’s direction.

3. Do order blocks and fair value gaps work in all markets?

They can appear in any liquid market, but reliability depends on context. Clean reactions are more common when liquidity is deep and participation is consistent. In thin or erratic conditions, zones can be overshot, making confirmation and invalidation rules critical.

4. What timeframe is best for SMC trading?

Many traders set direction on higher timeframes (4H/Daily/Weekly) and execute on lower ones (15M–1H). Lower than 5M often introduces noise unless the trader has strict rules for “valid swings” and avoids trading during illiquid hours.

5. Can you backtest SMC systematically?

Parts of SMC can be standardized (structure breaks, displacement rules, defined zone criteria), but many elements remain discretionary. Results improve when you write rule-based definitions for swing selection, confirmation candles, and invalidation levels before testing.

6. Is SMC better than indicators?

It is different. Indicators can help quantify momentum and volatility, while SMC focuses on structure and liquidity location. Many traders combine them, using SMC for “where and why” and indicators for “when” confirmation, provided risk rules stay consistent.

Conclusion

In summary, the Smart Money Concepts strategy offers a robust foundation for aligning retail trading decisions with institutional market activity. Its primary strengths are structural clarity and disciplined entry and exit protocols. However, successful implementation requires commitment to mastering specialized terminology, advanced chart analysis, and comprehensive risk management.

As with any trading methodology, SMC is not infallible. Nevertheless, it provides traders with a systematic framework for interpreting institutional market activity, thereby enhancing the identification of higher-probability trading opportunities.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.