The closing price refers to the price of the last transaction at the end of a

certain trading day in the stock market. In stock trading, there are important

price indicators such as the opening price, highest price, lowest price, and

closing price every day. The closing price is usually regarded as the overall

performance of the market on that day and is also an important reference for

investors to conduct technical analysis and formulate trading strategies.

The determination of the closing price is automatically calculated through

the trading system of the exchange, which represents the last trading price of

the market on that day. At the end of the trading day, the exchange will

announce the closing price of the day, which will be widely watched and quoted.

The high or low closing price can reflect the overall market trend and investor

sentiment on that day.

The importance of the closing price lies in its ability to provide a

reference for investors to determine the trend of stocks and the market. For

example, if the closing price of a stock continues to rise for several

consecutive days, it can be considered that the stock is in an upward trend, and

investors may consider buying. On the contrary, if the closing price of a stock

continues to decline for several consecutive days, it may indicate that the

stock is in a downward trend, and investors may consider selling or avoiding

buying.

In addition, the closing price can also be used to calculate the fluctuation

and yield of stocks. The rise and fall range refers to the difference between

the closing price of the day and the closing price of the previous trading day,

while the yield refers to the return obtained by investors holding stocks within

a certain period of time. These indicators can help investors evaluate their

investment performance and market volatility.

The significance of stock closing prices

The high or low closing price often reflects the degree of market funds'

attention to a particular stock and has the function of indicating the direction

of the next trading day. We mainly compare the closing price with the opening

price, highest price, and lowest price on the same trading day and judge the

trend characteristics of Stock Prices based on several different situations:

If the closing price is higher than the opening price, it indicates that the

stock has some resistance. Among them, if the stock opens low and rises high

during a decline, it indicates ultra-low capital intervention, but if it opens

high and rises high, it indicates that the stock is in a strong upward process.

If the closing price is lower than the opening price, it often means that the

stock has an adjustment requirement.

Generally speaking, the closing price has great guiding significance for

short-term investors, especially in the tail market. If the volume rises, the

stock price will close at a higher price on the same day, and the next day will

often have more outstanding performance, so such individual stocks have

short-term opportunities. But for medium- to long-term investors, paying

attention to the closing price is often the best way to judge changes in trend.

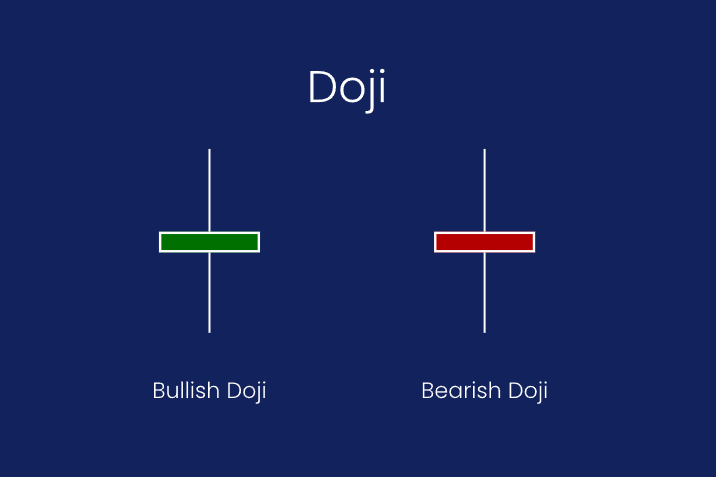

When a cross star with a long shadow appears, it generally indicates the arrival

of the bottom of an individual stock, which has positive technical significance

for market stock judgment. Conversely, it can be judged as the head of the

individual stock trend.

It should be noted that the closing price is only a price point in the

financial market and cannot fully represent the price fluctuations of the entire

trading day. During trading days, the prices of stocks and other financial

assets will constantly fluctuate, sometimes even with obvious highs and lows.

Therefore, in addition to the closing price, there are other price points and

indicators that also need to be considered and analyzed to comprehensively

understand the market dynamics.