Japan is the third-largest economy in the world and home to one of the most actively traded currencies in global financial markets—the Japanese Yen (JPY). From forex traders seeking liquidity to institutional investors searching for safe-haven assets, the Yen plays a crucial role in the dynamics of currency trading.

This comprehensive guide explains what currency Japan uses, its history, economic relevance, and why it remains a favourite among global traders in 2025.

What Currency Does Japan Use?

The official currency of Japan is the Japanese Yen, abbreviated as JPY and symbolized by "¥". Introduced in 1871 under the New Currency Act during the Meiji Restoration, the Yen replaced the Tokugawa coinage system. The word "Yen" means "circle" or "round object" in Japanese, a nod to the round shape of the coins.

Today, the Yen is managed by the Bank of Japan (BoJ), the nation's central bank. As the third most traded currency in the world, after the US Dollar (USD) and Euro (EUR), it is critical for the global forex ecosystem.

Brief History of the Yen

The Japanese Yen was modelled after European decimal currencies and was initially pegged to silver. Over the decades, its value has been shaped by significant economic milestones:

The post-WWII rebuilding period, where the Yen was pegged to the US Dollar at a fixed rate of ¥360 to $1

The breakdown of the Bretton Woods system in the early 1970s led to the floating exchange rate system

Japan's asset price bubble of the late 1980s and the ensuing "Lost Decade".

The Bank of Japan's low-interest and negative interest rate policies since the 2000s

These events helped mould the Yen into a symbol of Japan's economic resilience and a reflection of its monetary policy decisions.

The Role of the Bank of Japan (BoJ)

The Bank of Japan plays a central role in influencing the value of the Yen. Through tools like interest rates, quantitative easing, and currency intervention, the BoJ maintains price stability and promotes economic growth.

For example, when Japan faces deflationary pressures, the BoJ may engage in asset purchases or lower interest rates, which often weakens the Yen. On the other hand, during inflation, the central bank may tighten policy, strengthening the Yen.

Traders closely monitor announcements, interest rate decisions, and economic outlooks from the BOJ to anticipate the Yen movements in the forex markets.

Why Is the Yen Important in Forex Trading?

The Japanese Yen is considered one of the "major currencies" in the forex market. Its importance stems from several key factors:

High Liquidity: The JPY is involved in several popular currency pairs, such as USD/JPY, EUR/JPY, and GBP/JPY.

Low Spreads: Due to its high trading volume, Yen pairs often offer tighter bid-ask spreads.

Safe-Haven Status: The Yen is often perceived as a safe-haven currency in times of global economic or political uncertainty.

Carry Trade Potential: Japan's historically low interest rates make the Yen a preferred funding currency in carry trade strategies.

Because of these attributes, the Yen attracts both short-term speculators and long-term investors.

Popular Currency Pairs

The most traded currency pair involving the Yen is USD/JPY. This pair acts as a barometer for risk sentiment and interest rate differentials between Japan and the United States.

EUR/JPY: Reflects the economic relationship between the Eurozone and Japan

GBP/JPY: Known for its high volatility, popular among day traders

AUD/JPY and NZD/JPY: Often used to express risk appetite in the Asia-Pacific region

CHF/JPY: A cross-pair reflecting two safe-haven currencies

Why Traders Love the Yen in 2025

In 2025, the appeal of the Yen remains strong. Here's why traders continue to flock to it:

Volatility and Opportunity: Yen pairs, particularly GBP/JPY and USD/JPY, offer wide price swings suitable for scalping and swing trading.

Predictable Reaction to News: The Yen often moves predictably in response to BoJ policy changes or major economic releases.

Safe-Haven in a Turbulent World: Amid rising global debt and inflation concerns, the Yen acts as a hedge against volatility.

Technical Analysis-Friendly: Yen pairs often follow well-defined patterns and respond to technical indicators, making chart-based trading more effective.

Moreover, advancements in algorithmic trading and artificial intelligence have increased the efficiency of Yen-based strategies.

Yen as a Safe-Haven Currency

One of the most notable features of the Japanese Yen is its safe-haven appeal. During times of market turmoil—whether due to geopolitical tension, economic crises, or global pandemics—investors tend to move capital into the Yen.

This phenomenon is driven by Japan's stable government, large current account surplus, and consistent monetary policy. It's not uncommon to see the Yen appreciate sharply during global equity sell-offs or rising risk aversion.

This behaviour makes the Yen a key component of diversified trading strategies, especially during uncertain times.

Trading Strategies

1. Interest Rate Differentials (Carry Trade)

Borrowing Yen at a low rate and investing in a higher-yielding currency can generate positive returns. In 2025, traders exchange the Yen as a funding currency for carry trades, particularly when global interest rates diverge.

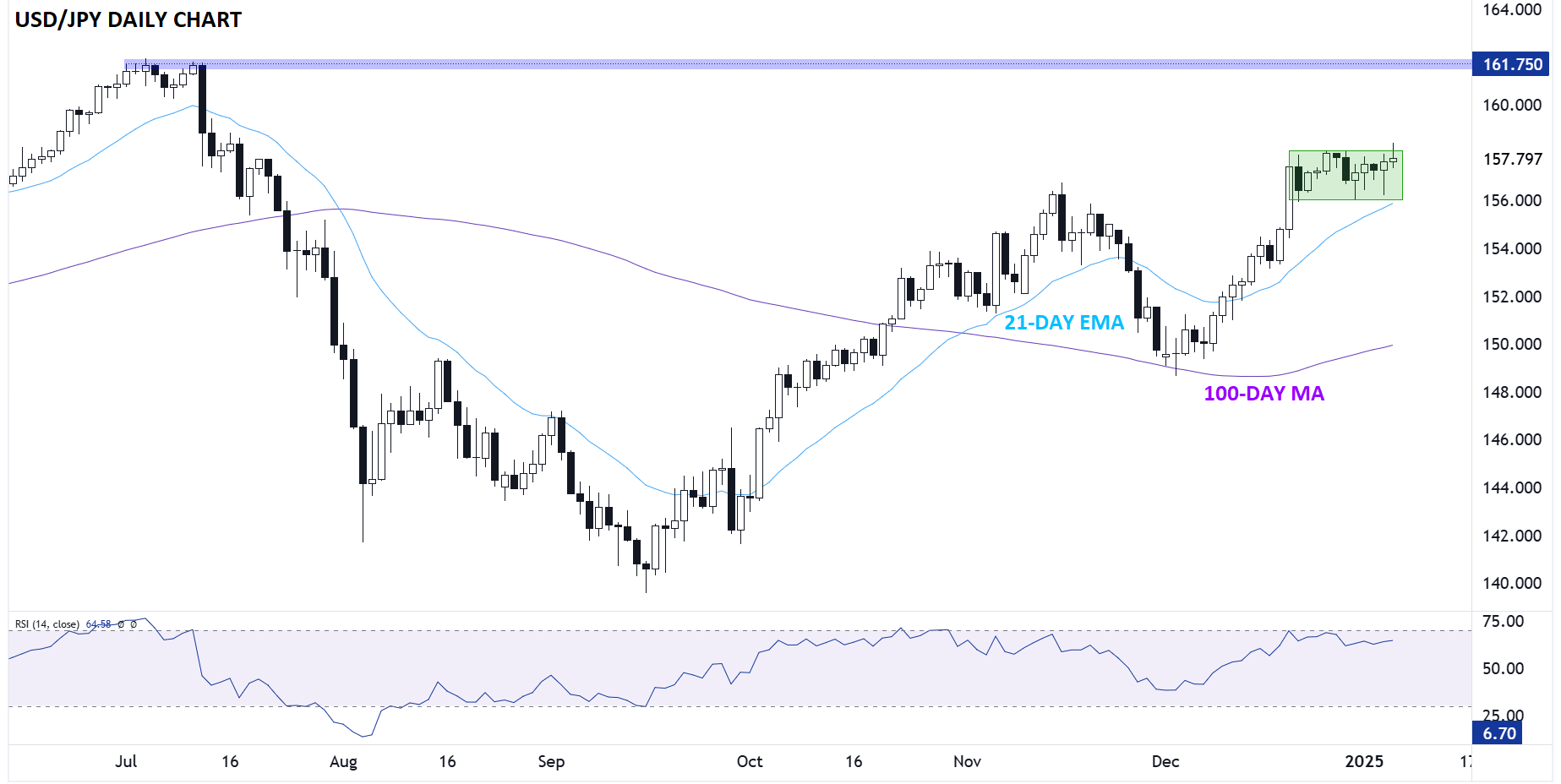

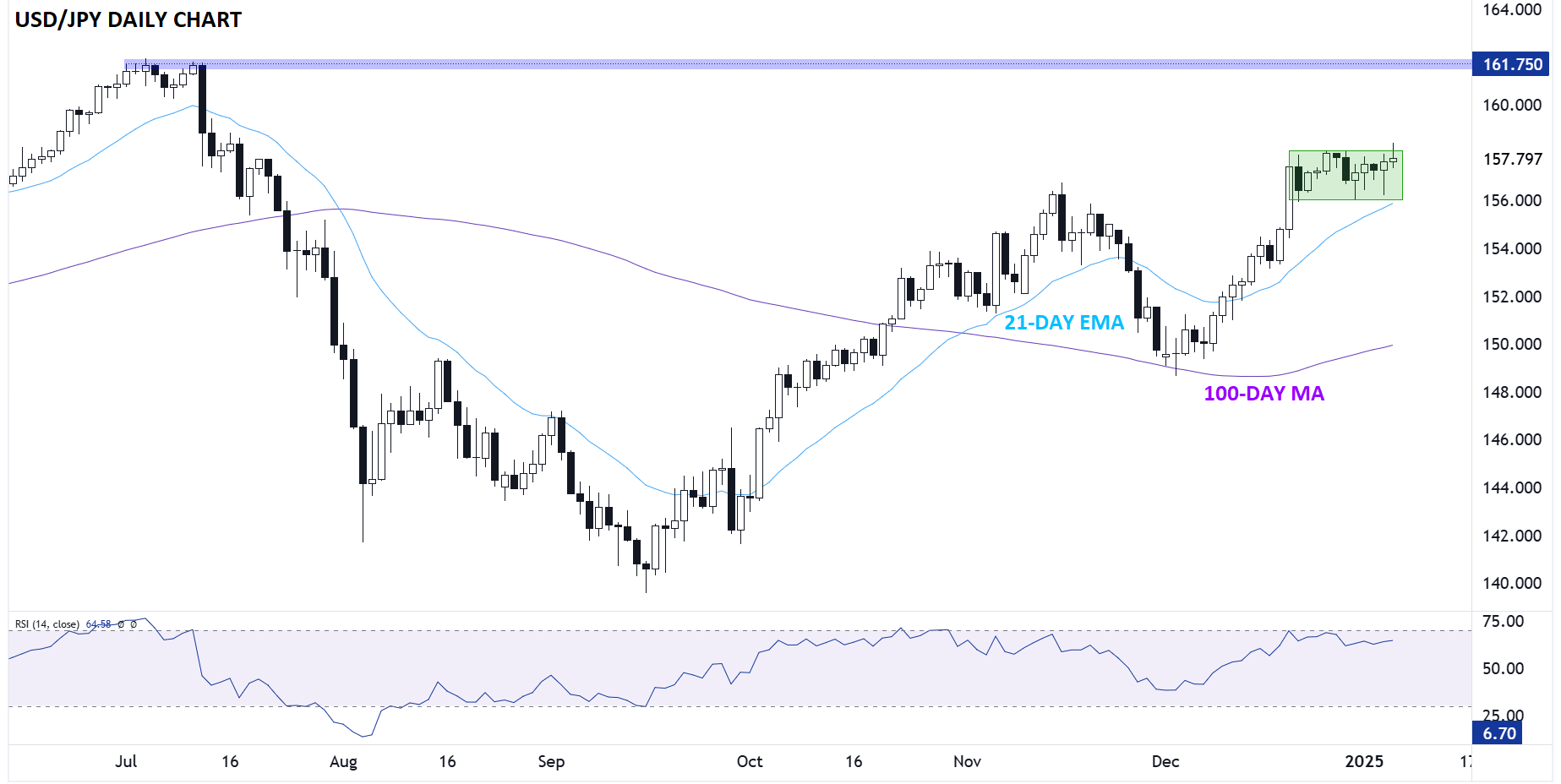

2. Technical Analysis

The Yen is popular among technical traders who use Chart Patterns like head and shoulders, double tops, and Fibonacci levels. Indicators such as MACD, RSI, and Bollinger Bands work well with Yen pairs due to their liquidity.

3. News-Based Trading

Economic reports and BoJ announcements provide excellent opportunities for breakout or fade-the-news strategies. The USD/JPY pair typically responds strongly to the US NFP reports or CPI figures.

4. Safe-Haven Flow Strategies

During times of risk-off sentiment, traders long the Yen to hedge against falling equities or commodities.

Each strategy requires proper risk management and an understanding of both fundamental and technical factors influencing the Yen.

Conclusion

In conclusion, the Yen remains a cornerstone of currency trading thanks to Japan's stable economy, disciplined monetary policy, and global financial relevance in 2025. However, success in trading the Yen requires preparation, a sound strategy, and a solid understanding of market dynamics.

As with any trading venture, practice, risk management, and continuous learning are essential. The Yen offers plenty of opportunities—but only for those who approach it with respect and skill.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.