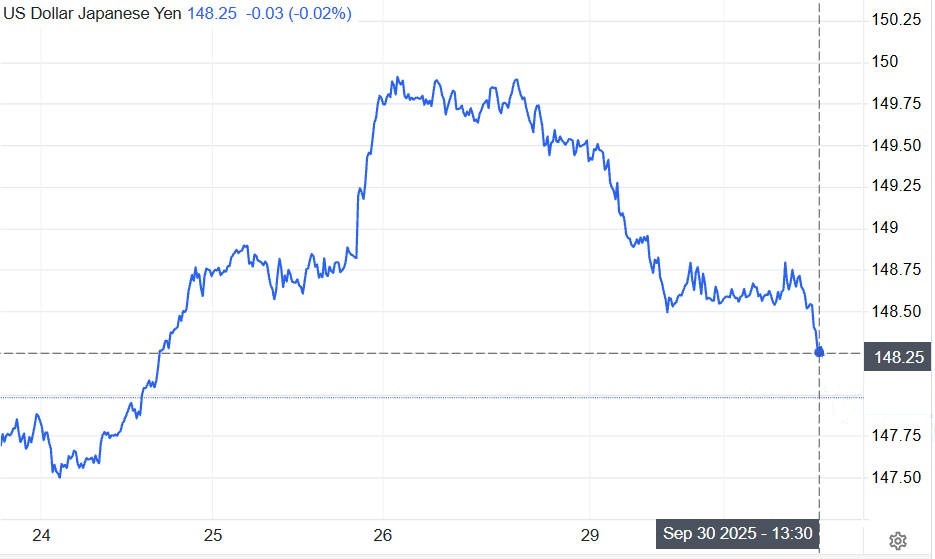

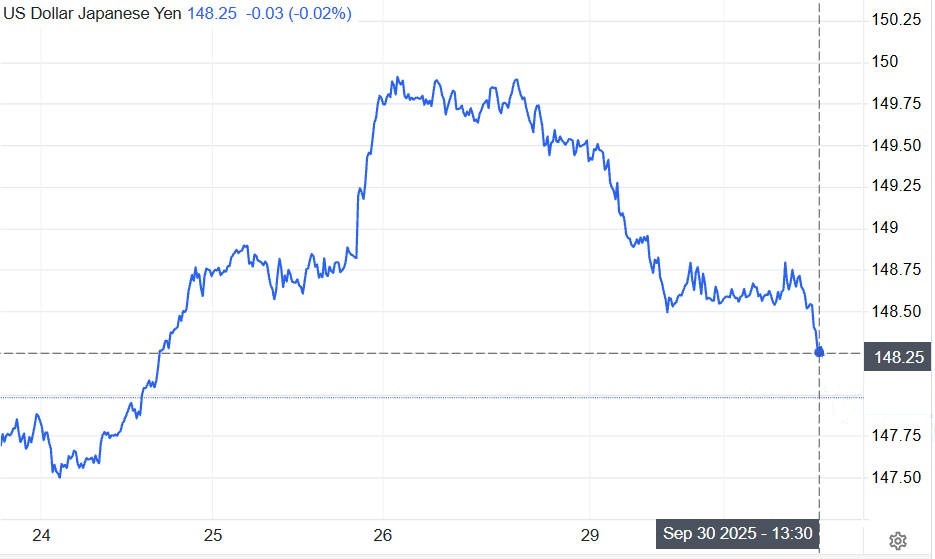

As of 30 September 2025. the USD/JPY currency pair is trading at approximately ¥148.25 reflecting a 0.22% decline from the previous day.

This movement indicates a period of consolidation following recent fluctuations influenced by geopolitical and economic factors.

The pair has been oscillating between ¥147.53 and ¥149.89 over the past week, with the highest level of 2025 recorded at ¥158.87 on 10 January 2025.

Technical Analysis: USD/JPY Price Action

Resistance and Support Levels

Key technical levels for USD/JPY are as follows:

USD/JPY Resistance and Support Levels

| Level |

Type |

Description |

| ¥150.00 |

Resistance |

Psychological barrier and recent high |

| ¥147.85 |

Support |

200-day moving average |

| ¥147.45 |

Support |

Short-term support level |

The pair is currently testing the ¥147.85 support level, with a potential rebound towards ¥150.00 if this support holds. A break below ¥147.45 could signal further downside risk.

Moving Averages and Indicators

The 200-day moving average near ¥147.85 serves as a critical support level. Short-term indicators suggest a neutral to slightly bullish bias, with potential for a corrective rally if the ¥147.85 support holds.

Fundamental Drivers: Economic and Political Factors

United States

Government Shutdown Concerns: The impending U.S. government shutdown has raised investor concerns, leading to a decline in USD/JPY.

Federal Reserve Policy Outlook: Market expectations suggest an 88% probability of a rate cut in October, influencing USD strength.

Japan

Bank of Japan's Stance: The BoJ's recent hawkish rhetoric has supported the yen, with potential rate hikes under consideration.

Economic Data: Weak economic indicators, including declining factory output and retail sales, have impacted the yen's performance.

Market Outlook: Short-Term and Long-Term Projections

Short-Term Forecast

USD/JPY is expected to test the ¥147.85 support level, with a potential rebound towards ¥150.00. A break below ¥147.45 could signal further downside risk.

Long-Term Projections

Analysts anticipate that a breakout above ¥150.00 could lead to further gains, with targets extending towards ¥151.20.

Conclusion: Strategic Considerations for Traders

Risk Management: Traders should monitor U.S. political developments and Japanese economic data closely.

Technical Levels to Watch: Key levels include ¥147.85 (support) and ¥150.00 (resistance).

Market Sentiment: Investor sentiment remains cautious, with geopolitical uncertainties influencing market dynamics.

Frequently Asked Questions

1. What is USD/JPY?

USD/JPY represents the exchange rate between the U.S. Dollar (USD) and the Japanese Yen (JPY), showing how many yen one dollar can buy.

2. What factors influence USD/JPY?

Key factors include U.S. Federal Reserve policy, Bank of Japan decisions, economic data, geopolitical events, and market sentiment.

3. What are the key support and resistance levels for USD/JPY?

Currently, ¥147.85 acts as a major support, while ¥150.00 serves as a key resistance level. A break of these levels may signal trend continuation.

4. How does the U.S. government shutdown affect USD/JPY?

Concerns about a government shutdown can weaken the USD, prompting a decline in USD/JPY as investors seek safer assets like the yen.

5. What is the short-term forecast for USD/JPY?

In the short term, USD/JPY may test support at ¥147.85. with a potential rebound towards ¥150.00 if the support holds.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.