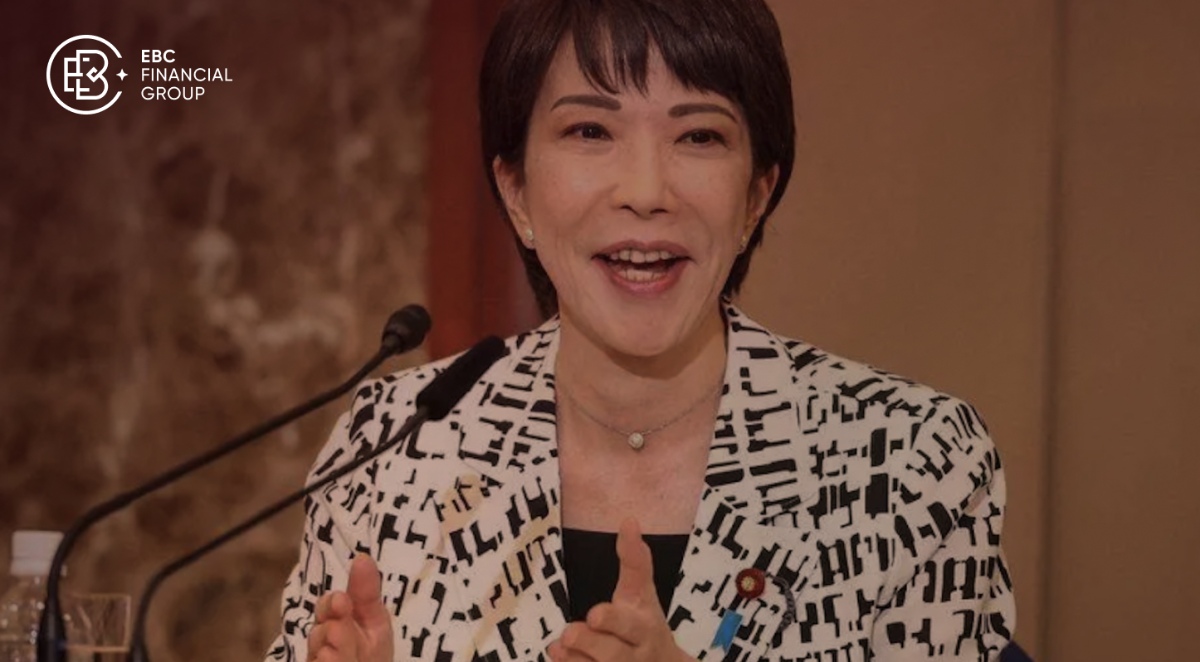

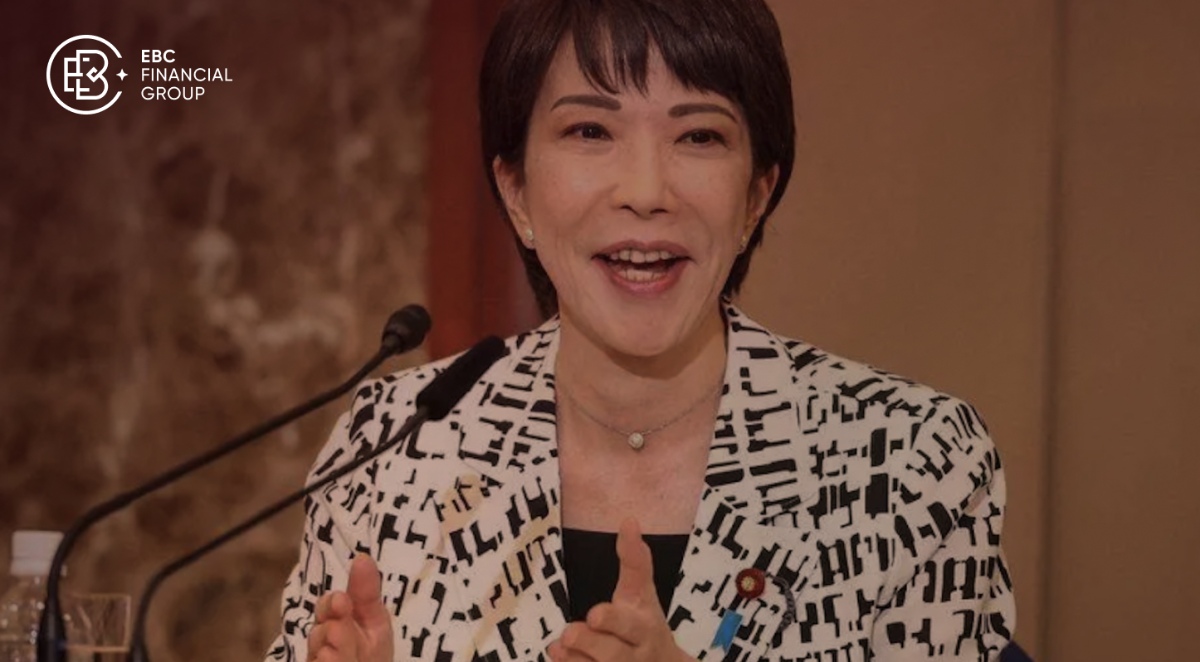

The yen weakened to a two-month low on Tuesday as attention in Japan turned

to who may join the cabinet of fiscal dove Sanae Takaichi after her party

leadership victory following Ishiba's resignation.

The PM candidate is seen as a proponent of "Abenomics" in favour of loose

monetary policy, fiscal spending and structural reforms. Despite higher

inflation, she has voiced opposition to the BOE's rate hikes.

Last week, Takaichi reportedly expressed misgivings about the US-Japan trade

deal, and said on a Fuji TV programme that a "do-over" of the agreement was not

off the table.

However, investors are concerned about her call for a hardline stance towards

China and a plan to revise Japan's pacifist constitution, especially Article 9,

which renounced right to wage war.

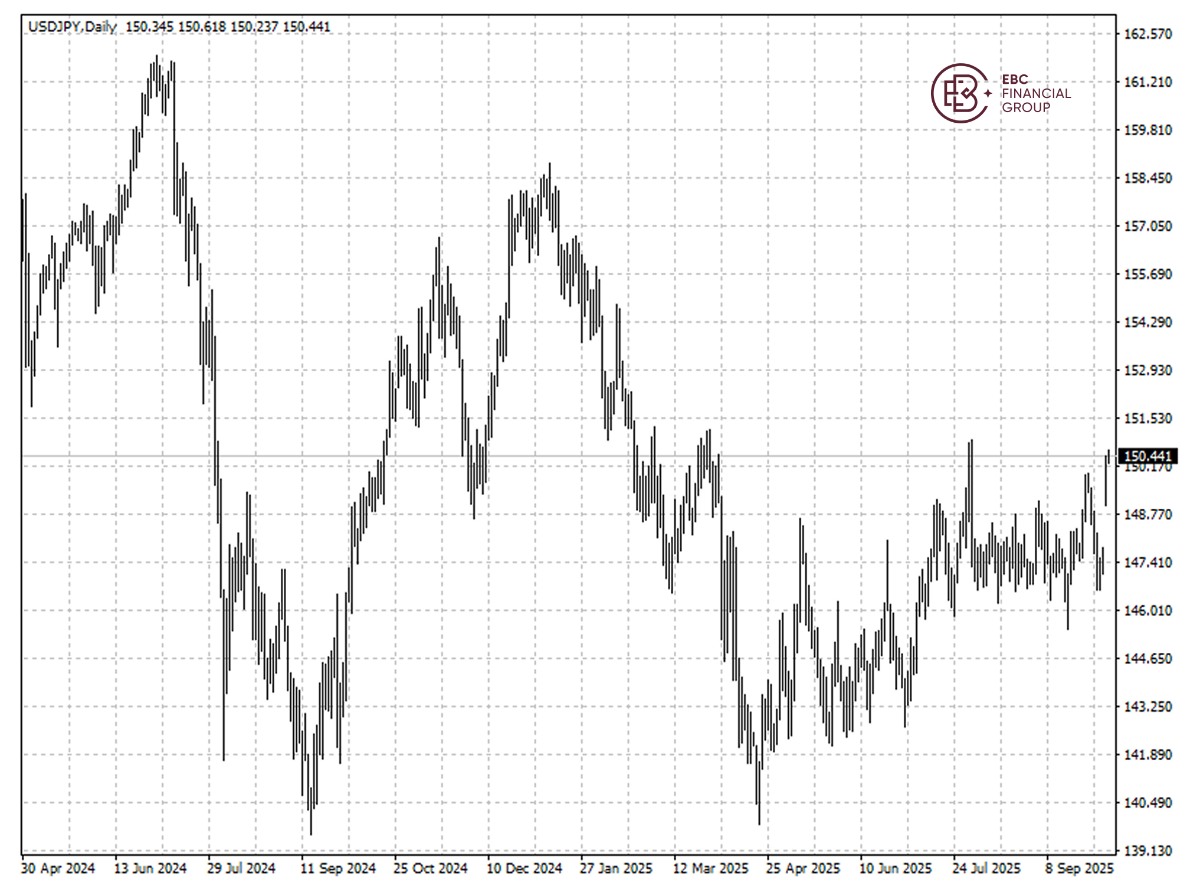

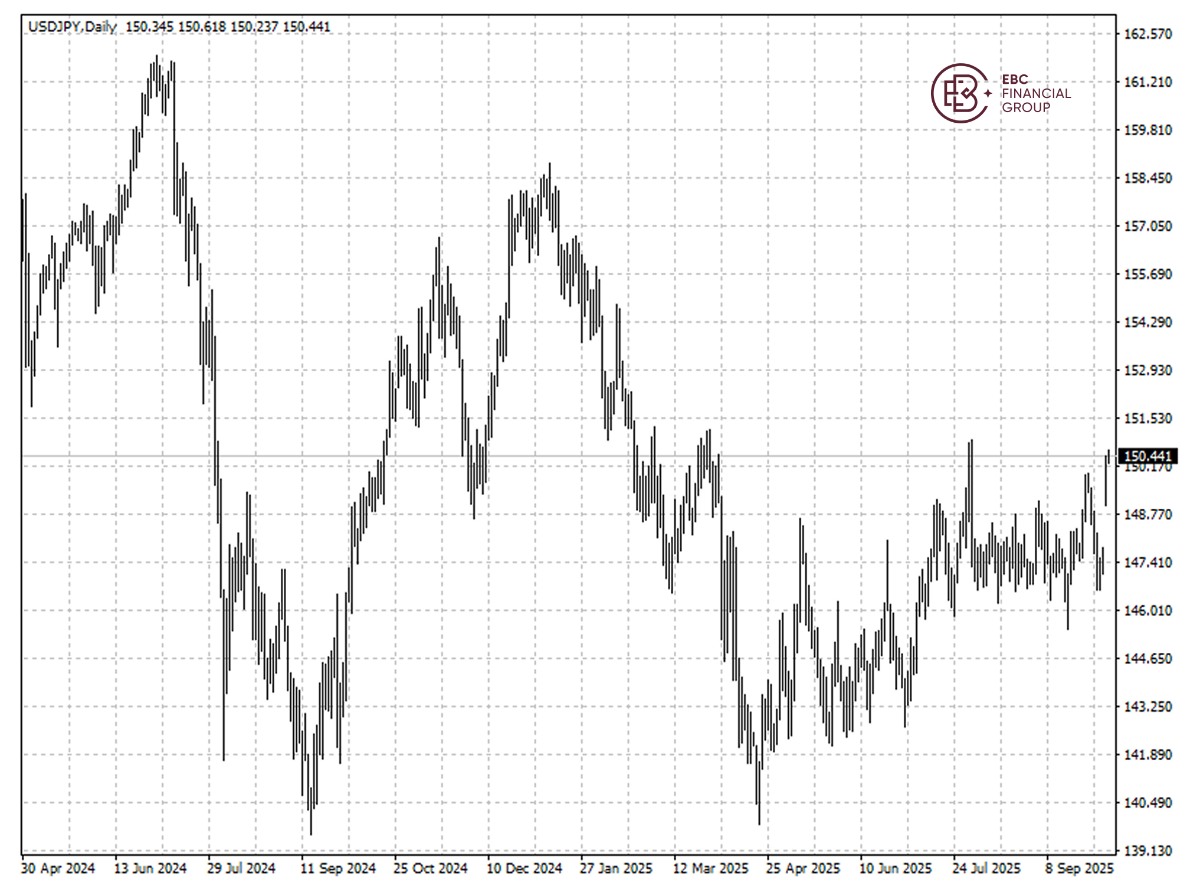

The last time the yen weakened to the 150-level was in August, which prompted

an intervention by the country's Ministry of Finance. A weaker yen could also

attract more criticism from Washington.

Japan's government said on Monday that the economy was recovering moderately

– a sign of the necessity of QT. In the latest economic report, it raised its

assessment of consumer spending.

The yen has largely moved in a tight range between 146 and 151 per dollar, so

we expect it to rise further towards 149 per dollar. Another leg lower could be

in the making If 151 does not hold.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.