Once dismissed as a volatile post-war currency, the Iraqi Dinar (IQD) has become a symbol of both hope and hype in global FX markets. It captures the attention of traders and investors worldwide, alternately hailed as a potential high-reward emerging currency or dismissed as a risk-laden market due to its geopolitical backdrop.

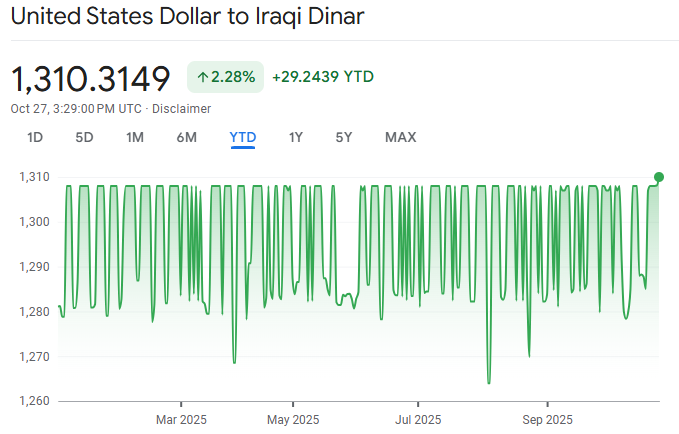

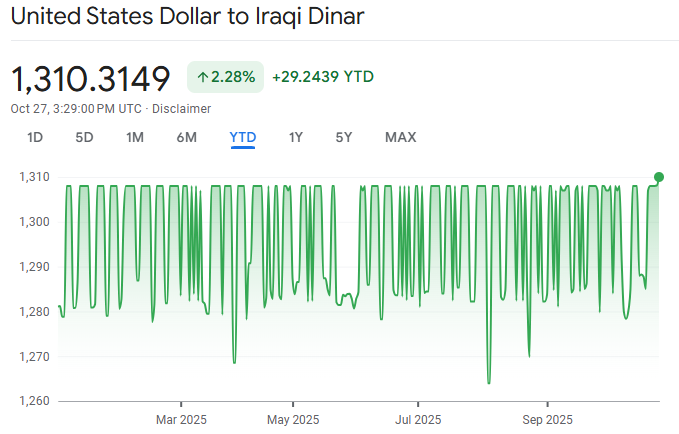

As of October 2025, the Iraqi dinar (IQD) remains effectively pegged and stable in the domestic market, trading around 1,300–1,310 IQD per USD in common rate tables. Iraq's foreign exchange reserves are substantial (around $95 billion by mid-2025), and the recovery in oil exports is bolstering public finances, all contributing to the dinar's short-term stability.

However, the dinar's path beyond 2025 depends on oil revenues, fiscal reforms agreed with international lenders (IMF), political stability, and the Central Bank's policy direction. Bold appreciation or a sudden "revaluation" remains highly unlikely without a massive policy shift and deeper structural reforms; speculative "dinar revaluation" claims continue to circulate but remain unsubstantiated.

IQD to USD Current Snapshot (October 2025)

Exchange rate: ~1,300–1,310 IQD per USD

Foreign-exchange reserves: Iraq reported FX reserves near $94–$97 billion in mid-2025 (around $94.7 billion by end-July 2025) [1]

GDP Growth: Expected at 1.2% in 2025, recovering from a contraction in 2024. Growth is forecasted to accelerate to 4.4% in 2026

Inflation: Moderated to around 4.3% in 2025, down from 7% in 2024, according to IMF estimates

Oil Dependence: Iraq remains heavily reliant on oil exports, which account for approximately 90% of government revenue

Why Iraqi Dinar Attracts Attention and Misconceptions About It

The Iraqi dinar attracts outsized public interest for three reasons:

Iraq's large oil wealth creates a plausible story for future currency strength.

The dinar's low nominal value versus major currencies (which tempts fantasies of big percentage gains)

Persistent online myths about an imminent "revaluation" or redenomination that would dramatically lift the exchange rate.

However, reality is more complex. The IMF and various official organisations consistently highlight that Iraq needs fiscal reforms, diversified revenue sources, and institutional stability to establish a sustainable macroeconomic foundation.

Additionally, the Central Bank of Iraq (CBI) has focused on reserve buffers and gradual market reforms, not sudden currency changes. Investors should treat "too good to be true" claims about guaranteed windfalls with healthy scepticism.

Iraqi Dinar Future Prediction: What Experts Say for 2025 and Beyond

Base Case: Managed Stability (60% Probability)

What happens: The CBI utilises reserves and oil revenue to maintain the domestic exchange-rate peg relatively stable at around 1,300–1,320 IQD/USD. IMF discussions persist, yet lack significant advancements.

Why it's plausible: Reserves are ample to smooth shocks; oil exports rose in 2025; political tensions remain contained.

Market effect: Minor fluctuations tied to oil or political headlines. IQD remains stable but lacks strong growth catalysts.

Bull Case: Gradual Strengthening With Reforms (25% Probability)

What happens: Iraq secures reliable IMF agreements, executes tax reforms, and increases oil production, enhancing foreign exchange inflows. CBI allows mild flexibility while avoiding abrupt moves. IQD appreciates modestly (single-digit % gains over 12 months).

Why it could happen: Structural reforms and donor cooperation could attract investment and strengthen the balance sheet.

Market effect: Gradual appreciation, improved liquidity, and renewed interest from emerging-market investors.

Bear Case: Pressure & Depreciation (15% Probability)

What happens: A global oil price drop, domestic instability, or loss of foreign support triggers capital outflow. Reserves fall, forcing the CBI to weaken the currency. IQD depreciates by double digits to restore competitiveness.

Why it might happen: Iraq's economy still hinges on oil; geopolitical or fiscal missteps could quickly destabilise sentiment.

Market effect: Higher inflation, import costs, and pressure on consumers.

The Five Drivers That Will Decide the Iraqi Dinar's Path

If you want to understand where the dinar goes from here, watch these five interacting drivers:

1) Oil Production and Export Receipts

Oil remains the dominant determinant of Iraq's foreign-currency flows. Stable oil prices and higher export volumes bolster fiscal strength and the dinar's defence. [2]

However, any production disruption or OPEC+ quota cuts could reverse the gains. Iraq's 2025 output recovery has improved fiscal receipts. But, continued stability is key.

2) Central Bank Reserves and Policy Stance

CBI's large reserves give Iraq a buffer to stabilise markets, grant time for reforms, and intervene to smooth volatility. The CBI's public messaging emphasises "capacity to defend the exchange rate," which reduces tail-risk premiums if sustained.

However, reserves are not an unlimited shield, as sustained deficits or capital flight would eventually exhaust buffers.

3) Fiscal Policy, Debt and IMF Support

Iraq must reconcile generous public spending and wage bills with the need for non-oil revenue growth. The 2025 staff report from the IMF highlights financing limitations and the immediate requirement for structural reforms to ensure sustainable development. [3]

Progress with IMF programs (loans, conditional support) tends to help markets by increasing transparency and unlocking financing; failure to agree or implement reforms increases the risk that the IQD remains constrained.

4) Political Stability and Security

Political infighting, protests, or changes that threaten oil operations or fiscal credibility can spook FX markets.

Political stability that supports investment and predictable policy will help the dinar; instability has historically caused sudden currency weakness.

5) Market Access, Convertibility and Revaluation Rumours

The dinar's availability is limited as most transactions occur through local interbank systems and designated currency exchange outlets.

Importantly, rumours about redenomination or an IMF-mandated "revaluation" circulate constantly, although they are typically speculative. Thus, treat revaluation claims skeptically.

Key Indicators and Data Sources to Watch Weekly/Monthly

If you track IQD, make a short watchlist of reliable indicators:

CBI foreign-exchange reserves

Iraq's oil exports and SOMO reports

IMF updates & Article IV reviews

OPEC+ decisions and global oil-price moves

Local political developments

Risk Checklist Before Taking Any Exposure to IQD

Liquidity risk: Low convertibility limits entry and exit.

Scam risk: Be Alert to "RV" (revaluation) schemes

Political & operational risk: Iraq's stability remains uneven.

Policy uncertainty: Regulatory changes can occur with little warning.

If taking speculative exposure, treat IQD as a high-risk emerging-market asset. Keep allocations small, use stop-loss levels, and rely only on regulated intermediaries.

Frequently Asked Questions

Q1: Will the Iraqi Dinar "Revalue" in 2025 and Make Investors Rich?

No credible public authority supports claims of an imminent windfall revaluation in 2025.

Q2: Can I Invest Directly in the Iraqi Dinar?

Direct trading in IQD is limited and often illiquid. Specialist brokers and currency funds offer access but carry high risk.

Q3: Are There Safe Ways to Get Exposure to Iraq's Economic Upside?

Yes. Consider diversified EM funds, sovereign bonds, or equities tied to Iraqi oil infrastructure, rather than holding physical dinar.

Conclusion

In conclusion, the Iraqi dinar forecast for 2025 points toward managed stability, supported by robust reserves and steady oil exports. Major appreciation remains unlikely without fiscal reform, economic diversification, and political stability.

For traders and investors, treat IQD exposure as high-risk but watchable, monitor reserve and oil data, and avoid speculative "revaluation" narratives. Staying disciplined, data-driven, and realistic will be essential in navigating Iraq's evolving monetary landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://shafaq.com/en/Economy/Iraq-forex-reserves-fall-below-95B

[2] https://www.reuters.com/business/energy/iraq-increases-oil-exports-sees-extra-revenues-state-oil-marketer-says-2025-09-21/

[3] https://www.washingtoninstitute.org/policy-analysis/facing-fiscal-pressures-iraqs-struggle-reform-ahead-2025-election