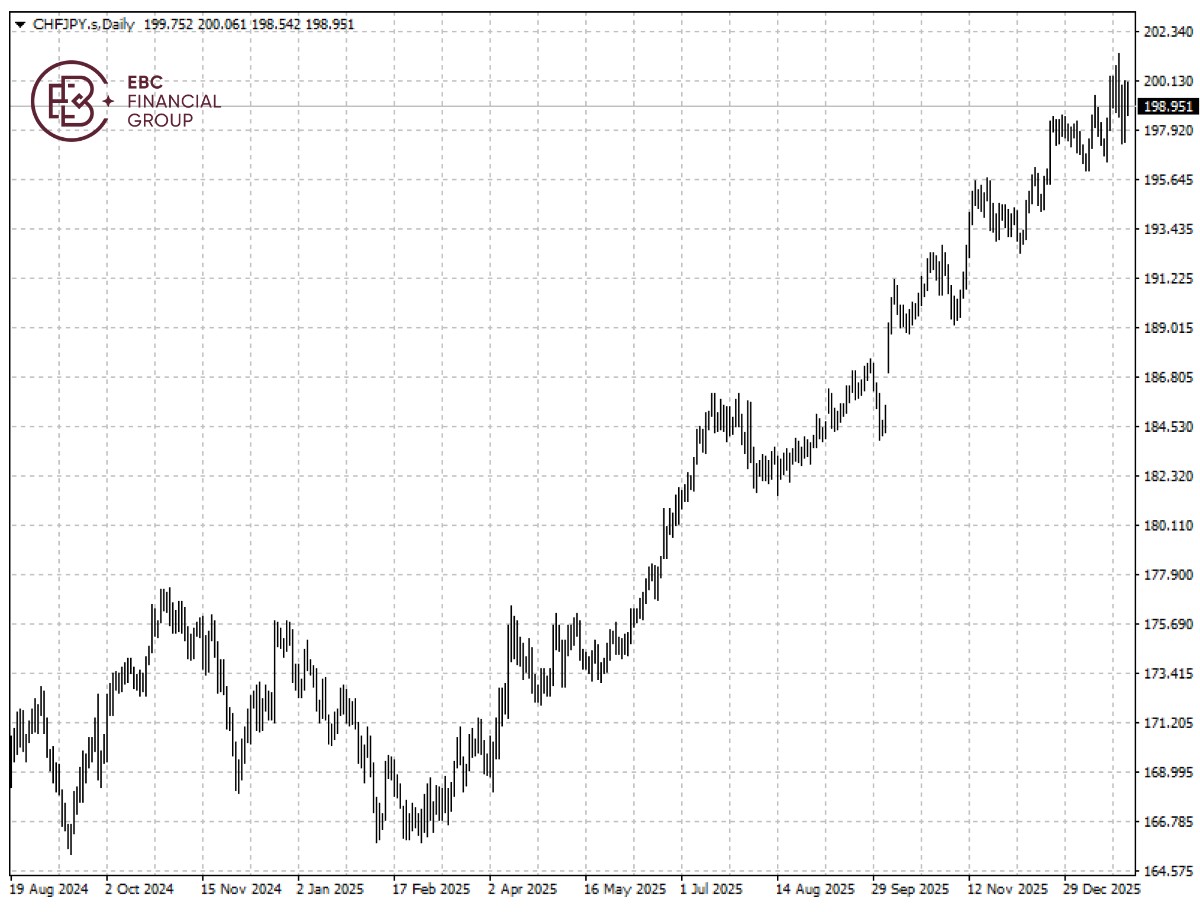

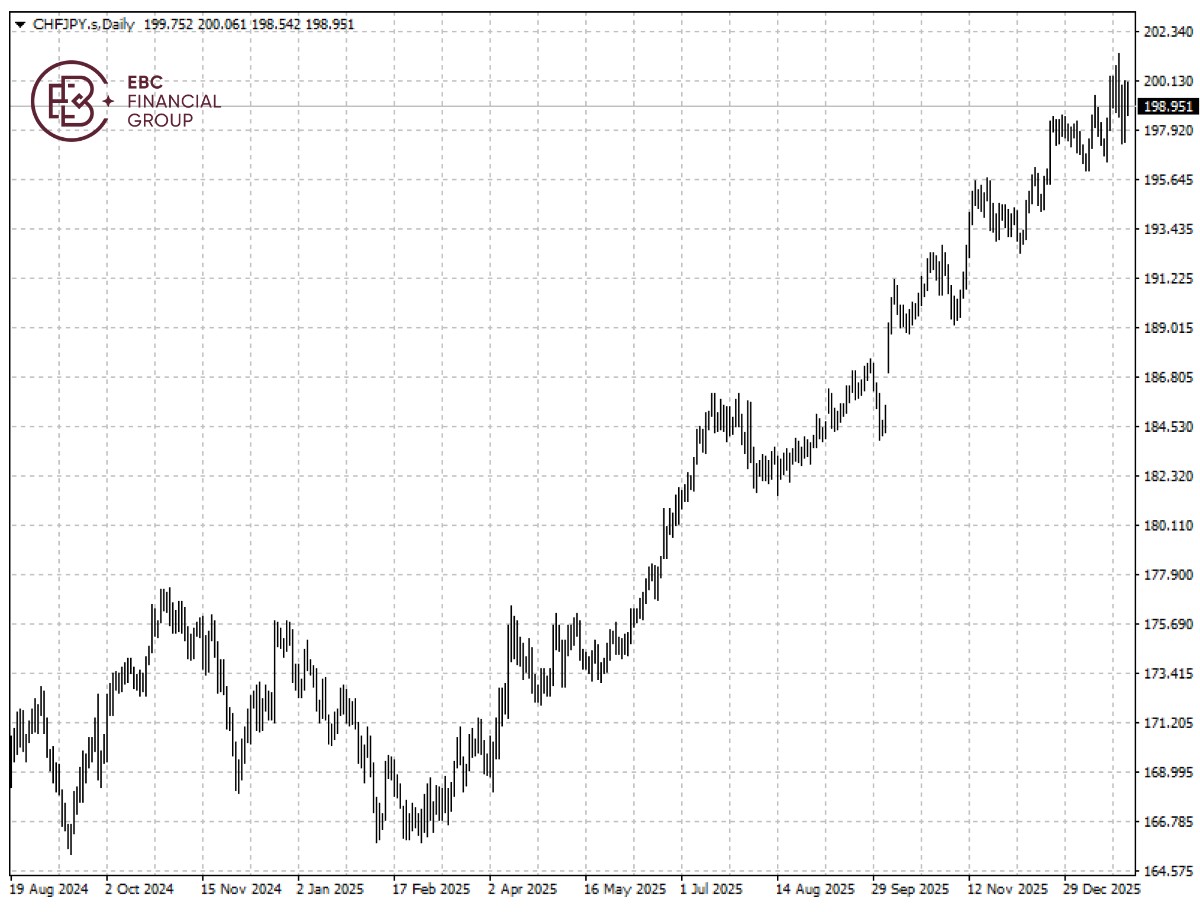

The Swiss franc rose to a fresh record high against the yen this month,

defying expectations that monetary divergence between Switzerland and Japan

helps rein in the pair's appreciation.

The BOJ retained its hawkish inflation forecasts last month and stressed it

will remain vigilant to price risks from a weak yen, signalling still-hawkish

stance in a politically charged atmosphere.

Meanwhile, policymakers raised growth and inflation outlook for fiscal 2025

and 2026. Analysts polled by Reuters in January expect inaction until July

following 4 rate hikes in the current easing cycle.

The central bank is bound to keep yen from further declines, without

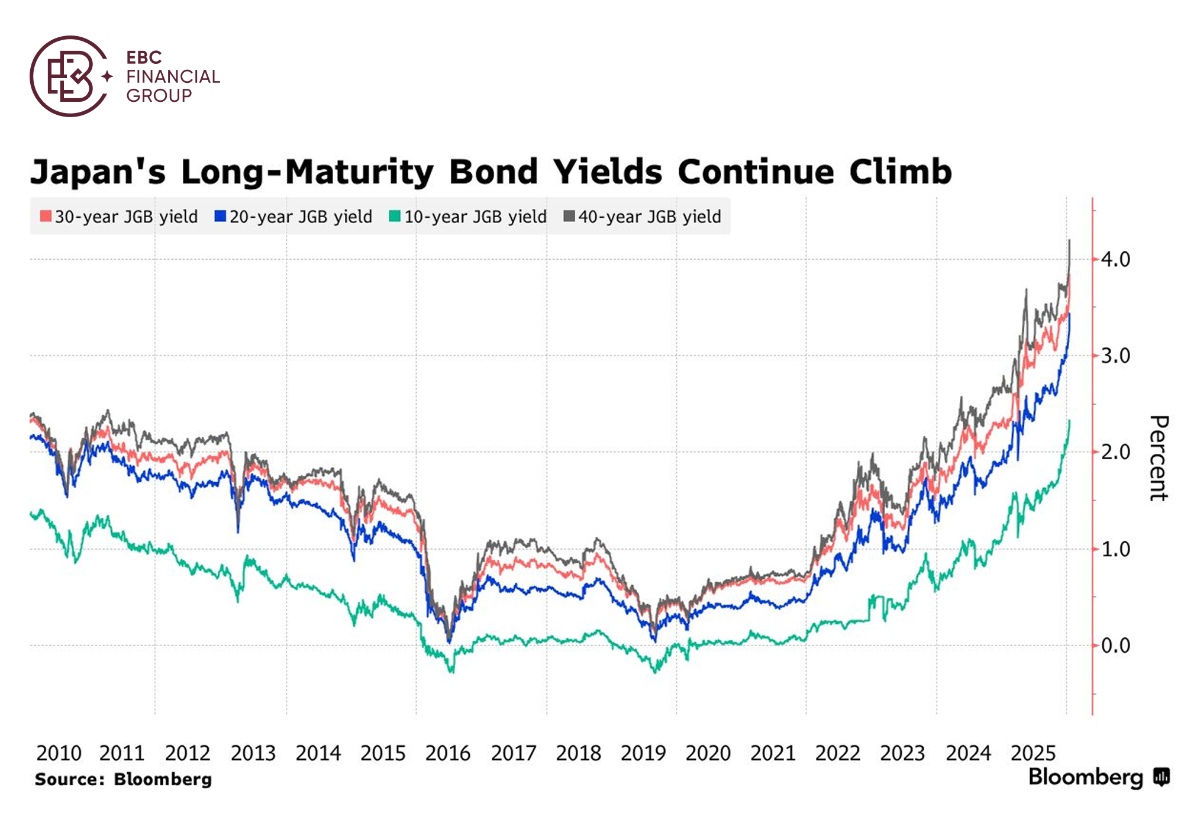

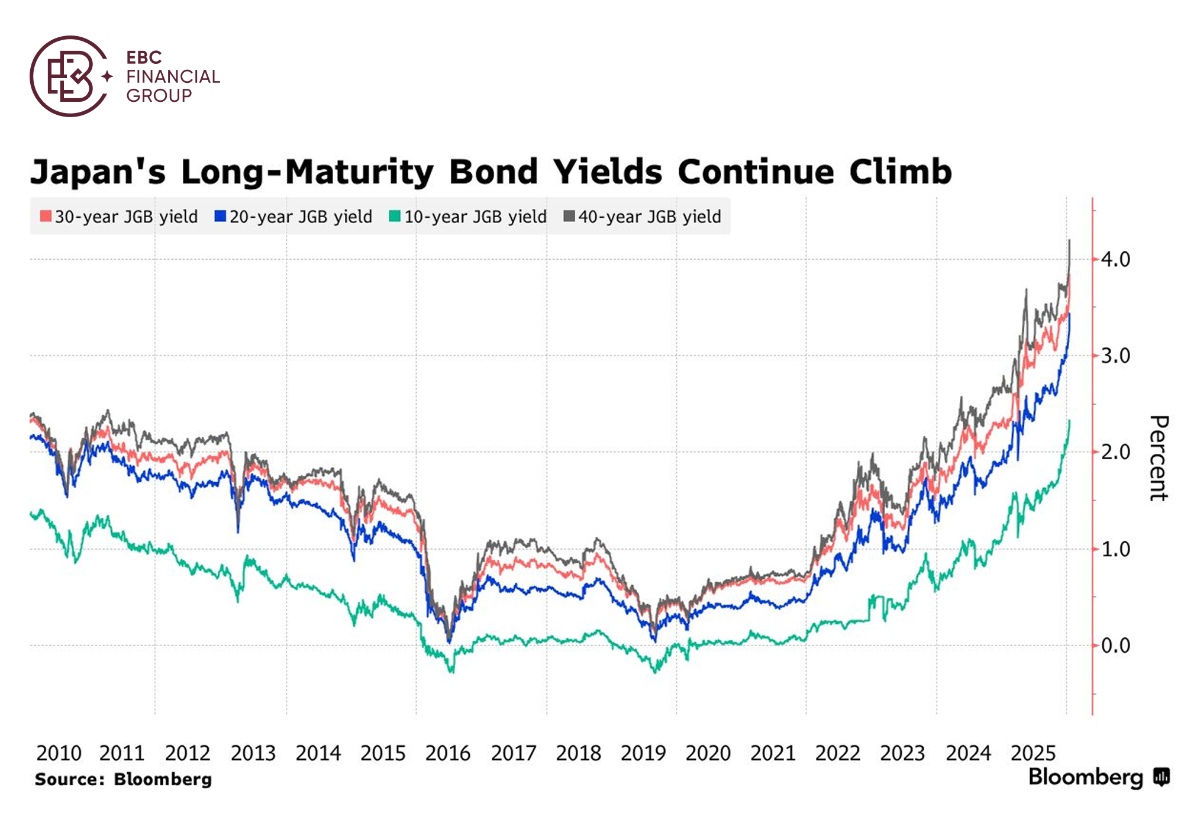

triggering further rises in bond yields. A bond meltdown has sent 40-year yield

to more than 4%, the highest since its debut in 2007.

The SNB stuck to 0% rates last month as the short-term inflation outlook has

weakened. This decision came against the backdrop of 0% inflation in November,

as opposed to 2.9% for Japan.

President Martin Schlegel said deflation could occur again later this year,

largely driven by a strong currency. Despite that, intervention seems unlikely

before meaningful de-escalation in geopolitical tensions.

Elsewhere top Japanese authorities said on Monday they have been in close

coordination with Washington on foreign exchange, but declined to confirm news

reports of rate checks.

Out of favour

US forces will conduct a multi-day air exercise in the Middle East, preparing

for a potential operation in Iran, with the USS Abraham Lincoln carrier strike

group on call in the Indian Ocean.

However, Trump is still considering his options and there is no indication

any decision has been made, sources told CNN. Iran protests death toll has

surpassed 3,000, according to state media.

US Ambassador to Israel Mike Huckabee suggested on Tuesday that he favoured

striking Iran rather than dealing with terror proxies. That came as Russia has

repeatedly rejected peace proposal.

Putin insists that Ukraine must cede the Donbas region as a "fundamental"

condition of any peace agreement. He is also opposed to NATO-like security

guarantees for Ukraine.

A scramble for Greenland only adds fuel to the fire. As a new era of

protectionism and militarism has begun, investors are increasingly channelling

funds to safe-haven assets, especially gold.

However, the dollar and the yen turn out to be the laggards. Transatlantic

cracks lead to Europe's fire sale of Treasury, while Trump's push for lower

interest rates puts the Fed's independence to the test.

Japan's premier Takachi, who is also labelled as a firebrand, keeps agitating

its largest trade partner. All scheduled flights on 49 air routes between China

and Japan have been cancelled for February.

An all-out gamble

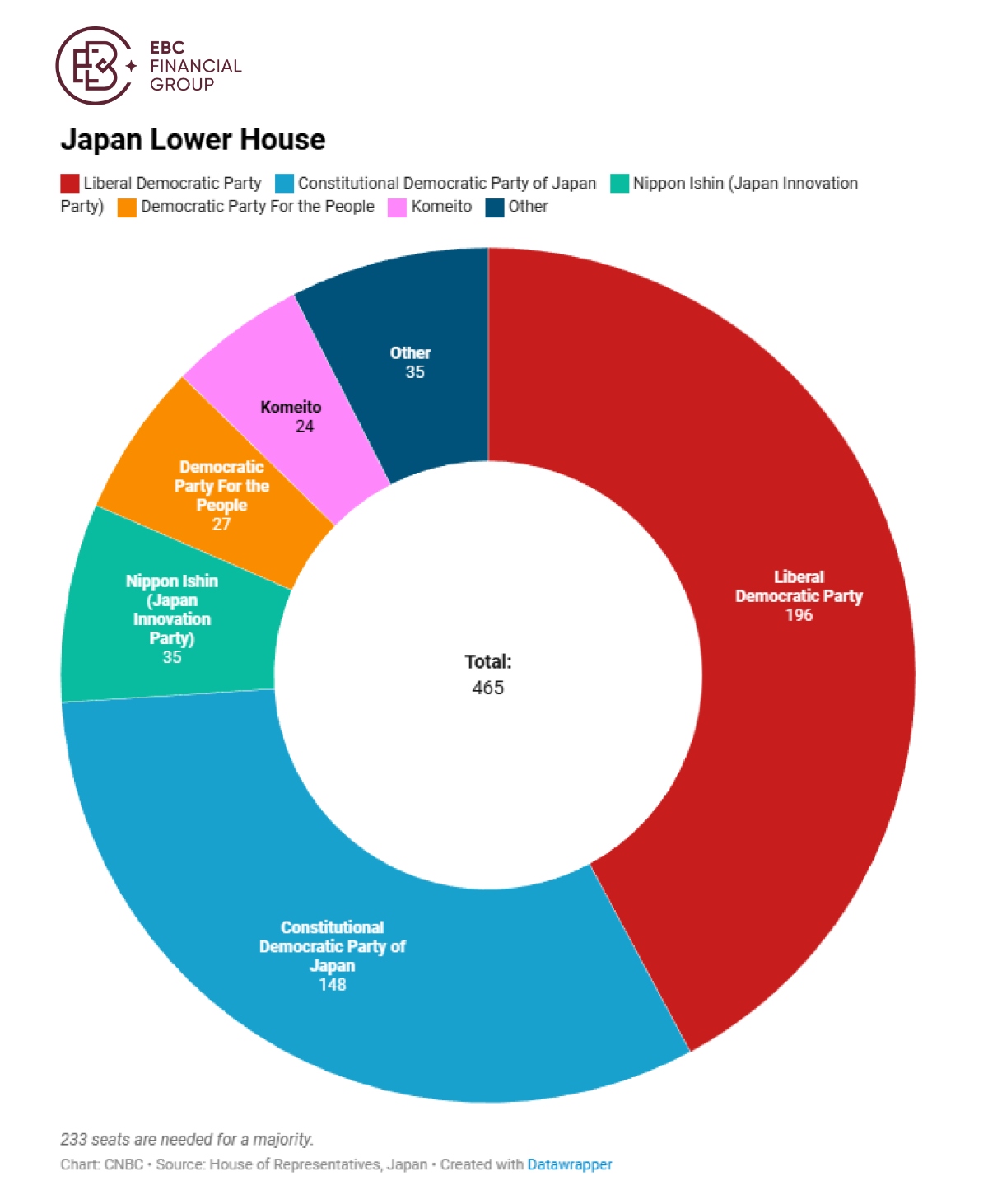

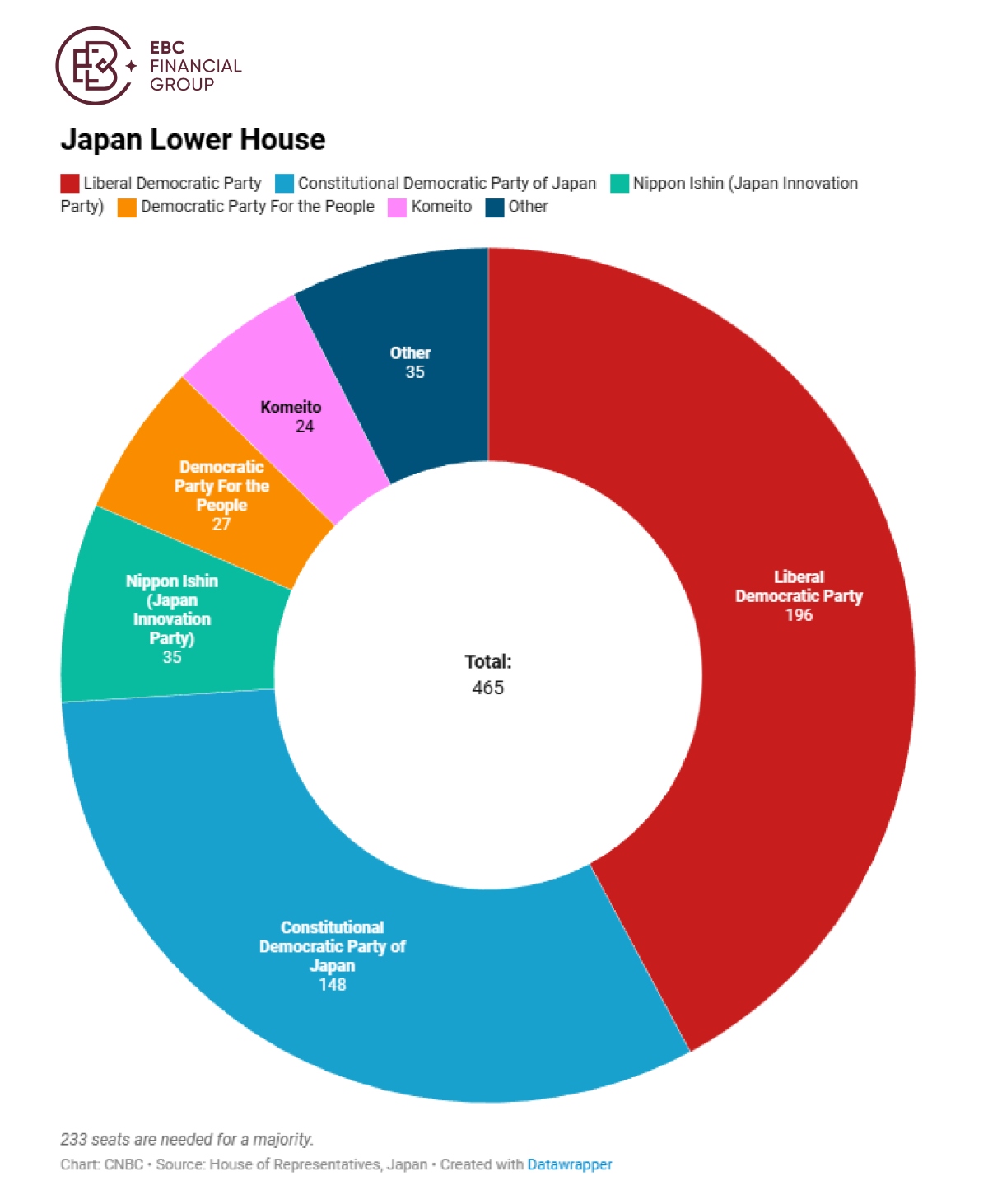

Takachi has decided to dissolve parliament and call a snap election, in a bid

to strengthen her power. Her approval rating stood at 59%, in a NHK survey

published this week – too good to be real.

However, asked about the most desirable balance of power between the ruling

and opposition camps for the upcoming general election, merely 24% said they

hope LDP wins a single-party majority.

The Constitutional Democratic Party of Japan, the largest opposition party,

joined with Komeito — the LDP's former coalition partner for 26 years — to

create a new party called the "Centrist Reform Alliance."

Takachi has pledged to resign if ruling bloc fails to secure a majority in

the upcoming House of Representatives election. The result is key to whether the

country's leadership merry-go-round will come to an end.

Even if she nails it, her massive stimulus package looks questionable

considering a debt-to-GDP ratio of more than 230% following decades of deficit

spending by government to reflate economy.

Switzerland maintains a very low and stable debt level in 2025, with that

ratio estimated at around 30.8%. The fiscal strength relative to Japan's abuse

of QE grants the franc a remarkable edge over its peer.

Bern keeps on good terms with Brussel, a norm that is absent between China

and Japan. Previous interventions did not ease the yen's underlying weaknesses,

and it will not make any difference this time if at all.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.