In today's foreign exchange market, there is one currency that is consciously or unconsciously overlooked. That currency is the Swiss franc, also known as the CHF. It was supposed to be the safest safe-haven currency in the world, and its popularity was comparable to that of the US dollar. But since the Black Swan event of 2015. it has become extremely special. Now let's take a good look at the story of the Swiss franc currency.

Which country's currency is the Swiss Franc?

Its English name is Swiss Franc, abbreviated as CHF. It is the official monetary unit of Switzerland and is mainly used in Switzerland and Liechtenstein. In addition, the CHF is also accepted in the border areas of some neighboring countries, such as France, Germany, Italy, and Austria. In these areas, especially near the Swiss border, stores and services usually accept CHF payments as well.

It consists of both banknotes and coins, and its banknotes are issued and managed by the Swiss National Bank (SNB). They are usually issued in different denominations, including 10. 20. 50. 100. 200. and 1.000. Each denomination has a unique design and security features to prevent counterfeiting and ensure the security of the currency.

Swiss banknote designs often include famous Swiss landmarks, historical figures, natural landscapes, and cultural symbols. The 2016 release, for example, features a nature theme to make Switzerland a desirable country. The back of each banknote depicts actual natural landscapes in Switzerland, each representing a feature and experience of the country and showcasing its rich history and culture.

Different denominations of Swiss francs present different themes, with the $10 having a theme of time, the $20 a story of light, the $50 telling of wind, the 100 of water, the 200 focusing on things, and the $1.000 telling of the language of mankind. The themes of this version are all more abstract, and secondly, these themes are broadly connected to human life and habitat.

The themes of the banknotes are all more abstract, such as creativity, experience, humanity, science, and communication on various levels. For example, the Swiss franc with a face value of 50 has wind as its theme. The obverse design depicts the shape of a hand holding a dandelion. The wind blows the seeds of the dandelion, blowing them into the air. The mass of the hand is in the center of the banknote and is made up of the graphic element of an arrow, which symbolizes the vane associated with the wind.

The other main graphic element on the front of the banknote is the earth, on the surface of which the red and green arrows show the direction of the winds connecting Switzerland with other regions and continents. The bottom portion of the background pattern, also represented by abstract arrows, shows the ambient air currents and air pressure on the earth.

On the back of the banknote, the wind lifts a glider high in the air amidst the mountains, and in the background, the mountains and contour lines illustrate the variety of Switzerland's landscapes and its geography.

The Swiss franc is also highly resistant to counterfeiting, with seven security markings on each bill. As the world's paper currency collection, it has both cutting-edge technology and first-class design concepts, and it is no secret that this version of the banknote is at least 10 years ahead of most countries, so it is also favored by many collectors of banknotes.

In addition, the Swiss franc is also widely used in international financial markets as an investment and reserve currency. Due to the robustness of the Swiss financial system, many international financial transactions and settlements are carried out using it, especially in transactions between private banks and international financial institutions. The central banks of some countries use the Swiss franc as part of their foreign exchange reserves in order to balance their foreign exchange reserve portfolios and to maintain the diversity and robustness of their currency reserves.

It is also one of the major currencies in foreign exchange transactions. Switzerland is an important financial center with relatively high liquidity in its official currency and therefore has extensive trading activities in the foreign exchange market. And because Switzerland is an important financial center, the Swiss franc is relatively liquid and therefore has extensive trading activity in the foreign exchange market.

Thus, its events with the euro in 2015 had a profound impact on its exchange rate and threw the financial markets into a state of confusion and panic, with a sharp drop in market liquidity. Overall, however, it is still seen as a safe-haven currency in times of global economic turmoil or geopolitical instability.

Swiss Franc Exchange Rates

Swiss Franc Exchange Rates

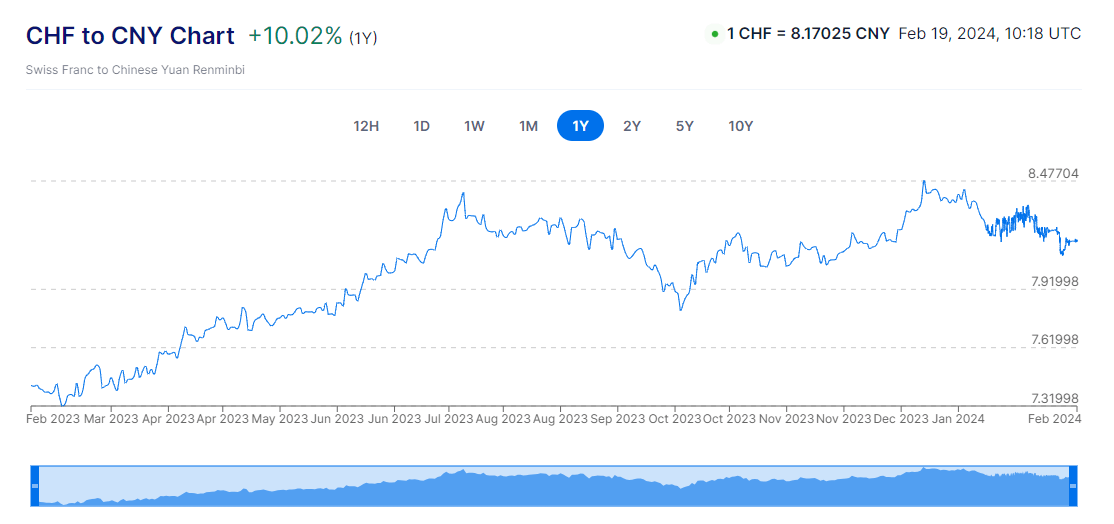

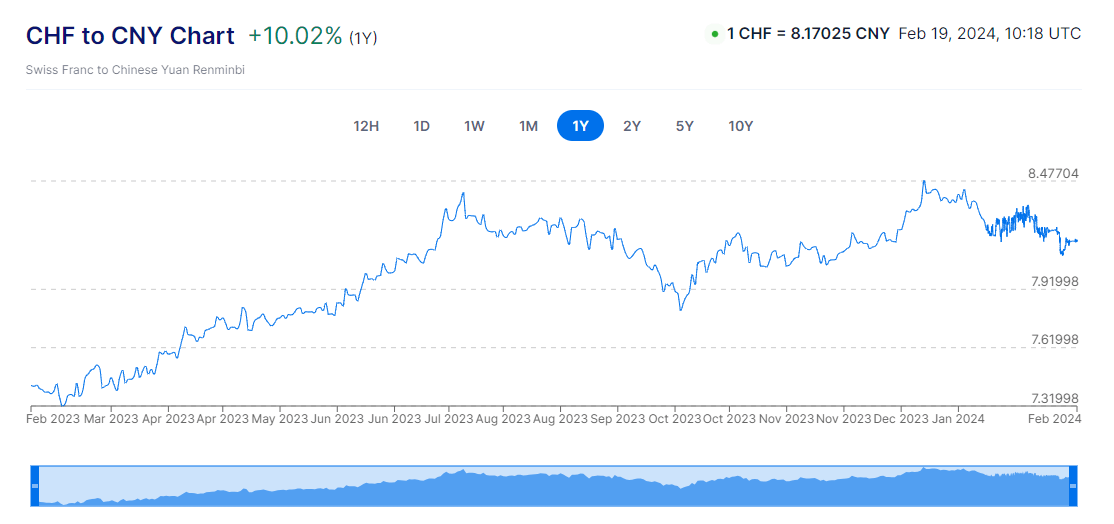

Benefits of Switzerland's political stability and financial market maturity The Swiss franc is generally regarded as a safe-haven currency and is relatively strong when the market turns stormy. It plays an important role in global financial markets, and movements in its exchange rate are closely linked to the Swiss domestic economy, interest rates, and even global risk sentiment.

The performance of the Swiss domestic economy has a direct impact on its value, and economic indicators such as inflation, employment figures, and economic growth rates can have a direct impact on its exchange rate. Stronger economic performance usually supports the value of the Swiss franc, while weaker economic data can lead to a depreciation of the Swiss franc. For example, Switzerland's booming economic growth, especially in the financial sector, may drive the appreciation of the Swiss franc.

Interest rates are a major key to the value of the currency, as they determine the rate of return investors receive on Swiss assets. If interest rates in Switzerland are higher than in other countries, investors may buy Swiss francs in search of higher returns, further pushing up their value. Conversely, if interest rates are lower, funds may flow out, causing the CHF to depreciate.

As a safe-haven currency, its value is usually affected by factors such as geopolitical tensions, the risk of war, and the threat of terrorism. In times of global turmoil or heightened uncertainty, investors tend to shift funds to safe-haven assets such as the Swiss franc, thus supporting its exchange rate. There is also the state of the global economy that affects its price; for example, in times of slowing global growth, the market may turn to risk aversion to boost its price.

Switzerland is an exporting economy, so the state of external trade also has an impact on its exchange rate. If Swiss exports increase, it will favor the CHF exchange rate, while if Swiss imports increase, it may have a negative impact on its exchange rate. At the same time, the relationship between the demand and supply of Swiss francs in the foreign exchange market will also have a direct impact on its exchange rate. If a large number of investors buy Swiss francs, their value may rise; conversely, if a large number of investors sell Swiss francs, their value may fall.

Overall, the Swiss Franc's exchange rate is affected by a combination of factors, including economic fundamentals, geopolitical risks, monetary policy, and external demand and supply. Investors need to carefully examine these variables to make the most informed investment decisions.

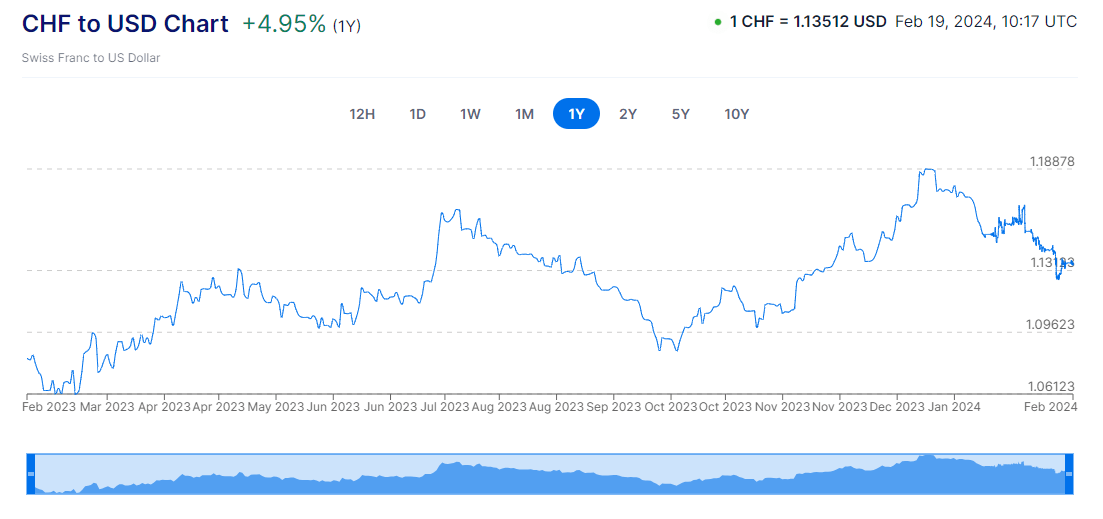

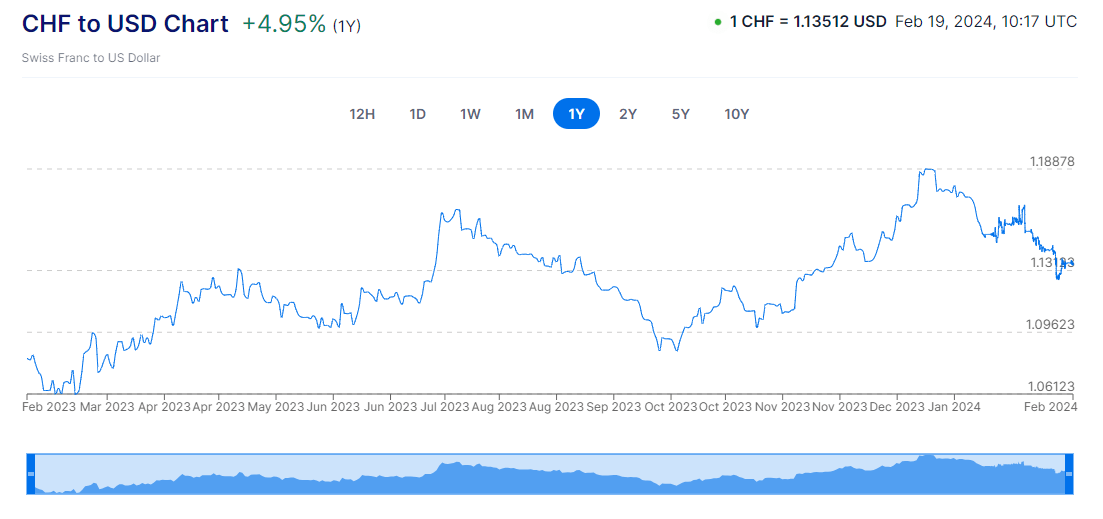

Chf To Usd

With the sudden announcement in 2015 that Switzerland was removing the one-point-two floor that had been maintained on the Euro to Swiss Franc exchange rate, a 20% surge in its value ensued. As a result, the Swiss central bank employed a variety of measures to curb demand for the Swiss franc over the ensuing years. However, as a safe-haven asset, its demand has recently increased due to the heightened risk of market turmoil.

This is due to Switzerland's special neutral country status, making the Swiss franc a long-sought-after currency. And looking at historical data, the Swiss franc has actually outperformed the US dollar. As a result, if there is any movement in Europe or the US, or if there is a bigger crisis or turmoil, it will also stimulate safe-haven funds into Switzerland, which of course will also boost the Swiss franc.

In fact, in recent years, the exchange rate of the Swiss franc to the U.S. dollar has also been on an upward trend, which has had a series of impacts on the Swiss economy and financial markets. For example, while exports may be challenged, the falling cost of imports may help to improve the balance of trade and thus have a somewhat balancing effect on the economy.

Firstly, Swiss exports become more expensive as foreign buyers have to pay more dollars for the same amount of Swiss products. This could lead to a shock to the Swiss export sector as foreign consumers may switch to less expensive alternatives.

At the same time, Switzerland would need to pay fewer dollars for imported goods as the value of each dollar increases. Switzerland would use fewer Swiss francs to buy the same amount of goods in dollars, which would lower the cost of imported goods, which would help control price levels and help domestic consumers and businesses.

For U.S. travelers, Swiss destinations become more expensive because they have to pay more U.S. dollars for the same amount of Swiss francs. But at the same time, it becomes less expensive for Swiss residents to travel to the U.S. because they can buy U.S. dollars with fewer Swiss francs. Because they need to use more Swiss francs to buy dollars, this could lead to an increase in travel spending in Switzerland, positively affecting tourism.

For U.S. investors, a rise in the Swiss franc to the U.S. dollar means buying Swiss assets at a higher cost. This could make Swiss assets less attractive, reduce capital inflows, and have some negative impact on economic growth. For U.S. investors, a rise in the Swiss franc against the U.S. dollar allows them to buy Swiss assets at a lower cost. This could increase U.S. capital inflows and boost economic growth.

Overall, the rise of the Swiss franc against the U.S. dollar is likely to have complex effects on the Swiss economy, and measures will need to be taken by the government and the central bank to balance these effects in order to ensure stable economic growth.

History of the Swiss franc exchange rate

| year |

Average exchange rate |

Maximum exchange rate |

Minimum exchange rate |

| 2019 |

1 CHF = 1.01 USD |

1 CHF = 1.03 USD |

1 CHF = 0.98 USD |

| 2020 |

1 CHF = 1.04 USD |

1 CHF = 1.08 USD |

1 CHF = 1.00 USD |

| 2021 |

1 CHF = 1.08 USD |

1 CHF = 1.12 USD |

1 CHF = 1.05 USD |

| 2022 |

1 CHF = 1.10 USD |

1 CHF = 1.15 USD |

1 CHF = $1.07 |

| 2023 |

1 CHF = $1.15 |

1 CHF = $1.20 |

1 CHF = $1.10 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Swiss Franc Exchange Rates

Swiss Franc Exchange Rates