Imagine walking into a café in Rome in 2002. Yesterday, your espresso cost 1,500 lire. Today, it's €0.77. The coins in your pocket look different, the notes feel foreign, and yet, they are now your only legal tender.

That was the reality for Italians when the lira, a currency that had been part of national identity for more than 140 years, was officially replaced by the euro. Some welcomed it as a step toward stability and European unity. Others saw it as the day Italy gave up a piece of its soul.

So, what exactly happened? What does the lira's legacy mean today, and what is the performance of its replacement, the euro, in modern markets? Let's explore.

Italian Lira History & Why Did the Euro Replace It?

The Italian lira (ITL), originating from the Latin term Libra (Proud), served as Italy's national currency from 1861, when the nation unified, until 2002. For over a century, it represented Italian identity, appearing on notes that depicted cultural icons like Leonardo da Vinci and historical monuments. [1]

However, by the 1980s and 1990s, the lira struggled with:

High inflation rates (prices rose quickly year after year).

Frequent devaluations make imports more expensive.

Economic instability, compared to stronger currencies like the German Deutsche Mark.

Italy joined the European Monetary Union (EMU) to gain price stability, lower borrowing costs, and integrate with European trade partners. This cleared the path for the euro, regarded as a contemporary, stable alternative.

The Euro Transition Timeline in Italy

| Year |

Milestone |

| 1999 |

Euro introduced as an electronic & accounting currency. Lira still used in cash, but exchange rates were fixed. |

| 2001 |

Prices in shops began showing dual currency (lira + euro). |

| Jan 1, 2002 |

Euro coins and banknotes entered circulation in Italy. |

| Feb 28, 2002 |

Lira ceased to be legal tender. Euro fully replaced the lira. |

The move from lira to euro wasn't sudden; it was carefully staged:

1999: The euro was launched as a "virtual" currency for electronic transfers and accounting.

2001: Shops began dual pricing with the lira and euro side by side.

January 1, 2002: Euro coins and banknotes entered Italian wallets.

February 28, 2002: The lira stopped being accepted as currency

Even after circulation ended, Italians had until December 6, 2011, to exchange their old notes at the Bank of Italy.

Fixed Exchange Rate: 1 € = 1,936.27 Lire

The conversion rate was fixed once and for all at: 1 euro = 1,936.27 lire.

It meant that an item priced at 1,936 lire suddenly became €1 in 2002. Many Italians joked that prices "doubled overnight". While technically not true, the perception of sudden inflation was widespread.

Why Italy Adopted the Euro

Italy's decision to adopt the euro was part of a massive movement within the European Union to foster economic unity and monetary stability through a single currency. The benefits of joining the euro were multifaceted:

1. Price Stability and Inflation Control

Italy had historically struggled with high inflation, especially during the 1970s and 1980s. The euro was seen as a tool to enforce greater fiscal and monetary discipline through the European Central Bank (ECB) framework.

2. Trade and Investment Benefits

By adopting a common currency, Italy eliminated exchange rate risk and currency conversion costs with its largest trading partners. The euro streamlined cross-border trade and made Italian exports more competitive within the eurozone.

3. Economic Convergence

The Maastricht Treaty required countries joining the euro to meet convergence criteria, including low inflation, stable public debt levels, and exchange rate stability. Italy undertook fiscal reforms to meet these goals in the late 1990s.

4. Tourism and Mobility

The euro facilitated tourism and business travel across Europe. Tourists no longer needed to exchange money when travelling between France, Germany, Spain, and Italy, leading to higher visitor numbers and spending.

What Were the Economic Effects After the Euro Replaced the Lira?

Positives

Lower inflation compared to the lira.

Reduced interest rates, helping borrowers and mortgage holders.

Closer integration with European markets is boosting trade.

Negatives

Loss of monetary sovereignty: Italy could no longer devalue its currency to boost exports.

Public discontent: Many Italians sensed that prices increased significantly following the introduction of the euro.

Debt burden: Italy's high public debt (over 100% of GDP in 2002, still above 130% as of 2025) remained unresolved.

Legacy of the Lira & Collectable Value Today

Though no longer legal tender, the lira holds cultural and collectable value:

Banknotes featuring Caravaggio or Marco Polo fetch high prices among collectors.

The 500,000 lire note (about €258.23) is especially sought after.

Coins, such as the 500 lire silver bimetallic, remain popular souvenirs.

In 1990, Italy released a 50,000 lira bill depicting Gian Lorenzo Bernini, valued at approximately €25.82 at the time, but it is now a collector's item.

As of 2025, a well-preserved lira note can be worth much more than its euro equivalent, depending on rarity.

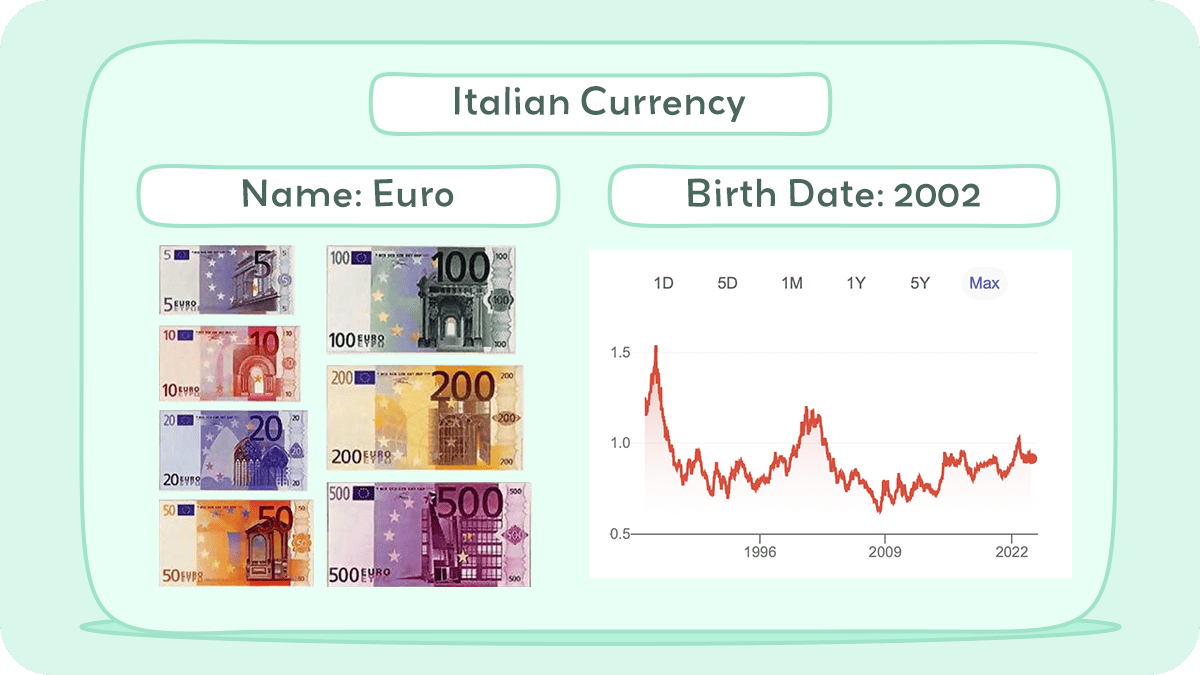

Euro Performance Outlook (2025)

While the lira is gone, the euro's performance still shapes Italy's economy:

Euro to USD: trading around 1.16–1.18 (Sept 2025)

Eurozone inflation: easing to 2.3% (Sept 2025) after energy-driven spikes in 2022–2023

Italy's GDP growth: modest at 0.8% for 2025 [2]

The euro remains both a stabiliser and a constraint: Italy enjoys lower inflation, but debates continue over whether the country could grow faster with its own currency.

Frequently Asked Questions

1. What Currency Did the Euro Replace in Italy?

The euro replaced the Italian lira (ITL), which had been Italy's official currency since 1861.

2. When Did Italy Officially Adopt the Euro?

Italy officially adopted the euro on January 1, 2002.

3. Why Did Italy Replace the Lira With the Euro?

Italy joined the euro to gain currency stability, lower inflation, reduced interest rates, and deeper integration with European trade and markets.

4. Did Prices in Italy Go Up After Switching to the Euro?

Many Italians felt that everyday prices rose when the euro replaced the lira, due to rounding and perception effects. Official data, however, showed inflation remained relatively low in the early 2000s.

Conclusion

In conclusion, the euro replaced the lira more than 20 years ago, yet the memory of the old currency remains alive.

As of 2025, the lira is no longer legal tender. However, it remains a symbol of national pride and a reminder of Italy's turbulent economic history before adopting the euro.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://economy-finance.ec.europa.eu/euro/eu-countries-and-euro/italy-and-euro_en

[2] https://ec.europa.eu/eurostat/web/products-euro-indicators/w/2-21072025-ap