Why Is Oman's Currency So Strong?

The Omani rial (OMR) consistently ranks among the world's strongest currencies, often placing third after the Kuwaiti dinar and Bahraini dinar.

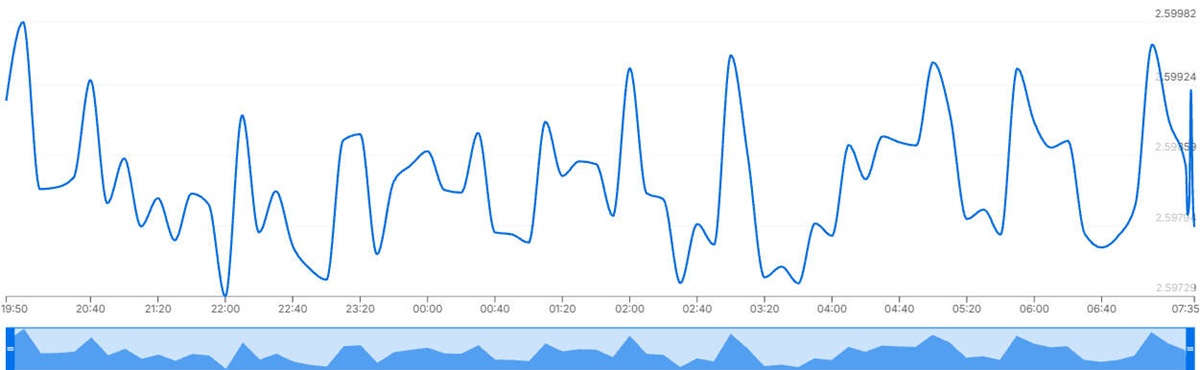

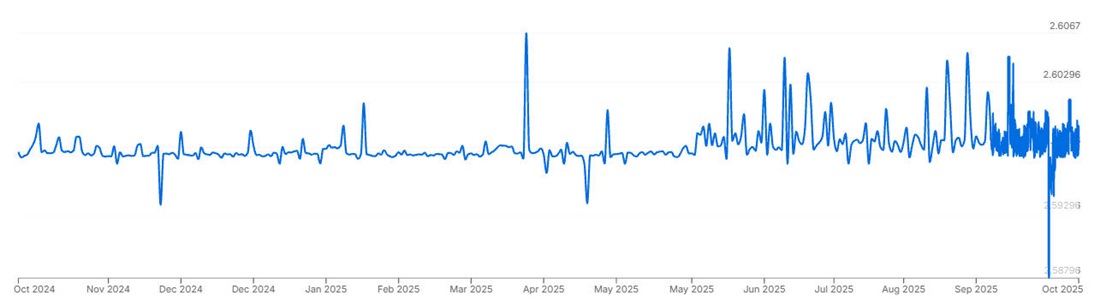

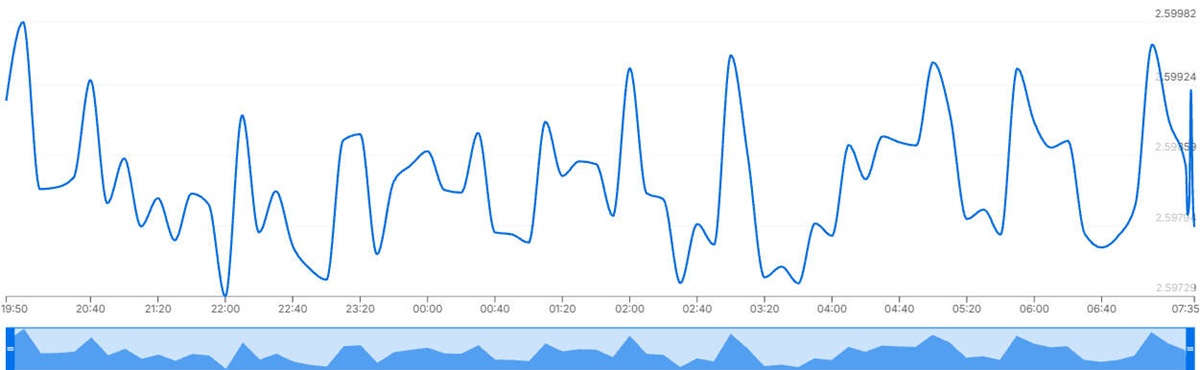

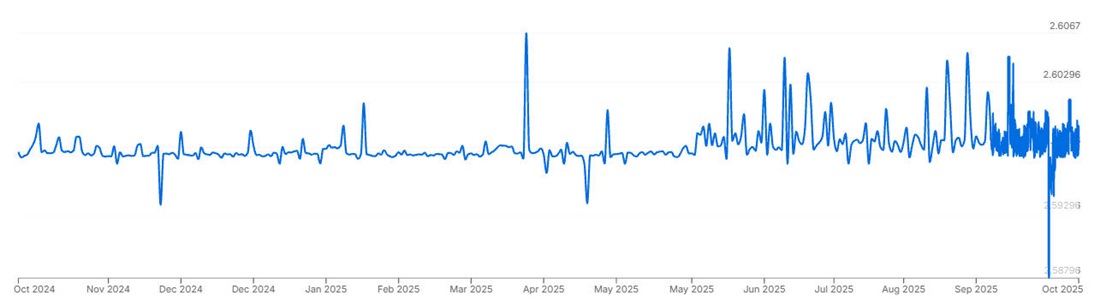

As of mid-2025. 1 OMR equals approximately 2.60 USD.

This exceptional strength is not coincidental; it results from a deliberate combination of economic policies, resource wealth, and strategic financial management.

In this article, we will explore the key factors contributing to the strength of the Omani rial, including its fixed exchange rate, oil wealth, fiscal discipline, monetary policies, economic diversification, and global trade relations.

Fixed Exchange Rate: Anchoring Stability

Since 1986. the Central Bank of Oman has maintained a fixed peg between the Omani rial and the US dollar at a rate of 1 OMR = 2.6008 USD. This policy provides several advantages:

Predictability: A stable exchange rate reduces currency risk for investors and traders.

Inflation Control: The peg helps keep inflation in check by limiting fluctuations in import prices.

Investor Confidence: A stable currency attracts foreign investment, bolstering economic growth.

The Central Bank actively manages this peg by adjusting interest rates and intervening in the foreign exchange market to maintain the fixed rate.

Oil Wealth: A Robust Economic Foundation

Oman is a significant oil producer, and oil exports are a primary source of government revenue. The steady demand for oil worldwide ensures a consistent inflow of foreign currency, which supports the value of the rial.

This oil wealth enables the government to maintain substantial foreign exchange reserves, further stabilizing the currency.

Fiscal Discipline: Managing Debt and Deficits

The Omani government has implemented prudent fiscal policies to manage public debt and reduce fiscal deficits. For instance, Oman has utilized windfalls from high oil prices to prepay foreign debt, thereby improving its debt metrics.

In July 2025. Moody's upgraded Oman's credit rating to investment grade (Baa3), citing strengthened debt metrics and fiscal discipline.

This fiscal discipline enhances investor confidence, as it demonstrates the government's commitment to maintaining economic stability.

Monetary Policy: Controlling Inflation and Interest Rates

The Central Bank of Oman plays a pivotal role in maintaining the stability of the rial through effective monetary policies. By adjusting interest rates and implementing measures to control inflation, the CBO ensures that the purchasing power of the rial remains stable.

This monetary discipline is essential for preserving the currency's strength, particularly in an environment where external factors such as global commodity prices can influence domestic inflation.

Economic Diversification: Reducing Oil Dependency

Recognizing the risks associated with over-reliance on oil revenues, Oman has embarked on a path of economic diversification. The Vision 2040 initiative aims to develop non-oil sectors such as tourism, manufacturing, and logistics.

By broadening its economic base, Oman seeks to reduce its vulnerability to oil price fluctuations, thereby contributing to the long-term stability and strength of the rial.

Global Trade Relations: Enhancing Currency Demand

Oman's strategic location and active participation in global trade enhance the demand for its currency. The country has established strong trade relations with various nations, facilitating the exchange of goods and services.

This increased demand for the rial supports its value in the foreign exchange market. Additionally, Oman's balanced foreign policy and diplomatic efforts have bolstered its regional influence, further strengthening the appeal of its currency.

Central Bank's Role: Ensuring Monetary Stability

The Central Bank of Oman is instrumental in maintaining the strength of the rial. Through its monetary policies and regulatory measures, the CBO ensures that the banking system operates efficiently and that the currency remains stable.

The bank's commitment to maintaining low and stable inflation, as noted by the International Monetary Fund (IMF), reinforces the credibility of the rial.

Credit Ratings: Reflecting Economic Health

Credit ratings provide insights into a country's economic health and its ability to meet financial obligations. Oman's recent upgrade to investment grade status by Moody's is a testament to its improved fiscal position and economic resilience.

A strong credit rating enhances investor confidence, attracting foreign investment and supporting the demand for the rial.

Inflation Control: Maintaining Purchasing Power

Controlling inflation is crucial for preserving the purchasing power of the rial. The Central Bank of Oman employs various tools to manage inflation, ensuring that it remains within target ranges.

By keeping inflation in check, the CBO helps maintain the real value of the currency, which is vital for both consumers and investors.

Investment Climate: Attracting Foreign Capital

Oman's stable economic environment and sound financial policies create an attractive investment climate. The country's commitment to economic reforms and diversification efforts signal a forward-looking approach to development.

These factors encourage foreign investment, leading to an increased demand for the rial and contributing to its strength.

Conclusion

The strength of the Omani rial is the result of a confluence of factors, including a fixed exchange rate, substantial oil revenues, fiscal discipline, effective monetary policies, economic diversification, and a favourable investment climate.

These elements collectively contribute to the stability and resilience of the rial, positioning it as one of the world's strongest currencies.

As Oman continues to implement its Vision 2040 initiatives and maintain prudent economic policies, the strength of the rial is likely to be sustained, reflecting the country's commitment to economic stability and growth.

Frequently Asked Questions

Q1: Why is the Omani rial considered one of the strongest currencies?

The Omani rial's strength is attributed to factors such as its fixed exchange rate to the US dollar, significant oil revenues, prudent fiscal management, and effective monetary policies.

Q2: How does Oman's oil wealth impact its currency strength?

Oil exports generate substantial foreign exchange earnings, which bolster Oman's foreign currency reserves and support the value of the rial.

Q3: What role does the Central Bank of Oman play in maintaining currency stability?

The Central Bank of Oman implements monetary policies to control inflation and interest rates, ensuring the stability and strength of the rial.

Q4: How does economic diversification contribute to the rial's strength?

By developing non-oil sectors, Oman reduces its reliance on oil revenues, mitigating risks associated with oil price fluctuations and supporting long-term currency stability.

Q5: How do credit ratings affect the strength of the Omani rial?

Strong credit ratings enhance investor confidence, attract foreign investment, and increase demand for the rial, thereby supporting its value.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.