The gaming industry is entering a transformative phase in 2025. With the market projected to reach $188.8 billion, driven by next-gen hardware, mobile gaming, and immersive technologies, investors have a unique opportunity to capitalize on undervalued stocks poised for growth.

This expansion is driven by factors such as eSports, cross-platform gaming, in-game purchases, AR/VR, and cloud/mobile gaming.

Major releases like Grand Theft Auto VI and the Nintendo Switch 2 are expected to further boost sales, while mobile gaming continues to capture a growing share of the market.

With these catalysts, leading gaming companies are well-positioned for robust revenue and profit growth.

Why Invest in Gaming Stocks in 2025?

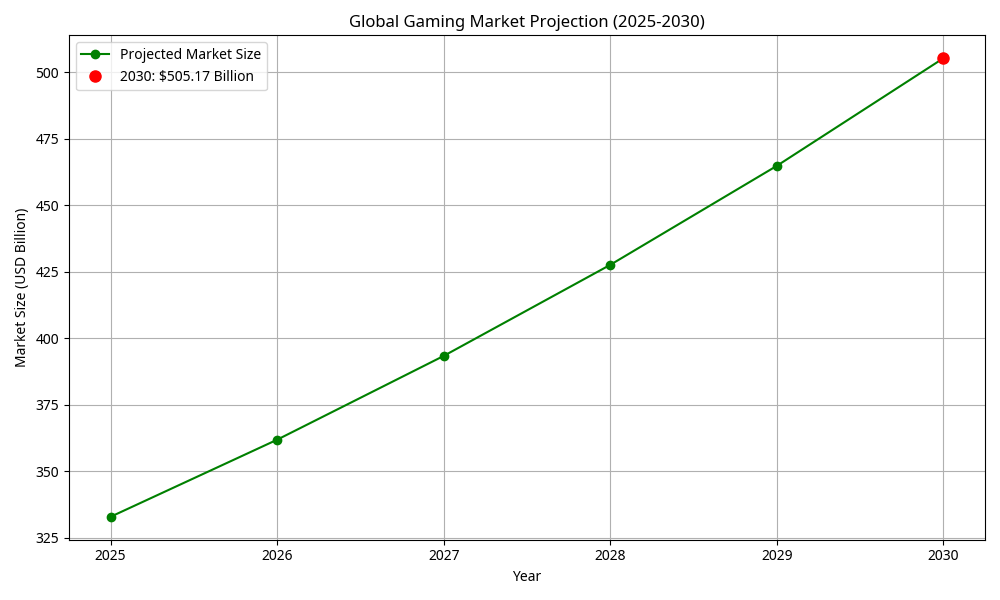

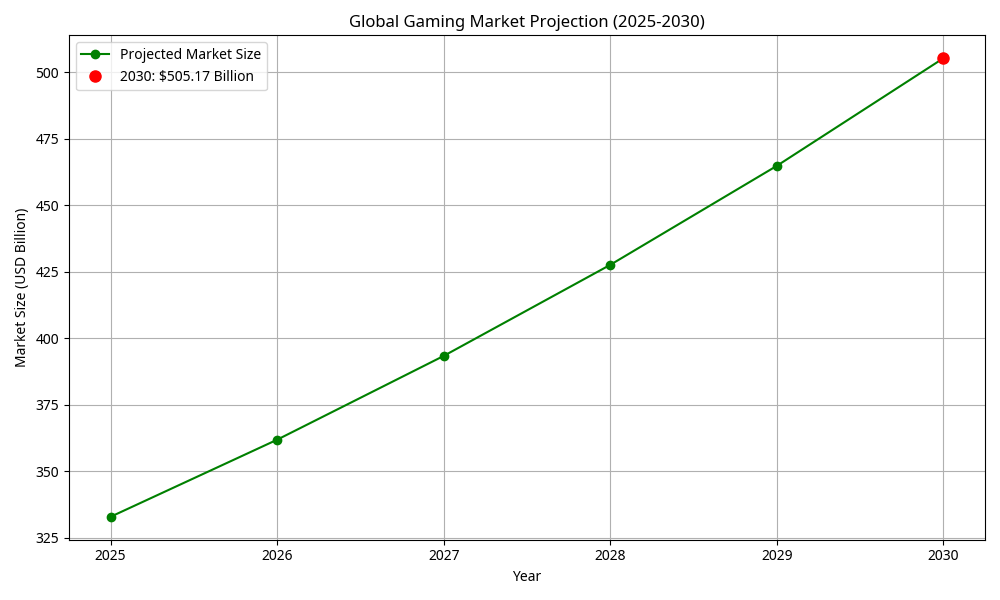

The global gaming market is projected to reach $505.17 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.7% from 2025 to 2030.

Growth is being driven by eSports, cross-platform titles, in-game purchases, AR/VR, and cloud/mobile gaming.

Major releases like Grand Theft Auto VI and the Nintendo Switch 2 are set to spark a new sales surge, while mobile gaming continues to capture an increasing share of the market.

These trends position leading gaming companies for strong revenue and profit growth, making them key targets for investors seeking exposure to a dynamic sector.

Top Gaming Stocks to Watch in 2025: Strong Growth Leaders

Below is a curated list of best gaming stocks to watch in 2025, highlighting companies poised for growth through major releases, innovative platforms, and expanding user bases.

| Company |

Ticker |

Oct 2024 Price |

Oct 2025 Price |

Change ($) |

Change (%) |

| Take-Two Interactive |

TTWO |

$162.93 |

$262.29 |

$99.36 |

61% |

| Roblox Corporation |

RBLX |

$132.92 |

$134.84 |

$1.92 |

1.4% |

| NetEase Inc. |

NTES |

$89.21 |

$152.85 |

$63.64 |

71% |

| Electronic Arts |

EA |

$200.30 |

$200.59 |

$0.29 |

0.1% |

| Nintendo |

NTDOY |

$13.11 |

$21.30 |

$8.19 |

62% |

| Sea Limited |

SE |

$94.05 |

$165.70 |

$71.65 |

76% |

| Microsoft Corporation |

MSFT |

$403.32 |

$516.79 |

$113.47 |

28% |

| Nvidia Corporation |

NVDA |

$135.20 |

$225.00 |

$89.80 |

66% |

1. Take-Two Interactive (NASDAQ: TTWO)

Anticipated to benefit from the release of Grand Theft Auto VI in May 2026, Take-Two reported Q3 2025 revenue of $1.6 billion, with net income of $360 million.

Its blockbuster franchise portfolio and recurring revenue from NBA 2K and Red Dead Redemption make it a top growth play.

2. Roblox Corporation (NYSE: RBLX)

With Q3 2025 revenue of $975 million and 38% year-over-year growth in bookings, Roblox continues expanding its user-generated content platform.

Strategic partnerships, including new IP collaborations with Mattel, position Roblox for long-term growth in the social gaming space.

3. NetEase Inc. (NASDAQ: NTES)

NetEase posted Q3 2025 net revenue of $3.9 billion, supported by strong mobile gaming and a diversified online gaming portfolio.

With over $17 billion in cash reserves, the company is well-positioned to invest in new titles and global expansion.

4. Electronic Arts (NASDAQ: EA)

EA generated Q3 2025 revenue of $1.8 billion, with a focus on live services and digital content driving recurring income.

Upcoming releases like Battlefield 6 and consistent sports franchise updates support steady growth despite a modest FY26 revenue forecast.

5. Nintendo (OTCMKTS: NTDOY)

The Nintendo Switch 2 launch in June 2025 rejuvenated both hardware and software sales, with strong game titles driving consumer demand.

Nintendo reported Q3 2025 revenue of $5.6 billion, with net income at $1.2 billion, underscoring the enduring strength of its IP and loyal fanbase.

6. Sea Limited (NYSE: SE)

Sea Limited’s Garena division achieved Q1 2025 bookings growth of 51% driven by Free Fire and other mobile titles.

Revenue from digital entertainment reached $3.4 billion in Q3 2025, supporting broader expansion into eSports and online platforms.

7. Microsoft Corporation (NASDAQ: MSFT)

Microsoft’s gaming division, including Xbox Game Pass and the integration of Activision Blizzard, contributed to Q3 2025 revenue of $21.7 billion in personal computing.

The company leverages AI-driven gameplay and cloud services to maintain a leading position in gaming and subscription growth.

8. Nvidia Corporation (NASDAQ: NVDA)

Nvidia reported Q3 2025 revenue of $15.2 billion, with gaming GPU sales remaining a core driver amid AI and data center expansion.

Strong performance in RTX graphics cards and growth in cloud gaming platforms positions Nvidia as both a hardware and gaming ecosystem leader.

Sector Trends Driving Growth

Mobile Gaming Surge: Mobile gaming continues to dominate, accounting for over half of global gaming revenue. Companies like NetEase and Sea Limited are capitalizing on this trend with strong mobile portfolios.

eSports Expansion: The 2025 Esports World Cup attracted over three million visitors and secured sponsorships from major brands such as Sony, Amazon, and Pepsi, highlighting the growing mainstream appeal of competitive gaming.

Cloud Gaming and AI Integration: Microsoft's acquisition of Activision Blizzard and its focus on AI-driven gaming platforms position it as a leader in the evolving gaming landscape.

What to Consider Before Investing in Gaming Stocks

When evaluating best gaming stocks to buy, consider the following factors:

Upcoming Game Releases: Titles like Grand Theft Auto VI and Battlefield 6 in 2026 have the potential to drive significant revenue growth.

Mobile Gaming Penetration: Companies with strong mobile offerings are well-positioned to benefit from the growing mobile gaming market.

eSports Engagement: Brands with a strong presence in eSports can tap into the expanding competitive gaming ecosystem.

Technological Innovation: Investing in gaming companies that are integrating AI and cloud technologies can provide exposure to the future of gaming.

Global Gaming Market Outlook: 2025 and Beyond

The global gaming market is projected to reach $188.8 billion in 2025, marking a 3.4% year-over-year increase. This growth is driven by several key factors:

Mobile Gaming: Continues to dominate with 3 billion players, accounting for 55% of global gaming revenue.

Console Gaming: Experiencing a resurgence, with the release of the Nintendo Switch 2 contributing to a 3.4% increase in console revenues.

PC Gaming: Maintains a steady growth trajectory, supported by a growing Steam player base and strong local releases in regions like China.

Emerging Technologies: Advancements in AR/VR and cloud gaming are expanding the gaming experience, attracting new players and increasing engagement.

Despite challenges such as hardware price increases and market saturation in certain regions, the gaming industry remains resilient.

The upcoming release of major titles like Grand Theft Auto VI and the Nintendo Switch 2 are expected to further drive growth in the coming years.

Diversifying with Gaming ETFs

For investors looking to spread risk while capturing growth in the gaming sector, ETFs focused on gaming and eSports provide a convenient solution.

Options like the VanEck Semiconductor ETF and the Global X Video Games & Esports ETF give exposure to a basket of top gaming companies, allowing participation in industry growth without relying on a single stock.

Frequently Asked Questions (FAQ)

1. Why should I invest in gaming stocks?

Gaming stocks offer exposure to a rapidly growing industry. Strong franchises and recurring revenue streams make many gaming companies attractive for growth-focused investors.

2. How can I assess if a gaming stock is a good buy?

Look at factors such as revenue growth, user engagement, upcoming game releases, and technological innovation. Companies with diverse portfolios and expanding global reach typically have better long-term potential.

3. Is investing in the gaming sector risky?

Yes, like all sectors, gaming stocks come with risks, therefore, diversification through ETFs or a mix of companies can help manage some of this risk.

Final Thoughts: Game On

The gaming sector is set for robust growth in 2025, driven by blockbuster releases, new hardware, and global expansion in mobile and online gaming.

Top gaming stocks like Take-Two Interactive, Roblox, NetEase, Activision Blizzard, Electronic Arts, Nintendo, Sea Limited, and Microsoft offer diverse opportunities for growth-focused investors.

By following industry trends, diversifying your portfolio, and staying vigilant, you can position yourself to benefit from the next wave of innovation in gaming.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.