Options trading offers exciting opportunities for traders, but it also comes with unique risks and complexities. For beginners, avoiding common pitfalls is crucial to long-term success.

This guide highlights the most frequent mistakes in options trading for beginners and provides practical tips to help you trade with greater confidence and discipline.

Options Trading for Beginners: 7 Mistakes to Avoid

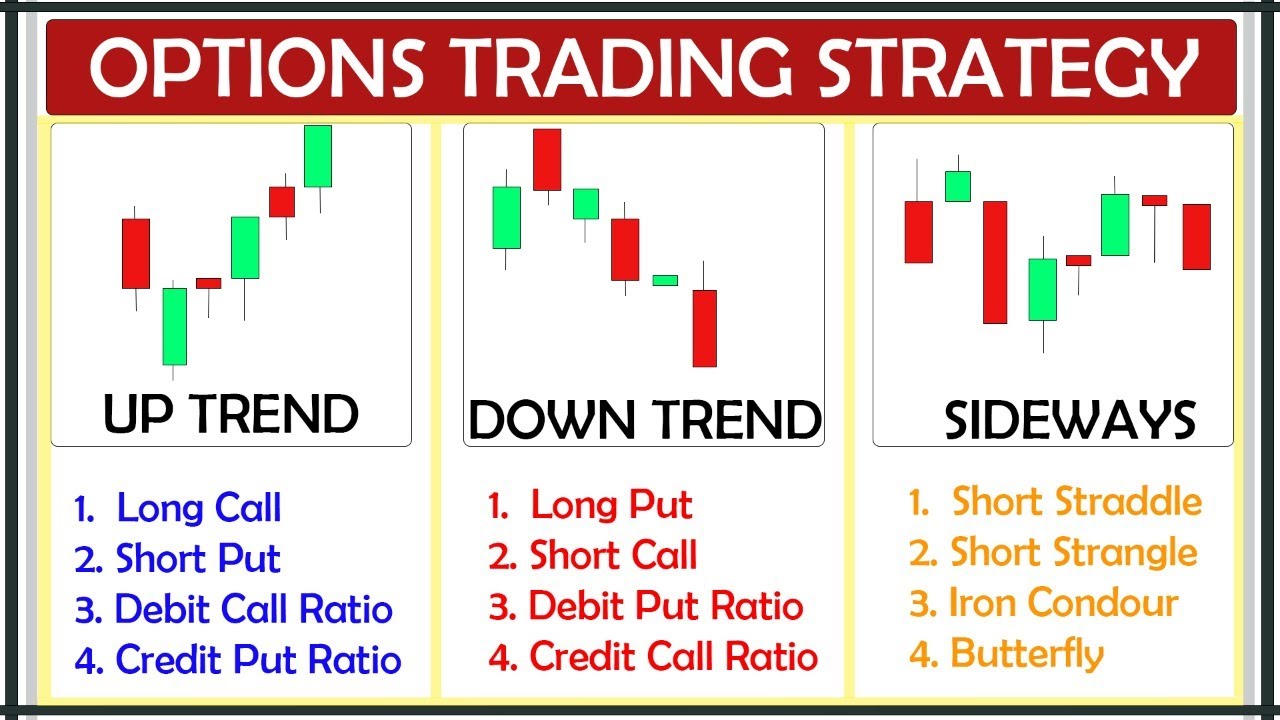

1. Trading Without a Clear Strategy

One of the biggest mistakes new options traders make is entering trades without a well-defined plan. Options provide a variety of strategies to suit different market outlooks, but each requires a clear understanding of your goals, risk tolerance, and market view. Without a strategy, traders often make impulsive decisions, leading to inconsistent results and avoidable losses.

Tip:

Before placing any trade, decide on your strategy, entry and exit points, and how much you are willing to risk. Match your options strategy to your market outlook—whether bullish, bearish, or neutral—and stick to your plan.

2. Choosing the Wrong Expiration Date

Selecting the right expiration date is a critical aspect of options trading. Beginners often pick expirations that are too short, leaving little time for their trade to work, or too long, making the option more expensive. The further out the expiration, the higher the premium, but more time also means more opportunity for your thesis to play out.

Tip:

Estimate how long you expect your trade to be profitable and choose an expiration that aligns with this view. Always consider how time decay (theta) will affect your option's value as expiration approaches.

3. Ignoring Volatility and the Greeks

Many beginners overlook the importance of volatility and the "Greeks" (delta, gamma, theta, vega) in options pricing. Implied volatility directly impacts the cost of options, and not understanding how it works can lead to overpaying or misjudging risk. The Greeks help you understand how factors like time, price movement, and volatility affect your option's price.

Tip:

Learn how to interpret implied volatility and the Greeks before trading. Use them to assess risk, price sensitivity, and the impact of time decay on your position.

4. Poor Position Sizing and Overleveraging

It's tempting to go "all in" on a single options trade, especially with the leverage options provide. However, trading too large can result in outsized losses, while trading too small may not justify the effort. Overleveraging can quickly wipe out your account if the trade moves against you.

Tip:

Only risk a small percentage of your trading capital on any single trade. Position sizing should reflect your risk tolerance and the probability of success. Diversify across different trades and strategies to reduce overall risk.

5. Trading Illiquid Options

Liquidity is vital in options trading. Beginners often trade contracts with wide bid-ask spreads, making it difficult to enter or exit positions at a fair price. Illiquid options can lead to slippage and unexpected losses.

Tip:

Focus on options with high open interest and tight bid-ask spreads. This ensures you can trade efficiently and at the best possible price.

6. Not Accounting for Probability

Options trading is about managing probability, not certainty. Some traders buy cheap, out-of-the-money options hoping for a big payoff, but these contracts often expire worthless if the underlying doesn't move enough. Ignoring the statistical odds can lead to repeated small losses that add up over time.

Tip:

Use probability calculators and statistical tools to assess the likelihood of your option expiring in the money. Make decisions based on probability, not just potential reward.

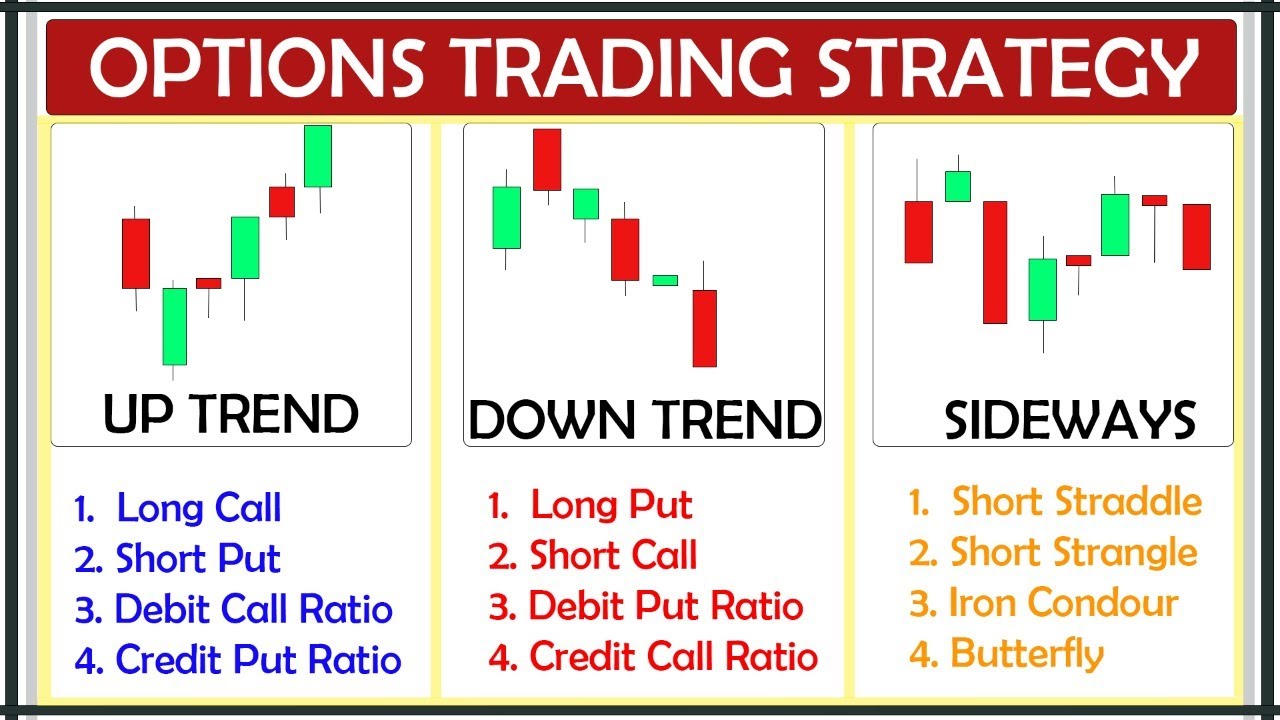

7. Failing to Adapt or Learn New Strategies

Markets change, and sticking rigidly to a single options strategy can be costly. Beginners sometimes avoid learning new approaches or fail to adapt when their current plan isn't working.

Tip:

Stay open to learning and exploring different options strategies. Regularly review your trades, analyse what worked and what didn't, and be willing to pivot as market conditions evolve.

Conclusion

Options trading for beginners can be rewarding, but it requires discipline, education, and careful risk management. By avoiding these common mistakes—such as trading without a plan, ignoring volatility, and overleveraging—you can set yourself up for long-term success.

Remember to keep learning, use the right tools, and always trade within your risk limits.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.