Choosing the right platform is one of the first and most critical steps for any trader. When comparing MT4 against MT5, it's not just about the software—it's about aligning your trading style with the tools that fit it.

MetaTrader 4 (MT4) has long been the gold standard for forex trading. It's simple, lightweight, and widely supported. On the other hand, MetaTrader 5 (MT5) brings more advanced features, multi-asset support, and improved performance.

As of 2025, both platforms are used by millions, but each offers a unique set of benefits depending on your trading goals.

What Are MT4 and MT5?

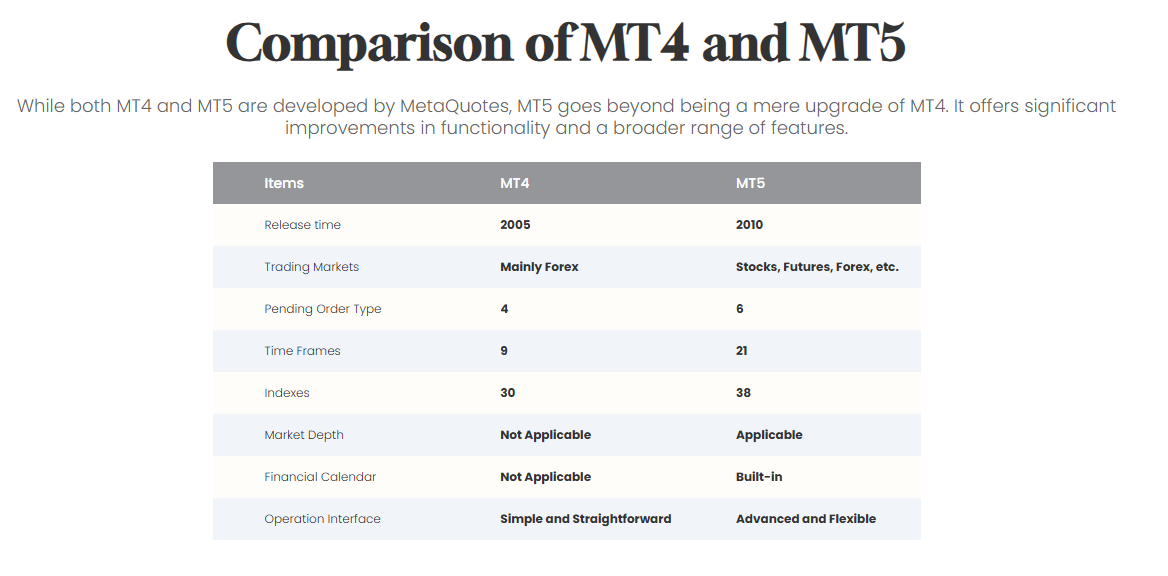

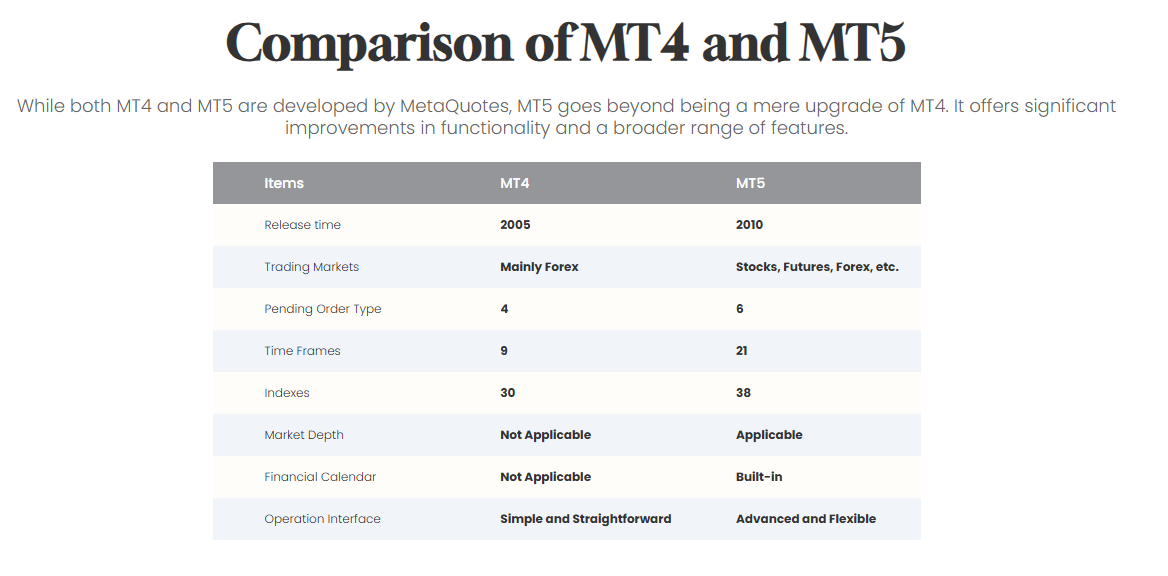

MetaTrader 4, launched in 2005, was built specifically for forex trading. It's known for its simplicity, reliability, and a massive library of indicators and Expert Advisors (EAs). MT4 currently dominates the forex space, maintaining an estimated 80% market share.

MetaTrader 5 followed in 2010. In contrast to its earlier version, MT5 is designed for more extensive financial markets, encompassing stocks, futures, commodities, and bonds.

While MT4 is ideal for traders focused solely on forex pairs such as GBP/USD or USD/JPY, MT5 caters to those managing multi-asset portfolios. Understanding the purpose behind each platform helps determine which best suits your strategy.

MT4 vs MT5: Differences Traders Need to Know

1) Market Access

One of the main differences between MT4 and MT5 is market access.

MT4 is forex-focused. It facilitates trading currency pairs and CFDs with resources to manage even sophisticated forex strategies.

MT5 extends its features by providing access to stocks, commodities, indices, bonds, and additional assets.

In 2023, MT5 users collectively traded over $1 trillion across various asset classes. So, if your strategy involves more than just currency pairs, MT5 is the better choice. But if you're exclusively trading forex, MT4 remains a reliable and efficient option.

2) Indicators and Timeframes: How Deep Is Your Analysis?

Both platforms offer technical indicators and charting tools—but MT5 gives you more depth.

MT4 offers 30 integrated indicators and 9 different timeframes. That suffices for the majority of forex traders and approaches such as swing trading or day trading.

MT5 enhances trading with 38 indicators and 21 timeframes, enabling detailed analysis—particularly beneficial for scalping or high-frequency strategies.

For example, if you're trading gold and need precise entry timing, MT5's expanded timeframes may offer the edge. However, for standard analysis of major pairs like USD/JPY, MT4's features are more than sufficient.

3) Programming and Automation

Both platforms support Automated Trading, but they use different coding languages:

MT4 utilises MQL4, an easier scripting language ideal for developing basic Expert Advisors (EAs).

MT5 utilises MQL5, an object-oriented and more robust language, enabling the development of sophisticated trading algorithms

MQL5 operates more quickly and includes advanced functionalities such as multi-threaded strategy testing. Learning MQL5 require more time for those who are new to it.

If you're new to EAs, MT4 provides a simpler starting point. However, if you are a developer or aim to create robust bots, MT5 offers greater flexibility.

4) System Requirement and Speed

When it comes to performance:

MT4 is lightweight, running on older 32-bit systems with minimal RAM.

MT5 is optimised for 64-bit systems, with faster execution and support for handling large datasets.

In 2024, approximately 25% of traders continued to utilise MT4 on low-end devices, especially in developing markets. Nevertheless, for demanding tasks such as backtesting numerous currency pairs or executing sophisticated algorithms, MT5 stands out as the better platform.

5) Strategy Testing

Backtesting is crucial for refining any trading strategy.

MT4 offers basic strategy testing, typically one currency pair at a time.

MT5 features multi-currency and multi-threaded backtesting, allowing for faster and more realistic simulations.

In 2023, users of MT5 performed 50% more strategy tests than MT4 users, primarily due to its cloud optimisation and quicker processing speed. If you're executing strategies on various assets or need solid testing environments, MT5 is the solution.

6) User Community and Marketplace Resources

MT4 has a massive community and a mature ecosystem. Thousands of free and paid indicators, EAs, and templates are available through the market and popular forums.

MT4 offers a broader array of tools—perfect for forex traders to improve configuration.

MT5's marketplace is expanding, yet it remains smaller by comparison. It also offers more advanced trading features, such as built-in economic calendars, depth of market (DOM) displays, and partial order executions.

If access to tried-and-tested resources is your priority, MT4 is unbeatable. However, if you're seeking contemporary, unified tools for multi-asset trading, MT5 is worth considering.

Additional MT5 Features That Stand Out

MT5 is more than just an upgraded MT4. It includes several exclusive features:

Economic Calendar: Provides real-time news and macro data without leaving the platform.

Depth of Market (DOM): Indicates liquidity and aids in strategising large orders.

Hedging & Netting Modes: Ideal for managing diverse positions.

Integrated Fund Transfers and Reports: Enhances the efficiency of managing your portfolio.

In 2023, 30% of MT5 users regularly utilised the integrated economic calendar to plan trades according to occurrences such as RBA rate decisions or US Non-Farm Payrolls.

Which Platform Suits You?

For new traders, MT4 is typically the better starting point.

Its user-friendly design, lighter system requirements, and huge educational ecosystem make it easy to get started. In 2022, 75% of first-time traders chose MT4 as their entry platform. It's straightforward, focused, and ideal for learning the basics of forex trading.

Traders with more experience or those managing larger portfolios typically favour MT5.

Its support for multi-asset trading, faster execution, and advanced backtesting tools make it a better choice for professionals. In 2024, 40% of institutional and futures traders used MT5, especially for strategies involving gold, oil, or stock indices.

MT5 is more suitable for quantitative trading, intricate algorithms and faster execution speeds.

Conclusion

Ultimately, the decision between MT4 and MT5 transcends mere technicalities—it's a matter of strategy. MT4 excels in forex simplicity, minimal resource consumption, and robust community backing.

MT5 offers improved performance, wider market access, and features tailored for contemporary multi-asset traders. Therefore, utilise free trials, examine both interfaces, and gain assurance before making a decision.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.