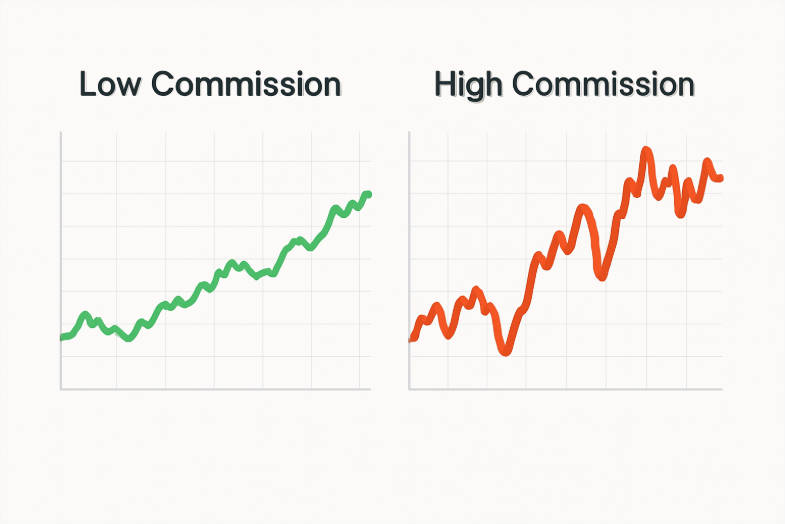

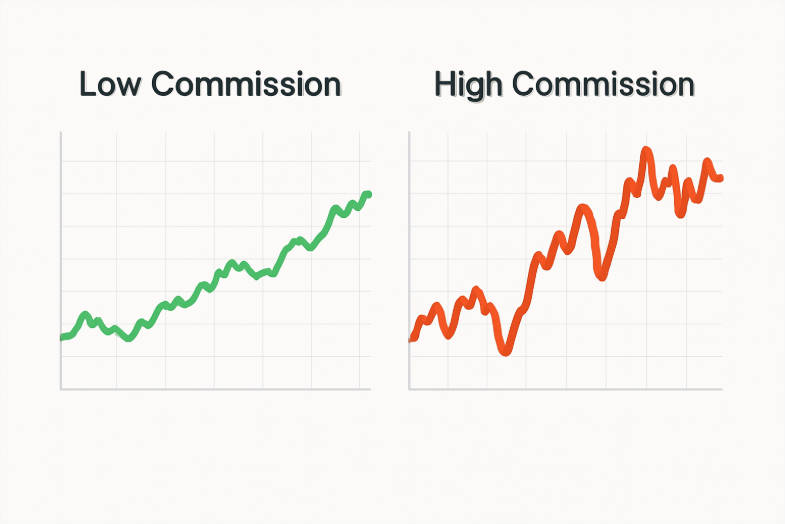

In forex trading, especially for frequent traders, scalpers, or high-volume strategies, trading costs can quietly eat into profitability. Spread differences, per-trade commissions, slippage, and hidden fees all accumulate. Choosing a true low commission forex broker profoundly affects your net returns: lower costs mean more profit margin, better risk-reward potential, and more flexibility to scale trading strategies. A low-cost broker isn't just about saving money but also enable higher-frequency trading, tighter risk control, and more consistent returns.

What Defines a Low Commission Forex Broker

A broker qualifies as a "low commission forex broker" when its cost structure is consciously designed to minimise friction. Key defining elements:

Tight or raw spreads, often close to the interbank rate.

Low (or transparent) per-lot commissions, so traders know exactly what they pay.

Transparent pricing: no hidden fees (for platform usage, deposit/withdrawal, inactivity, excessive slippage, etc.).

Efficient execution with minimal slippage or latency, so trades don't get eaten by spread widening or delayed fills.

Reasonable leverage and account conditions, where costs and margin requirements are aligned with low-fee trading value.

A broker must do more than advertise "cheap" and must deliver low actual trading costs under real conditions.

Key Features of a Low Commission Forex Broker

When evaluating a low-cost broker, watch for:

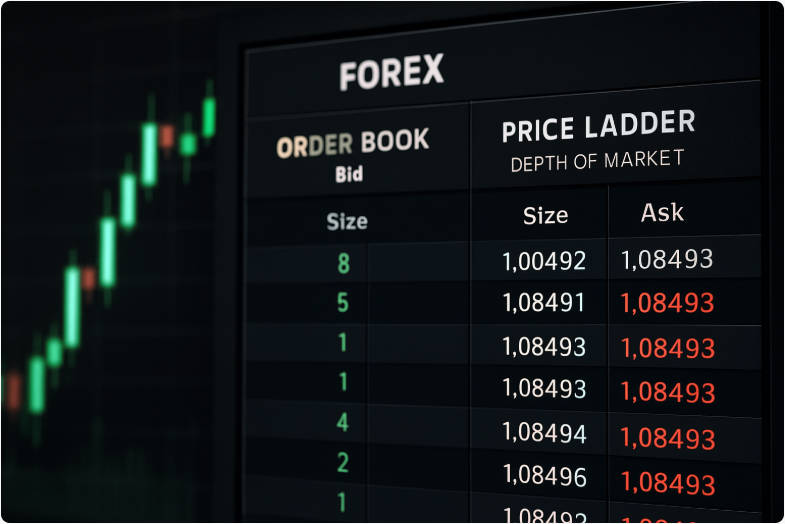

Raw or very tight spreads — ideally from 0.0 pips on major pairs for ECN/Pro-style accounts.

Commission-based accounts (rather than wide-spread markups), where you pay a clear commission per lot instead of hidden costs.

Robust liquidity and direct market access (STP/ECN) — ensures tight spreads even during volatile times.

Transparent fee disclosure — all costs (commissions, swaps, funding, withdrawal) clearly stated.

Reliable, fast execution and minimal slippage — reduces cost uncertainty, especially for scalpers and active traders.

Flexible account types (standard, raw/ECN, demo) and reasonable minimum deposit levels — useful for both beginners and experienced traders.

Strong regulation or oversight (where applicable), or credible safeguards if jurisdiction differs — to ensure fairness, fund security, and transparency.

Ranking Criteria for the Best Low Commission Forex Broker

To systematically compare brokers, consider the following evaluation metrics:

True trading cost per trade — spread + commission + swap/rollover + funding/withdrawal fees.

Execution quality — speed, latency, slippage, order rejection rates.

Platform stability and features — support for major platforms (e.g. MT4/MT5), charting tools, order types, account management, mobile/web access.

Liquidity depth and reliability — to ensure tight spreads and order fills even under high volatility.

Regulation / fund security / transparency — licences, segregated client funds (if provided), compliance with reputable authorities, clear disclosures.

Account flexibility — different account types (raw, standard, mini), reasonable minimum deposit, leverage options suitable for different trader types.

Support and service quality — customer service responsiveness, deposit/withdrawal processes, educational resources, clarity for beginners.

By judging brokers on these criteria, you can better distinguish genuine low-commission providers from those who just market "cheap" but hide costs or compromise execution.

Generic Broker VS EBC Financail Group

| Broker / Account Type |

Spread / Commission Style |

Typical Minimum Deposit |

Execution Type / Liquidity |

Regulation / Oversight |

| Generic Low-Cost Broker A (ECN/Raw) |

Raw spreads from ~0.0 pips + commission per lot |

Moderate |

STP/ECN, good liquidity |

Regulated or offshore |

| Generic Broker B (Standard) |

Wider spreads, no commission |

Low |

Standard market maker / STP |

Varies |

| EBC Financial Group (EBC) – Pro/Raw Account |

Very tight spreads (from 0.0 pips) + competitive commissions |

Low to moderate |

STP/ECN with aggregated institutional liquidity |

Claimed FCA / ASIC / CIMA regulation |

| Generic Broker C (Hybrid) |

Mix of spread/commission depending on account |

Varies |

Mixed liquidity |

Mixed regulation or offshore |

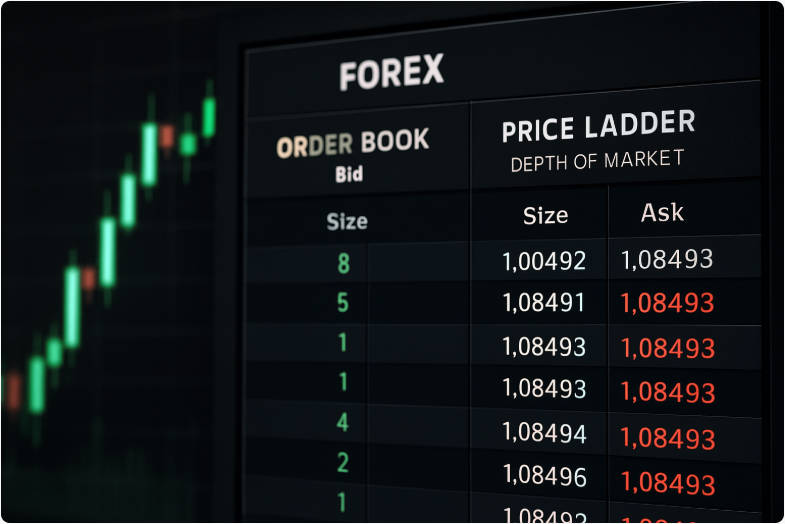

Low Commission Forex Broker with the Tightest Spreads

For traders employing scalping, frequent intraday trades, or high-volume trading — tight spreads are critical. A broker offering raw spreads (often from 0.0 pips) plus a transparent per-lot commission often delivers the lowest possible cost per trade. This structure minimizes the spread "cost floor," enabling small-profit trades to remain viable even after fees — a must for scalpers and algorithmic strategies.

Low Commission Forex Broker with the Lowest Overall Fees

It's not enough to have tight spreads. Traders must consider the all-in cost: commissions, swap or rollover fees for overnight positions, funding/withdrawal fees, inactivity fees, and potential slippage costs. The "cheapest" broker is the one with lowest true cost per example trade. Brokers that combine raw spreads, low commission rates, efficient swaps, and transparent withdrawal fees will often outperform "low-spread but hidden fee" alternatives over time.

Low Commission Forex Broker for Beginners

If you are new to forex:

Look for a broker with low initial deposit requirements — so you can start small.

Choose standard account or demo-first to test platform and execution without big risk.

Ensure pricing and fees are clear and easy to understand — tight spreads + fixed or known commissions.

Prefer brokers with educational tools, responsive customer support, and straightforward deposit/withdrawal methods.

Avoid complicated fee structures or "too good to be true" claims — simplicity often beats low-cost illusions for new traders.

With a genuine low-cost broker, beginners can test, learn, and scale without being penalised by high spreads or hidden costs.

Low Commission Forex Broker for Professional and High-Volume Traders

For professional traders, prop firms, or high-volume traders:

Raw/ECN-style accounts with tight spreads and small commissions maximize profitability per lot.

Institutional-grade liquidity & execution ensure orders fill rapidly, with minimal slippage, even for large volumes.

Strong platform tools (automation, API, advanced order types) support complex strategies — scalping, arbitrage, automated trading.

Transparent, scalable cost structure helps with margin management, risk controls, and long-term strategy viability.

High-volume traders benefit most when cost structure is predictable and minimal — exactly what a good low commission forex broker should deliver.

Safety and Regulation When Selecting a Low Commission Forex Broker

Cost savings are attractive — but never at the expense of safety. A reputable low commission forex broker should ideally:

Operate under a credible regulatory authority (or several across jurisdictions).

Segregate client funds from operational funds (or provide other safeguards).

Disclose licensing/licence numbers, compliance, audit status, and risk-management policies.

Provide transparent documentation for deposits, withdrawals, and financial safeguards.

Without proper regulation or safeguards, even low-cost offers may carry hidden risks — sometimes greater than any fee savings.

Why EBC Financial Group Is a Strong Option

Here's a case for considering EBC as a candidate among low commission forex brokers — along with some caveats:

Competitive pricing with tight spreads + transparent commission structure. According to EBC, its pricing model includes "spreads from 0.0 pips" on accounts with commission and transparent fees overall.

Good execution infrastructure and liquidity depth. EBC claims to aggregate institutional-grade liquidity from multiple providers, offering fast execution and stable pricing even under volatility.

Multi-jurisdictional regulation — claimed by EBC. Their site states they operate under the supervision of major regulators: the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cayman Islands Monetary Authority (CIMA), offering a broad regulatory footprint.

Product & account flexibility. EBC reportedly offers multiple account types, multi-asset support (forex, CFDs, commodities), and popular trading platforms (e.g. MT4 / MT5), making it suitable for both novice and advanced traders.

Industry recognition. EBC has been awarded by industry bodies: e.g. "Most Trusted FX Broker" and "Best CFD Broker" by the World Finance Awards 2024, which reflects peer and industry recognition of their service standards.

Caveats / What to check:

Some third-party reviews and watchdog sites have flagged concerns about regulation transparency and actual regulatory license verification.

As with all offshore/multiple-jurisdiction brokers, regulatory protections may differ depending on your location — double-check if you qualify for protections or if your jurisdiction imposes restrictions.

Always test with a demo account first, and start with small capital to evaluate execution, withdrawals, and real-world costs.

In short, EBC stands out as a potentially good low commission forex broker, especially for traders prioritising tight spreads, transparent fees, and flexibility — but proper due diligence remains essential before committing real capital.

How to Optimise Your Strategy with a Low Commission Forex Broker

Scalping & high-frequency trading — tight spreads + low commissions reduce cost per trade, making small-profit trades viable.

Frequent swing or day trading — lower fees lower the break-even point, enabling more frequent entries/exits without eroding profits.

Automated / algorithmic trading — predictable, low-cost infrastructure and good liquidity help algorithms function reliably under different market conditions.

Hedging / multi-leg strategies — low commissions across many legs reduce total cost, making complex strategies more efficient.

Long-term trading with minimal cost drag — even for longer holding periods, low swaps, transparent rollover fees, and minimal spreads help preserve returns.

With the right broker and strategy, low-cost trading becomes a foundation for consistent, scalable performance.

Common Mistakes When Choosing a Low Commission Forex Broker

Focusing only on advertised "zero spread / zero commission" — often hides cost in slippage, swap rates, funding/withdrawal fees.

Ignoring liquidity and execution quality — tight spreads alone don't guarantee good fills or fast execution.

Overlooking regulation, fund security, and legitimacy — low cost is worthless if broker is unreliable or unregulated.

Starting with large capital before testing — risking big losses before verifying execution, withdrawals, or hidden costs.

Choosing based on promotions or bonuses, rather than cost transparency and real trading conditions.

Always evaluate the full picture — costs, reliability, regulation, and trading conditions — before committing.

Frequently Asked Questions

Q1: What makes a broker a low commission forex broker?

A low commission forex broker offers reduced trading fees through tight spreads, minimal per-lot charges, and transparent pricing. These brokers prioritise efficiency and cost structure, allowing traders to retain more profit across frequent or high-volume trades.

Q2: Are low commission forex brokers safe for beginners?

Yes, low commission forex brokers can be safe if they are well regulated, offer beginner-friendly platforms, and provide educational tools. Beginners should prioritise regulation and clarity of fees before focusing solely on low-cost trading conditions.

Q3: How do I compare different low commission forex brokers?

Compare spreads, commissions per lot, swap fees, execution speed, regulation, and platform quality. A structured comparison ensures you select a broker that offers genuinely low costs without hidden charges or compromised trading performance.

Q4: Do low commission forex brokers offer tight spreads?

Most low commission forex brokers provide tight or raw spreads. They earn revenue mainly through small commissions, allowing spreads to stay highly competitive, which is ideal for scalpers, day traders, and algorithmic trading strategies.

Q5: Is EBC suitable for professional traders?

Yes. EBC's structure suits professional traders because its tight spread + commission model, liquidity, and execution infrastructure reduce per-trade costs. For high-frequency or high-volume strategies, the lower cost basis improves long-term profitability.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.