The IBB ETF offers one of the most established and diversified routes into U.S. biotechnology.

Its objective is to replicate, as closely as possible, the ICE Biotechnology Index. The fund provides exposure to companies engaged in biotechnology, including those involved in creating or using biological entities or derivatives to develop products or processes for medical, agricultural, industrial or other uses.

Yet, it may not always be the "best" option since its large-cap bias and volatility mean other biotech funds could suit different investor goals better.

This article breaks down how IBB works, its structure and performance, the benefits and drawbacks, and whether it is the right fit for your portfolio.

IBB ETF's Key Metrics & Structure

To understand IBB properly, several metrics and structural features should be considered.

IBB ETF's Key Metrics & Structure

| Metric |

Figure / Description |

| Expense Ratio (Management Fee + other fees) |

~ 0.44% per annum. |

| Assets Under Management (AUM) |

About US$5.6-5.7 billion. |

| Number of Holdings |

Approximately 250-260 individual biotechnology-related equities. |

| Top 10 Holdings Concentration |

Roughly 47-48% of total assets are in the top ten holdings. |

| Valuation Metrics (approximate) |

Price/Earnings ratio ~ 25.8×; Price/Book ratio ~ 3.98×, based on recent data. |

| Beta (3-year) |

About 0.80 relative to the broader market. |

| Standard Deviation (3-year) |

~ 17.04%. This reflects a fairly high volatility. |

| 12-month Trailing Dividend Yield |

Approximately 0.29%. |

Structurally, IBB covers a wide range of biotech companies but leans toward more established firms with larger market capitalisations.

This means it provides exposure to numerous biotech players, while some of the overall risk is tempered by the prominence of bigger, more stable companies.

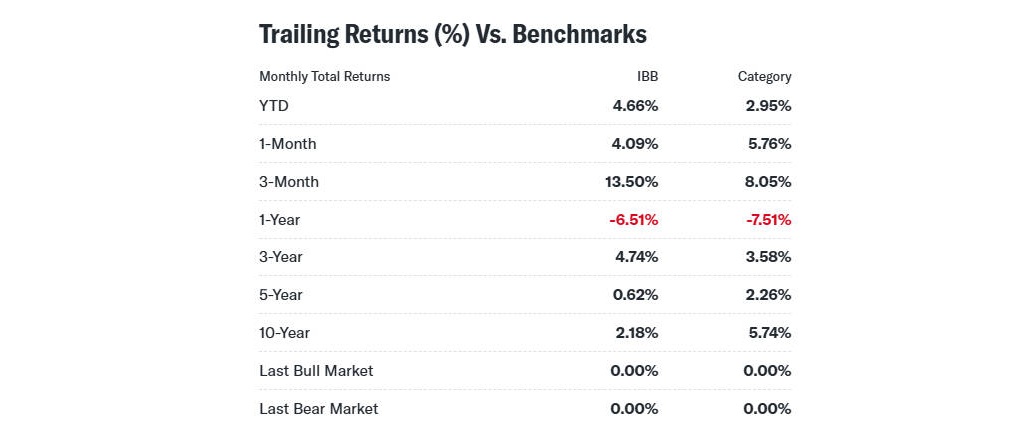

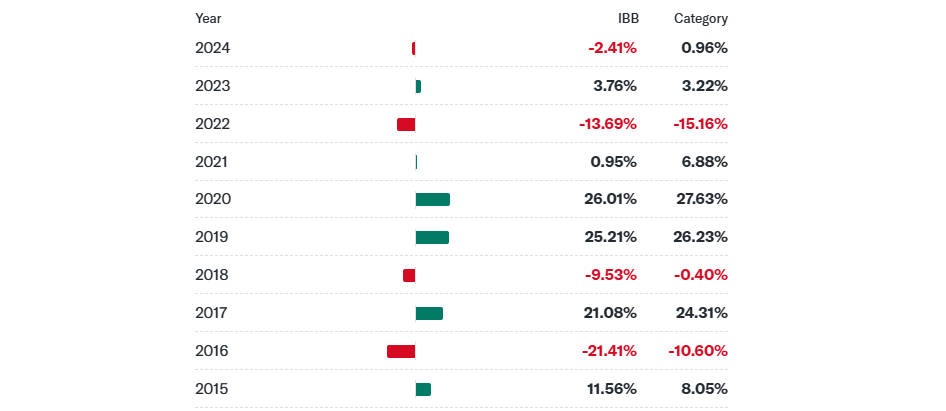

Performance Trends of IBB ETF: Past, Present & Comparisons

Historical Returns

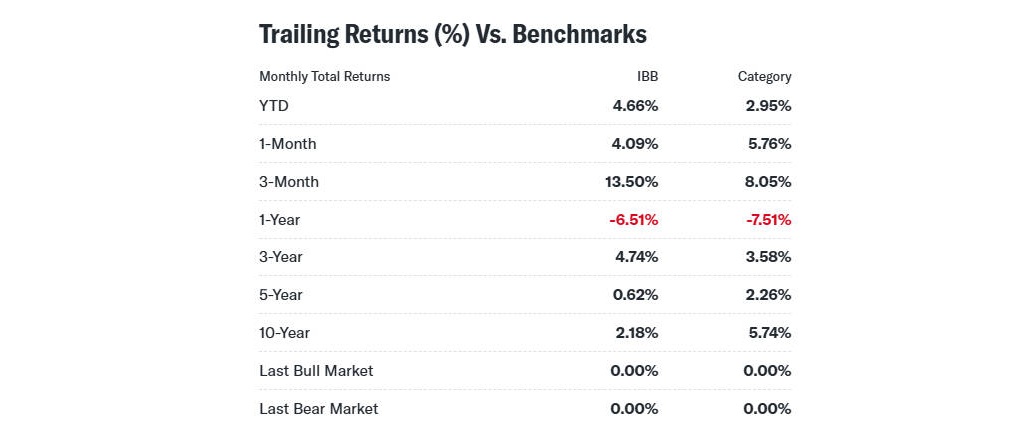

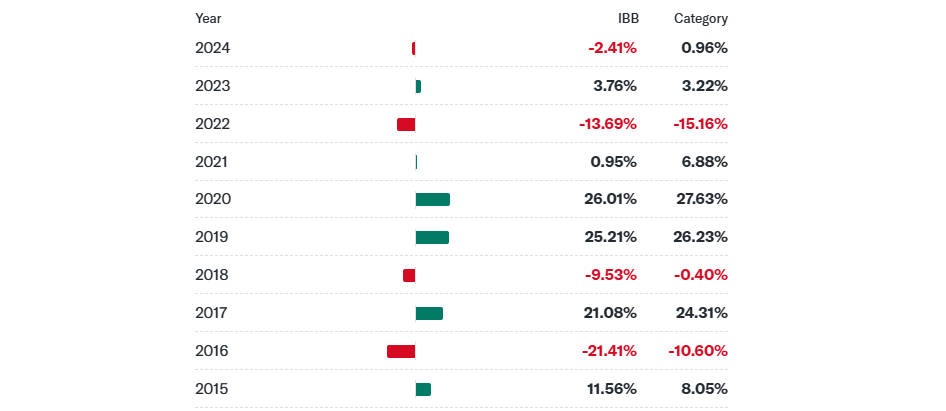

IBB's performance has varied over time. Its long history (since 2001) means that over many years, returns have been driven by cycles in biotech innovation, regulatory shifts, interest rate environments, and investor sentiment. More recently:

Year-to-date returns are positive in many reports, though modest.

Over the past 12 months there has been mixed performance: some sources show modest gains; others indicate slight declines depending on benchmark and exact timing.

Recent Behaviour & Momentum

IBB has experienced periods of volatility, often reacting to:

Clinical trial results or approvals (or rejections).

Regulatory policy and changes in healthcare laws.

Macro factors such as interest rates, inflation, and broader market risk appetite.

The funding environment for biotech, which influences small-cap and early-stage firms strongly.

Comparisons with Peer ETFs

When compared to biotech-focused ETFs such as XBI (SPDR S&P Biotech ETF), IBB typically differs in:

1) Weighting methodology:

IBB is capitalisation-weighted, so larger companies carry more weight; peers like XBI may use equal weighting, giving smaller companies more influence.

2) Risk/volatility:

IBB tends to be somewhat less volatile than some equal-weight peer funds that have higher exposure to small-cap biotech firms.

3) Expense:

IBB's cost (≈0.44%) is moderate for sector specialised ETFs; some peers may cost more, especially those with thematic or narrow focuses.

Strengths & Weaknesses: Where IBB Shines, Where It Struggles

Strengths

1) Diversified exposure:

With ~250-260 holdings, IBB gives exposure across the biotechnology sector, reducing idiosyncratic risk compared to owning a few biotech stocks.

2) Scale & liquidity:

It has substantial assets under management and is well known; its shares trade with decent volume, which helps with tight bid-ask spreads.

3) Access to innovation:

Biotechnology remains a field of strong scientific innovation—gene therapy, mRNA technology, precision medicine, etc.—so investors in IBB participate in that potential upside.

4) Moderate valuation relative to risk:

The valuation metrics like P/E and P/B are not extreme given the sector; and the weighting toward larger, more stable firms helps buffer some downside.

Weaknesses / Risks

1) High volatility:

The biotech sector is inherently volatile due to scientific, regulatory, and funding risks. IBB's standard deviation is high.

2) Regulatory risk:

Drug approvals, government policy, healthcare regulation, patent law—any adverse change can disproportionately affect biotech firms.

3) Clinical trial failures:

Many biotech firms are still in development phases; a failed trial or safety concern can severely impact individual companies, sometimes dragging down sector sentiment.

4) Interest rate & macroeconomic sensitivity:

When interest rates rise, growth stocks (including biotech) often suffer more, as future cash flows are discounted more heavily.

5) Concentration risk:

Although IBB has many holdings, nearly half its value comes from its top ten holdings, so risks or underperformance in a few large names can move the fund significantly.

Suitability & Strategy: Who Might Use IBB & How

IBB is not for everyone, but in the right context, it can be a useful part of a portfolio.

Investor Types / Use Cases

Those who believe in long-term biotech innovation, and want exposure to medical research, therapies, and advances rather than just short-term gains.

Place in Portfolio

Timing Considerations

What Lies Ahead: Outlook & Key Catalysts

Trends

1) Scientific and technological innovation:

Gene editing (e.g. CRISPR), personalised medicine, immunotherapies, mRNA technologies, and biotechnology in agriculture remain important frontiers.

2) Regulatory developments:

Approvals, fast-track designations, FDA and equivalent regulators' policies will influence which companies succeed.

3) Funding environment:

Access to capital (venture funding, public markets) for biotech firms is critical; investor sentiment matters.

4) M&A activity:

Larger pharma companies often acquire biotech firms to bolster pipelines; acquisitions can create upside for small/mid biotech players.

Risks

1) Policy and regulatory uncertainty:

Government changes, regulation tightening, or healthcare spending austerity can hamper progress.

2) Valuation concerns:

When valuations run ahead of fundamentals (e.g. earnings, or realistic revenue prospects), there is risk of correction.

3) Interest rate risk:

As noted, higher rates discount future earnings more heavily, which is a drag for biotech.

4)Scientific risk:

Clinical failures, safety concerns, or setbacks in trials can lead to rapid deterioration of market confidence.

Possible Scenarios

1) Upside scenario:

Strong innovation yields several successful drug approvals; regulatory environment is supportive; capital is relatively cheap; biotech rallies, delivering strong returns for IBB.

2) Base scenario:

Modest gains or flat returns, with occasional volatility; sector performs in line with expectations, but doesn't dramatically outperform broad markets.

3) Downside scenario:

Regulatory or policy headwinds, rising rates, funding drying up, significant trial failures; could cause underperformance or losses, particularly for smaller biotech firms, dragging down the ETF.

Conclusion

IBB ETF provides broad, diversified exposure to the biotechnology sector and access to its growth potential. However, it carries high volatility and sector-specific risks, making it more suitable for investors with a medium- to long-term horizon and a tolerance for risk.

As part of a diversified portfolio, IBB can be a valuable way to participate in biotech innovation, but careful consideration of timing, valuations, and regulatory factors is essential.

Frequently Asked Questions

Q1: How volatile is IBB compared with the broader market?

IBB is more volatile than broad index funds. Its three-year beta is about 0.80. and its standard deviation is around 17 per cent, reflecting the sector's sensitivity to clinical trial results, regulation, and broader market sentiment.

Q2: What is the expense ratio, and how does it compare to peers?

The fund charges roughly 0.44 per cent annually. This is higher than broad market ETFs but moderate for a specialised sector ETF, making it competitive against other biotechnology and healthcare funds.

Q3: Does IBB pay dividends, and what is the yield?

Yes, IBB distributes dividends, but the yield is very low at around 0.3 per cent. This is typical for biotech companies, which tend to reinvest earnings into research rather than paying shareholders.

Q4: How does IBB differ from other biotech ETFs such as XBI?

IBB is market-capitalisation weighted, giving larger companies more influence. By contrast, XBI uses equal weighting, resulting in greater exposure to smaller, riskier firms. This makes IBB less volatile but sometimes less responsive to speculative biotech rallies.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.