In the stock market, people always keep an eye on the price of a company's stock, rejoicing over its rise and worrying over its fall. The fluctuation of the stock price has always been on the minds of investors, as this fluctuation can lead to huge profits or losses. However, in addition to stock price, there is an equally important indicator that is often overlooked, and that is market capitalization. It is not only the sum of the market value of the outstanding shares of a listed company but also an important indicator of the scale of the company's operations and investment value. Now let's understand together the significance of market capitalization and the calculation method.

What does market capitalization mean?

What does market capitalization mean?

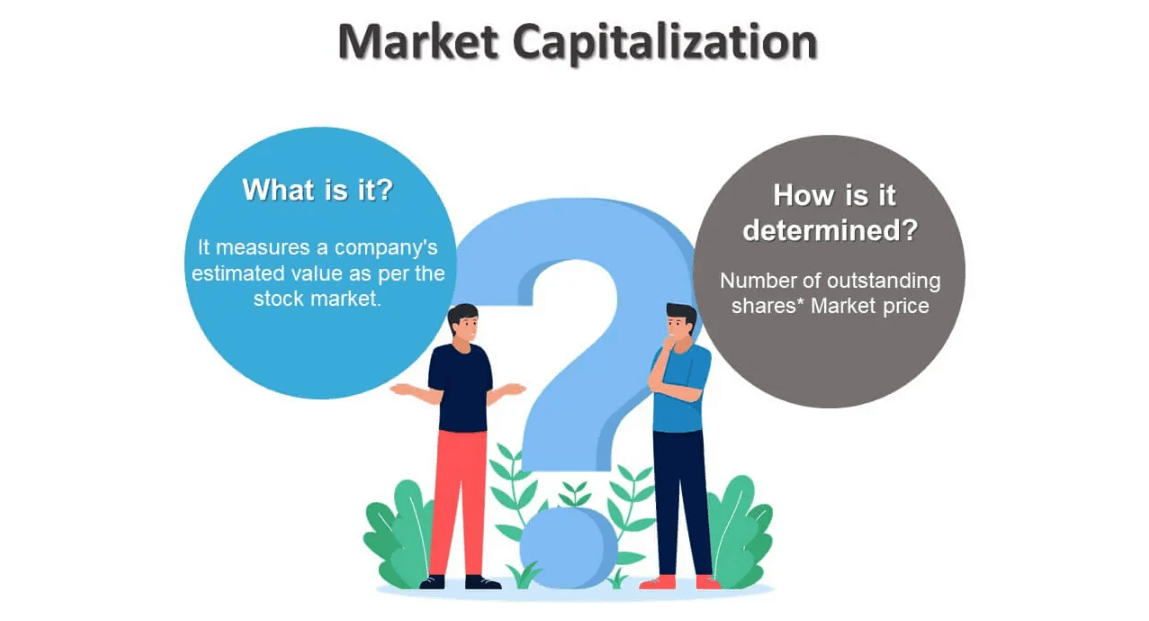

It refers to the market value of a company, i.e., the total value of all issued shares of a company, and is the overall valuation of a company by investors. It is not only an important indicator to measure the scale of operations of a listed company but also one of the most important bases for investors to assess the potential of stock investment.

For listed companies, market value growth is an important goal because it reflects the overall market recognition and expectations of the company. Realizing value growth requires a company to continuously create intrinsic value, which means that the company needs to take a series of measures to improve its performance, expand its market, and attract more attention and trust from investors.

A company can achieve value growth by continually improving performance, expanding markets, increasing brand awareness and public image, and engaging in effective investor relations management and transparency. Excellent financial performance, expanding business areas, a good corporate image and reputation, as well as good communication and disclosure with investors, can increase investor trust and attention, thus increasing value.

The market's estimate of a company's overall value is also one of the indicators used by investors to assess a company's size and financial condition. A high value usually indicates that the company is large and its business is relatively stable, while a low market capitalization may indicate that the company is in a growth stage with high growth potential.

Its high and low size also have a relationship with investment risk and return. Generally speaking, the value of the company's relatively low risk may also be more stable, while the value of the company may have a higher growth potential, but the risk is also correspondingly increased. Investors can choose the type of stock that suits their risk appetite and investment objectives.

For example, a blue-chip company with a large market capitalization may be a large corporation with a long history of stable earnings, and investors can usually earn relatively stable dividend income when holding its stock. A smaller-value emerging technology company, on the other hand, may have high growth potential but also come with higher market risk.

Watching how the value of a listed company changes can help investors adjust their investment strategies in a timely manner. For example, a rise in value may mean that the market is optimistic about the company's prospects, and investors may consider increasing their holdings or buying the stock, while a fall in value may suggest that the company is facing challenges, and investors may need to consider reducing their holdings or exiting.

When investors find that certain companies are undervalued, but these companies have good growth potential, they may believe that these companies are undervalued and are expected to achieve higher growth in the future. In this case, investors may consider investing in these potential stocks to gain more income.

Less valuable companies may be undervalued due to pessimistic market expectations about their prospects or other temporary factors. However, if investors are able to recognize that these companies actually have good operational strength, industry position, or innovation capability, their share prices may rise in the future, thus generating handsome returns for investors.

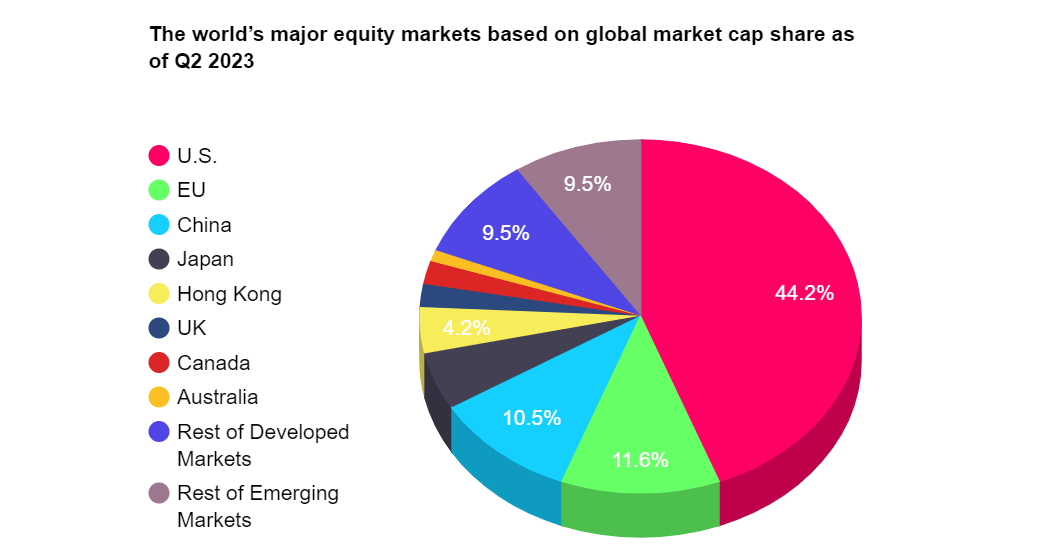

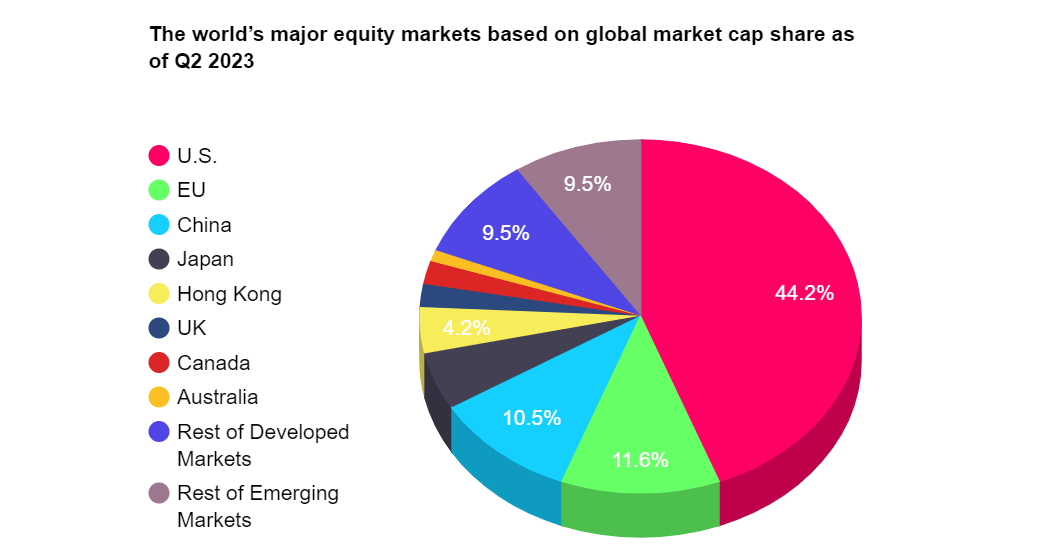

By calculating the sum of the market capitalization of all listed companies in the stock market, it is possible to measure how developed a country's stock market is, which in turn reflects the strength of the country's economy. This figure reflects how developed the country's stock market is, which in turn can be used as one of the indicators to assess the strength of the country's economy. A well-developed stock market usually represents an economically active and well-capitalized country.

For investors, it is an important window into a company's business situation. By observing changes in the market capitalization of a listed company, investors can keep abreast of the market's overall assessment and expectations of the company. Such information can help investors adjust their investment strategies in a timely manner, including buying, holding, or selling stocks in response to market changes.

How to Calculate Market Capitalization

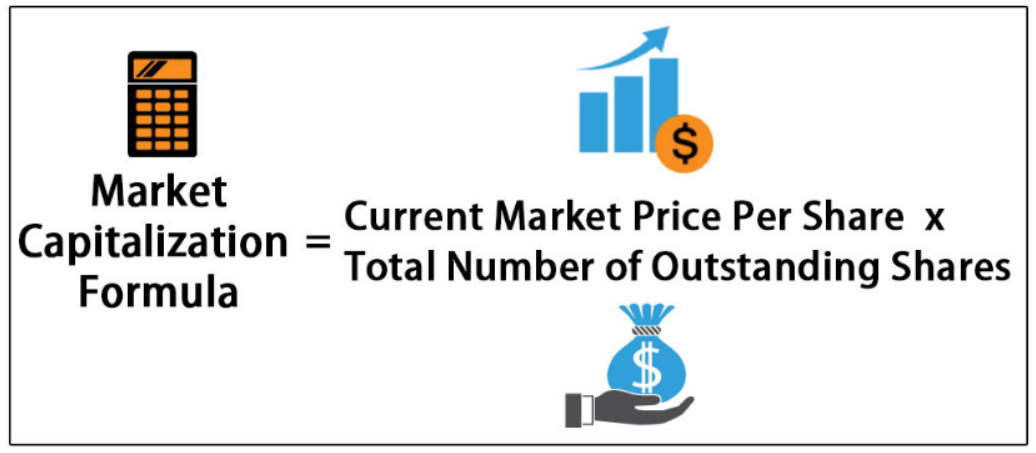

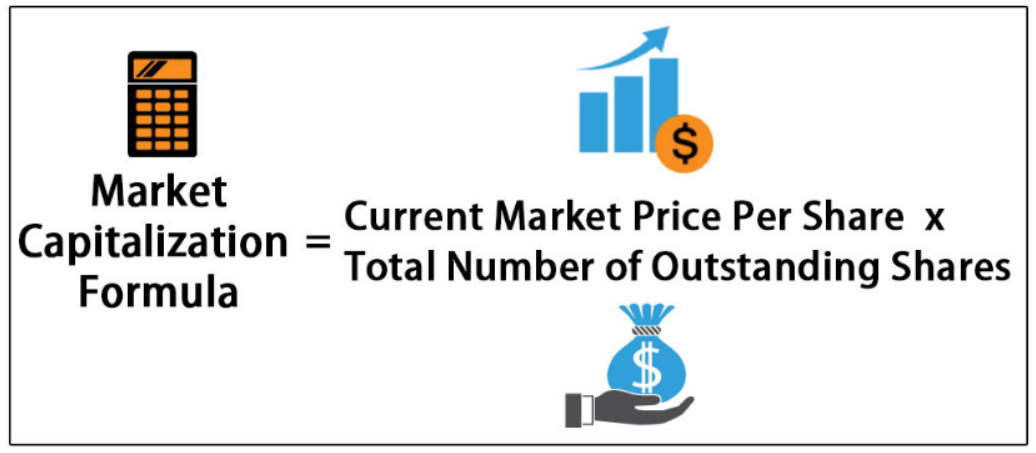

It is the overall value of a publicly traded company in the market and is calculated by multiplying the number of outstanding shares of the company by the current share price. In other words, it indicates the total amount of money that would be required if an investor wanted to buy all of the company's publicly traded shares.

For example, assuming that Company A has three units of stock outstanding in the market and the latest stock price is $20. the market capitalization of the company would be $20 multiplied by 3. or $60. It is important to note that it is not the same as the same share capital or paid-in capital of the company, nor is it the same as the amount of money that the company actually receives from its shareholders when it raises capital.

Also, when calculating this, it is important to note that the stock price used should be the most recent trading price or market price, not an outdated or inaccurate price. Since it varies with changes in stock price and number of shares, the most recent data should be used in the calculation to ensure accuracy.

Changes in market capitalization reflect the market's overall view of the company and its expected earnings. For example, a company may receive $3 million from shareholders at $1 million per share in its initial capital raising, but as the market becomes bullish on the company's ability to make money and is willing to buy stock at $2 million per share, the company's value rises to $6 million even though the company's actual capitalization is still $3 million.

In this case, even though the company's capital has not increased, the market price of the stock has risen as the market recognizes its future earning potential, thus driving up its value. This shows that it is not only affected by the actual capital of the company but also by investors' expectations of the company's future performance and market supply and demand.

It is usually calculated based on the number of outstanding shares of a company rather than on the total number of shares. Therefore, it should be ensured that only outstanding shares are considered in the calculation. The currency units of the stock price and the number of shares should be consistent in the calculation to avoid calculation errors.

And all of the company's outstanding stock, including common stock, preferred stock, etc., should also be considered in the calculation. No stock should be omitted from the calculation. If there is a change in equity (e.g., Stock Split, merger, etc.), the number of shares needs to be adjusted accordingly to reflect the latest equity structure.

The significance of a well-calculated market capitalization is that it provides an overall valuation of the company in the market, which is crucial for investors to assess the investment potential and risk of a stock. Depending on how high or low the calculated value is, investors can get a more accurate picture of a company's market position and potential value, which in turn can guide their investment decisions.

Is it better to have a high or low market capitalization for a stock?

Stocks can be categorized into large-cap, mid-cap, and small-cap stocks according to their height. Investors can evaluate the stability and growth potential of a company based on its size to make investment decisions. Large-cap stocks usually have a smoother share price performance, while small-cap stocks have a more volatile share price and relatively higher risk. Investors can choose the type of stock that suits their risk appetite and investment objectives.

Large-cap stocks usually refer to higher-value companies whose total value is usually in the tens to hundreds of billions of dollars or more. These companies are often industry leaders with stable profitability and strong market positions. Due to their size and capitalization, large-cap stocks usually have a smoother share price performance. They are more likely to be favored by institutional investors and are preferred by some value-added and solid investors.

Mid-cap stocks, on the other hand, fall between large-cap and small-cap stocks and usually range from a few billion to tens of billions. These companies are moderately sized and may be leaders in their industries, but they may have slightly less market share and profitability than large-cap stocks. Mid-cap stocks have relatively more stable share price performance as well as some growth potential, thus attracting a portion of growth investors and medium- to long-term investors.

Small-cap stocks refer to companies with a small market capitalization, usually between a few hundred million and a few billion dollars. These companies may be innovators in emerging industries or newcomers in traditional industries with high growth potential, but they also come with greater risks. Small-cap stocks are relatively risky, as their share prices are more volatile and subject to market sentiment and disclosure. Small-cap stocks often attract aggressive investors and short-term traders.

Of course, different indices in different countries have different criteria for categorizing large-, medium-, and small-cap stocks. For example, the S&P 500 index in the United States contains companies with a minimum value of $4 billion, while the S&P 400 index contains companies with a value between $1 billion and $4.4 billion, and the S&P 600 index contains companies with a value between $300 million and $1.4 billion.

Typically, companies with larger values have relatively lower risk because they typically have more stable business models, richer resources, and stronger market positions. These companies tend to have more stable cash flows and profits, and it is usually easier to obtain financing and attract investor confidence. As a result, investing in these larger companies is likely to provide more stable returns, but the growth rate may be relatively slow.

In contrast, smaller-value companies typically have higher growth potential but also come with higher risk. These companies may be in the early stages of development, with smaller market shares, greater competitive pressures, and less sophisticated management than larger companies.

Due to the relative instability of their businesses, the share price of these companies may be more volatile, with a corresponding increase in investment risk. However, if these smaller companies succeed in growing their businesses, their share prices may rise sharply, bringing substantial gains to investors.

Usually, companies with high market capitalization are large, mature, and stable companies with more stable profitability and market position. They tend to have more resources and capital and are able to cope with fluctuations in economic cycles, providing investors with relatively stable income and dividends. Suitable for those seeking stable returns and lower risk, as well as long-term investors. It is also suitable for core portfolio holdings, which are used to stabilize overall portfolio performance.

The lower companies, on the other hand, are usually emerging growth companies with greater potential and higher growth potential. They may be leaders in their industries, or they may have innovative products and technologies that promise higher returns. They are suitable for investors who seek high risk and high return and are willing to take greater risks, as well as short-term speculative investors. It is also suitable for investors who have sufficient risk tolerance and expertise to be able to thoroughly research and evaluate the potential of these companies.

However, it is important to note that its high or low value does not always directly reflect the value of a company. Sometimes, its high value may mean that the market is overly optimistic in its valuation of the company or that there is speculative behavior. In such cases, investors need to exercise prudent judgment and avoid blindly chasing highs.

On the contrary, companies with lower values may have potential investment opportunities, but they also come with higher risks. Therefore, when deciding whether to invest in a particular company, investors should consider the company's fundamentals, industry outlook, management team, financial position, and other factors, not just the size of its value.

Overall, stocks with high market capitalization are usually more stable and suitable for prudent investors, while stocks with low values have higher risks but greater growth potential and are suitable for investors who are willing to take higher risks. Investors should make their choices based on their investment objectives, risk appetite, and investment strategies.

Top 10 Companies by Market Capitalization Global

| Company |

Market capitalization ($ billion) |

| Microsoft |

20480 |

| Apple |

20200 |

| Saudi Aramco |

18750 |

| NVIDIA |

7950 |

| Amazon |

7770 |

| Google(Alphabet) |

7720 |

| Meta(Facebook) |

7600 |

| Berkshire Hathaway |

6770 |

| Eli Lilly |

6700 |

| tesla |

6680 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What does market capitalization mean?

What does market capitalization mean?