The oil spot market is renowned for its volatility, offering traders both risk and opportunity. By understanding and applying the right strategies, many have profited from sharp swings in oil spot prices—whether driven by global events, supply-demand shifts, or technical signals.

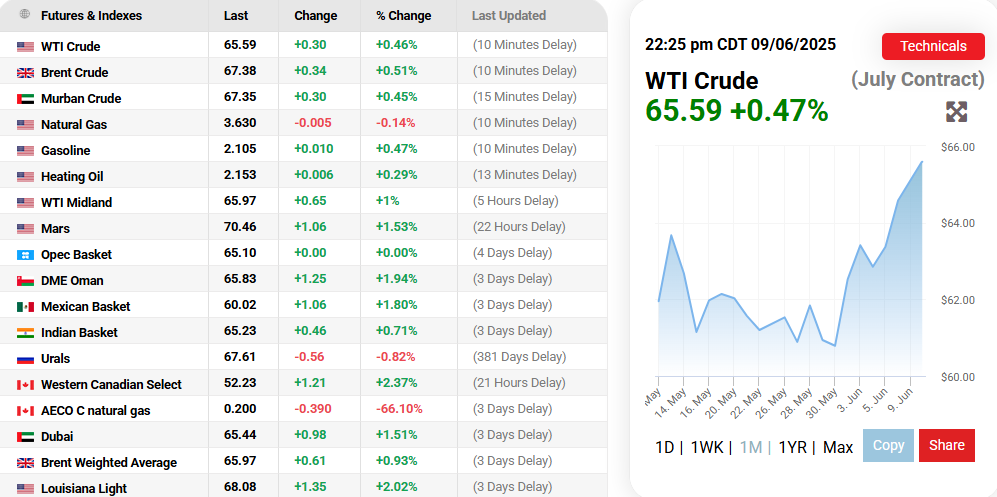

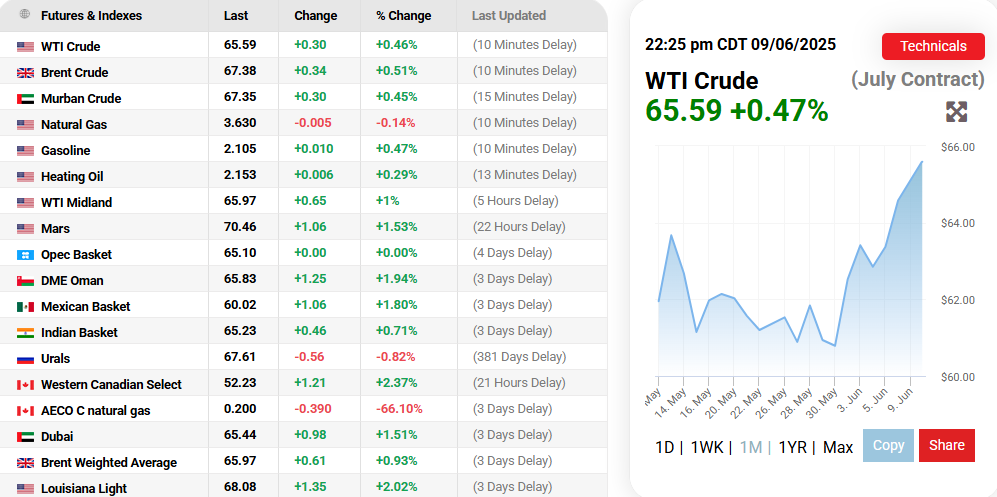

The surge in oil prices from 2 June to 6 June 2025, fuelled by geopolitical tensions and trade optimism, provided a fresh example of how swiftly markets can move and how prepared traders can benefit.

Understanding Oil Spot Price Swings

The oil spot price reflects the current market value for immediate delivery of crude oil. Unlike futures contracts, which lock in prices for later dates, the spot market responds instantly to economic data, geopolitical tensions, and industry news. This immediacy creates frequent price swings, making it a prime arena for active traders.

Oil Price Surge: 2 June – 6 June 2025

During the week of 2 June to 6 June 2025, oil prices experienced a significant surge. Brent crude rose by 4% and WTI gained 6.2%, marking their first weekly increase in three weeks. The rally was driven by optimism surrounding US-China trade talks, which boosted risk appetite and expectations for stronger global fuel demand.

Brent crude futures climbed to $67.19 on Monday, 2 June, their highest since late April, while WTI crude broke above key technical resistance at $63.30, settling at $64.60 per barrel by Friday, 6 June, and notching a 6.5% weekly gain.

Geopolitical developments also played a role. Reports of potential Israeli strikes on Iranian nuclear sites stoked fears of supply disruptions in the Middle East, a region critical to global oil exports. These concerns, combined with ongoing negotiations over Iran's nuclear programme and OPEC+ supply policies, added further upward pressure to prices.

Core Strategies for Profiting from Oil Spot Price Swings

1. Trend Trading

Trend trading involves identifying whether the oil market is in a bullish or bearish phase and aligning trades with that direction. Traders use technical indicators such as moving averages, MACD, and RSI to confirm the trend's strength. For example, the technical breakout above $63.30 for WTI crude on 2 June signalled a shift in sentiment, prompting traders to take long positions as momentum accelerated.

2. Swing Trading

Swing trading aims to capture price movements over several days or weeks. During the surge from 2 June to 6 June, swing traders who entered positions near support and rode the rally to resistance levels were able to lock in substantial gains as prices broke through key thresholds.

3. Arbitrage

Arbitrage exploits price differences for the same asset across different markets. Oil traders might buy crude in one market where it's undervalued and simultaneously sell in another where it's overpriced. The heightened volatility and rapid price changes during this period created short-lived arbitrage opportunities for nimble traders.

4. Day Trading

Day trading focuses on rapid price changes within a single session. Oil's sensitivity to news—such as updates from the US-China trade talks or Middle East tensions—makes it ideal for this approach. Traders who monitored headlines and technical levels closely during the week could enter and exit positions quickly, profiting from intraday spikes and dips.

5. News Trading

News trading leverages immediate market reactions to breaking news. The surge in oil prices from 2 June to 6 June was partly fuelled by positive reports from US-China negotiations and escalating geopolitical risks. Traders who acted swiftly on these developments were able to capture the resulting price moves.

6. Options and Volatility Strategies

Some traders use options to profit from expected volatility. For example, a "long straddle" involves buying both a call and a put option at the same strike price, profiting if oil prices move significantly in either direction. The volatility seen in early June would have benefited traders positioned for increased price swings.

7. Hedging

While often used by producers, hedging is also a tool for traders to manage risk. By taking offsetting positions in futures or options, traders can protect themselves from adverse price movements while still participating in the market's upside.

Real-World Examples of Profiting from Oil Swings

-

Technical Breakout: Traders who recognised the breakout above $63.30 for WTI crude on 2 June entered long positions, riding the momentum as prices surged to $64.60 by 6 June.

-

News-Driven Moves: Those who responded quickly to news about US-China trade progress or Middle East tensions were able to capitalise on sharp, short-term price spikes.

Swing and Day Trading: By identifying support and resistance levels and monitoring volume and momentum, traders captured gains during the week's rally.

Risk Management: The Key to Long-Term Success

Profiting from oil spot price swings requires more than just strategy—it demands disciplined risk management. Successful traders set stop-loss and take-profit orders, ensuring no single trade jeopardises their capital. Position sizing and diversification across commodities or related assets further reduce risk exposure.

Technical and Fundamental Analysis

Traders blend technical analysis—using indicators like moving averages, RSI, and Bollinger Bands—with fundamental analysis of supply-demand data, inventory reports, and macroeconomic trends. This dual approach enables them to anticipate price swings and react promptly to changing market conditions.

Conclusion

Oil spot price swings present both challenges and opportunities for traders. The surge from 2 June to 6 June 2025, driven by trade optimism and geopolitical tensions, is a timely reminder of how quickly markets can move.

By employing strategies such as trend trading, swing trading, arbitrage, and news-based decisions—and by maintaining robust risk management—traders have consistently found ways to profit from oil's notorious volatility. As global events continue to unfold, those who adapt quickly and stay informed are best positioned to capitalise on the next big move.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.