Gold has surged beyond $3.800 per ounce, reaching record levels as investors respond to a weaker U.S. dollar, expectations of imminent Federal Reserve rate cuts, and growing demand for safe-haven assets.

Key Market Metrics — Gold Price Today (29 September 2025)

| Metric |

Latest Value |

Change / Context |

| Spot Gold (USD/oz) |

3,814.91 |

+1.5% daily |

| U.S. Gold Futures (Dec, USD/oz) |

3,844 |

Near record high |

| Year-to-Date Change (2025) |

≈ +44.8% |

Strongest rally in over a decade |

| U.S. Dollar Index (DXY) |

97.93 |

-0.2% daily, steady decline since April |

| Fed Cut Probabilities (Oct / Dec) |

~90% / ~65% |

Market expects easing cycle to begin soon |

| SPDR Gold Trust (GLD) Holdings |

1,005.72 tonnes |

+8.87 tonnes in one session (+0.89%) |

Strong inflows from central banks and institutional buyers have added to the momentum. While the rally underscores gold's resilience, potential risks such as stronger-than-expected economic data or a rebound in the dollar remain.

Recent Price Action & Market Milestones

1) Current Level & Trajectory

Spot gold has risen above $3.800 per ounce, surpassing previous records and extending its remarkable rally.

Futures prices have mirrored this strength, with gains firmly above $3.820 in recent trading.

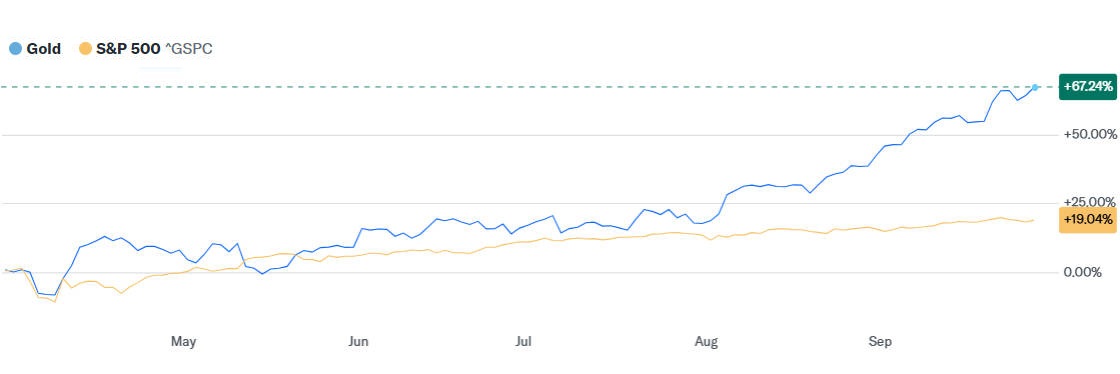

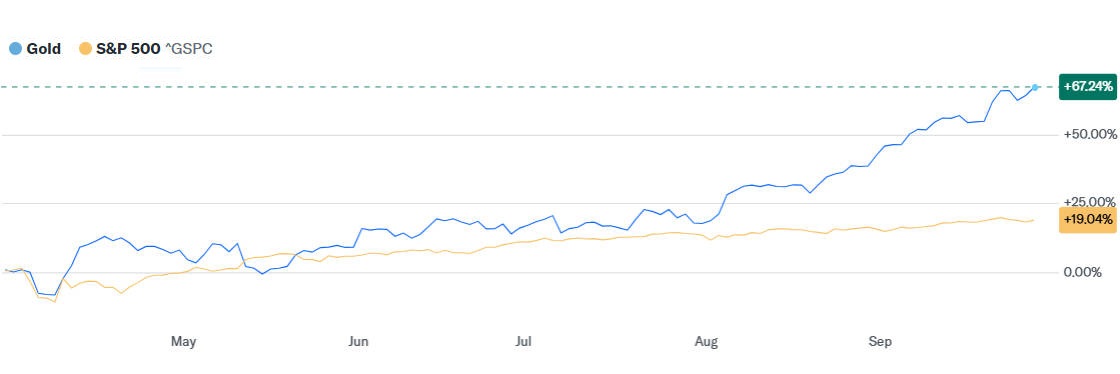

Year-to-date, gold has outperformed most major asset classes, underlining its role as a hedge during uncertain times.

2) Short-Term Swings

The rally has been characterised by sharp intraday movements, with price surges of more than $40 within hours following U.S. economic data releases.

Traders note heightened volatility, particularly around announcements related to interest rates and inflation.

Drivers Behind the Rally

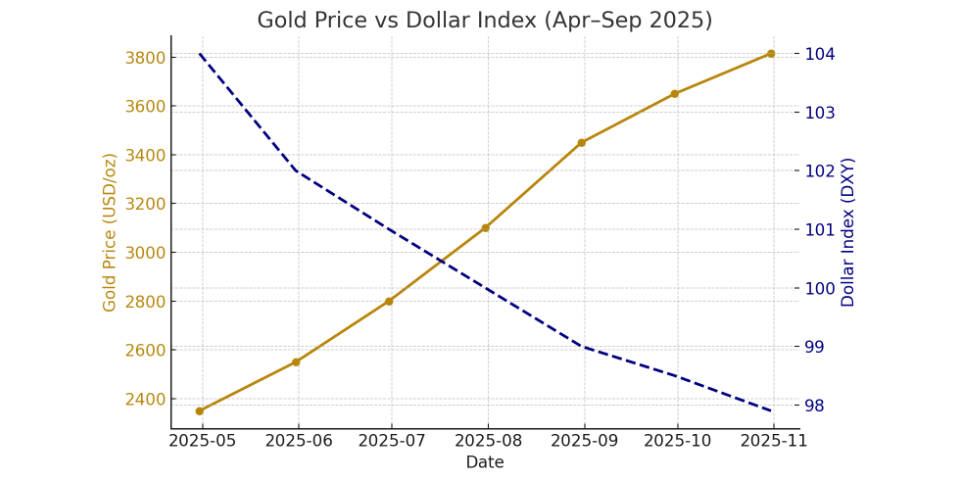

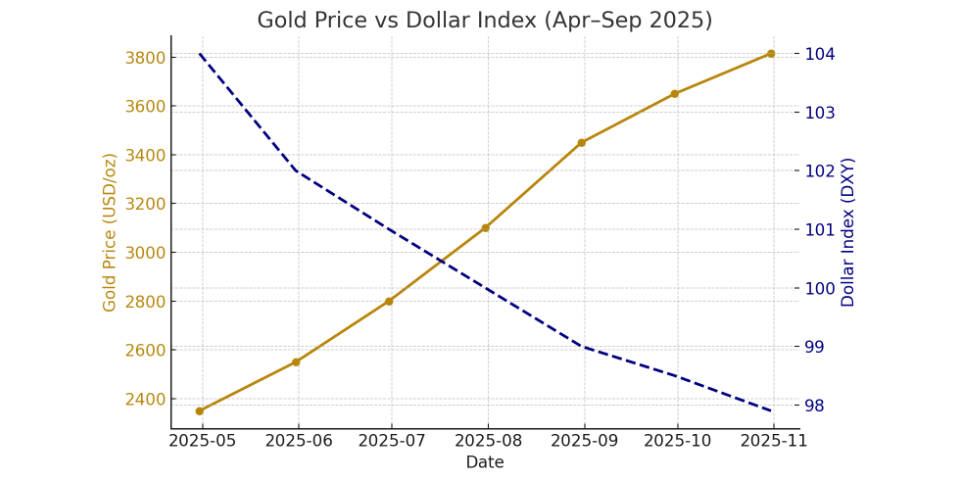

1) Dollar Weakness and Rate Expectations

A key factor behind gold's surge has been the weakening of the U.S. dollar.

The market is now pricing in Federal Reserve rate cuts in the coming months, with futures contracts suggesting at least a half-point reduction by year-end. Lower interest rates reduce the opportunity cost of holding gold, increasing its appeal.

2) Safe-Haven Demand

Global investors continue to view gold as a reliable store of value. Political gridlock in Washington, risks of a U.S. government shutdown, and wider geopolitical tensions have heightened demand for assets perceived as safe.

3) Central Bank and Institutional Buying

Strong purchases by central banks have provided additional support. Several emerging-market nations have been diversifying reserves away from the dollar, with gold a key beneficiary.

Exchange-traded funds have also seen renewed inflows, reflecting institutional conviction in the metal's long-term value.

4) Technical Factors

The break above previous resistance levels has encouraged momentum traders to add exposure.

Technical indicators such as the Relative Strength Index (RSI) point to overbought conditions, yet the strength of demand has allowed gold to sustain its upward momentum.

Risks and Potential Headwinds

1) Federal Reserve Surprises

If U.S. inflation data proves stronger than expected, the Federal Reserve may delay rate cuts or adopt a more hawkish stance. Such a shift could undermine gold’s near-term prospects.

2) Dollar and Bond Yield Rebound

A strengthening dollar or rising real yields would weigh on gold. As a non-yielding asset, gold becomes less attractive when fixed-income returns improve.

3) Technical Pullbacks

The rapid pace of gains has increased the risk of short-term corrections. Traders warn of potential profit-taking should gold test psychological resistance near $3.850–$3.900.

Outlook and Forecasts

1) Near-Term Outlook

Gold's near-term direction will largely depend on U.S. data releases and the Federal Reserve’s policy stance. Should the dollar remain under pressure, the rally could extend.

2) Medium-Term Projections

Analysts remain broadly constructive, with some projecting gold could challenge $4.000 if monetary easing gathers pace and geopolitical tensions persist. However, sustained strength in the U.S. economy could temper gains.

3) Investment Strategy Considerations

Investors may consider phased entries to manage volatility. Exchange-traded products offer exposure without the logistical challenges of physical gold. Stop-loss orders are recommended to mitigate downside risks.

Regional Perspectives

In Asia, particularly India and China, jewellery demand has softened slightly due to elevated prices.

However, strong central bank purchases in the region continue to underpin the broader trend. In local currency terms, gold has reached fresh highs across several emerging markets, reinforcing its global appeal.

Frequently Asked Questions

1. Why is gold price today reaching record levels?

Because of dollar weakness, expectations of lower US interest rates, and rising geopolitical risks.

2. How does the dollar index affect gold?

A weaker dollar makes gold cheaper for overseas buyers, boosting demand.

3. What are the key support and resistance levels?

Support lies at USD 3.700–3.750. while resistance is at USD 3.850–3.900.

4. Is now a good time to buy gold?

The outlook is bullish, but overbought conditions suggest caution for short-term traders.

5. What role do ETFs play in gold prices?

ETFs like GLD reflect institutional demand; rising holdings often signal sustained price momentum.

Conclusion

The surge in gold price today reflects a confluence of factors: a softer dollar, the prospect of U.S. rate cuts, safe-haven demand, and strong central bank accumulation. While risks such as policy surprises and technical corrections loom, the broader outlook remains supportive.

For investors, gold continues to serve as both a hedge against uncertainty and a key portfolio diversifier.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.