The dollar rose to its strongest levels in six weeks on Wednesday as risks

around the US government shutdown intensified. Meanwhile, the euro dropped on

France's political impasse.

Lawmakers in the lower house forced the resignation of both the previous

premiers over budget plans, and were preparing to do the same to the incumbent

Lecornu as soon as this week.

That means the government will struggle to meet the deadline to file a budget

by 13 October, pushing the country's yield premium to the highest since early

January over German 10-year debt.

Macron now faces the unenviable task of deciding what to do next with no

option likely to be pleasant – choose another struggling prime minister or hold

new parliamentary elections.

Deutsche Bank on Monday said that if the government collapsed, as it has now,

then France would likely be "maintaining spending near the 2025 framework, with

the deficit landing around 5.0–5.4 % of GDP."

France's manufacturing sector contracted in September, with output and new

orders declining sharply amid rising political uncertainty. Service activity

sank deeper into contraction territory.

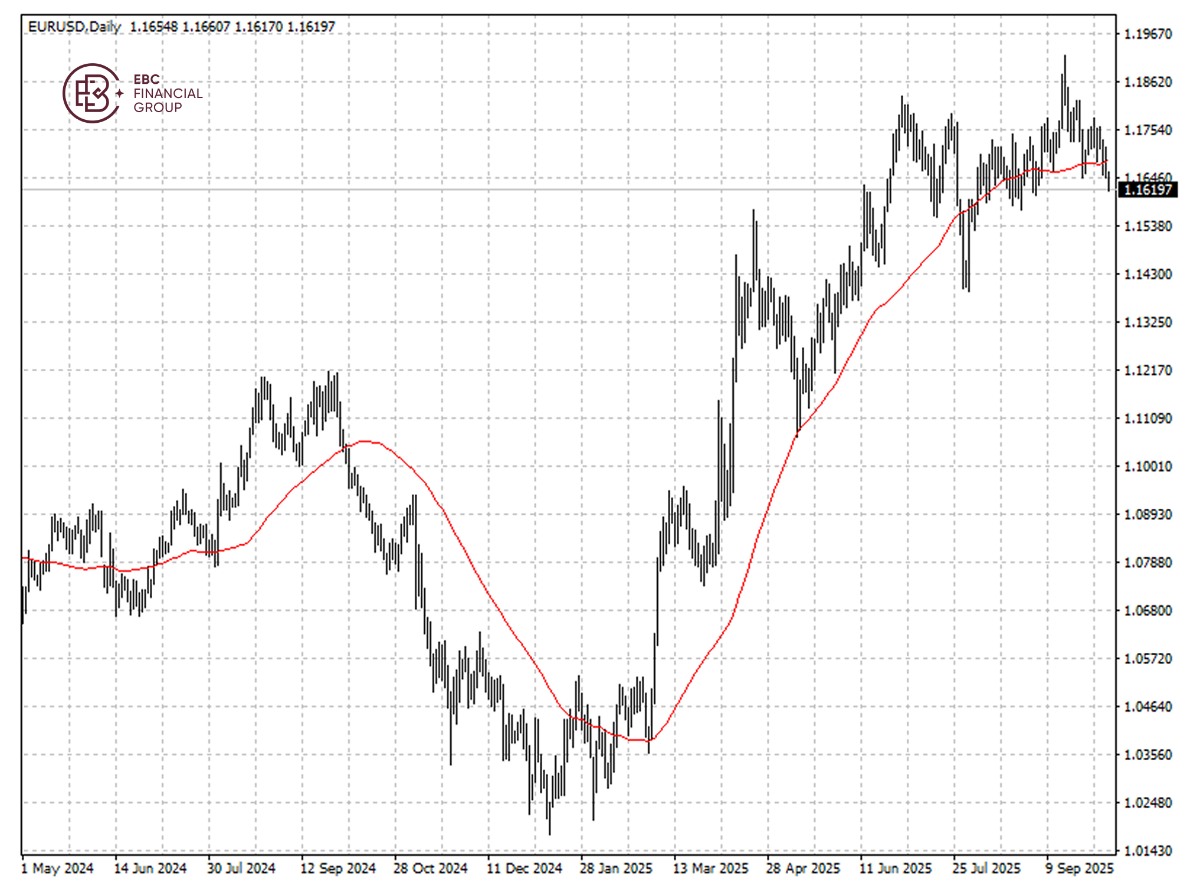

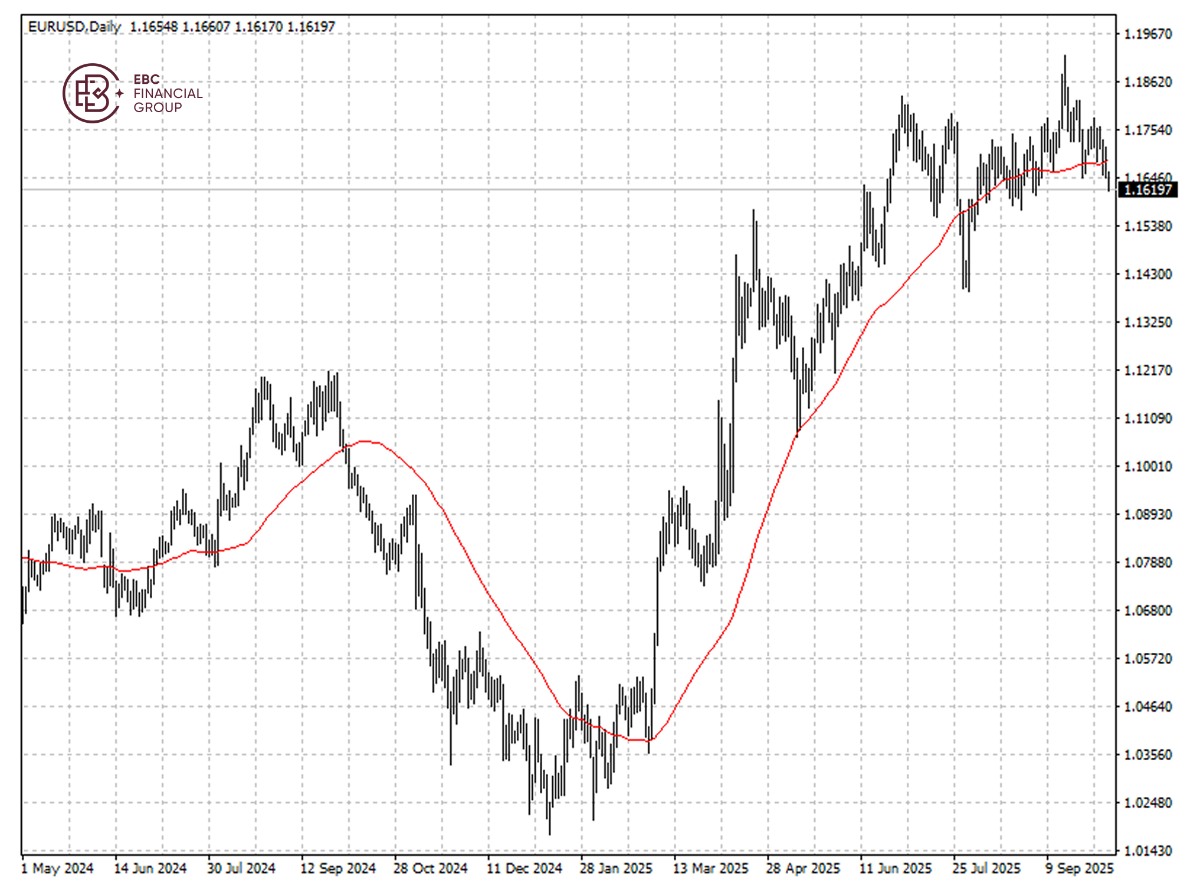

The single currency which shows the head and shoulders pattern has dipped

below 50 SMA, but the low of 1.1608 hit in early September is expected to lend

support.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.