CVS Health (NYSE: CVS) has experienced significant fluctuations in recent years. After a challenging 2024, the company shows signs of recovery in 2025.

As of May 8, 2025, CVS Health Corp (NYSE: CVS) is trading at $66.86 per share, reflecting a significant rebound from its 2024 lows. The company's stock has appreciated over 45% year-to-date, positioning it as the top performer in the S&P 500 for Q1 2025.

This article examines CVS's current performance, analyst CVS stock forecasts, and factors influencing its stock trajectory.

Current Financial Performance

In the first quarter of 2025, CVS reported adjusted earnings per share (EPS) of $2.25, surpassing analyst expectations of $1.70. Revenue increased 7% year-over-year to $94.59 billion, driven by improved Medicare Advantage performance and higher star ratings. The company raised its full-year adjusted EPS forecast to between $6.00 and $6.20, from the previous estimate of $5.75 to $6.00.

Under CEO David Joyner, CVS has implemented cost-cutting measures and reorganised management. The company's medical loss ratio declined to 87.3%, better than the expected 88.9%, reflecting more efficient healthcare spending.

How CVS Stock Rebounded From a Challenging 2024

1) Strategic Leadership and Restructuring

In October 2024, CVS appointed David Joyner as its CEO, launching a series of strategic changes designed to revitalise the company's performance.

Under his leadership, CVS adopted cost-cutting measures, reorganised its management team, and prioritised operational efficiency. These initiatives have garnered positive responses from investors, highlighted by the stock's strong performance in early 2025.

2) Improved Medicare Advantage Performance

The company's Aetna division reported adjusted operating income of $2 billion, up from $732 million the previous year. This improvement was largely due to enhanced Medicare benefits and higher star ratings for its Medicare Advantage plans.

3) Strategic Exit from Underperforming Markets

CVS announced plans to exit the Affordable Care Act (ACA) individual marketplaces in 2026, affecting approximately one million customers across 17 states. This move aims to streamline operations and focus on more profitable segments.

4) Partnership with Novo Nordisk

CVS strengthened its partnership with Novo Nordisk to expand access to the weight-loss drug Wegovy through its CVS Caremark pharmacy-benefit manager.

Starting July 1, Wegovy will become the preferred prescription drug for weight loss among its members, potentially boosting revenue in this segment.

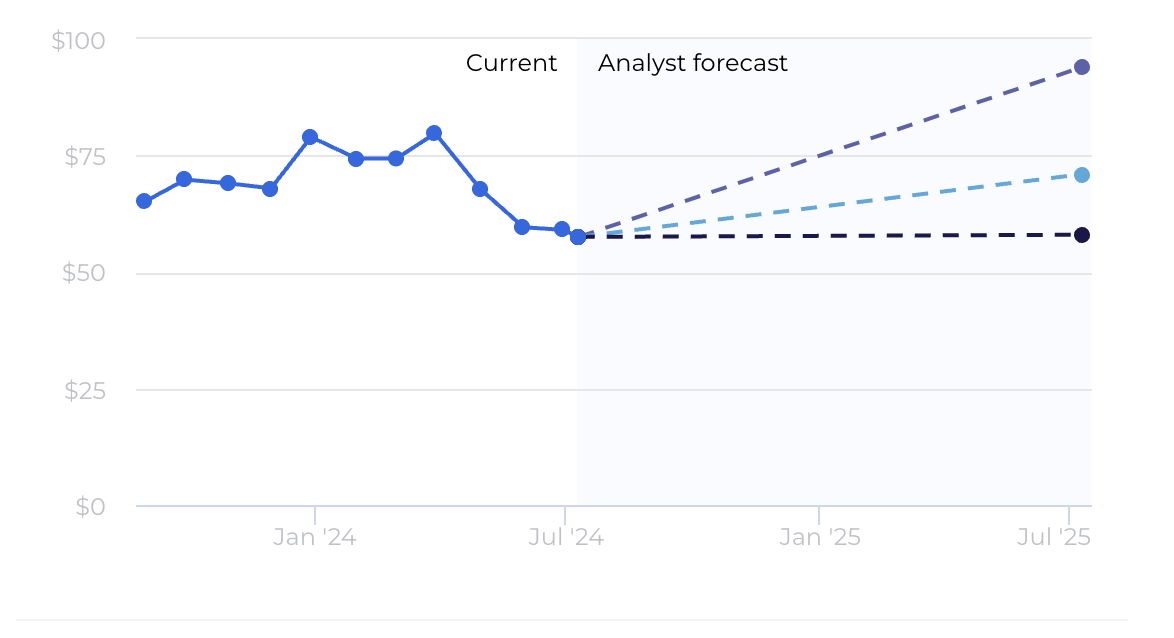

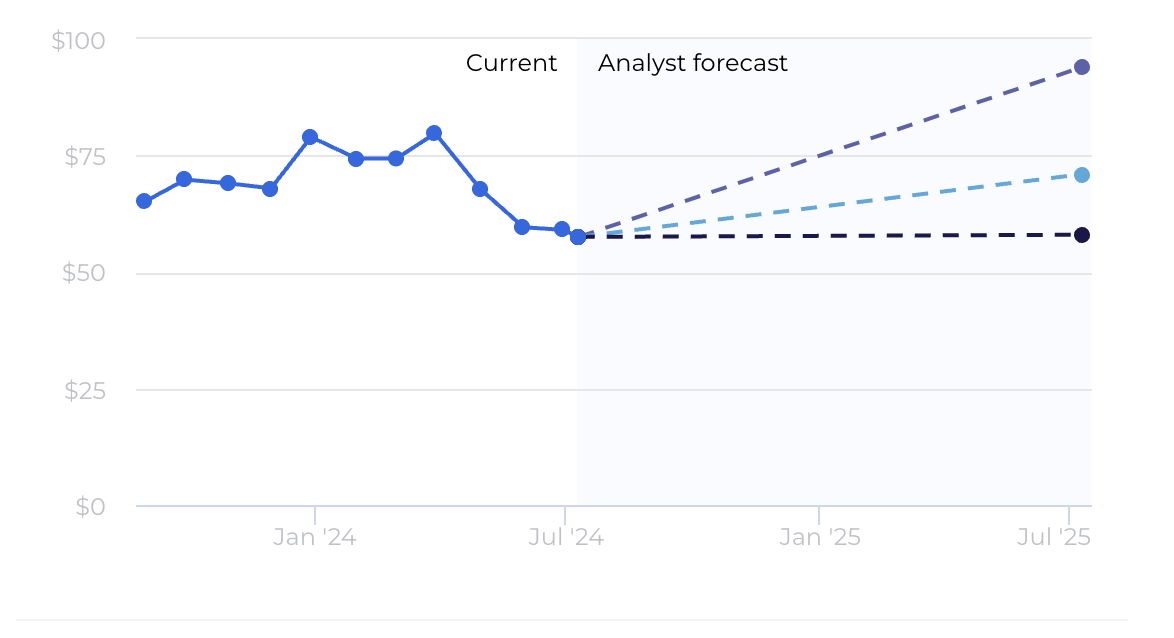

CVS Stock Forecast: Analyst Perspectives

Analysts have a generally positive outlook for CVS in 2025:

JPMorgan: Raised its price target to $86, maintaining an Overweight rating.

MarketBeat: Reports an average price target of $75.13, with a high of $84.00 and a low of $62.00.

CoinPriceForecast: Predicts the stock will reach $80.72 by the end of 2025, representing an 80% year-over-year increase.

These forecasts suggest a potential upside, contingent on the company's continued operational improvements and market conditions.

Risks and Challenges

Despite positive developments, CVS faces several challenges:

Regulatory Scrutiny: The company faces criticism from both political parties regarding its pharmacy-benefit manager (PBM) practices, with potential legislative actions that could impact its business model.

Healthcare Benefits Division: Anticipated challenges include expected membership declines in Medicare Advantage between 5% and 10%, suggesting potential revenue loss.

Store Closures: CVS plans to close 270 stores in 2025, which could affect its retail footprint and revenue.

Conclusion

In conclusion, CVS Health's stock has recovered significantly in 2025, fueled by strong financial results and strategic leadership changes.

While analysts predict a positive outlook, the company must address regulatory challenges and operational risks. Continued monitoring of CVS's execution on its strategic initiatives will be crucial in assessing its long-term investment potential.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.