1-minute scalping can be highly effective for rapid trading success by capturing small, frequent price movements, but it requires discipline, speed, and precise risk management.

This approach targets micro-fluctuations in highly liquid markets. Each trade lasts just a few minutes, requiring decisive action and reliance on technical indicators. Even tiny price moves can become profitable opportunities.

This article dives deep into the mechanics of 1-minute scalping, providing actionable guidance, expert insights, and trust-building strategies to help you navigate this rapid-fire trading approach.

The Scalper's Playground – Choosing Your Market Wisely

Not every market is built for lightning-fast trading. High liquidity and active volatility are the lifeblood of successful 1-minute scalping.

Major currency pairs like EUR/USD and GBP/USD, along with liquid stocks or ETFs, provide the tight spreads and constant price swings that scalpers rely on to turn small movements into profits.

Timing is just as critical as market choice. The overlap between major trading sessions, such as London and New York, creates surges in volume and rapid price shifts—prime conditions for executing quick, precise trades. Recognising these windows can make the difference between a fleeting opportunity and a profitable trade.

Chart Alchemy – Crafting the Perfect 1-Minute Setup

A scalper's edge lies in chart mastery. The 1-minute timeframe provides traders with granular insight into price action, allowing them to make split-second decisions with confidence.

Essential Indicators:

Expert tip: Relying on a single indicator is risky. Confluence between EMA alignment, RSI momentum, and Bollinger Band signals provides a higher probability setup and demonstrates a methodical, professional approach.

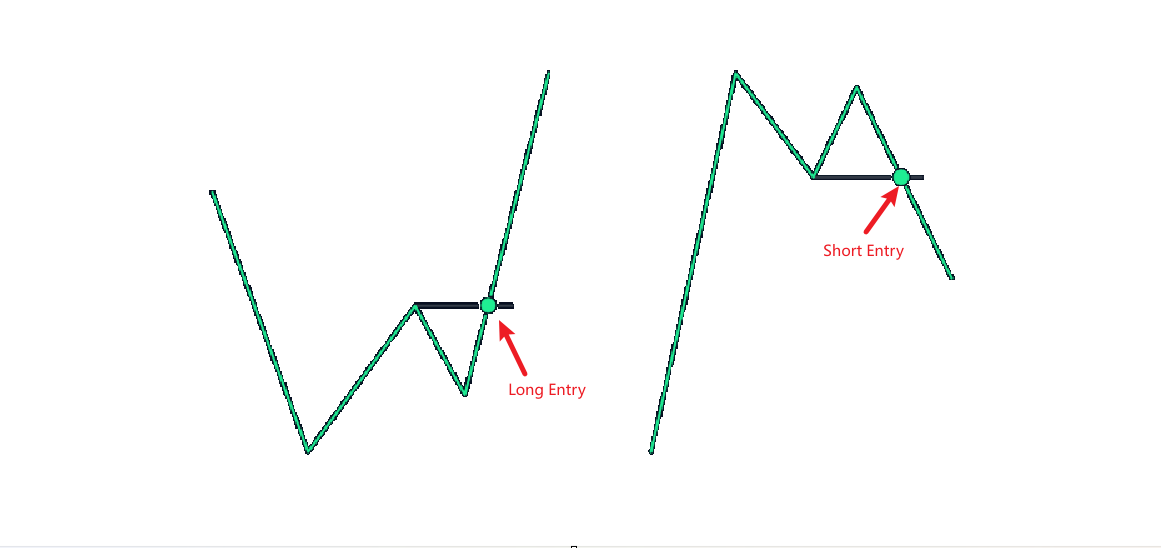

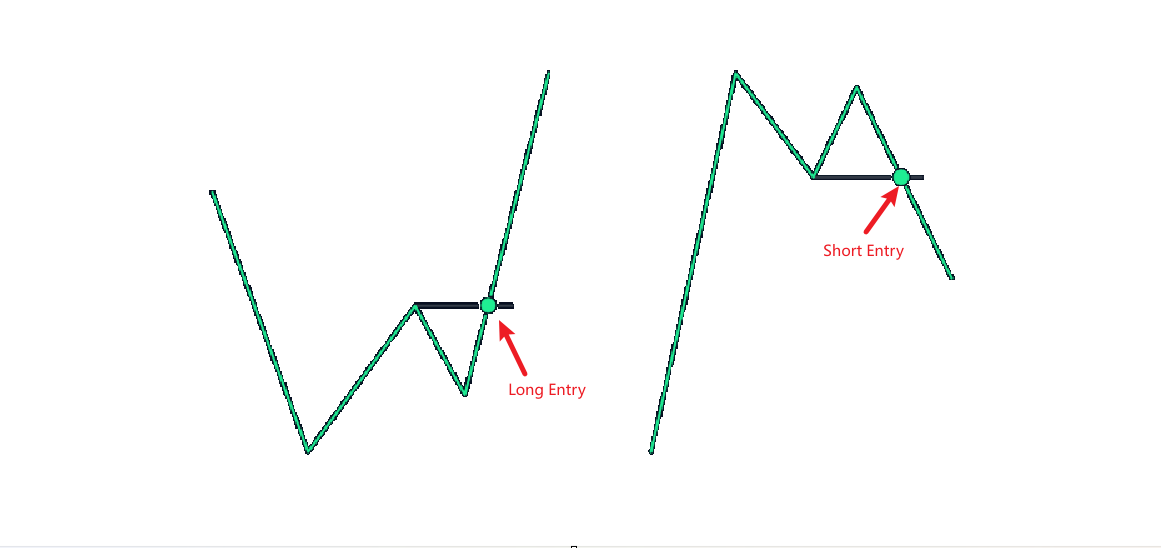

The Art of Entry – When Precision Meets Opportunity

Knowing when to enter a trade is where scalping transforms from guesswork to strategy.

1)Trend Validation:

Only trade in the direction of the micro-trend confirmed by the EMA crossover. Entering against the trend dramatically reduces your success rate.

2)RSI Breakthroughs:

A move from oversold to above 30 signals a potential long entry; conversely, a move from overbought to below 70 suggests a short opportunity.

3)Bollinger Momentum:

When the price breaks above the upper band or below the lower band, it often triggers sharp, short-term movements perfect for scalping.

From an authority standpoint, traders can reinforce credibility by sharing backtesting results or historical trade examples, demonstrating that these entry techniques are not theoretical but have real-world success.

Exit Like a Pro – Locking in Micro-Profits

In scalping, the Exit Strategy is as crucial as the entry.

Profit Targets: Aim for small, achievable gains with a 1:1 risk-to-reward ratio. Attempting to capture larger moves may lead to missed opportunities.

Stop-Loss Discipline: Place stop-loss orders just beyond recent swing highs or lows to mitigate sudden market reversals.

Time-Limited Trades: If the trade hasn't reached its target within 1–2 minutes, consider closing it manually to preserve capital and reduce exposure.

Demonstrating trustworthiness, experienced scalpers often document trade results and maintain transparency, providing a clear track record of past performance.

Risk Management – Protect Capital, Preserve Confidence

Scalping is inherently fast-paced, making risk management non-negotiable.

Micro-Position Sizing: Limit risk to no more than 1% of your capital per trade.

Broker Selection: Opt for brokers with tight spreads, rapid execution, and strong regulatory credentials.

Case Studies and Testimonials: Including real trader experiences or verified performance stats strengthens E-E-A-T credibility and reassures readers that the strategy is reliable and actionable.

By adhering to risk management rules, traders safeguard their capital and maintain the confidence necessary for consistent scalping success.

Frequently Asked Questions (FAQ)

Q1: How does a 1-minute scalping strategy really work?

A 1-minute scalping strategy targets tiny price movements, often using EMAs, RSI, and Bollinger Bands to identify short-term trends and execute rapid trades for incremental profits.

Q2: Can beginners succeed with 1-minute scalping?

While possible, beginners should practice on demo accounts first. Scalping requires speed, discipline, and emotional control that develop with experience.

Q3: How many trades can be executed in a day?

Depending on market conditions, a scalper may place dozens to hundreds of trades per day, focusing on high-quality setups rather than sheer quantity.

Q4: What are the main risks in 1-minute scalping?

Risks include high transaction costs, rapid market swings, and psychological stress. Effective stop-loss placement, discipline, and capital preservation strategies are essential.

Conclusion

The 1-minute scalping strategy offers traders the chance to profit from rapid market movements with precision and discipline. By focusing on liquid markets, timing entries accurately, and managing risk, micro-trades can become a consistent source of gains.

Though fast-paced, this approach rewards practice, focus, and careful execution, allowing traders to navigate volatility and capitalise on short-term opportunities effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.