China's gold hoard matters as it shifts reserve power, strengthens the yuan, and drives global gold and currency markets.

Highlights

China holds ~2.300 tonnes of gold, with nine consecutive months of buying.

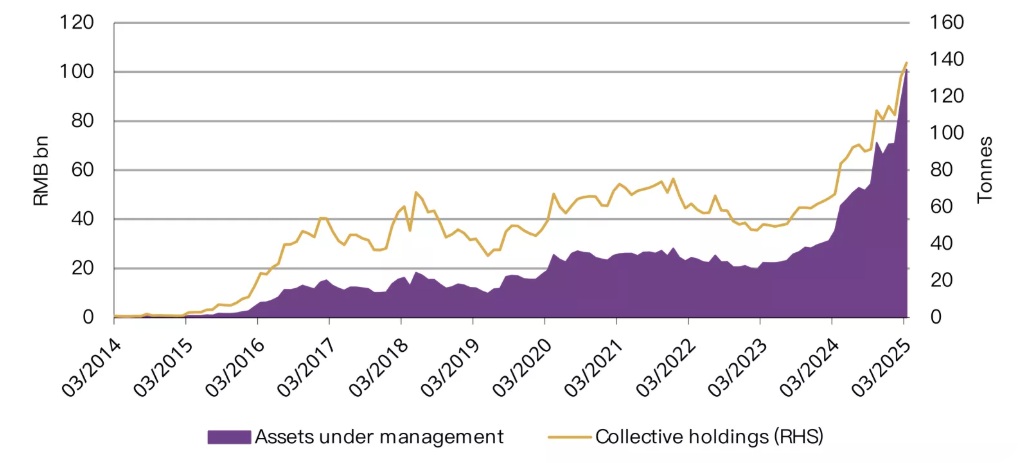

Accumulation aims to reduce dollar reliance, hedge risks, and back the yuan.

Analysts suggest true reserves may exceed 5.000 tonnes, far above official figures.

Opaque reporting fuels market uncertainty but strengthens gold's global momentum.

Why China's Gold Matters Now

Gold has always been more than a commodity—it is a signal of financial security and global influence.

For China, the world's second-largest economy, gold reserves form a crucial pillar of economic strategy. In recent years, Beijing has accelerated its accumulation, raising questions about its intentions and the wider implications for global markets.

This article draws on central bank data, market research, and analysis from international organisations to provide a detailed, trustworthy picture of China's gold reserves, why they matter, and what the future may hold.

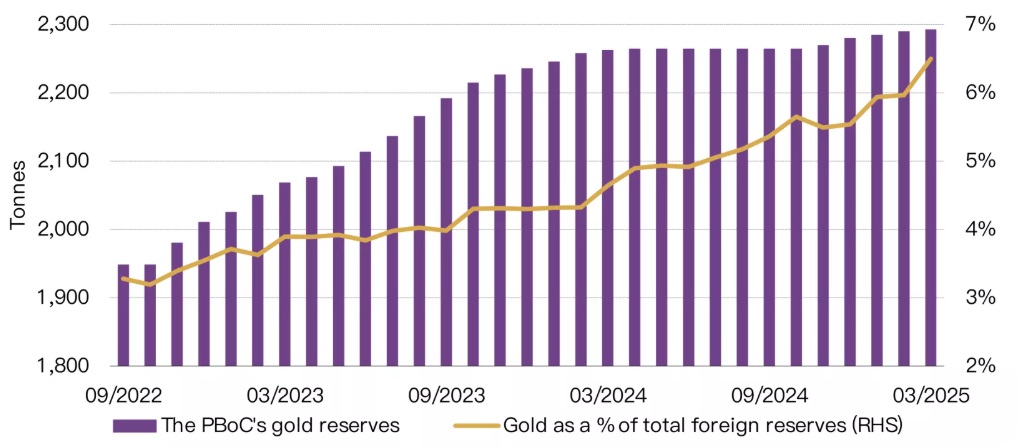

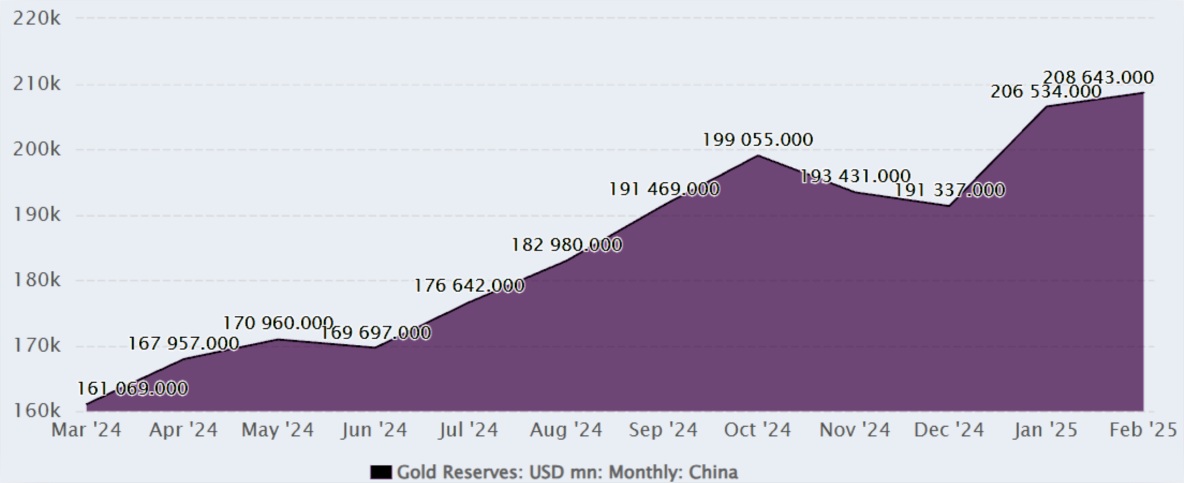

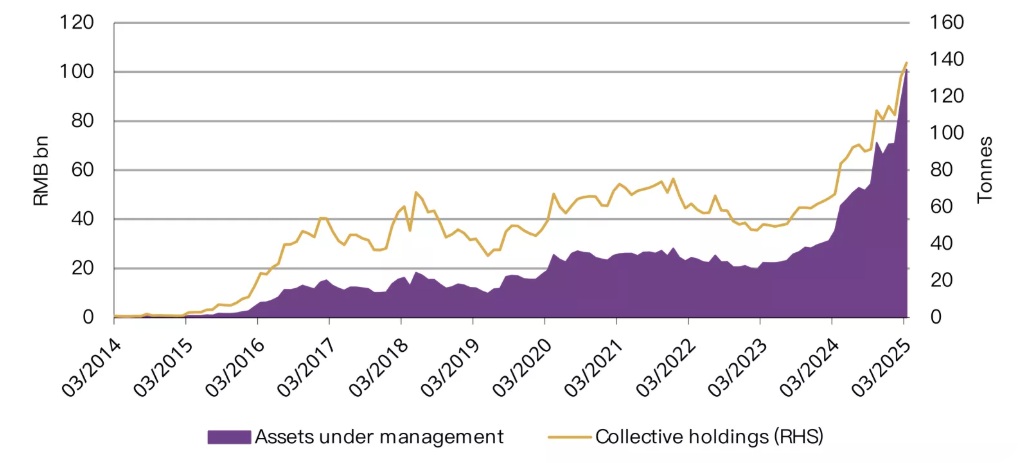

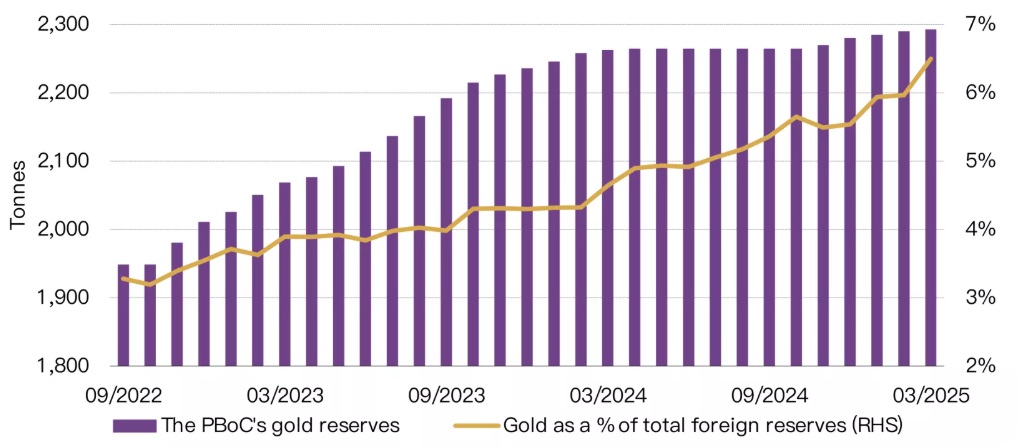

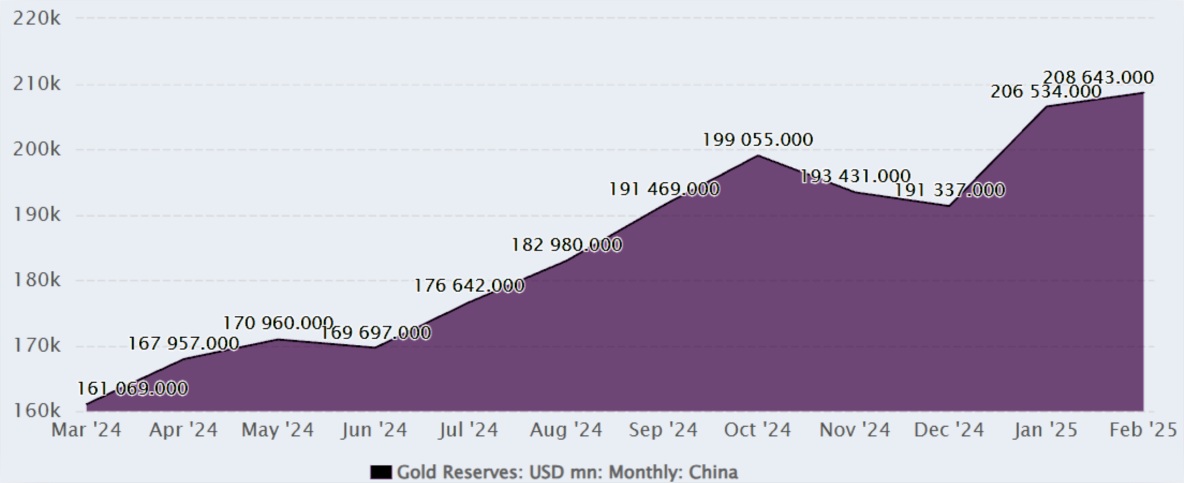

China's Official Gold Holdings: The Current Ledger

According to the People's Bank of China (PBOC), as of July 2025. the country officially holds around 2.300 tonnes of gold. The latest increase—a two-tonne purchase—marks the ninth consecutive month of acquisitions, underlining China's steady commitment to bullion accumulation.

Although China ranks sixth globally, behind the United States, Germany, and others, its trajectory is far more dynamic.

Historical Evolution: From Transparency to Acceleration

Early figures (pre-2015): China disclosed its holdings only sporadically. In 2009. reserves were reported at 1.054 tonnes.

2015 disclosure: A jump to 1.658 tonnes surprised markets, signalling greater openness.

2023–2025 surge: The PBOC added more than 225 tonnes in 2023 alone, and the trend has continued.

This rapid acceleration suggests a strategic policy shift towards gold as a foundation of financial resilience.

Why China Is Buying: Strategic Motivations

China's motives for accumulating gold are rooted in long-term financial security:

1)Diversification away from the U.S. dollar

Gold reduces reliance on dollar-denominated assets, shielding China from foreign monetary policy shifts.

2)Hedging against geopolitical risks

Gold cannot be frozen or sanctioned, making it invaluable in a world of increasing financial weaponisation.

3)Leveraging domestic production

As the world's largest gold producer, China can acquire reserves at scale and at lower cost.

4)Supporting the yuan's international role

A larger gold base increases confidence in the renminbi, aligning with Beijing's ambitions for a multipolar currency system.

Global Context: China in the League Table

On a per capita basis, however, China lags behind significantly, reflecting both the scale of its population and the scope of its ambitions.

Expert Analysis: Market Implications

Analysts caution that official numbers may only reveal part of the story. Trade data suggest China could be secretly stockpiling more gold, possibly pushing real holdings closer to 5.000 tonnes.

This has three major implications:

Bullish momentum for gold prices: Central bank demand, led by China, is a key driver of the current price rally.

Stronger yuan credibility: Larger reserves underpin China's long-term effort to internationalise its currency.

Reduced transparency risk: Limited disclosure complicates accurate forecasting, adding uncertainty to global markets.

Trust and Transparency: What We Know vs. What We Don't

China's gold reserves are notoriously difficult to measure with precision. Unlike Western central banks, which publish detailed accounts, the People's Bank of China (PBOC) offers limited updates.

This selective reporting creates uncertainty and invites speculation about the real scale of China's holdings.

What We Know

Official figures: The PBOC lists holdings of about 2.300 tonnes as of July 2025.

Buying streak: Nine months of consecutive purchases show clear intent to keep accumulating.

Mining advantage: As the largest producer, China secures gold directly from domestic supply at scale.

What Remains Unclear

Undeclared stockpiles: Gold may also be stored by sovereign wealth funds or state banks, outside official tallies.

True reserves: Import and trade data hint that total holdings could surpass 5.000 tonnes.

Policy motives: The staggered reporting may be designed to mask long-term reserve goals.

Why Transparency Matters

For markets, limited disclosure has wide effects:

Forecasting: Hidden buying alters supply–demand balance, influencing global prices.

Currency confidence: The renminbi's credibility depends partly on clear reserve backing.

Geopolitical risk: Opaque figures complicate assessments of China's monetary independence and its challenge to the dollar.

Thus, China's gold reserves sit in a grey zone—anchored in official numbers yet shadowed by plausible speculation. This lack of clarity forces investors, analysts, and governments to weigh data cautiously while preparing for hidden realities.

FAQ: Common Questions on China's Gold Reserves

1. How much gold does China officially hold?

Approximately 2.300 tonnes as of mid-2025. according to the PBOC.

2. Why is China increasing its gold reserves?

To diversify from the U.S. dollar, hedge against risk, and support the renminbi's global role.

3. Is China's true gold reserve higher than reported?

Likely. Analysts estimate unofficial holdings may push the total above 5.000 tonnes.

4. How does China compare to other countries?

China ranks sixth globally but is gaining ground rapidly compared to peers.

Conclusion: A Strategy Cast in Gold

China's gold reserves are not merely financial assets—they are instruments of strategy. Each tonne acquired reduces dependence on the dollar, increases financial sovereignty, and enhances China's influence in global markets.

For policymakers, analysts, and investors, one thing is clear: as China continues to build its golden foundation, the balance of global financial power is subtly but steadily shifting.

China's Gold Reserves: Key Facts and Implications

| Section |

Key Points |

| Official Holdings |

~2,300 tonnes (July 2025); nine consecutive months of buying; 6th largest globally but expanding quickly. |

| Historical Trend |

2009: ~1,054t; 2015: 1,658t; 2023–2025: sharp surge (+225t in 2023 alone). |

| Strategic Goals |

Reduce reliance on USD; hedge against sanctions; leverage domestic mining; reinforce yuan's credibility. |

| Global Standing |

US: ~8,133t; Germany: ~3,352t; China: ~2,300t; low per capita reserves show long-term ambitions. |

| Market Impact |

Real reserves may top 5,000t; central bank demand supports gold prices; opacity adds uncertainty to markets. |

| Transparency Gap |

PBOC releases limited data; suspected hidden stockpiles; unclear reporting complicates global forecasting. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.