Alibaba once symbolised China's booming tech sector. Its meteoric rise was driven by a vast e-commerce empire and bold expansions into cloud computing and fintech. But recent years have brought a different story—slowing growth, tighter regulations, and a nervous trader base. As 2025 approaches, many are asking: is Alibaba still worth betting on? And if so, how high can its stock climb?

Current Market Performance and Analyst Projections

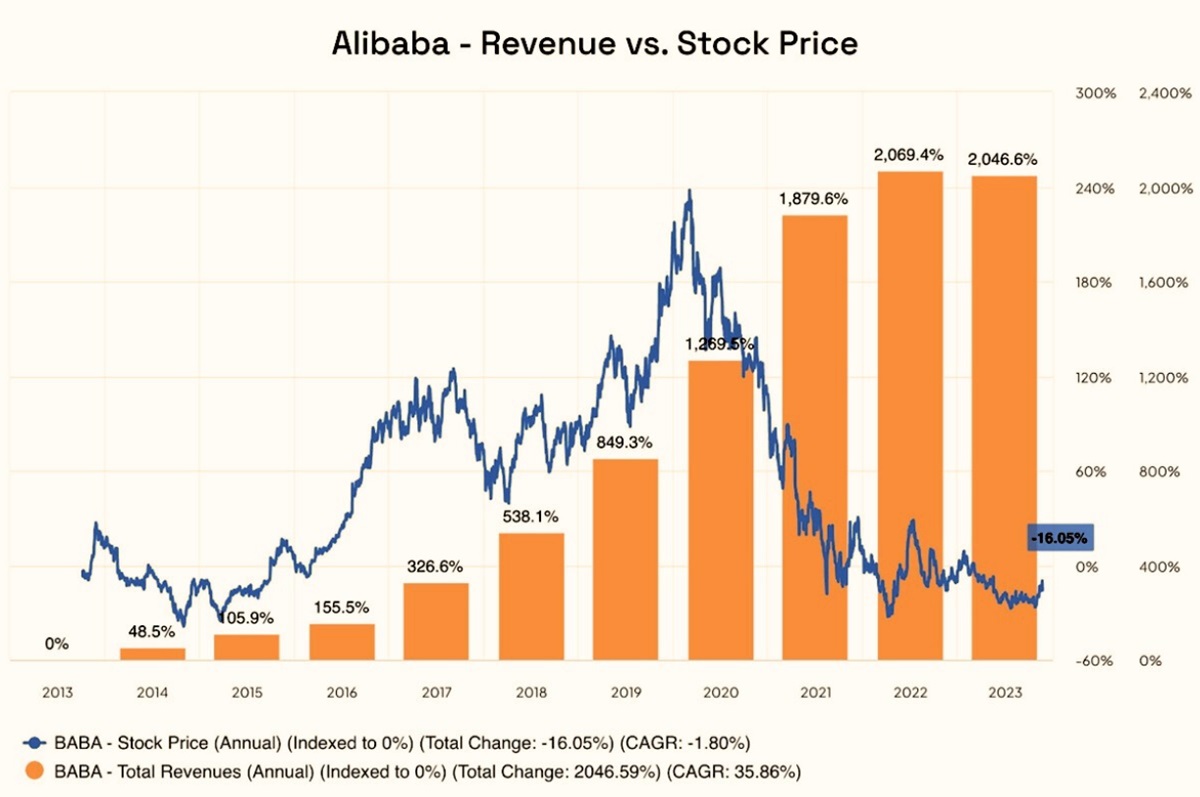

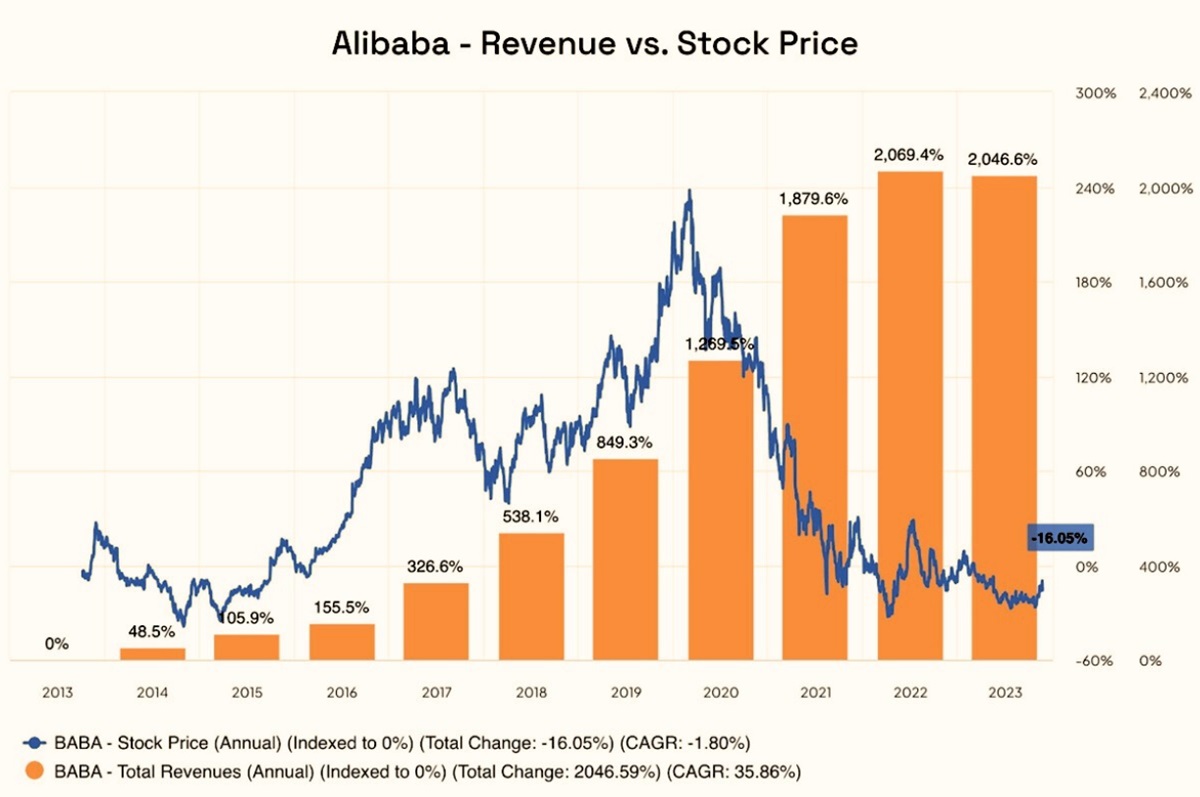

Alibaba's share price has seen sharp ups and downs since peaking in late 2020. The company, once valued above $800 billion, now trades at a fraction of that. A combination of Beijing's regulatory crackdown, rising competition, global tech sell-offs, and a weak Chinese economy have all weighed heavily.

Yet the tide may be turning. Over the past several months, Alibaba's stock has shown signs of stabilising. Analysts from institutions like Goldman Sachs and Morgan Stanley have gradually shifted from bearish to neutral or cautiously bullish. Projections for 2025 vary, but many now expect the stock to rebound moderately—potentially gaining 25% to 50%—as conditions normalise.

Crucially, these projections rest on Alibaba executing on its long-term strategy while avoiding new regulatory headwinds.

Impact of AI and Cloud Investments on Growth

Alibaba Cloud is a major pillar of the company's future—and a big reason why some analysts are still optimistic. It remains China's largest cloud service provider, with growing traction in Southeast Asia and the Middle East. While growth has slowed recently, it's still a key part of Alibaba's long-term plan to move away from low-margin retail.

At the same time, Alibaba is pouring resources into artificial intelligence. The launch of its own AI model, Tongyi Qianwen, signals its intent to keep pace with rivals like Baidu and Tencent in this space. From AI-powered customer service to predictive analytics in supply chains, these technologies could enhance operational efficiency and create new monetisation opportunities.

In short, while e-commerce drives volume, cloud and AI may drive the value—and traders are watching these segments closely.

E-commerce and International Expansion Strategies

E-commerce remains Alibaba's core business, but even here, the landscape is changing. Domestically, it faces fierce competition from JD.com and Pinduoduo, not to mention the rise of livestream shopping platforms like Douyin (TikTok's Chinese sister app).

To maintain its edge, Alibaba is revamping its platforms, reducing internal silos, and pushing for faster innovation. At the same time, it's expanding abroad. Lazada (in Southeast Asia) and AliExpress (targeting Europe and Latin America) are growing parts of its global footprint. While international sales still form a smaller share of overall revenue, they're becoming increasingly important for long-term diversification.

By 2025. success abroad may play a larger role in determining Alibaba's valuation, particularly if growth at home continues to plateau.

Regulatory Environment and Its Implications

Perhaps no topic has shaped Alibaba's stock in recent years more than regulation. The abrupt halt of Ant Group's ipo in 2020 marked the beginning of a sweeping crackdown on Chinese tech firms. Fines, restructuring orders, and antitrust investigations followed, and trader sentiment suffered badly.

The mood appears to be shifting, though. Recent signals from the Chinese government suggest a more supportive stance towards private enterprise and the digital economy. Beijing is now prioritising growth and innovation again, and Alibaba seems to be benefitting from this change in tone.

Still, the regulatory environment remains uncertain. Future policy changes—especially around data security, fintech, and overseas listings—could quickly affect market confidence. For now, reduced interference is seen as a positive sign, but traders are unlikely to forget the risks overnight.

Technical Analysis and Stock Valuation Metrics

From a technical standpoint, Alibaba's stock appears to be trying to form a base. Key support levels have held up in recent months, and moving averages are flattening—often a sign of consolidation before a potential uptrend. However, the stock still faces resistance near psychological levels like $100 and $120.

Valuation-wise, Alibaba currently trades at a price-to-earnings ratio significantly lower than global peers like Amazon or even Tencent. This may reflect China-specific risks, but it also suggests there's upside potential if sentiment improves. Price-to-sales and price-to-book metrics also indicate that the stock is undervalued by historical standards.

If Alibaba's earnings begin to beat expectations and macro conditions stabilise, we could see a re-rating in the market. But technical and valuation signals need to be confirmed by real-world progress.

Final Thoughts

Alibaba's journey into 2025 is about more than a stock price—it's a story of reinvention. The company is navigating a post-crackdown China, recalibrating its core businesses, and betting big on AI and cloud to drive future growth. At the same time, it's trying to win over global traders who've grown sceptical of Chinese tech.

Whether or not it succeeds will depend on many moving parts. But for traders who believe in its long-term vision and can tolerate some uncertainty, Alibaba may just be worth a second look.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.