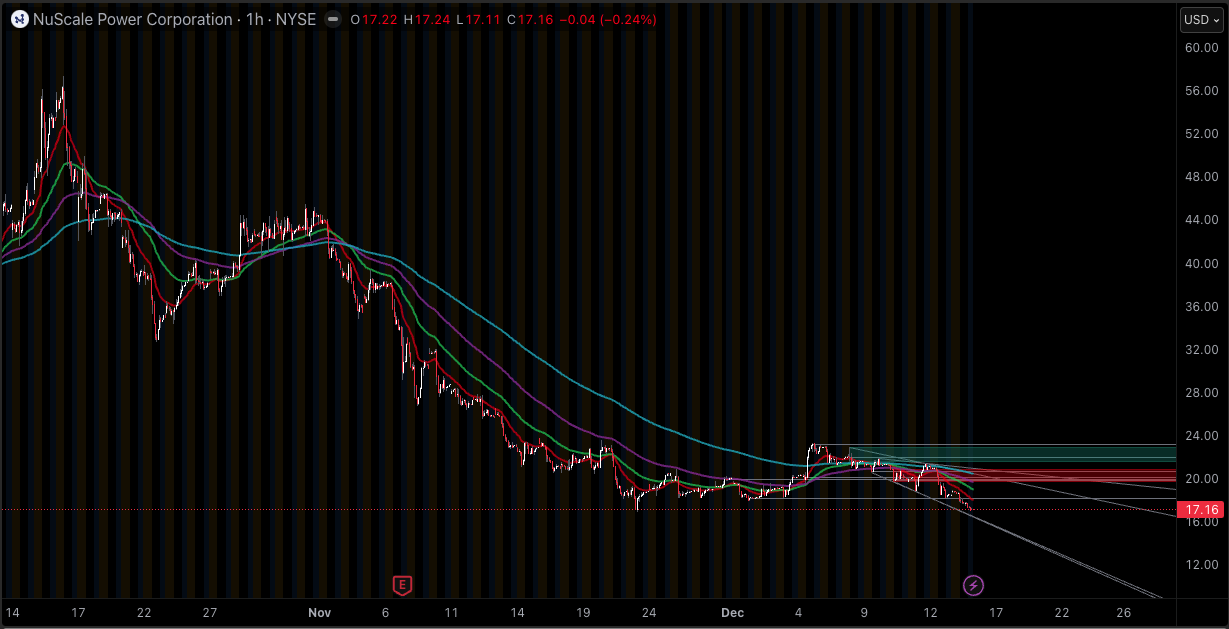

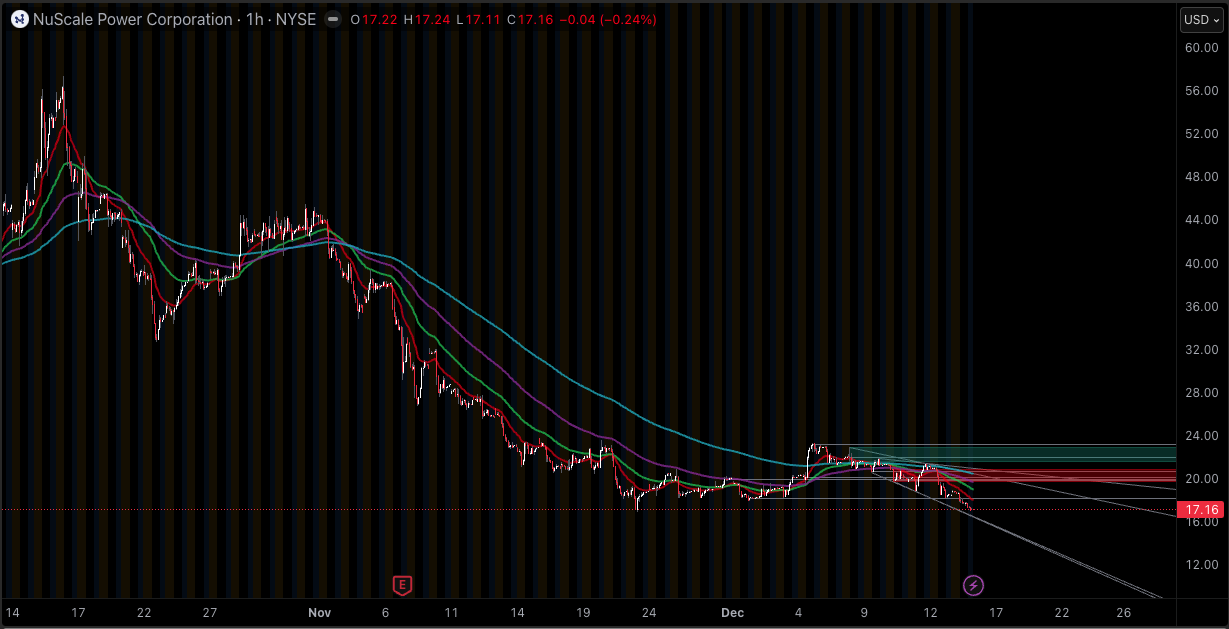

NuScale Power (SMR) stock is dropping again, trading near $17.41 after a roughly 5% drop in the last session. The move has pushed the stock back into a make-or-break zone, where buyers usually decide whether they want to defend support or step aside.

The selling is not random. It reflects two pressures hitting at the same time. First, the market is adjusting to higher potential share supply, which often weighs on price even before new shares appear. Second, the chart has broken below key trend levels, and that shift changes how many traders behave.

When a stock loses support, bounces tend to fade until a new base is built. That is why SMR stock support is the main level to watch right now.

Why is SMR Stock Falling?

The main drivers of NuScale Power stock dropping are dilution risk, capital-raising overhang, and a technical breakdown after a crowded run higher. The company has been explicit that it wants more flexibility to issue stock, and traders typically price that in early, especially after a big rally.

Key factors behind the SMR stock drop:

Share supply overhang: shareholders were asked to approve lifting authorized Class A shares from 332,000,000 to 662,000,000.

Active equity fundraising: the company reported selling 13.2 million shares via an ATM program in Q3, raising $475.2 million gross.

Big earnings optics: Q3 included a very large $495.0 million item tied to a partnership milestone that hit G&A, which spooked sentiment around near-term fundamentals.

Technical damage: SMR is below key moving averages, with RSI near oversold and multiple indicators still pointing down.

Recent Performance of SMR Stock: 1 Week, 1 Month, 6 Months

Before diving deeper, it helps to look at the path that got SMR here.

NuScale Power - Last Week

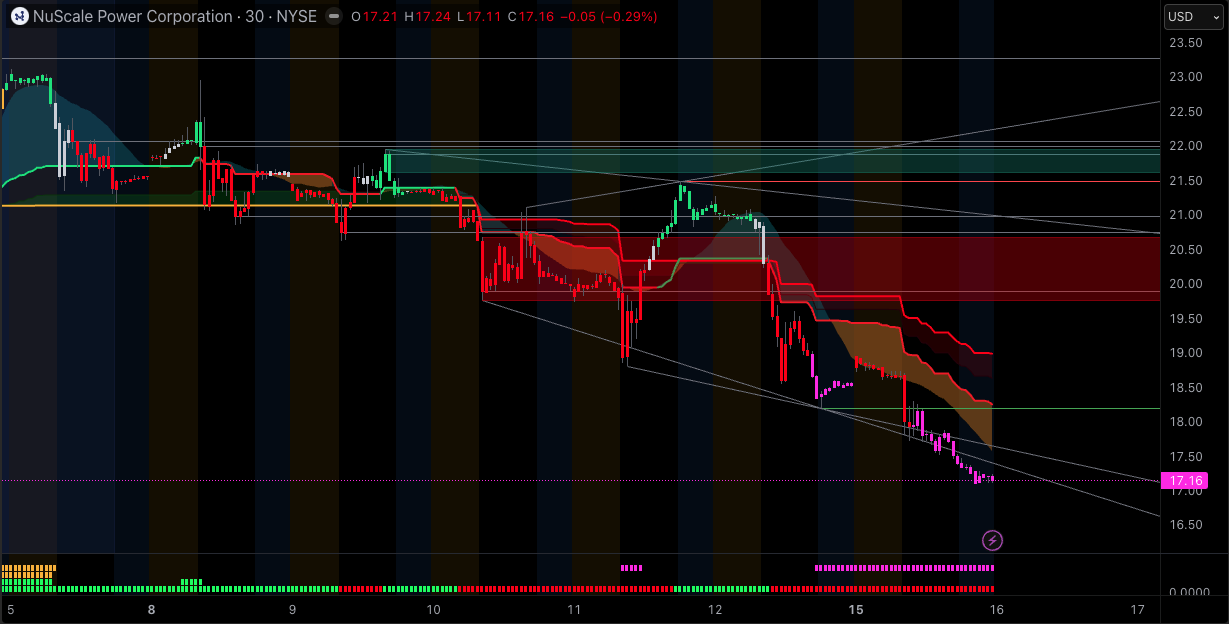

Over the last week of trading, SMR fell about -19.25% (from $21.56 on Dec 8 to $17.41 on Dec 15).

The drop was not smooth. There were sharp intraday swings and heavy volume on the worst days, which fits the profile of forced selling plus traders exiting momentum positions.

The drop was not smooth. There were sharp intraday swings and heavy volume on the worst days, which fits the profile of forced selling plus traders exiting momentum positions.

NuScale Power - Last 1 Month

Over roughly one month, SMR is down about -22.45% (from $22.45 on Nov 14 to $17.41 on Dec 15).

That period shows a clear pattern: failed rebounds, lower highs, and repeated breaks of short-term support. It’s the kind of tape where rallies tend to get sold until price proves otherwise.

NuScale Power - Last 6 Months

The bigger context is even more dramatic. SMR traded as high as $57.42 within the last 52 weeks and as low as $11.08. From the high to the latest close, the stock is down about -69.7%.

Even after this slide, SMR is still well above the 52-week low, which is a reminder of how wide the trading range has been. This is a high-volatility stock, and risk controls matter more than opinions here.

Main Reasons Behind SMR Stock Drop

1) Dilution risk moved from “theory” to “timeline”

When a company asks for a major increase in authorized shares, traders usually treat it as a signal: more stock can be issued when management chooses, which can cap upside in the near term.

NuScale called a special meeting (December 16, 2025) that included a proposal to increase authorized Class A shares from 332,000,000 to 662,000,000. The proxy also lays out why: more flexibility for capital raising, strategic transactions, and equity compensation.

Even if extra shares are not issued immediately, the market often discounts the stock ahead of time because the supply risk becomes hard to ignore.

2) Equity fundraising is already happening, and traders are pricing in more

NuScale finished Q3 with $753.8 million in cash, cash equivalents, and investments, which is a real positive for an early-stage business.

But that stronger cash position partly came from issuing stock: the company said it sold 13.2 million shares through an at-the-market program in Q3, bringing in $475.2 million gross proceeds.

The market’s concern is not that the company raised cash. The concern is the pattern: when a stock runs hot, an ATM program can become a steady source of supply, especially on up days.

That can weaken rallies and change the “feel” of the tape from momentum-driven to distribution-driven.

3) Q3 headline numbers hurt sentiment, even with solid liquidity

In Q3, the company reported that general and administrative expenses rose sharply due largely to recognizing a $495.0 million milestone contribution under a partnership agreement.

Large accounting items like this can distort how the quarter looks to the market. Even when traders understand the detail, the headline still affects positioning: it reminds everyone that this is a company still in the heavy investment stage, with results that can look “lumpy” quarter to quarter.

In plain terms: the balance sheet looks healthier than before, but the earnings picture still looks early-stage. When a stock is priced for big future wins, anything that raises uncertainty can hit hard.

4) The technical breakdown pulled selling forward

Once SMR lost major moving averages, the slide became self-feeding. Breaks of the 20-day, 50-day, and 200-day moving averages often trigger stop-loss orders, systematic selling, and short-term traders flipping bias.

Right now, most daily signals still point down, even though some oscillators are near oversold. That’s why “oversold” does not automatically mean “bottom.” In strong downtrends, oversold can stay oversold longer than expected.

Technical View: Key Levels Traders Are Watching on NuScale Power

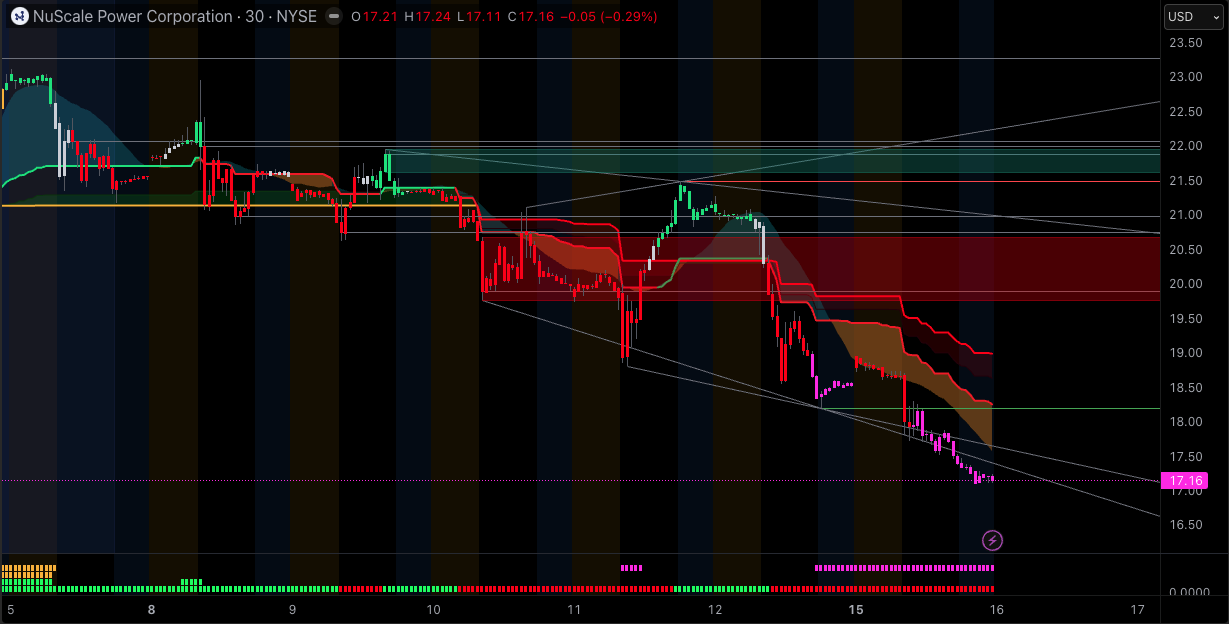

From a technical analysis perspective, SMR is in a downtrend on the daily timeframe, with momentum still weak.

Current Trend and Momentum

RSI (14): ~32, which is near oversold but still reads as bearish.

MACD: -0.859, still negative, showing bearish momentum.

ADX: ~38, which signals the trend has been strong (and the trend direction is down).

ATR (14): ~0.598, implying a typical daily move of about $0.60 (around 3% to 4% at current prices).

SMR stock technical analysis table (daily)

| Indicator (Daily) |

Value |

What It Suggests |

| Last Close |

$17.41 |

Sharp selloff into support zone |

| RSI (14) |

32.026 |

Weak momentum, near oversold |

| Stochastic (9,6) |

13.609 |

Oversold conditions |

| MACD (12,26) |

-0.859 |

Bearish momentum |

| ADX (14) |

38.198 |

Strong downtrend |

| ATR (14) |

0.598 |

Typical daily swing of approximately $0.60 |

| MA 5 (Simple) |

17.693 |

Price below short-term trend |

| MA 10 (Simple) |

18.095 |

Overhead pressure |

| MA 20 (Simple) |

19.075 |

Key “line in the sand” for rebounds |

| MA 50 (Simple) |

20.351 |

Medium-term downtrend remains intact |

| MA 200 (Simple) |

22.871 |

Long-term resistance well above current price |

Important Support and Resistance Zones

Support levels to watch (SMR stock support):

$17.35 to $17.45: current battle zone around the latest lows and nearby pivot supports.

$16.90 to $17.00: prior swing-low area from late November.

$11.08: 52-week low and the “line” long-term traders will keep in mind if the selloff turns into a deeper unwind.

Resistance levels to watch:

$18.10 to $19.10: sits around the 10-day and 20-day moving averages, a common area where downtrends reject bounces.

$20.35: the 50-day moving average, often a key test for any recovery attempt.

$22.87 to $23.00: the 200-day moving average area, and also a prior breakdown zone.

A practical volatility map (built from ATR)

Using ATR as a simple “normal move” guide:

Typical daily range is roughly $16.81 to $18.01 (about $0.60 up or down).

A rough one-week band (ATR × √5) points to about $16.07 to $18.75.

This is not a forecast. It’s a way to set expectations for how far SMR can swing without any new catalyst.

What Bulls and Bears Are Looking For

For bulls:

A clean hold above $17.35 to $17.45, followed by a push back through $19.07 (the 20-day average).

Higher lows on rebounds, not just quick spikes.

For bears:

A break and close below the $16.90 to $17.00 area, which would keep the pattern of lower lows intact.

Failed bounces under the 20-day and 50-day moving averages.

Frequently Asked Questions (FAQ)

1. Why is SMR stock dropping today?

SMR’s latest decline fits a broader downtrend, with selling pressure still strong and price below key moving averages. When a stock loses major support levels, short-term traders often reduce risk quickly, which can steepen daily drops.

2. Did dilution concerns cause the SMR stock drop?

Dilution risk is a major weight. NuScale asked shareholders to approve a large increase in authorized Class A shares, and it has already used an ATM program to sell shares. Markets often price in the chance of more supply ahead of time.

3. Will SMR recover after this drop?

A recovery is possible, but it usually needs two things: improving sentiment and better price structure. On the chart, traders often look for SMR to reclaim the 20-day and 50-day moving averages, and to stop making lower highs.

4. Is SMR too risky to trade right now?

SMR is high risk because it moves fast. Indicators show strong trend pressure and wide daily swings. For many traders, that means smaller size, wider stops (based on volatility), and fewer trades until the chart stabilizes.

Conclusion

NuScale Power stock dropping is not just a “bad day” story. It’s a reset after a crowded run, made heavier by dilution fears, active equity fundraising, and a chart that broke several key trend lines.

For traders, the most useful question now is simple: can SMR hold the $17 area and rebuild a base, or does the stock keep bleeding into lower support? Either outcome is tradable, but only with discipline.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The drop was not smooth. There were sharp intraday swings and heavy volume on the worst days, which fits the profile of forced selling plus traders exiting momentum positions.

The drop was not smooth. There were sharp intraday swings and heavy volume on the worst days, which fits the profile of forced selling plus traders exiting momentum positions.