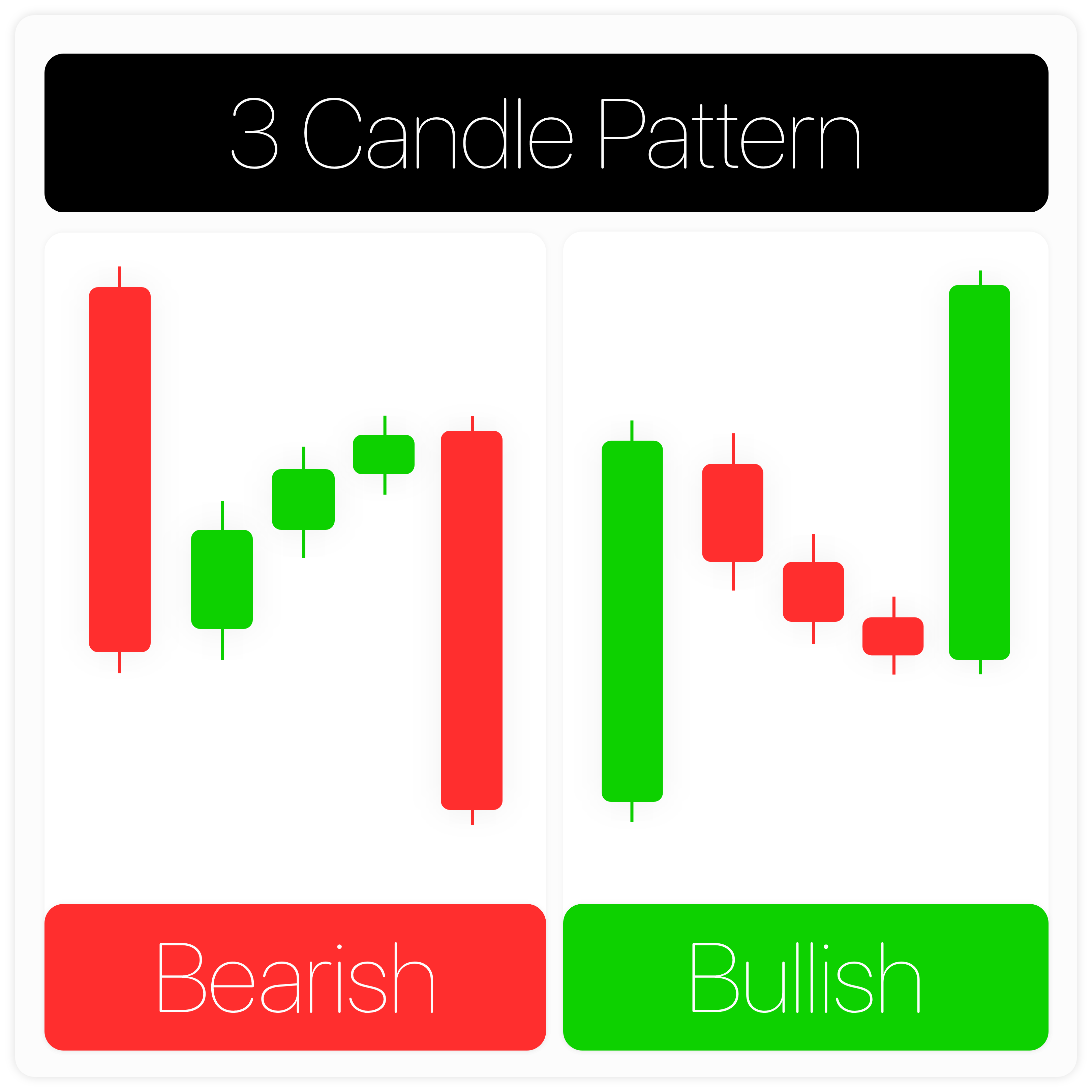

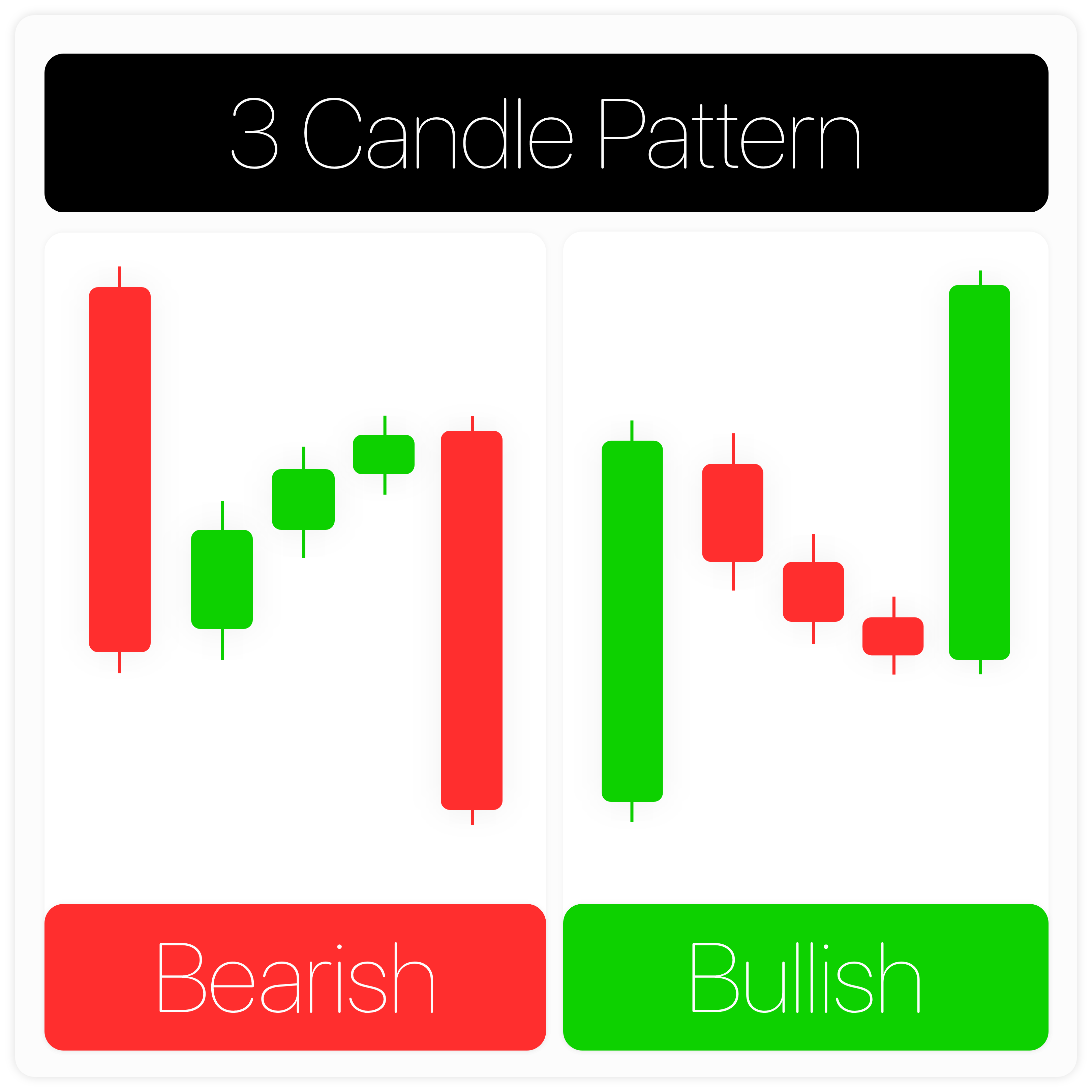

In trading, pattern recognition remains one of the most powerful tools for forecasting price movements. Among various price action setups, the 3 Candle Pattern stands out due to its straightforwardness, dependability, and adaptability across different markets.

Whether you're a beginner just learning to read candlesticks or a seasoned trader looking to refine your strategy, mastering the 3 Candle Pattern can add clarity and precision to your entries and exits.

In this guide, we'll explore the 3 Candle Pattern by explaining what it is, outlining its key types, showing you how to identify and confirm the setup effectively, providing practical trading strategies, and essential risk management tips.

What Is the 3 Candle Pattern?

The 3 Candle Pattern refers to a group of candlestick formations that involve three successive candles. These patterns signal a reversal or continuation of a trend, depending on the structure and market context.

In contrast to single candlestick patterns (Doji) or two-candle patterns (engulfing), the three-candle pattern offers greater confirmation, helping traders avoid false signals.

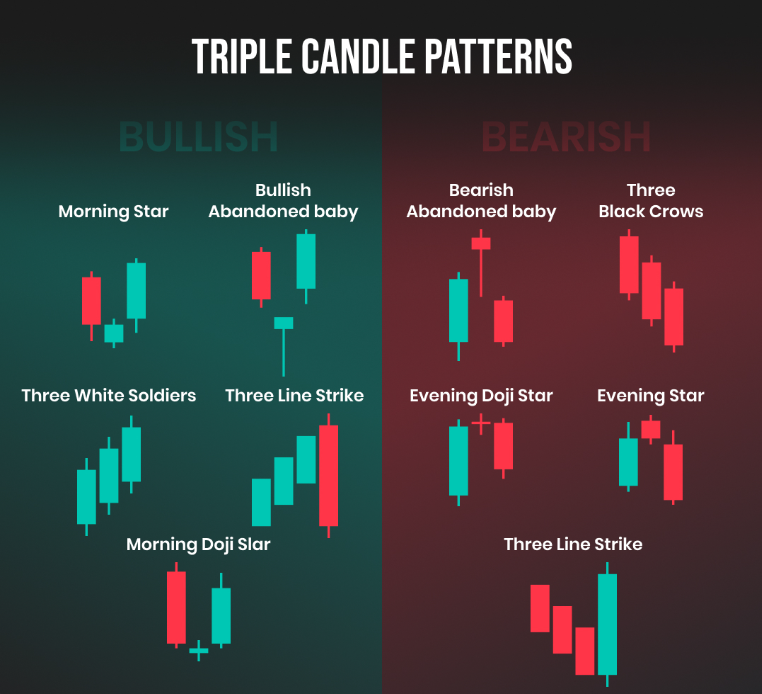

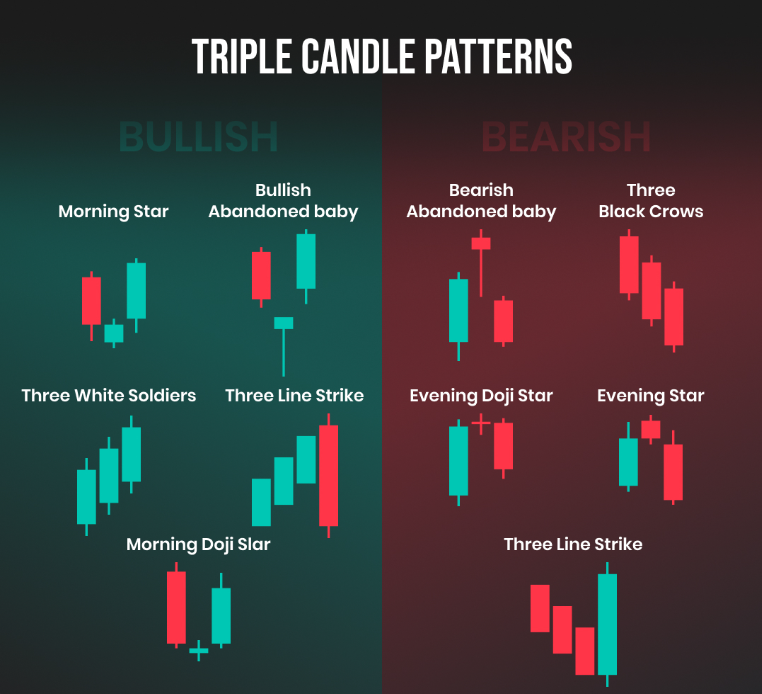

The most well-known 3 candle formations include:

Three White Soldiers

Three black crows

Morning Star

Evening Star

Three Inside Up/Down

These can appear at key market turning points or during consolidation before a trend resumes.

Top 5 Three Candle Patterns

1. Three White Soldiers (Bullish Reversal)

Description:

This pattern appears following a downtrend and consists of three long bullish candles, with each closing above the previous.

Characteristics:

All three candles have small or no wicks

Each opens within the previous candle's body

Consistent upward momentum

Signal:

Strong bullish reversal, especially when volume increases or when forming near a support zone.

Strategy:

Entry: After the close of the third candle

Stop-loss: Below the first candle's low

Take-profit: Use a 1:2 risk-reward or the next resistance level

2. Three Black Crows (Bearish Reversal)

Description:

It serves as the negative equivalent of the Three White Soldiers. It appears after an uptrend and consists of three long bearish candles closing progressively lower.

Characteristics:

Each candle opens within the previous candle's body

Lower closes indicate strong bearish momentum

Small wicks suggest dominance by sellers

Signal:

Bearish reversal, especially pronounced near resistance levels or following prolonged uptrends.

Strategy:

Entry: After the third candle closes

Stop-loss: Above the first candle's high

Take-profit: Target recent support zones

3. Morning Star (Bullish Reversal)

Description:

The Morning Star is a classic bottom reversal setup with three distinct candles:

First candle: Large bearish

Second candle: Small body (Doji/spinning top), showing indecision

Third candle: Large bullish candle closing above the midpoint of the first candle

Signal:

Indicates sellers are losing control, and buyers are stepping in.

Strategy:

Entry: After the third candle closes

Stop-loss: Below the lowest point of the pattern

Confirmation: RSI divergence or support zone strengthens the signal

4. Evening Star (Bearish Reversal)

Description:

This pattern is the opposite of the Morning Star and occurs at market tops:

First candle: Strong bullish candle

Second candle: Indecision (Doji/spinning top)

Third candle: Bearish candle closing below the midpoint of the first candle

Signal:

Momentum transitions from bulls to bears, indicating a change in trend.

Strategy:

Entry: After confirmation of the third candle

Stop-loss: Above the pattern's high

Risk management: Avoid entries in strong uptrends unless confirmed with indicators

5. Three Inside Up/Down (Reversal Pattern)

Three Inside Up (Bullish):

Candle 1: Large bearish candle

Candle 2: Smaller bullish candle (inside the first)

Candle 3: Bullish candle closing above the first

Three Inside Down (Bearish):

Candle 1: Large bullish candle

Candle 2: Small bearish candle (inside the first)

Candle 3: Bearish candle closing below the first

Signal:

A sudden move followed by a momentum reversal often indicates a correction or shift in trend.

How to Identify the 3 Candle Pattern

To recognise these setups accurately:

Use candlestick charts, not line or bar charts

Look for the patterns near support/resistance, trendlines, or moving averages

Check for volume spikes to validate conviction

Avoid trading them in choppy or sideways markets

3 Candle Pattern Across Timeframes

| Timeframe |

Best Use |

Notes |

| 1-min / 5-min |

Scalping setups |

May need confirmation with indicators |

| 15-min / 1H |

Intraday trading |

Combine with S/R or VWAP for consistency |

| 4H / Daily |

Swing trading or position entries |

Stronger reliability, less market noise |

| Weekly |

Long-term trend reversal or breakout |

Very powerful when combined with fundamentals |

Ideal Conditions:

Clear prior trend

Clean candle bodies with minimal wicks

Appears near known price zones

Confirmation from RSI, MACD, or momentum indicators

Risk Management and Common Mistakes for 3 Candle Patterns

| Rule |

Why It Matters |

| Use a stop-loss beyond pattern |

Protects against false breakouts |

| Risk 1–2% of capital per trade |

Maintains account longevity |

| Use a trading journal |

Tracks win rate and pattern effectiveness |

| Avoid overtrading the pattern |

Not all 3 candle setups are high quality |

| Combine with trend filters |

Only trade bullish patterns in uptrends, bearish in downtrends |

As for common rookie mistakes, here are what beginners should look out for:

Ignoring market context: Don't trade the pattern without trend analysis

Entering too early: Always wait for the third candle to close

No confirmation: Combine with other tools for a higher probability

Improper risk management: Always use stop-losses and position sizing

Conclusion

In conclusion, the 3 Candle Pattern is more than just a visual formation; it's a window into market sentiment and price psychology. Whether signalling a reversal like the Morning Star or confirming bearish momentum with Three Black Crows, these patterns offer high-probability setups across all markets.

Therefore, to trade the 3 Candle Pattern successfully, it's essential to understand its structure and the broader market context, use confluence with other indicators for stronger signals, apply disciplined risk management, and study real chart examples for practical insight.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.