Some currencies look "cheap" because you need thousands, or even millions, of units to equal one US dollar. It can catch the eye, but that doesn't mean it's "the worst economy."

Often, the currency unit is established with a very low face value following extended periods of inflation.

In this updated 2026 list, we rank currencies by units per USD, using mid-market exchange rates. Some of these currencies are under real pressure from inflation, debt, and limited access to US dollars. Others sit on the list mostly because the country never removed zeros through redenomination.

What Iranian Rial Is the Cheapest Currency In the World in 2026?

If you use market-based pricing, the Iranian rial (IRR) is the weakest by a wide margin, because the market rate is around one million rials per US dollar.

If you use official or tightly managed rates for government transactions, Iran's official rate is much stronger than its market rate. In that "official-rate" world, the Lebanese pound (LBP) often shows up as the weakest because Lebanon's day-to-day price level against the dollar is extremely low and widely used in the local economy.

In short, Iran's currency (market rate) is the weakest, while Lebanon is the cheapest currency for the official rate.

Cheapest Currency In the World 2026: Updated Top 15 List

The table below organizes currencies according to the number of local units that equal 1 USD. More units per dollar means a lower face value.

| Rank |

Currency |

Code |

Approx. units per 1 USD (Jan 19, 2026) |

Quick note |

| 1 |

Iranian rial |

IRR |

1,069,230 |

Multiple rates exist; “market” pricing is far weaker than old official-style quotes. |

| 2 |

Lebanese pound |

LBP |

89,525.25 |

The currency remains deeply discounted after the banking crisis. |

| 3 |

Vietnamese dong |

VND |

26,273.50 |

Low face value, with a managed policy framework shaping day-to-day moves. |

| 4 |

Lao kip |

LAK |

21,618.76 |

Low face value, with FX availability and confidence still key themes. |

| 5 |

Indonesian rupiah |

IDR |

16,954.30 |

A major EM currency that can weaken when global USD demand rises. |

| 6 |

Uzbek som |

UZS |

11,967.11 |

Low denomination size is common where no redenomination occurred after inflation periods. |

| 7 |

Guinean franc |

GNF |

8,754.50 |

Often appears in "weakest currency" lists because of its low unit value. |

| 8 |

Paraguayan guarani |

PYG |

6,667.02 |

Low face value does not automatically mean the currency is collapsing. |

| 9 |

Malagasy ariary |

MGA |

4,646.42 |

Low unit value; moves can be less visible than major FX pairs. |

| 10 |

Cambodian riel |

KHR |

4,025.25 |

Cambodia posts official reference rates; the unit value remains low by design and history. |

| 11 |

Colombian peso |

COP |

3,691.79 |

Still a picture of EM sensitivity to global growth and commodity sentiment. |

| 12 |

Mongolian tugrik |

MNT |

3,566.31 |

Low face value, with periodic volatility depending on external balances and trade. |

| 13 |

Ugandan shilling |

UGX |

3,554.51 |

Frequently shows up on weakest-by-value lists because of denomination size. |

| 14 |

Burundian franc |

BIF |

2,960.82 |

Low unit value; not widely traded like major currency pairs. |

| 15 |

Tanzanian shilling |

TZS |

2,520.31 |

Low face value; the rate is often followed via official and market feeds. |

Important note: Some countries have capital controls, official rates, and parallel market rates. Rates also move every day. This snapshot uses widely quoted rates from available major market data sources and official central bank postings.

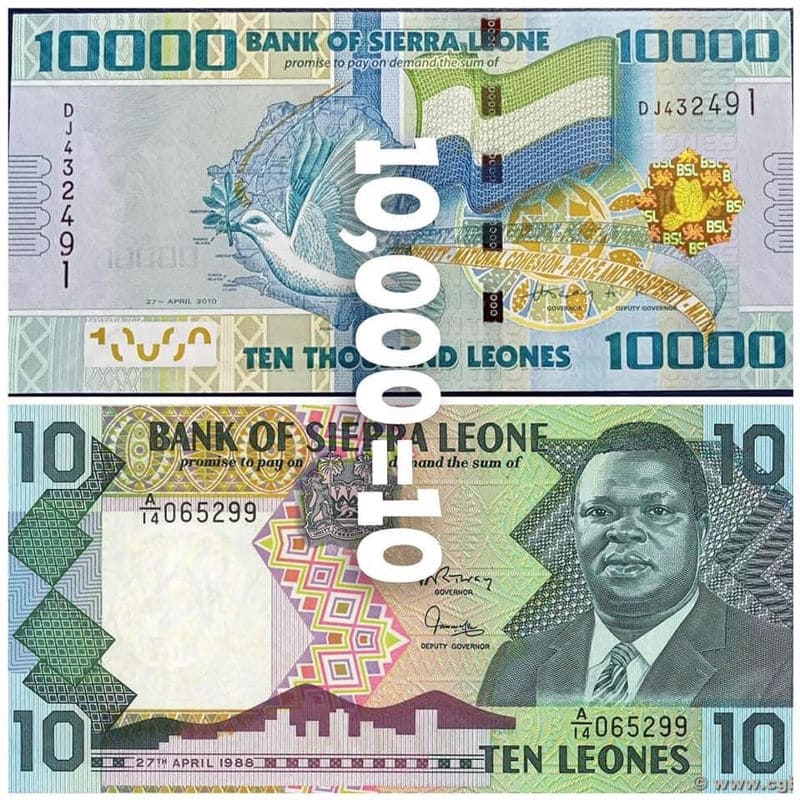

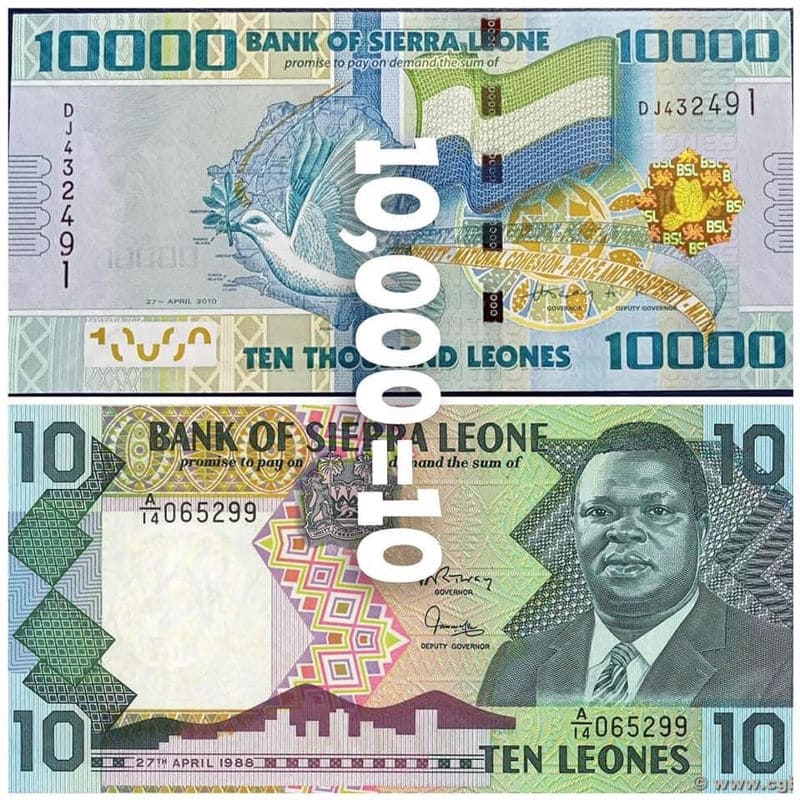

Why SLL Is Not Considered As One of The Cheapest Currencies Now

Many older lists still mention SLL (Sierra Leonean leone), but this code is no longer the current currency code.

Sierra Leone Redenominated and Moved from SLL to SLE

Sierra Leone removed three zeros from its currency in 2022, meaning 1 new leone equals 1,000 old leones.

The Bank of Sierra Leone announced a transition period during which both the old and new Leone notes could be used. They later confirmed that the old Leone would cease to be legal tender after this transition period.

ISO currency updates also reference the redenomination and the current code SLE.

How Does This Change Affect Sierra Leone's Currency?

After a 1,000:1 redenomination, the currency can look much stronger on paper even if the economy has not improved overnight. That is why Sierra Leone may drop off "cheapest currency by face value" lists.

The number of units per USD becomes smaller simply because zeros were removed.

Frequently Asked Questions

1. What Is the Cheapest Currency in the World in 2026?

Based on widely reported open-market references, the Iranian rial (IRR) is the weakest by face value.

2. Is the Vietnamese Dong "Weak" in the Same Way as the Lebanese Pound?

Not usually. The dong is a high-denomination currency and is managed. Lebanon's pound reflects a clear indicator of the ongoing banking and monetary crisis in the country.

3. Can a Weak Currency Recover?

Yes, but it usually requires credible policy steps, starting from lower inflation, stronger reserves, and restored trust. In many cases, reformation helps, such as in the case of Sierra Leone.

Conclusion

In conclusion, the Iranian rial stands out as the weakest currency in early 2026 by face value versus the US dollar, with the Lebanese pound next on the list.

The biggest takeaway is that the same names keep showing up because the drivers are slow-moving: inflation control, debt management, access to dollars, and public trust. When those improve, currencies can stabilise. When they do not, the zeros tend to stay.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.