SPDW provides broad, cost-efficient exposure to developed markets outside the U.S., allowing investors to diversify internationally and tap into global growth.

A Passport Beyond Wall Street: What is SPDW?

The SPDR® Portfolio Developed World ex‑US ETF (SPDW) serves as a gateway for investors seeking exposure to developed markets outside the United States. While many portfolios are heavily weighted towards U.S. equities, SPDW offers a unique opportunity to access international growth, diversification, and global market potential.

Launched by State Street Global Advisors in April 2007. SPDW tracks the S&P Developed Ex‑U.S. BMI Index, providing broad exposure to non-U.S. developed markets. Unlike U.S.-centric ETFs, SPDW is tailored for investors who understand the importance of spreading risk across multiple countries and industries. Essentially, this ETF acts as a "passport" to global investment opportunities.

Mapping the World: Countries & Companies Inside SPDW

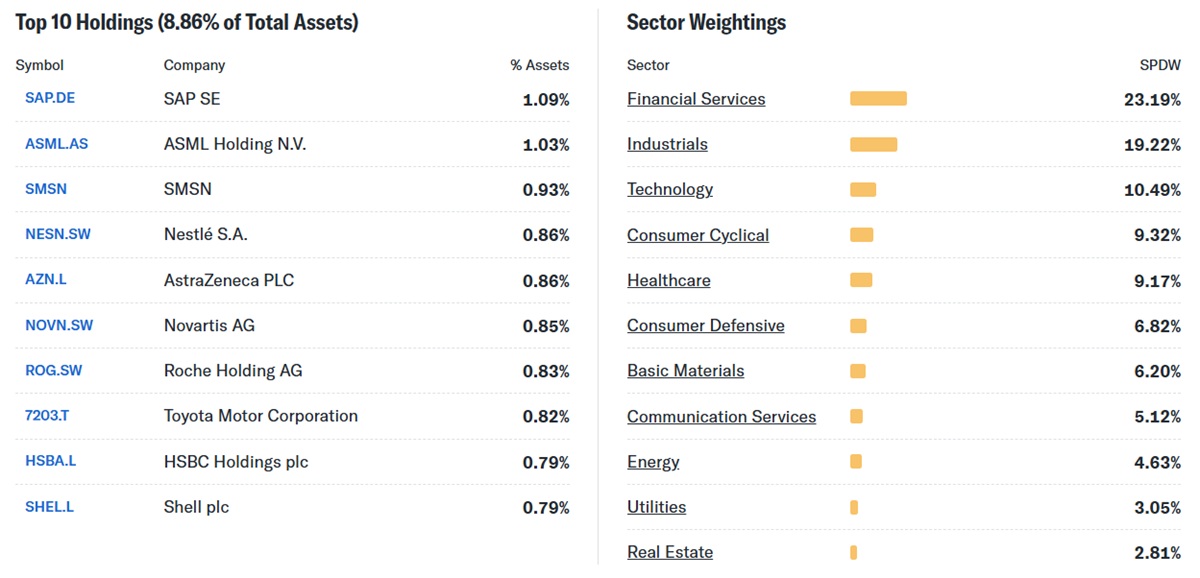

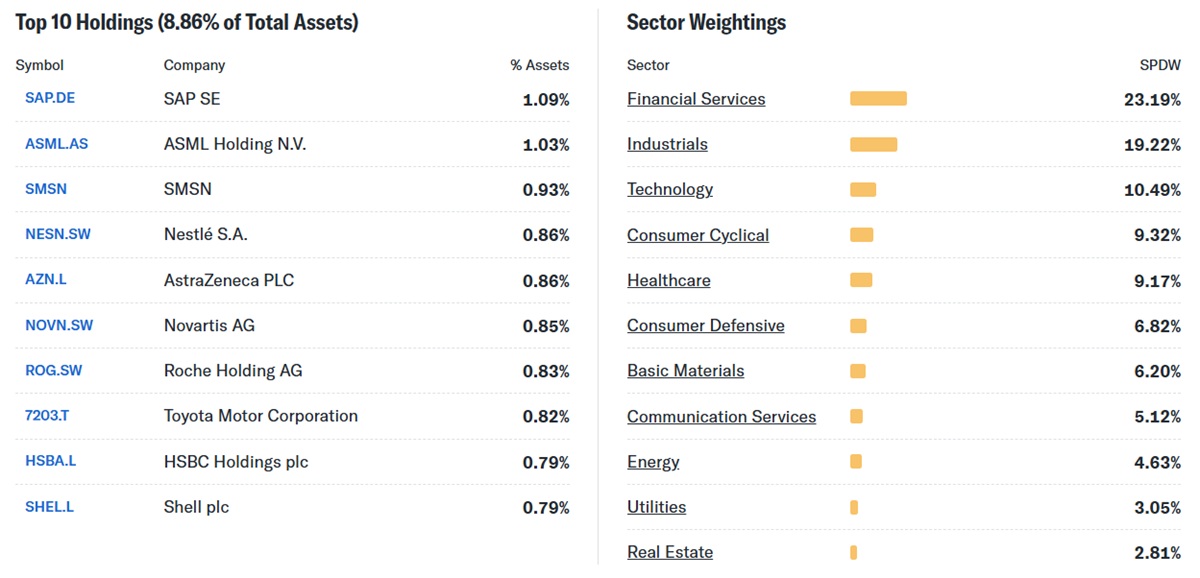

SPDW boasts a broad geographical footprint, covering approximately 2.300 to 2.400 companies. Its exposure spans Europe, Canada, Japan, and South Korea, making it a true reflection of the developed world beyond U.S. borders.

Some of the fund's standout holdings include:

ASML – a Dutch semiconductor giant

SAP – Germany's software powerhouse

Samsung Electronics – South Korea's technology titan

Novartis – Switzerland's pharmaceutical leader

By including such companies, SPDW ensures investors gain a diversified stake in global economic growth, from technology and healthcare to financial services and industrials.

The Price of a Global Ticket: Costs, Dividends & Efficiency

One of SPDW's strongest appeals is its remarkable cost efficiency. With an ultra-low expense ratio of just 0.03%, it is one of the cheapest avenues for broad developed-market exposure.

Moreover, SPDW offers semiannual dividend distributions, with a current yield of around 2.7%. This combination of low costs and steady income makes it an attractive option for long-term, buy-and-hold investors seeking global diversification without the expense of multiple country-specific funds.

Riding the Waves: Performance, Momentum & Market Cycles

Historically, SPDW has demonstrated steady growth in alignment with global market trends. Investors can track its performance against the S&P Developed Ex‑U.S. BMI Index, which acts as a reliable benchmark.

While annual returns vary due to currency fluctuations, economic cycles, and geopolitical events, SPDW has consistently been a strong performer relative to other international ETFs. For instance, recent YTD performance reflects gains driven by robust European and Asian markets, despite temporary global market volatility.

Why Investors Pack SPDW in Their Portfolio Luggage

SPDW is often included in portfolios for several key reasons:

Diversification: It provides access to international equities, reducing home-country bias.

Core International Holding: Serves as a foundational building block for global equity exposure.

Long-Term Strategy: Ideal for investors with a horizon that spans multiple market cycles.

For those looking to balance heavy U.S. equity exposure, SPDW offers a straightforward and cost-effective solution, eliminating the need to purchase multiple country-specific funds.

The Flip Side of the Globe: Risks and What to Watch

While SPDW is compelling, it is not without risks. Investors should consider:

Currency Risk: Fluctuations in foreign exchange rates can impact returns.

Geopolitical Exposure: Political events in Europe, Asia, or Canada may influence markets.

Overlap with Other ETFs: Investors already holding international ETFs might encounter duplicate exposure.

Despite these considerations, careful portfolio planning and regular monitoring can help mitigate potential drawbacks, making SPDW a valuable component of a well-diversified investment strategy.

Conclusion

SPDW stands out as an efficient and diversified gateway to the global equity markets. Its low costs, broad geographic exposure, and steady dividend yield make it an ideal choice for long-term investors seeking to balance U.S. holdings with international growth. While it carries certain risks such as currency fluctuations and geopolitical exposure, careful portfolio planning can harness its potential effectively. For those looking to broaden their horizons and explore the developed world beyond the U.S., SPDW remains a practical, reliable, and strategically sound investment.

Frequently Asked Questions(FAQ)

Q1: What is SPDW and what does it track?

A: SPDW is the SPDR® Portfolio Developed World ex‑US ETF. It tracks the S&P Developed Ex‑U.S. BMI Index, providing broad exposure to developed markets outside the United States.

Q2: How does SPDW differ from other international ETFs like IEFA or VEA?

A: Unlike some peers, SPDW includes markets such as Canada and South Korea and has a very low expense ratio of 0.03%, offering cost-efficient diversification.

Q3: Is SPDW suitable for long-term investing?

A: Yes. SPDW is ideal for long-term, buy-and-hold investors seeking global diversification. Its broad holdings and low costs make it a core international equity choice.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.