In a world where equity markets are increasingly interconnected, limiting investment exposure to domestic stocks can mean missing out on significant growth opportunities abroad. The Schwab International Equity ETF (SCHF) offers a simple, cost-effective route to access developed international markets, providing exposure to a wide range of companies across Europe, Asia, and other major global economies.

Known for its ultra-low fees and broad diversification, SCHF has become a go-to option for investors seeking to balance their portfolios with international equities—without taking on the complexity of picking individual foreign stocks. Understanding how this ETF works, and what sets it apart, is key for those building a globally resilient investment strategy.

Fund Overview & Objective

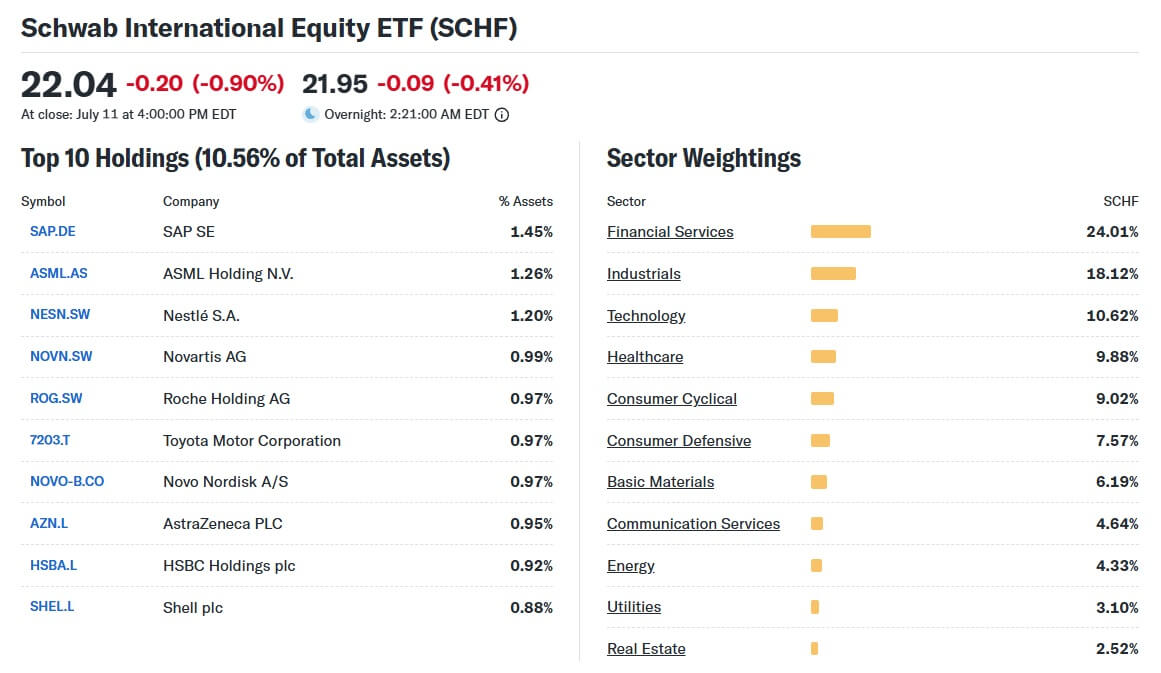

The Schwab International Equity ETF (SCHF) is designed to provide exposure to a broad basket of large- and mid-cap companies from developed countries outside the United States. It tracks the FTSE Developed ex US Index, which includes firms across Europe, Asia, and North America—excluding U.S. stocks entirely.

The Schwab International Equity ETF (SCHF) is designed to provide exposure to a broad basket of large- and mid-cap companies from developed countries outside the United States. It tracks the FTSE Developed ex US Index, which includes firms across Europe, Asia, and North America—excluding U.S. stocks entirely.

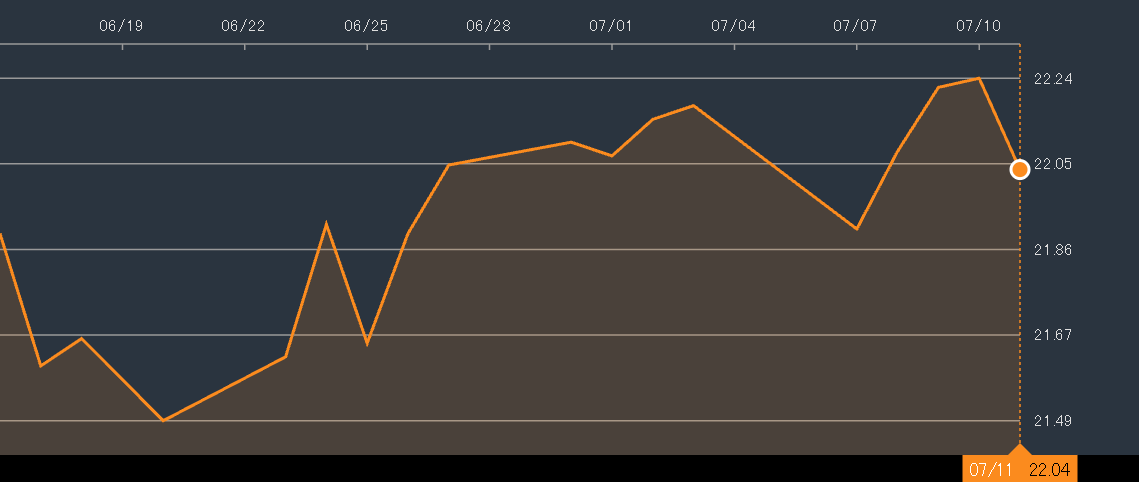

Launched in 2009 by Charles Schwab Investment Management, SCHF has grown into one of the largest ETFs in its category, managing tens of billions in assets. As a passively managed fund, it seeks to replicate the performance of its underlying index rather than outperform it, making it ideal for investors who favour a long-term, buy-and-hold strategy.

The fund includes approximately 1.450 stocks, spanning countries such as Japan, the United Kingdom, France, Germany, and Canada. With this wide breadth, SCHF allows investors to tap into the performance of international markets with a single, easy-to-access product.

Expense Ratio & Cost Benefits

One of the most attractive features of SCHF is its ultra-low cost. The fund's net expense ratio is just 0.03%, making it one of the cheapest international ETFs on the market. For every £10.000 invested, this equates to a mere £3 in annual fees.

One of the most attractive features of SCHF is its ultra-low cost. The fund's net expense ratio is just 0.03%, making it one of the cheapest international ETFs on the market. For every £10.000 invested, this equates to a mere £3 in annual fees.

Compared to the average international equity ETF, which often charges between 0.30% and 0.50%, SCHF offers a significant saving over time. This low fee structure is especially important in international investing, where currency risk and geopolitical uncertainty may already compress returns. By reducing cost drag, SCHF improves the probability of long-term capital growth.

Moreover, the fund is offered commission-free for clients trading on Schwab's platform, adding an extra layer of affordability for U.S.-based investors.

Diversification & Geographic Allocation

SCHF's strength lies in its broad diversification across countries and sectors. With more than 1.400 holdings, the fund spreads risk efficiently, limiting exposure to any single company or country.

Country allocation (approximate):

This regional distribution reflects SCHF's developed-market focus, avoiding emerging economies which may introduce higher volatility. It also helps to reduce home-country bias for investors whose portfolios are heavily skewed toward U.S. or local equities.

In terms of sector diversification, the fund includes companies from industries such as technology, healthcare, industrials, consumer goods, and financials—providing a well-rounded equity exposure without overconcentration in any particular field.

Dividend Yield & Tax Considerations

For income-oriented investors, SCHF offers a consistent dividend yield, generally in the range of 2.5% to 3%, depending on the economic cycle and currency effects. Dividends are distributed quarterly and can be reinvested for compounding growth.

While international dividends may be subject to foreign withholding taxes, SCHF benefits from favourable tax treatment in some jurisdictions thanks to tax treaties and fund structure. For instance, U.S.-domiciled investors might be eligible to claim foreign tax credits, though non-U.S. investors should consult local tax regulations to understand implications.

In addition, SCHF is structured as a regulated investment company (RIC) under U.S. law, which enhances transparency and makes tax reporting simpler for most investors.

Ideal Investor Profile

SCHF is best suited for cost-conscious investors seeking broad international diversification without the complexities of picking individual foreign stocks. It serves well as a core holding within a globally diversified equity portfolio.

Ideal candidates include:

Long-term investors aiming to reduce U.S. or domestic equity concentration

Passive index investors who prioritise low fees and broad exposure

Retirees and income seekers looking for international dividend streams

Cost-sensitive portfolio builders (especially those using Schwab's commission-free ecosystem)

Moreover, SCHF complements U.S. equity ETFs like SCHX (Schwab U.S. Large-Cap ETF) or VTI (Vanguard Total Stock Market ETF), creating a balanced global allocation when paired together.

Conclusion

The SCHF ETF represents one of the most efficient ways to gain exposure to international equities from developed markets. Its combination of extremely low fees, wide geographic reach, and strong diversification makes it a compelling choice for both novice and experienced investors.

As global markets continue to evolve, allocating a portion of one's portfolio to international assets is increasingly seen as a prudent move. With SCHF, investors can do so without sacrificing simplicity or cost-effectiveness.

Whether you're seeking diversification, dividend income, or simply aiming to build a balanced portfolio, SCHF deserves serious consideration as a core global equity holding.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The Schwab International Equity ETF (SCHF) is designed to provide exposure to a broad basket of large- and mid-cap companies from developed countries outside the United States. It tracks the FTSE Developed ex US Index, which includes firms across Europe, Asia, and North America—excluding U.S. stocks entirely.

The Schwab International Equity ETF (SCHF) is designed to provide exposure to a broad basket of large- and mid-cap companies from developed countries outside the United States. It tracks the FTSE Developed ex US Index, which includes firms across Europe, Asia, and North America—excluding U.S. stocks entirely. One of the most attractive features of SCHF is its ultra-low cost. The fund's net expense ratio is just 0.03%, making it one of the cheapest international ETFs on the market. For every £10.000 invested, this equates to a mere £3 in annual fees.

One of the most attractive features of SCHF is its ultra-low cost. The fund's net expense ratio is just 0.03%, making it one of the cheapest international ETFs on the market. For every £10.000 invested, this equates to a mere £3 in annual fees.