In the fast-paced realm of financial markets, having a clear, structured, and adaptable trading strategy is the defining factor between consistent profits and erratic outcomes. Unlike investing, which seeks long-term value, stock trading is centred on capturing price movements within shorter timeframes—be it minutes, days, or months. Whether you're an aspiring trader or a seasoned participant, this guide offers a deep dive into the foundations, strategic frameworks, and tools that form the bedrock of successful stock trading.

Understanding the Foundations of Stock Trading

Before diving into specific strategies, it's essential to grasp the fundamentals that underpin all trading activity.

Before diving into specific strategies, it's essential to grasp the fundamentals that underpin all trading activity.

Trading vs Investing:

While investing involves buying and holding securities over years for gradual appreciation and dividend income, trading is more dynamic—capitalising on price volatility over short to medium timeframes.

Market Types:

Bull Markets: Marked by rising prices and optimism—favour long strategies.

Bear Markets: Characterised by falling prices—traders often go short or trade defensively.

Sideways Markets: Range-bound conditions—ideal for mean-reversion or range-trading strategies.

Market Participants:

Traders contend with various players—retail traders, institutional investors, hedge funds, and high-frequency trading (HFT) algorithms—each influencing liquidity and volatility in different ways.

Trading Infrastructure:

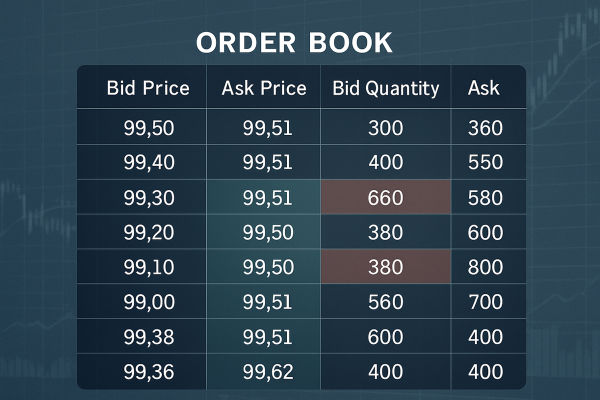

To execute trades effectively, traders rely on broker platforms, charting software (e.g., TradingView, MetaTrader), and news feeds for real-time updates. Familiarity with order types—market, limit, stop-loss, and bracket orders—is vital for risk control and precision.

Trader Psychology:

Discipline, emotional control, and consistency are more important than having a perfect strategy. Recognising and managing fear, greed, and overconfidence can dramatically improve outcomes.

Major Types of Stock Trading Strategies

There is no one-size-fits-all strategy in trading. Instead, traders often adopt a style that suits their personality, schedule, and risk tolerance. Below are the most common types:

Day Trading

Day traders buy and sell stocks within a single trading day, closing all positions before the market closes. This strategy relies on intraday patterns, volume spikes, and news catalysts. It demands full attention, fast execution, and strict discipline.

Swing Trading

Swing traders hold positions for several days to a few weeks, aiming to capture short-term trends or price swings. This strategy combines technical setups with broader trend analysis and is less intense than day trading but still active.

Position Trading

Position traders hold trades for weeks or months, relying heavily on fundamental analysis and macroeconomic trends. It's a longer-term approach compared to swing trading and suits those who can tolerate larger swings.

Scalping

Scalping involves executing dozens or hundreds of trades in a day to capture very small price movements. This high-frequency style requires tight spreads, low commissions, and lightning-fast execution.

momentum trading

Momentum traders jump into stocks showing strong directional movement with volume confirmation, often driven by news, earnings, or technical breakouts. The idea is to "buy high and sell higher."

News-Based Trading

Traders react to company earnings, central bank announcements, geopolitical events, or economic data releases. This approach demands rapid interpretation of news and the ability to act quickly before the market fully digests the information.

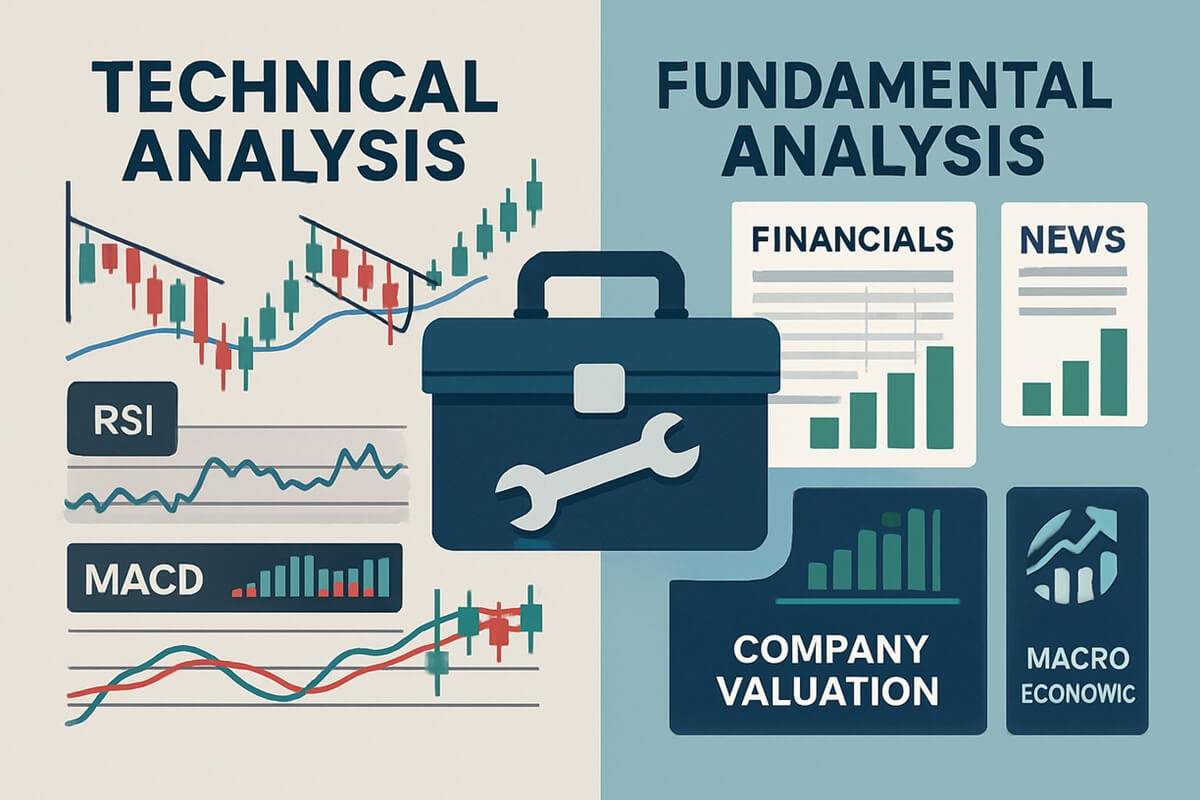

Technical and Fundamental Tools for Strategy Building

Every successful trading strategy is underpinned by a robust toolkit—ranging from technical indicators to macroeconomic insights.

Every successful trading strategy is underpinned by a robust toolkit—ranging from technical indicators to macroeconomic insights.

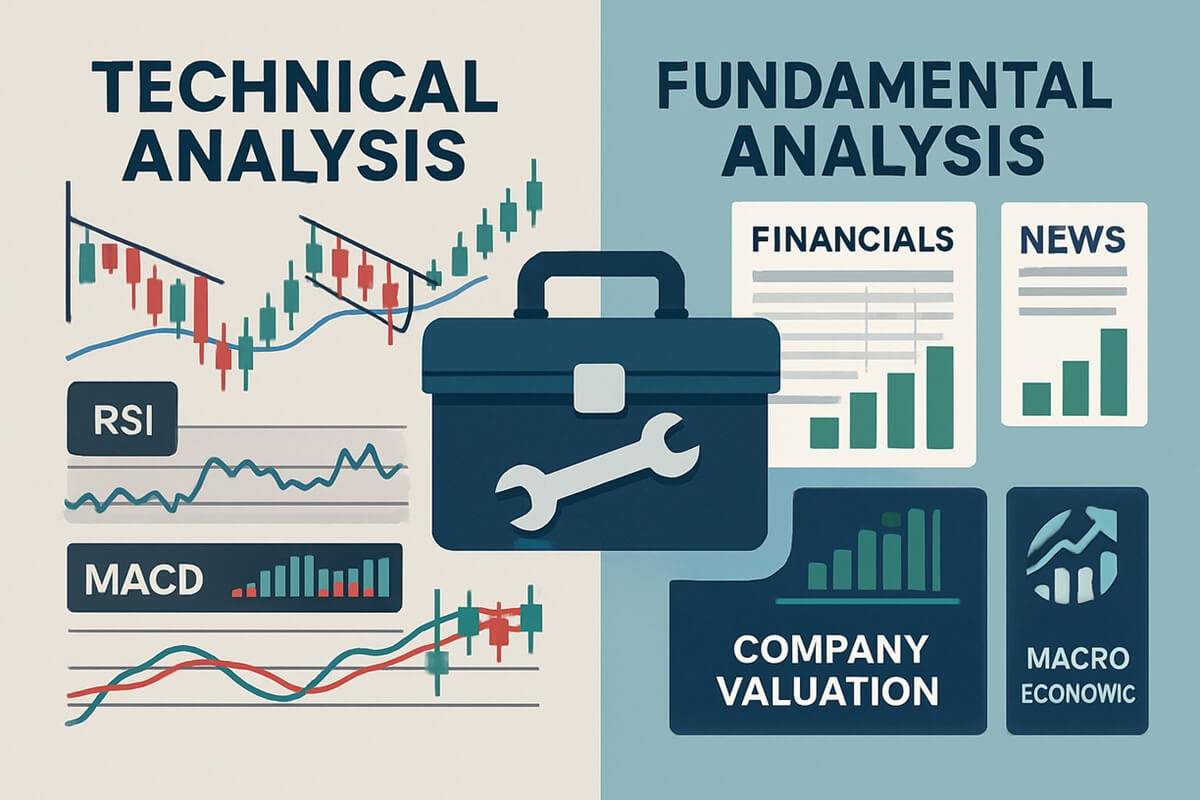

Technical Analysis

This is the cornerstone of most trading strategies. It involves interpreting price charts and indicators to identify entry and exit points.

Key elements include:

Chart Patterns: Flags, pennants, triangles, head and shoulders, double tops/bottoms.

Indicators: Moving averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands.

Volume Analysis: Helps confirm breakouts, reversals, and trend strength.

Support and Resistance: Identifying key price levels where price may stall, reverse, or break through.

Fundamental Analysis

Though less commonly used by short-term traders, fundamentals provide critical context.

Relevant factors:

Earnings Reports and Guidance

Valuation Metrics (e.g. P/E ratio, PEG ratio)

Balance Sheet Strength

Industry Trends and Macroeconomic Indicators

Analyst Upgrades/Downgrades

Many traders combine both technical and fundamental factors—a hybrid approach that adds nuance and improves decision-making.

Risk Management and Trade Execution

In trading, risk management is the strategy. It protects traders from ruin during drawdowns and ensures long-term viability.

Stop-Loss and Take-Profit Levels

Setting a stop-loss determines where a trade will be exited if it moves against you. Take-profit levels define where profits will be secured.

Risk-Reward Ratios

A good rule of thumb is to risk £1 to make £2 or more. Even with a 50% win rate, this maintains a positive expectancy.

Position Sizing

Traders should never risk more than 1–2% of their account on a single trade. Using tools like the Average True Range (ATR) helps set stop distances relative to market volatility.

Avoiding Emotional Mistakes

Overtrading, revenge trading, and doubling down on losses are common pitfalls. Setting rules and automating entries/exits where possible helps mitigate emotion-driven decisions.

Strategy Optimisation and Adaptation

Markets evolve. A strategy that worked last year may fail this year without adaptation.

Markets evolve. A strategy that worked last year may fail this year without adaptation.

Backtesting

Traders test strategies on historical data to evaluate performance metrics such as win rate, drawdown, and profit factor.

Forward Testing

Running strategies in a demo or paper-trading environment helps validate performance in real-time without financial risk.

Adjusting to Market Conditions

Strategies should be adjusted for:

Trending Markets: Trend-following systems perform well.

Choppy or Sideways Markets: Range trading or mean reversion may be more effective.

Volatile Environments: Position size may need to be reduced to maintain risk levels.

Seasonality and Event Trading

Earnings seasons, end-of-quarter flows, and central bank announcements present recurring opportunities and risks. Awareness of the economic calendar is key.

Building and Refining a Personal Trading System

Ultimately, traders should develop a system tailored to their goals, time commitment, and capital.

Define Your Edge

An edge could be a particular pattern, news setup, or behavioural observation that consistently works for you.

Create a Trading plan

This should include:

Preferred strategies and markets

Entry and exit criteria

Risk limits and daily stop-out rules

Tools and indicators to be used

Maintain a Trading Journal

Tracking each trade helps identify what's working and what isn't. Record:

Measure Performance

Track metrics such as:

Over time, this data-driven feedback loop allows traders to fine-tune their approach and grow in skill and confidence.

Final Thoughts

Stock trading is both an art and a science. It requires discipline, patience, and a constant willingness to learn and adapt. No single strategy guarantees success, but with a clear plan, robust risk management, and continuous refinement, traders can navigate the markets with confidence.

Stock trading is both an art and a science. It requires discipline, patience, and a constant willingness to learn and adapt. No single strategy guarantees success, but with a clear plan, robust risk management, and continuous refinement, traders can navigate the markets with confidence.

Whether you gravitate towards momentum trades, technical setups, or news events, the key is to treat trading like a profession—not a hobby. The markets reward preparation, not guesswork.

With the right strategy and mindset, the journey from surviving to thriving as a trader is entirely within reach.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Before diving into specific strategies, it's essential to grasp the fundamentals that underpin all trading activity.

Before diving into specific strategies, it's essential to grasp the fundamentals that underpin all trading activity. Every successful trading strategy is underpinned by a robust toolkit—ranging from technical indicators to macroeconomic insights.

Every successful trading strategy is underpinned by a robust toolkit—ranging from technical indicators to macroeconomic insights. Markets evolve. A strategy that worked last year may fail this year without adaptation.

Markets evolve. A strategy that worked last year may fail this year without adaptation. Stock trading is both an art and a science. It requires discipline, patience, and a constant willingness to learn and adapt. No single strategy guarantees success, but with a clear plan, robust risk management, and continuous refinement, traders can navigate the markets with confidence.

Stock trading is both an art and a science. It requires discipline, patience, and a constant willingness to learn and adapt. No single strategy guarantees success, but with a clear plan, robust risk management, and continuous refinement, traders can navigate the markets with confidence.