Wall Street ended lower on Thursday after PacWest's move to explore strategic

options deepened fears about the health of U.S. lenders and hit shares of

banks.

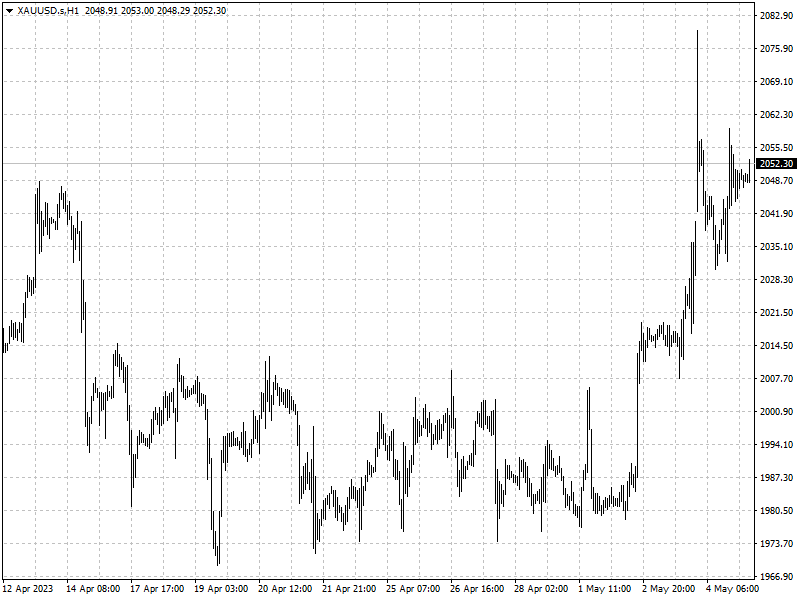

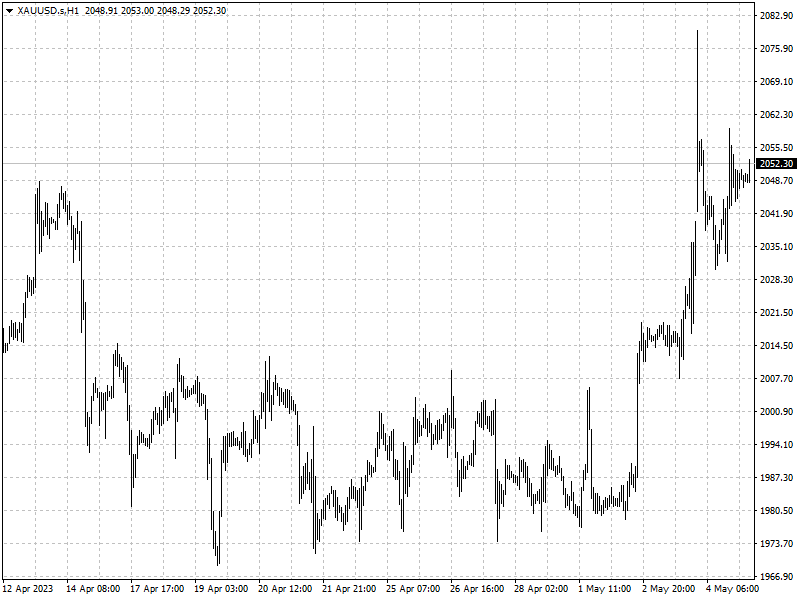

Gold made another run toward record highs on Thursday as U.S. banking

concerns accelerated a flight to the safe-haven asset and sustained its stellar

rally driven by bets for a pause in U.S. rate hikes. Oil prices held steady, but

were set for a third straight week of losses.

With investors increasingly worried a widening banking crisis and an economic

downturn, U.S. interest rate futures prices now imply traders mostly expect the

U.S. Federal Reserve to cut rates by the central bank's July meeting, according

to CME Group's FedWatch Tool.

Commodities

Spot gold added 0.6% to $2,050.66 an ounce. U.S. crude settled down 0.06% at

$68.56 per barrel and Brent ended at $72.50, up 0.24% on the day.

The melt-up in prices overnight associated with the banking stress revealed

that traders are willing to deploy some of their dry powder, said Daniel Ghali,

commodity strategist at TD Securities.

"The same flight to safety buying that pushed us over $2,000 is still in this

market," said Bob Haberkorn, senior market strategist at RJO Futures.

Traders are now focused on the release of U.S. employment data for April

later in the day, hoping it could help gauge the health of the economy.

Forex

The dollar gained some ground as the ECB raised rates on Thursday and

signalled the need for more tightening a day after the U.S. Federal Reserve also

raised rates.

In contrast to the ECB, the Fed had implied that its marathon hiking cycle

may be ending. In Treasuries, benchmark 10-year yields and 2-year yields sank as

investors worried about regional banks and signs of a weakening economy.

While the idea of a pause in U.S. rate hikes was welcome news for U.S.

investors, it came with the implication that the economy is slowing, said Lauren

Goodwin, economist and portfolio strategist at New York Life Investments in New

York.

"It's highly unlikely we'll avoid a recession," Goodwin said. "We're on a

clear path toward a recession in the next few months."