The dollar was trading flat on Friday after jobs gains and wage growth for

April beat economists’ forecasts but showed downward jobs revisions for

March.

Employers added 253,000 jobs, beating economists' forecasts for a 180,000

gain. U.S. average hourly earnings rose at an annual rate of 4.4%, above

expectations for a 4.2% increase.

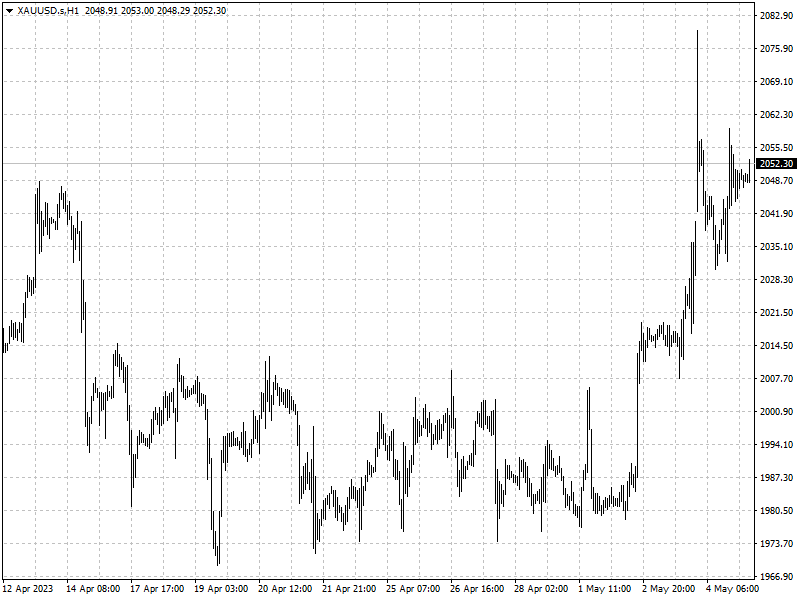

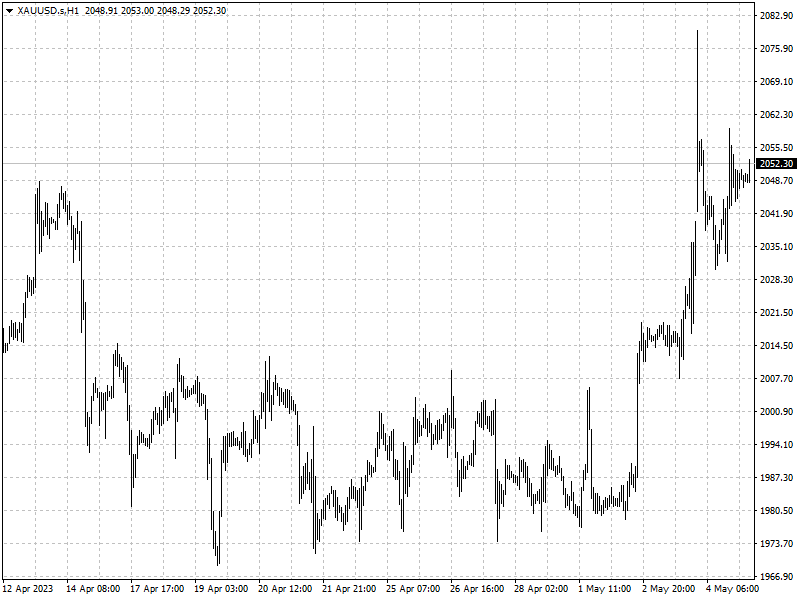

After getting close to a record high in the previous session, gold beat a

fast retreat after the payrolls data tempered expectations for Fed rate

cuts.

U.S. markets jumped Friday as Apple shares popped and regional bank stocks

recovered. European stocks finished up — Adidas, with an 8.9% surge, was a big

winner in the index.

Commodities

Concerns that the U.S. banking crisis will slow the economy and sap fuel

demand in the world's biggest oil consuming nation drove the Brent benchmark

down 5.3% last week and sent WTI plunging 7.1%, despite a sharp rebound on

Friday which saw the benchmarks gain about 4% each.

A healthy U.S. jobs report for April, a weaker dollar, and expectations of

supply cuts at the next OPEC+ meeting in June have helped stop the slide in

prices.

‘Oil's rebound follows energy stocks' comeback on Wall Street last Friday

after the U.S. reported strong job data, which eased concerns about an imminent

economic recession that led to the selloff early in the week,’ said Tina Teng,

an analyst at CMC Markets.

Forex

The dollar gave back earlier gains against the euro but stayed stronger

against the yen. Investors are pricing in the likelihood that the Fed will cut

rates in the second half of this year.

However, while the economy is slowing, there are still pockets of strength,

which is making investors hesitant to get too much more bearish on the U.S.

currency for now.

Technical analysts at JPMorgan including Jason Hunter noted on Friday that

there are bearish divergences on the daily EUR/USD chart and that the single

currency's gains have stalled, but the rally is ‘not decisively over.’

The bank said that if the euro sees sustained weakness below the $1.0909 and

$1.0831 levels, it would confirm a short-term trend reversal, while a drop below

$1.0762 ‘would imply a more significant trend reversal is in the making.’