As of May 2025, the U.S. economy continues exhibiting signs of strain, prompting debates among economists and investors about whether the nation is entering a recession. While some indicators suggest a downturn, others point to continued resilience.

Thus, the question: Are We in a Recession Right Now? This article examines the latest economic data to assess the current state of the U.S. economy.

Understanding Recession: Definition and Criteria

A recession is typically defined by two consecutive quarters of negative Gross Domestic Product (GDP) growth. However, the National Bureau of Economic Research (NBER), the official arbiter of U.S. recessions, considers a range of indicators, including employment, industrial production, and consumer spending, to determine the onset of a recession.

Key Economic Indicators

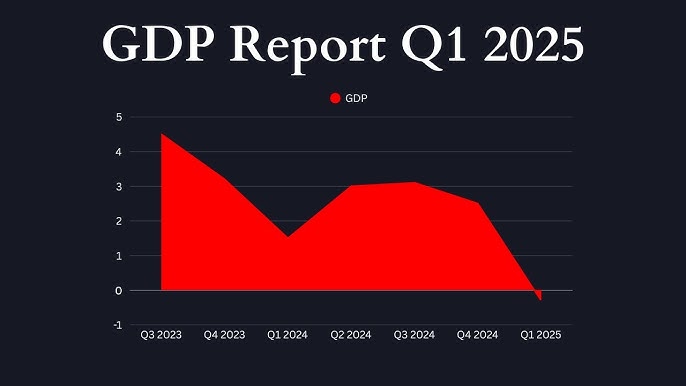

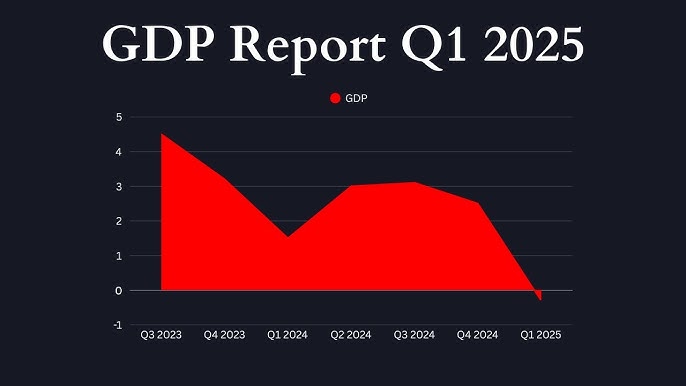

1. Gross Domestic Product (GDP)

In the first quarter of 2025, the U.S. GDP contracted at an annual rate of 0.3%, a reversal from the 2.4% growth in the previous quarter. This decline was primarily due to a surge in imports ahead of anticipated tariffs and a decrease in government spending.

However, it's important to note that a quarter of negative GDP growth does not constitute a recession. Economists typically look for two consecutive quarters of negative growth to confirm a recession.

2. Employment and Unemployment

The unemployment rate rose slightly to 4.2% in March 2025, up from previous months. While this is still considered low by historical standards, the upward trend could indicate emerging weaknesses in the labour market.

The Federal Reserve projects the unemployment rate to average 4.2% in 2025, suggesting a modest increase but not a significant spike that would typically accompany a recession.

3. Consumer Confidence and Spending

Consumer confidence has declined amid inflation concerns and high interest rates, leading to reduced spending and investment. Retail sales have shown weakness, and companies like McDonald's have reported global drops in same-store sales.

According to the latest data, retail sales are currently 1.55% below their all-time high from April 2021, indicating a slight dip but not a drastic decline. It suggests that while consumers may be more cautious, spending has not collapsed, which would be a more definitive sign of a recession.

4. Manufacturing and Industrial Production

The manufacturing and construction sectors have experienced declines, contributing to concerns about the broader economic outlook. These sectors are sensitive to interest rates and global demand, making them key indicators of economic health.

For context, Industrial production is just 0.32% below its all-time high from February 2025, and personal income remains at its peak. These indicators point to continued strength in production and income levels, which does not align with a full-blown recession.

Trade tensions and policy uncertainties have also impacted business investment. The anticipation of tariffs led to a surge in imports in early 2025, distorting GDP figures and potentially leading to a slowdown in subsequent quarters. These factors contribute to an environment of caution among businesses, potentially dampening investment and hiring.

5. Inflation and Monetary Policy

Inflation has been a persistent concern. Core inflation slowed to 2.8% over the twelve months through March 2025, down from its post-pandemic peak.

For context, inflation remains above the Federal Reserve's 2% target, driven by tariffs and supply chain disruptions. The Fed is expected to hold interest rates steady while monitoring inflation and employment trends.

While moderating inflation can be positive, it also reflects reduced consumer demand, which could signal economic cooling.

Expert Opinions and Forecasts

Economists are divided on the likelihood of a recession. Some, like Torsten Sløk, predict a high chance of a "Voluntary Trade Reset Recession" due to tariff policies.

J.P. Morgan also raised the probability of a U.S. recession in 2025 to 60%, citing various economic pressures. Moreover, the International Monetary Fund (IMF) increased the likelihood of a U.S. recession to 40%, up from 25% in its previous outlook.

Others, such as Dana Peterson and David Kelly, argue that economic fundamentals remain strong, suggesting any potential recession would be mild.

These assessments reflect growing concerns but not a consensus that a recession is underway.

Conclusion

In conclusion, based on current data, the U.S. economy is not in a recession as of May 2025. While there are signs of slowing growth and emerging risks, key indicators such as employment, consumer spending, and industrial production remain relatively strong.

However, the situation is fluid, and continued monitoring of economic indicators is essential to assess future developments.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.