The Japanese yen was on track for its best week against dollar on the

prospect of narrowing US-Japan rate differential though remaining above the

important 150 mark.

The BOJ signalled that negative interest rates could be ended at its latest

policy meeting. More specifically, spring wage talks between business and unions

will be key to the timing of an exit.

Nearly 60% of economists polled by think tank Japan Center for Economic

Research after the policy tweak expect the BOJ to tighten policy in April,

followed by 12% projecting a January move.

Warren Buffett’s Berkshire Hathaway plans to sell yen-denominated corporate

bonds for the second time this year to take advantage of low rates which could

be turned on its head later.

That being said, a widely anticipated wage-price spiral in the country is

dubious as wholesale inflation in Oct cooled more expected with the biggest

decline in 3.5 years.

Crack in economy

More challenges are underway on top of softening price pressure. Japan’s

economy likely shrank over the summer as the impact of trade kicked in.

GDP is expected to shrink at an annualised pace of 0.4% in the third quarter,

a dramatic U-turn from 4.8% growth in the second, according to economists.

That would mark the sixth quarterly contraction since spring 2022. The key

factor is more likely to be a rebound in import costs partly due to a weakening

yen.

Domestic consumption and capital outlay are seen to have been largely flat

quarter on quarter. Consumers are feeling the pitch when real wages have

declined for the 18th straight month in Oct.

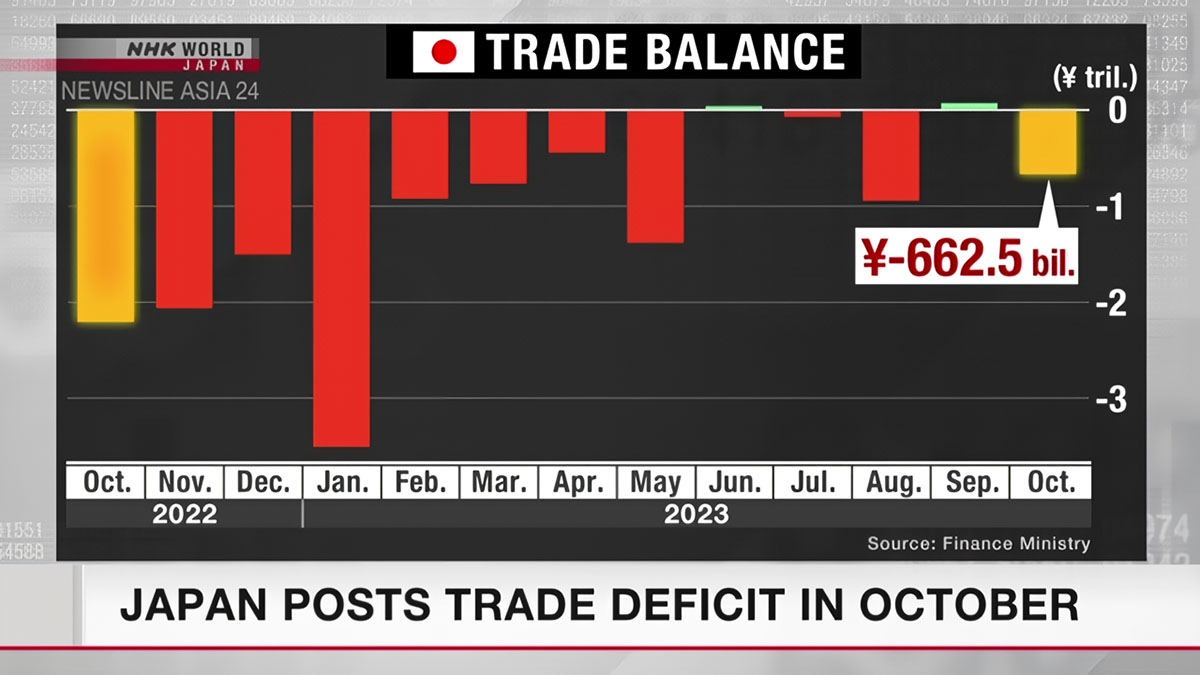

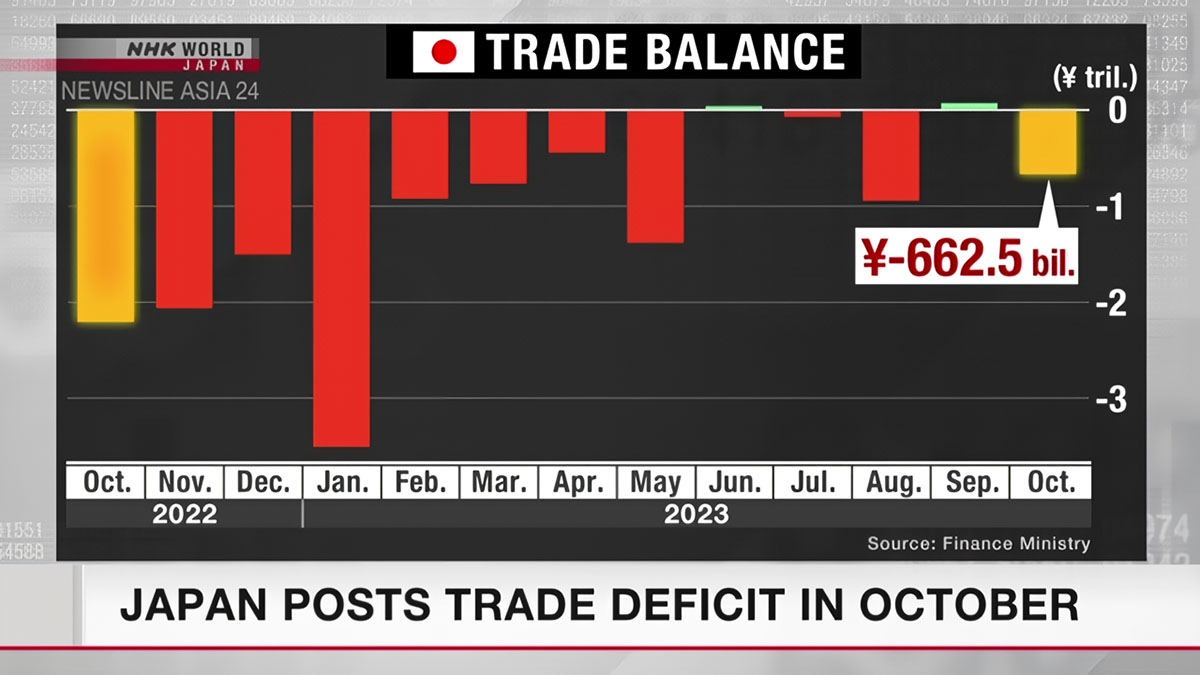

However, Japan's trade deficit last month shrank 70% from a year earlier to

662.5 billion yen as imports continued to drop sharply and exports grew for the

second straight month, government data showed.

Kazuma Kishikawa, economist at Daiwa Institute of Research, said “Japan's

trade deficit is on the mend” going forward. That may offer relief to

policymakers even if growth in the last quarter disappointed.

Japanese investors bought the most high-yielding US sovereign bonds in six

months in September while selling most other sovereign debts, according to data

released last week.

That has watered down expectations that Japanese funds will bring back their

cash to the home market on signs of policy normalisation and thus weighs on the

yen.

Rate-cut euphoria

Investors could become over-optimistic thinking that the Fed is done with

tightening although consumer prices and private sector payrolls fuelled that

sentiment.

Notably, the Atlanta Fed’s measure of “sticky” prices that don’t change as

often as items such as gas, groceries and vehicle prices, showed inflation still

climbing at a 4.9% yearly clip.

Hedge funds added to long positions for eight-straight weeks — the longest

streak in over two years, according to CFTC. Some high-profile investors argue

that the dollar’s bull run has the potential to extend.

T. Rowe Price expects growth in the US and higher interest rates versus other

major economies to support the dollar and rate cuts next year are overblown.

Fidelity International sees those higher-for-longer US interest rates risking

dragging the economy into a downturn that would benefit the greenback.

“We maintain our view of dollar resilience as we head into 2024, especially

in the face of soft global growth and relatively firm US yields,” according to

HSBC.

Other money managers cite ongoing geopolitical tensions, which will keep the

dollar bid. But Bank of America are sceptical, warning that the US currency

could be “vulnerable to a quick positioning reversal” from one of the most

crowded trades.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.