As of September 3. 2025. gold prices have reached unprecedented levels, with XAU/USD trading above $3.500 per ounce. This surge is primarily driven by market anticipations of an imminent Federal Reserve interest rate cut, a weakening U.S. dollar, and increased demand for safe-haven assets amidst global economic uncertainties.

Current Market Overview

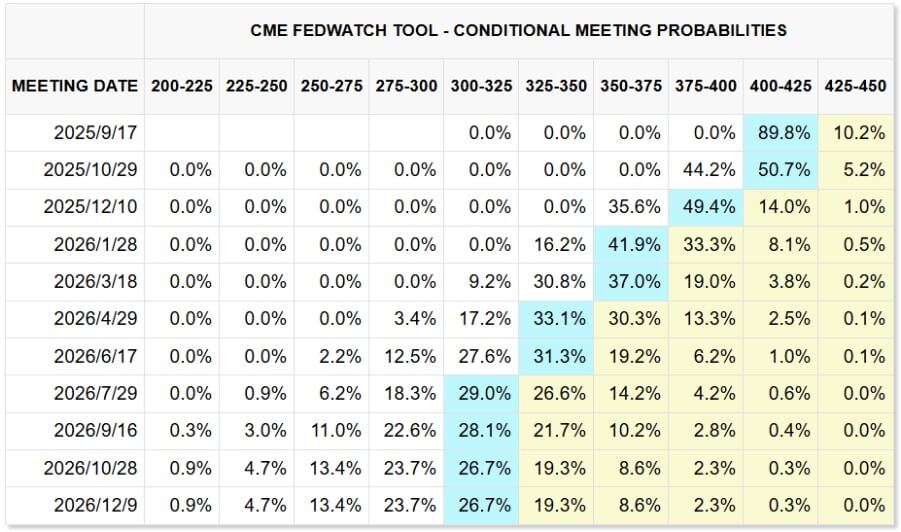

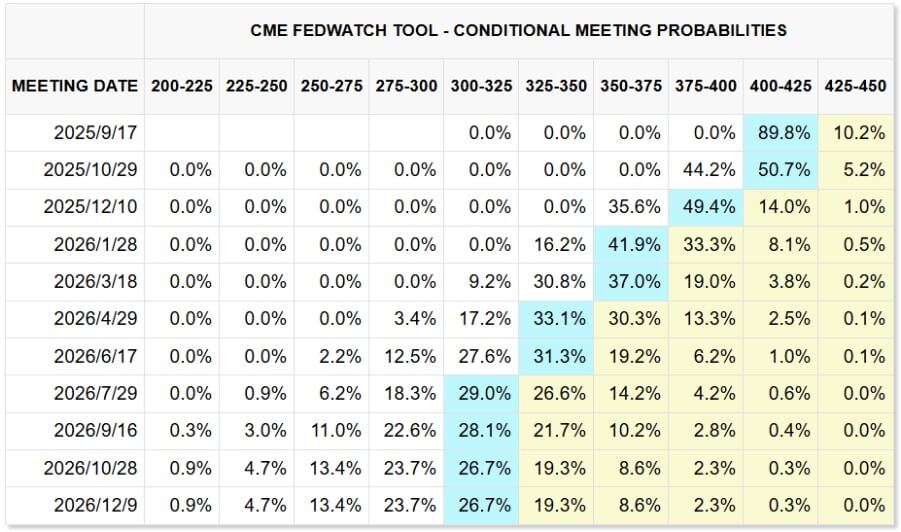

Federal Reserve Rate Cut Expectations

Market participants widely anticipate that the Federal Reserve will announce a 25-basis-point interest rate cut at its upcoming FOMC meeting scheduled for September 17. 2025.

While some analysts suggest that the probability of a rate cut may be closer to 50-50 due to strong economic indicators, the prevailing sentiment leans towards monetary easing.

Institutional Forecasts

Morgan Stanley: The bank has raised its gold price forecast for Q4 2025 to $3.800 per ounce, citing a weakening U.S. dollar, potential inflation pressures, and ongoing global uncertainty.

Technical Analysis

Technical indicators suggest that gold prices may continue their upward trajectory. The Relative Strength Index (RSI) remains in bullish territory, and gold is trading above key moving averages, indicating sustained buying pressure. Analysts forecast that XAU/USD could reach $3.615 in the near term, with potential resistance around $3.650.

Conclusion

The XAU/USD today reflects a robust bullish trend, driven by expectations of a Federal Reserve rate cut, a weakening U.S. dollar, and increased demand for gold as a safe-haven asset. Institutional forecasts suggest that gold prices may continue to rise, with potential targets ranging from $3.700 to $3.800 per ounce by the end of 2025.

Investors should monitor upcoming economic data and Federal Reserve communications for further insights into the future direction of gold prices.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.