Broadcom Inc. (NASDAQ: AVGO) executed a 10-for-1 Stock Split on July 15, 2024, marking a significant event in its corporate history. This move aimed to make the stock more accessible to a broader range of investors by reducing the share price per unit.

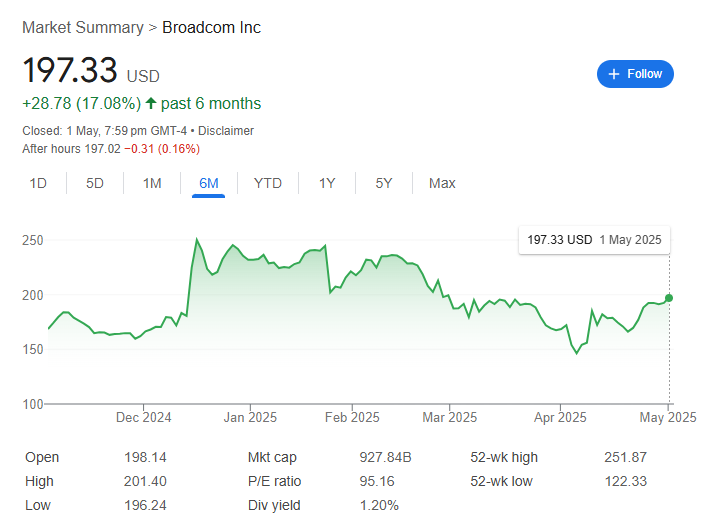

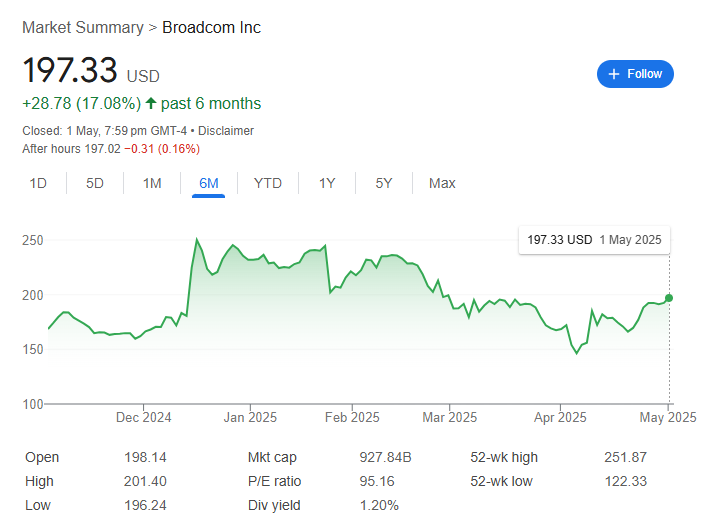

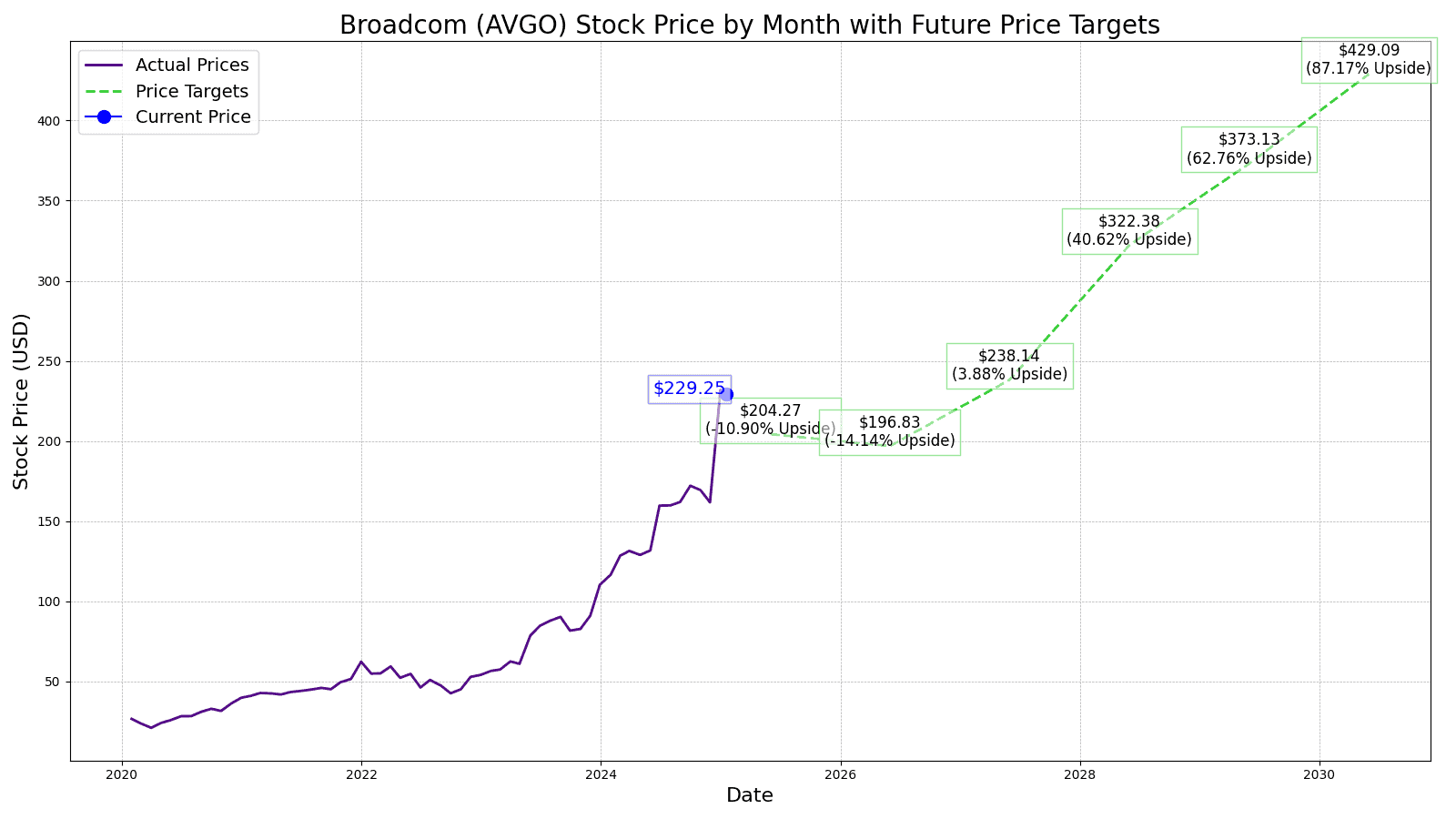

As of April 30, 2025, AVGO is trading at $191.17 per share, reflecting a robust performance post-split. Thus, investors are keen to know whether another AVGO stock split is on the horizon.

This article delves into Broadcom's stock split history, financial performance, and market trends to assess the likelihood of a subsequent split.

AVGO Stock Split History and Financial Performance Post-Split

Broadcom's history with stock splits is relatively limited. Before the 2024 split, the company had not split its stock since the 2006 3-for-2 split when it operated under the ticker BRCM. The 2024 split was significant, marking the first under the AVGO ticker since Avago Technologies acquired Broadcom in 2016.

Broadcom's financial health has remained robust following the stock split. In the fiscal fourth quarter of 2024, the company reported revenue of $14.05 billion, a 51% increase year-over-year. Net income rose to $4.32 billion, up from $3.52 billion the previous year.

A significant contributor to this growth has been the surge in AI-related revenue, which more than tripled to $12.2 billion. This boom in AI demand has positioned Broadcom as a key player in the semiconductor industry, with a market capitalisation exceeding $1 trillion as of December 2024.

Market Trends and Analyst Expectations

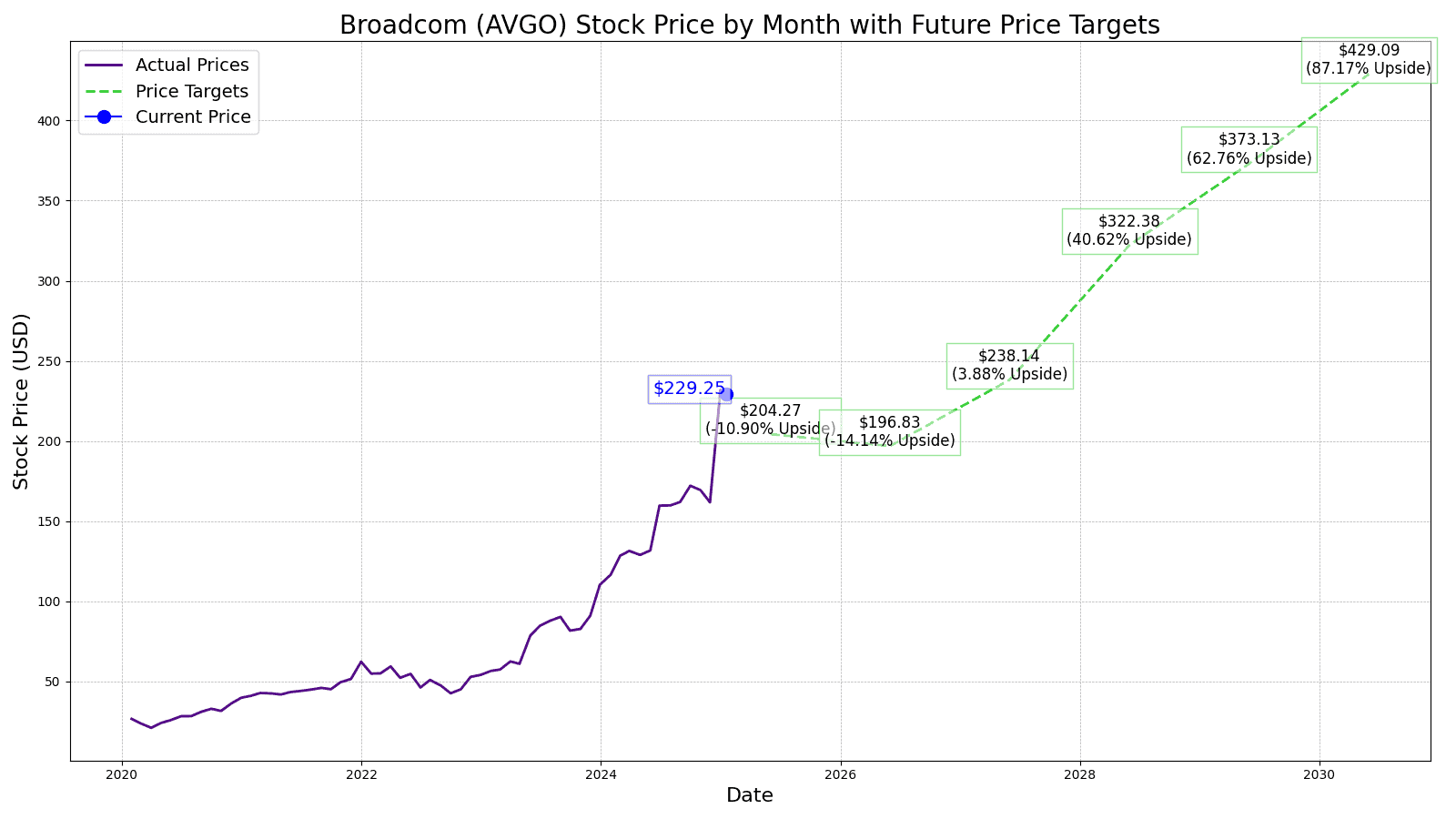

Historically, companies executing stock splits often experience positive stock performance the following year. According to Bank of America, companies see an average share price appreciation of 25.4% in the year following a stock split announcement. Broadcom's shares have increased by 3% since the June 2024 announcement, suggesting potential for further gains.

Analysts remain optimistic about Broadcom's prospects, expecting continued earnings growth driven by AI and data centre demand. The company's strategic acquisitions, such as the $69 billion purchase of VMware completed in November 2023, further bolster its market position.

Factors Influencing Potential Future Splits

Several factors could influence Broadcom's decision to consider another stock split in 2025:

Stock Price Appreciation: If AVGO's stock price rises significantly, the company might consider another split to keep shares affordable for retail investors.

Market Liquidity: A higher share count can enhance liquidity, making it easier for investors to buy and sell shares without affecting the stock price.

Investor Accessibility: Splitting the stock can make it more accessible to a broader range of investors, potentially increasing demand and supporting the stock price.

Likelihood of Another AVGO Stock Split in 2025

Analysts have noted Broadcom's impressive financial performance, particularly its AI-driven revenue growth. In fiscal 2024, the company's AI revenue soared by 220% to $12.2 billion, contributing to a total revenue of $51.6 billion. This strong performance has increased investor interest and speculation about future stock splits.

However, given the recent 10-for-1 split and the current share price hovering around $191.17, another AVGO stock split in 2025 appears unlikely.

Companies typically consider stock splits when share prices become prohibitively high, potentially deterring retail investors. With the adjusted price post-split, Broadcom's shares are now more accessible, reducing the immediate need for another split.

Furthermore, Broadcom seems focused on consolidating its recent gains and integrating its acquisitions rather than pursuing additional stock splits. The company's strong financial performance and strategic positioning suggest that it will continue to deliver value to shareholders without the need for another split in the near term.

Conclusion

Broadcom's 2024 stock split was a significant move that aligned with its growth trajectory and market dynamics. While the company's financial performance remains strong and market trends are favourable, the likelihood of another stock split in 2025 is minimal.

Regardless, investors should focus on Broadcom's continued innovation and strategic initiatives as indicators of its long-term value.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.