The Colombian peso (COP) has experienced noticeable weakness in 2025, frustrating many investors and locals alike amid economic complexities. While the peso had sporadic periods of strength earlier in the year, the overall trend has skewed toward depreciation against the U.S. dollar.

The peso's weakness in 2025 stems from a mix of factors, including rising inflation, tight central bank policy, fiscal strain, debt challenges, volatile oil revenues, a widening current account deficit, sensitive capital flows, and continued political uncertainty under President Petro's administration.

This article analyses the latest statistics and expert insights as of October 2025 to explain why the Colombian peso continues to encounter difficulties and what implications this has for the country's economy moving forward.

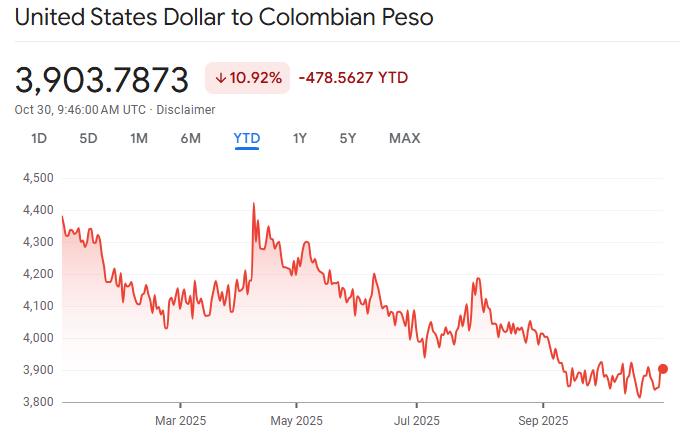

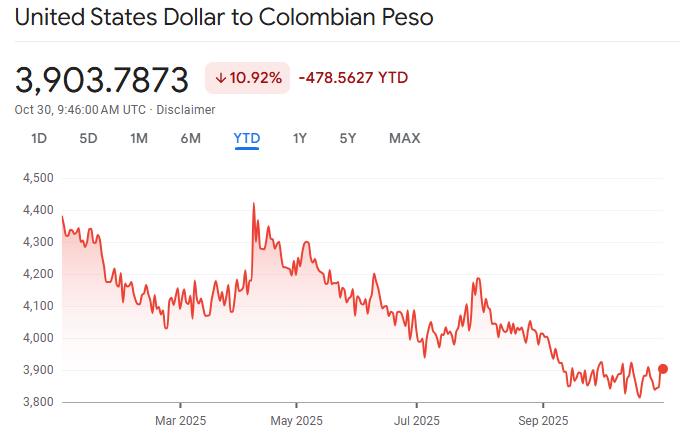

USD/COP Current Snapshot: Where We Stand Now

As of late October 2025, the USD/COP rate is trading in the roughly 3,800–3,900 range, after a period of volatility earlier in the year that pushed intraday peaks above 4,300 at times.

Over 2025, the peso has been hit by episodic sell-offs as markets priced in fiscal and political risks, commodity shocks and changes in global risk appetite. Inflation remains higher than the central bank's 3% target as headline CPI in September 2025 rose near 5.18% YoY, which keeps real-rate pressures and complicates policy easing.

At the same time, Banco de la República (BanRep) has maintained the policy rate at 9.25% (a high figure by historical Colombian standards) to combat ongoing inflation. Those high nominal rates matter for local borrowing costs and domestic demand.

Colombia's foreign-exchange reserves have recently been stable to rising, about $65.8 billion in September 2025, which gives the central bank some room to intervene if necessary.

Why Has the Colombian Peso Weakened in 2025? 6 Key Drivers

1. Fiscal Stress and Debt Operations

Colombia faces a major fiscal adjustment challenge in 2025. In October, the government executed its largest domestic debt swap on record, exchanging about 43.4 trillion pesos (around $11.2 billion) in securities to smooth maturities and lower interest costs.

While the move underscores proactive debt management, it also signals growing fiscal strain. Markets have read these large-scale operations as a sign of budget pressure.

That perception increases sovereign risk premia and can weaken the peso if foreign investors begin trimming their holdings of domestic bonds.

Why It Matters for the Peso

When governments depend on debt swaps or re-profiling instead of building stronger primary balances or securing sustainable external financing, investor confidence tends to erode.

Cautious foreign inflows reduce portfolio investment in pesos, forcing corporates and banks to absorb more local paper.

The resulting excess supply of pesos chasing dollars for imports and external payments puts downward pressure on the currency.

2. Commodity Volatility

Oil remains a cornerstone of Colombia's economy, driving fiscal revenues, foreign-exchange earnings, and the trade balance. In early 2025, Ecopetrol reported weaker profits and shrinking margins as global crude prices softened amid geopolitical uncertainty. [1]

The results underscored how closely Colombia's fiscal and export performance depend on commodity dynamics. Any sustained drop in oil prices or disruption in exports quickly reduces FX inflows and adds pressure on the peso.

Recent Data and Market Impact

Even with stable production volumes, lower Brent benchmarks or weaker realised export prices weigh on the external accounts. Conversely, any rebound in oil prices tends to strengthen the peso by easing external financing needs and improving investor sentiment.

Throughout 2025, volatility driven by shifting OPEC+ policy, uneven Chinese demand, and broader geopolitical tensions created recurring strain on Colombia's export earnings and currency stability.

3. Inflation That Stayed "Too Hot" and a High Real-Rate Policy

As mentioned above, Colombia's headline CPI remained elevated through mid-2025 and into September (≈5.18% YoY), well above the 3% central target. Core inflation components have been resilient, which kept BanRep cautious. [2]

The persistent inflation gap relative to trading partners erodes real returns on domestic assets, strains household purchasing power, fuels political discontent, and complicates the path toward monetary easing.

Policy Reaction

To curb inflation, BanRep kept the policy rate unchanged at 9.25 per cent as of October 2025, a restrictive level aimed at dampening demand and anchoring prices.

While elevated rates can attract carry trades and temporarily bolster the peso, they also raise debt-servicing costs, slow economic momentum, and worsen fiscal dynamics if public borrowing expenses rise.

The net result is a policy trade-off that often leaves the currency volatile: supportive in the short run, but vulnerable to the drag from weaker growth and fiscal pressure.

4. External Deficits & Capital Flow Sensitivity

Research and central bank commentary indicate that Colombia's current-account deficit widened in 2025 as robust domestic demand fueled higher imports while export growth remained modest. This structural imbalance persists in fueling steady dollar demand for trade dealings.

BBVA's analysis highlighted that the surge in imports has further widened the trade gap this year. When a country runs a persistent current-account deficit, it must finance that shortfall through foreign direct investment, portfolio inflows, or reserve drawdowns.

If those financing sources slow, the currency typically comes under pressure, as weaker inflows fail to offset external payment needs.

Portfolio Flows & Risk Appetite

2025 saw heightened sensitivity of international investors to both geopolitical headlines and domestic fiscal signals (cabinet churn, legislative fights).

Risk-off moves in global markets produce swift withdrawals from EM bond and equity funds; for Colombia, that means fewer dollars coming into local markets and more pressure on COP.

Reuters and FT reporting on political turbulence and investor caution reflect exactly this dynamic. [3]

5. Politics and Policy Uncertainty

In 2025, Colombia experienced political unrest characterised by cabinet departures, disputed reforms, strikes, and major protests, underscoring a phase of governance instability.

High-profile events (e.g., suspensions of certain decrees, labour reform disputes, mass demonstrations) raise uncertainty around policy continuity.

That increases the country risk premium for foreign investors and can accelerate capital outflows or reduce new investment.

Elections on the horizon.

Colombia's 2026 elections began to influence 2025 policy choices and investor expectations (legislative and presidential timetables, reform agendas).

Electoral cycles often raise uncertainty in EM FX as markets dislike policy pivot risk and may demand a premium to hold local assets through noisy political seasons.

6. Remittances and Other Stabilisers

Remittances have risen sharply in 2025, becoming a key source of foreign currency for Colombia. The sustained increase in inflows has helped finance part of the country's external deficit, partially offsetting weaker export earnings and portfolio flows.

BBVA and BanRep analyses both emphasise a notable remittance increase in 2025 (remittances grew over 14% year-on-year mid-2025), which cushions FX needs and supports household demand. While helpful, remittances are not a full substitute for higher export receipts or stable FDI.

What's Next for the Colombian Peso?

Short to Medium Term (Rest of 2025 and 2026)

Analysts expect a gradual peso depreciation continuing through 2025, possibly reaching COP 4,100–4,150 per dollar.

Inflation is projected to ease gradually to around 4.0–4.5% in 2026, creating room for measured central bank rate cuts from 9.25% to roughly 8.0%.

Economic growth is projected to remain moderate at around 2.5% in 2025, restricting potential for swift peso appreciation without significant structural reforms.

Long-Term Outlook

Sustained peso stability will depend on deep structural changes emphasising fiscal discipline, anti-corruption efforts, stronger security, and broader trade diversification.

Expanding exports beyond oil and enhancing the overall business climate will be crucial for boosting foreign investment trust and minimising fluctuations in external financing.

What Traders and Investors Should Monitor Next

Oil & Ecopetrol updates.

BanRep announcements & minutes

FX reserves & central-bank FX intervention flows

SOMO/export receipts and trade balance releases

Debt operations & fiscal calendar

Political headlines & election calendar

Portfolio flows & EM sentiment

Frequently Asked Questions

Q1: Why Is the Colombian Peso Weak Despite Inflation Easing?

Inflation remains above target, fiscal concerns persist, and external pressures continue to weigh on the peso, despite occasional signs of relief.

Q2: Can the Peso Strengthen Quickly?

Rapid strength is unlikely without major reform, political stability, or a significant external shock favouring Colombia.

Q3: Is Colombia About to Default or Run Out of Reserves?

No, reserves were about $65.8bn in Sep 2025, and the government is actively managing maturities (debt swaps).

Q4: Will Banrep Cut Rates Soon to Help Growth?

Not yet. BanRep maintained the policy rate at 9.25% in a split vote in September/October 2025 because inflation remained elevated.

Conclusion

In conclusion, the Colombian peso's weakness in 2025 results from a complex interplay. While short-term depreciation is expected to continue, a path to gradual recovery exists if Colombia undertakes serious economic reforms and global conditions stabilise.

Investors should carefully monitor inflation data, central bank moves, oil price trends, and political developments, as these remain the primary levers influencing the peso's future.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/americas/colombia-carries-out-largest-domestic-debt-swap-history-112-billion-2025-10-09/

[2] https://www.reuters.com/business/energy/colombias-ecopetrol-posts-22-profit-drop-q1-2025-05-06/

[3] https://www.ft.com/content/28b9598b-74a2-4903-a726-25a70ca1e115