Edwin Lefèvre stands at the crossroads of finance and literature. His best‑known work manages to capture the volatile heart of speculation while delivering narrative drama that reads like fiction.

Through his writing, he transformed market anecdotes into timeless lessons about human behaviour, risk, and reward. In doing so, he became more than a chronicler of Wall Street, becoming a philosopher of the marketplace.

Early Life of Edwin Lefèvre from Panama to America

Edwin Lefèvre was born George Edwin Henry Lefèvre on 23 January 1871 in Colón, then part of Colombia, now in Panama. His father, Henry Lefèvre, originally from the Channel Islands, worked for the Pacific Steamship Company in Panama.

As a boy Edwin was sent to the United States for education, where he trained in mining engineering at Lehigh University. At the age of nineteen he abandoned the engineering path and entered journalism, setting the stage for his lifelong interest in financial markets.

Those early experiences provided him with a grounding in both technical and observational skills. The discipline of engineering, the global exposure in Panama, and then the oral narrative work of journalism all came together in his later financial writings.

Edwin Lefèvre's Career Trajectory: Journalist, Broker, Diplomat

Edwin Lefèvre's career was marked by heterogeneity. He first worked as a commodity price‑collector and financial journalist for newspapers in New York in the 1890s.

He then moved into the world of brokerage, becoming an independent investor after inheriting wealth from his father. In 1909 he was appointed by Panama as ambassador to Spain and Italy, an unusual detour that broadened his worldview.

| Year |

Role |

Significance |

| ~1890s |

Journalist |

Covered commodity prices, honed descriptive skills |

| Early 1900s |

Stockbroker / Investor |

Gained firsthand trading experience |

| 1909 |

Diplomat (Panama→Spain/Italy) |

Enriched perspective beyond US markets |

This journey from reporter to trader to diplomat gave Lefèvre a rare vantage point: he saw markets from within, but also examined them from the outside.

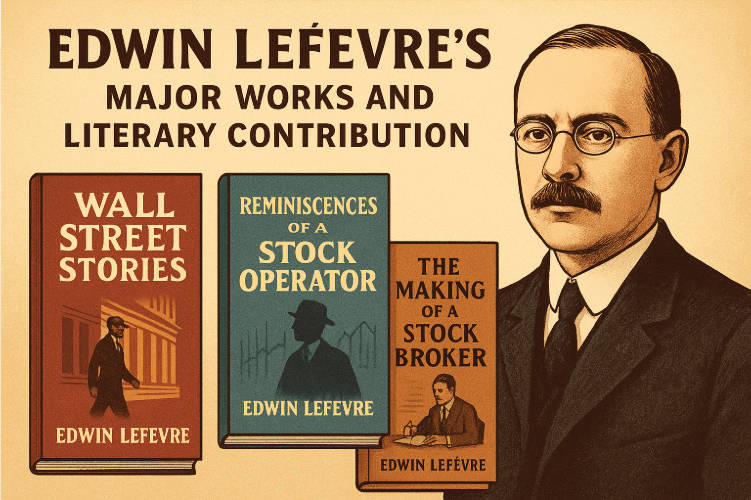

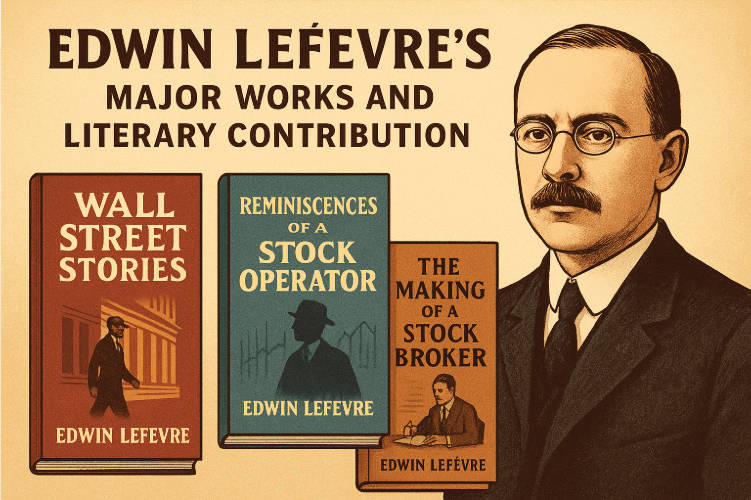

Edwin Lefèvre's Major Works and Literary Contribution

Edwin Lefèvre's output includes short story collections, novels, and non‑fiction, with a recurring theme of money, power and risk.

Wall Street Stories (1901) was his first collection of short stories about financial life.

He later published novels such as Golden Flood (1905) and Sampson Rock of Wall Street (1907).

His landmark work, Reminiscences of a Stock Operator (1923), is written in first‑person narrative, loosely based on the life of trader Jesse Livermore.

In 1925 he published The Making of a Stockbroker, a more factual biography of John K. Wing.

| Title |

Type |

Key Contribution |

| Wall Street Stories |

Short stories |

Early depiction of financial life in narrative form |

| Reminiscences of a Stock Operator |

Fiction/biog |

Classic of investor psychology and speculative behaviour |

| The Making of a Stockbroker |

Biography |

Insights into a real‑world brokerage career |

Lefèvre fused narrative art with market insight, allowing readers to engage emotionally with the trader's journey rather than simply read analytical text.

Trading Philosophy through the Lens of Edwin Lefèvre

Lefèvre's writings go beyond storytelling: they distil enduring truths about speculation and investing.

He emphasised that success in markets does not stem merely from being correct but from sitting tight, showing discipline and humility.

Some of his famous maxims include:

In summary, Lefèvre's philosophy can be summarised as: understand market patterns, but understand yourself even more; risk management sits at the core; and the most valuable lessons are often learned from losses.

Personal Life of Edwin Lefèvre: The Man Behind the Pen

Away from the hustle of Wall Street, Edwin Lefèvre lived a quieter life in East Dorset, Vermont, where he resided after 1908 with his wife Martha and their sons. He balanced his life as a writer and investor with a love for rural tranquillity. His diplomatic tenure, international upbringing and broad interests enriched his writing beyond pure finance.

He passed away in 1943 in Vermont, leaving behind a home listed on the U.S. National Register of Historic Places. His blend of lived experience and narrative gift ensured that his legacy would outlast his lifetime.

Legacy of Edwin Lefèvre: Influence on Modern Investing Culture

Today, Edwin Lefèvre's influence is felt every time a trader quotes "sit tight" or reflects on the psychology of speculation. His book Reminiscences of a Stock Operator has been continuously republished and remains a staple of trading education.

Modern behavioural finance owes a debt to his observations about instinct, greed, fear and discipline. He made the case that markets are not mechanistic systems but arenas of human emotion, a viewpoint that resonates in today's markets just as much as in his era.

Criticisms and Controversies Surrounding Edwin Lefèvre

While widely revered, Lefèvre's work is not without criticism. Some scholars debate the level of factual accuracy in Reminiscences of a Stock Operator: the lines between biography and fiction are blurred.

Others point out that his portrayal of speculation risks glamourising high‑stakes market play. From a literary perspective his style is sometimes seen as romanticised rather than strictly analytical.

Nonetheless these criticisms underscore the complexity of his work rather than diminish its significance.

Conclusion

Edwin Lefèvre crafted more than stories about money. He crafted narratives about human beings in the swirl of markets: their hopes, fears, impulsive decisions and ultimate reckonings.

For investors, writers and students of psychology alike his work remains a compelling blend of entertainment and instruction. In an era of algorithmic trading and automated systems his insistence that the greatest market variable is the human one rings perhaps more true than ever.

Frequently Asked Questions

Q1: Who was Edwin Lefèvre and why is he notable?

Edwin Lefèvre was a journalist, novelist and investor whose work, especially Reminiscences of a Stock Operator, transformed financial writing into narrative art and embedded trading lessons in story‑form.

Q2: Is Reminiscences of a Stock Operator based on a true story?

The book is a semi‑fictionalised biography strongly inspired by the life of trader Jesse Livermore, blending fact and narrative for illustrative effect.

Q3: What other significant works did Edwin Lefèvre produce besides Reminiscences?

He wrote Wall Street Stories, Golden Flood, Sampson Rock of Wall Street and The Making of a Stockbroker, among other novels and short‑story collections.

Q4: How did Edwin Lefèvre's own trading experience shape his writing?

Having worked as a broker and investor, Lefèvre drew on first‑hand market exposure and psychology to enrich his narratives with authenticity and insight.

Q5: Why does Edwin Lefèvre's work remain relevant today?

His writings address human traits such as greed, fear and discipline which remain unchanged in markets, making his lessons evergreen in both calm and turbulent times.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.