China's inflation rate is a key economic indicator, not just for the world's second-largest economy but for global markets as well. As of May 2025, China stands out for its notably low inflation, especially compared to other major economies.

This article explains the latest trends in China's inflation rate, what's driving them, and why they matter for consumers, investors, and businesses.

What Is the Current Inflation Rate in China?

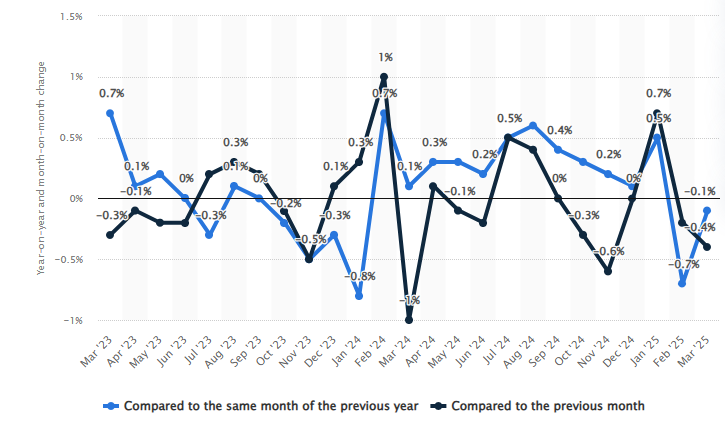

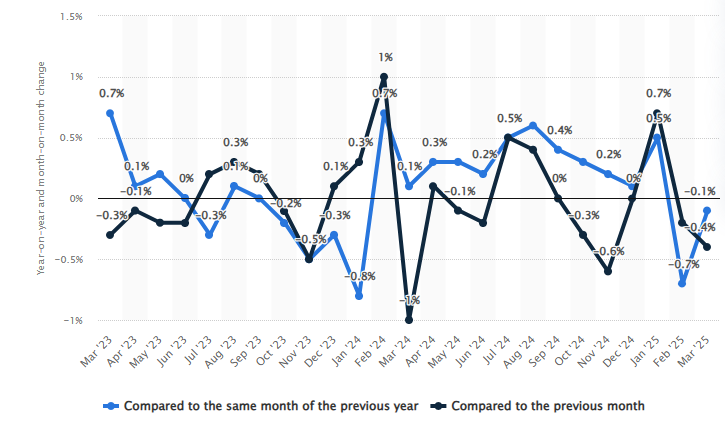

As of March 2025, China's inflation rate was -0.10% year-on-year, according to the National Bureau of Statistics of China. This means that, on average, prices were slightly lower than a year earlier.

This follows a period of very low inflation in 2024, when the annual average was about 0.2%. Monthly figures show that inflation has hovered around zero or even dipped into negative territory several times since late 2023.

How Is Inflation Measured in China?

China's inflation rate is calculated using the Consumer Price Index (CPI). The CPI tracks the price changes of a basket of goods and services that an average Chinese consumer buys, including:

Food (31.8% of the CPI basket)

Housing (17.2%)

Recreation, education, and culture (13.8%)

Transport and communication (10%)

Healthcare (9.6%)

Clothing (8.5%)

Household goods and services (5.6%)

Tobacco, liquor, and other items (3.5%)

The basket is reviewed and updated every five years to reflect changing consumer habits and economic development.

Why Is China's Inflation So Low in 2025?

Several factors are contributing to China's unusually low inflation in 2025:

Weak Consumer Demand: Despite government stimulus, consumer spending has struggled to rebound strongly after the pandemic and amid ongoing trade tensions with the US.

Food Prices: Food prices, especially pork and fresh fruit, have shown only mild increases or even declines, helping to keep overall inflation subdued.

Falling Transport Costs: Transport costs have continued to decline, putting further downward pressure on the CPI.

Global Factors: China's export-focused economy is sensitive to global demand. Slower growth in major trading partners and ongoing trade disputes have limited price increases.

Regional Differences in Inflation

Inflation in China varies by region. For example, Tibet saw the highest CPI growth in early 2025, while Beijing reported the lowest. Rural areas often experience slightly higher inflation than cities, mainly due to differences in food and service prices.

How Does China's Inflation Compare Globally?

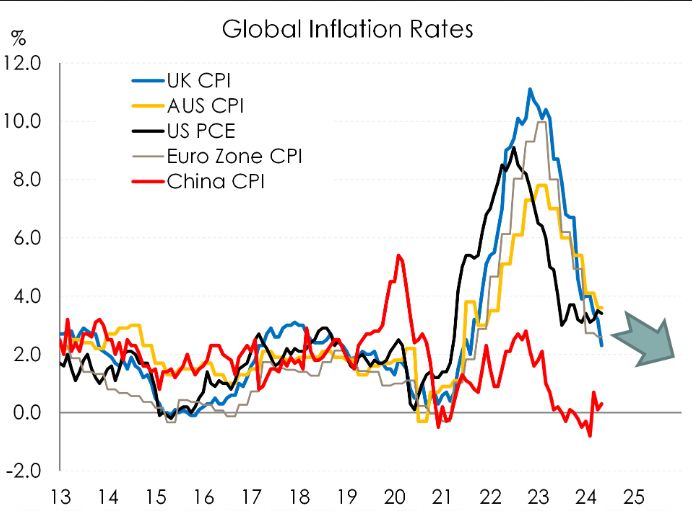

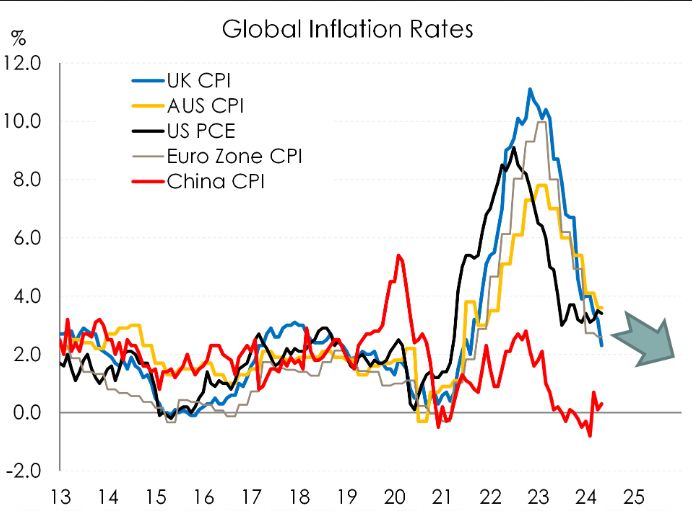

China's inflation rate is currently much lower than in most other major economies. In 2023 and 2024, inflation in the US and Europe rose quickly, while China's prices remained relatively stable or even fell.

For context, Zimbabwe had the world's highest inflation in 2024 (over 500%), while Turkmenistan saw the lowest, with prices dropping by about 1.7%.

What Are the Risks and Outlook for 2025?

Risks

Deflation: Prolonged periods of falling prices (deflation) can hurt economic growth, as consumers and businesses delay spending in anticipation of lower prices.

Real Estate Market: China's real estate sector remains a risk, with only marginal rebounds in housing prices and continued weakness in other property indicators.

Trade Disputes: The ongoing China-US trade war continues to affect consumer and producer prices, adding uncertainty to the inflation outlook.

Outlook

The IMF projects China's inflation rate to rise to about 1.7% in 2025, but so far, inflation remains subdued.

Government stimulus and supportive monetary policy may help lift prices modestly in the second half of the year.

Why Does China's Inflation Rate Matter?

For Consumers: Low inflation means stable or even falling prices for everyday goods, but it can also signal weak economic growth and job creation.

For Investors: China's inflation trends affect global markets, commodity prices, and the performance of companies with exposure to China.

For Policymakers: Managing inflation is crucial for economic stability. Too little inflation can be as problematic as too much, especially for a country aiming for steady growth.

Final Thoughts

China's inflation rate is remarkably low in 2025, with prices slightly below last year's levels and well below the global average. This reflects a mix of subdued consumer demand, falling transport costs, and ongoing economic challenges. While low inflation benefits consumers in the short term, persistent weakness could pose risks to growth and stability.

As China continues to implement stimulus and adapt to global trends, its inflation rate will remain a closely watched signal for the health of the world’s second-largest economy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.