The US dollar rebounded from a 3-1/2-year low on Thursday after the Fed

lowered interest rates by 25 bps as expected. Meanwhile, the Australian dollar

fell following the latest data release.

Australian employment unexpectedly fell in August as full-time positions

slipped after a sharp rise in the previous month, while the jobless rate held

steady in a sign of cooling labour market.

The RBA would likely skip a move in interest rates this month, with a cut in

November about 75% priced. Some of the Big Four down under are considering mass

redundancy programmes.

The New Zealand dollar also tumbled after data showed the country's economy

shrank far more than expected in Q2. Slowing export volumes largely offset

middling growth in private spending.

Westpac changed its call for the RBNZ's meeting next month to a half-point

cut from a quarter-point reduction. The central bank has largely kept the door

open for more monetary loosening.

So far in 2025, precious and industrial metals have led the charge, while

energy markets, though volatile, have avoided outright collapse. That helps push

the relate currencies higher.

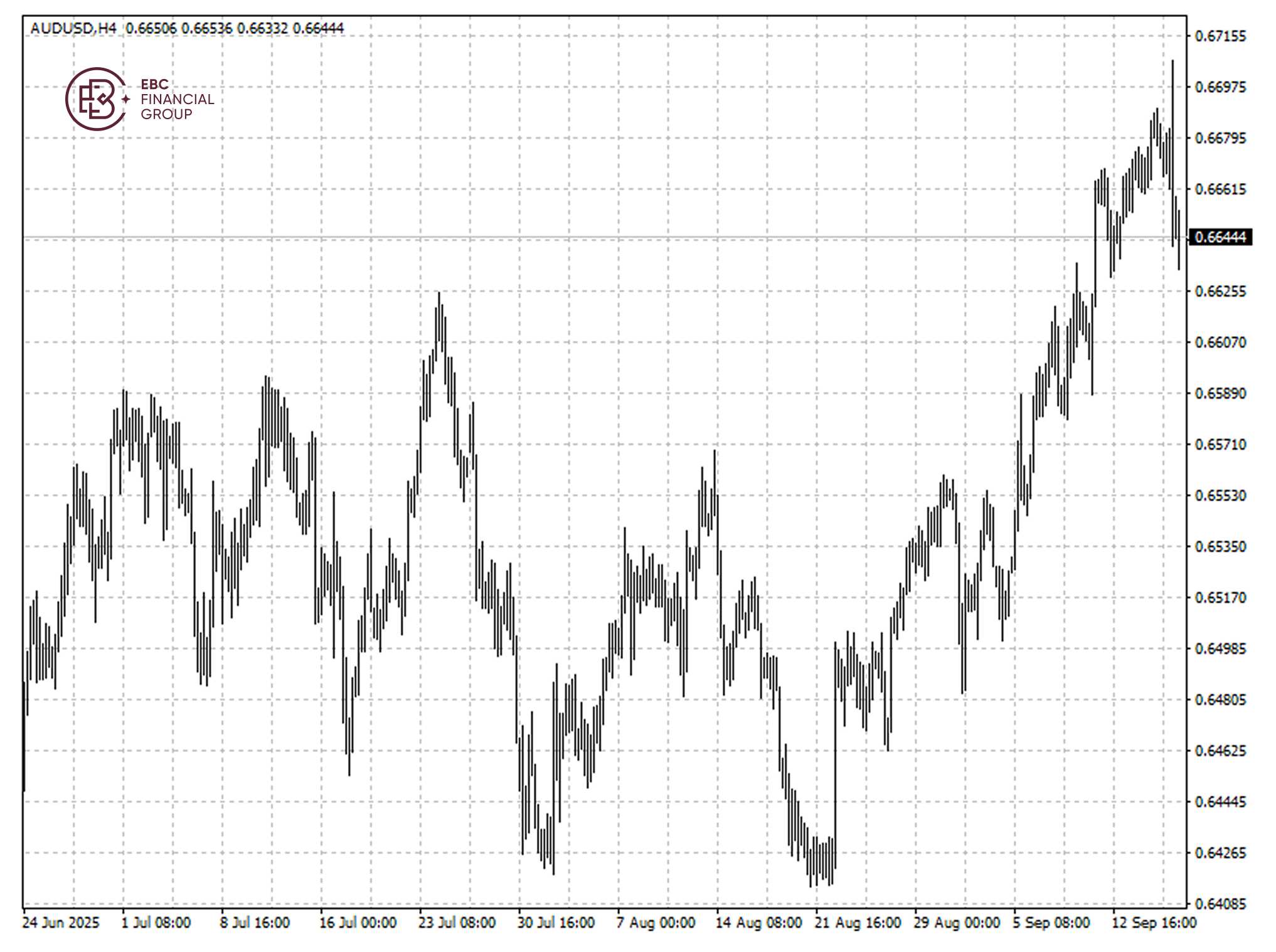

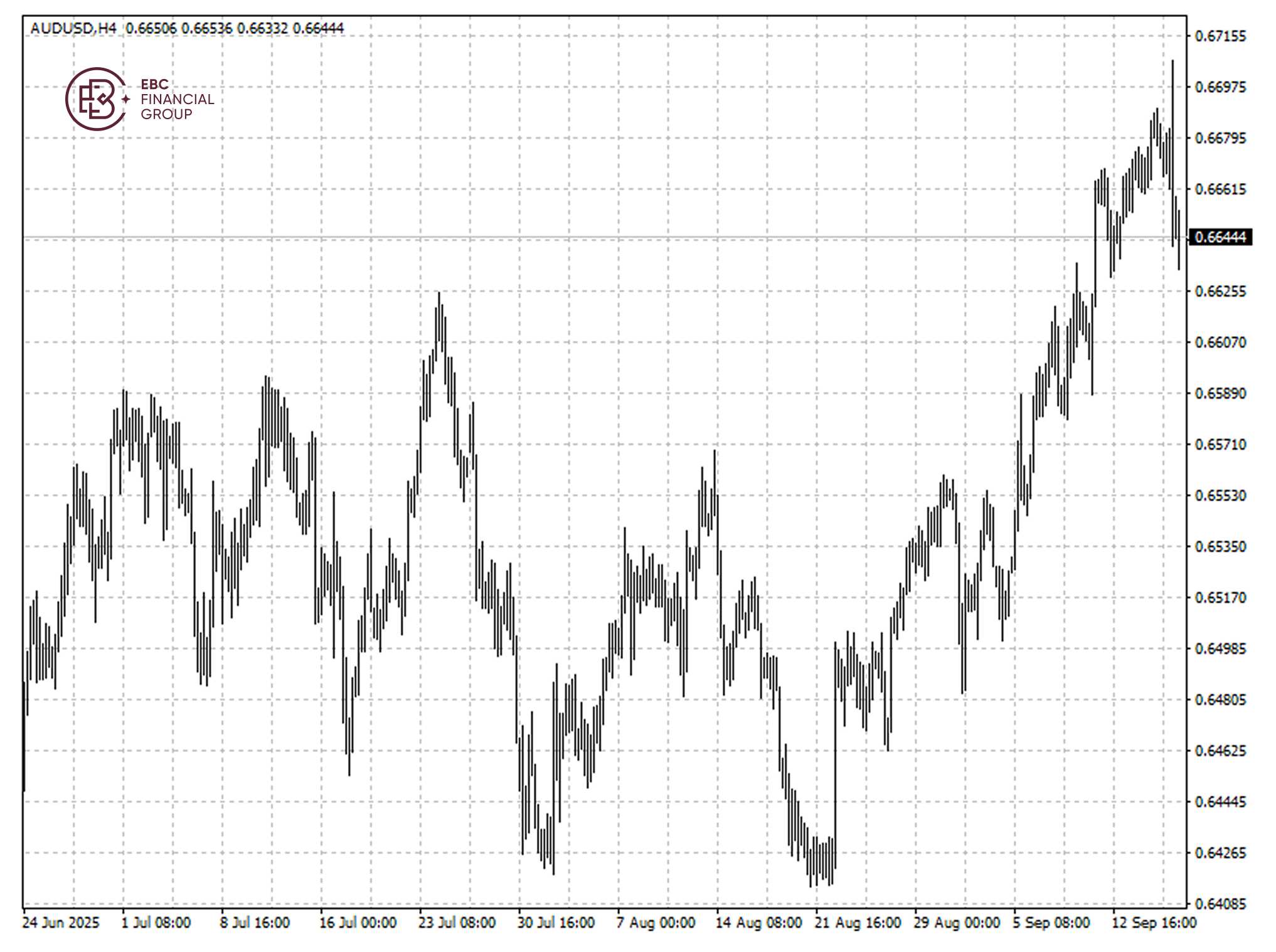

The Australian dollar slid towards the neckline of 0.6630 after a head and

shoulders pattern was formed. The next support of 0.6620 will be exposed if the

downside momentum stays.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.