Wall Street stocks ended sharply lower on Friday, with selloffs in Amazon, Microsoft and other technology heavyweights, after US data stoked fears of weak economic growth and high inflation.

Consumer spending rebounded less than expected in February, while a University of Michigan survey showed consumers'12-month inflation expectations soared to the highest in nearly 2.5 years in March.

Individual investors have pumped almost $70bn into US stocks this year even as professional money managers are slashing their exposure to the market, underlining their divergent views on outlook.

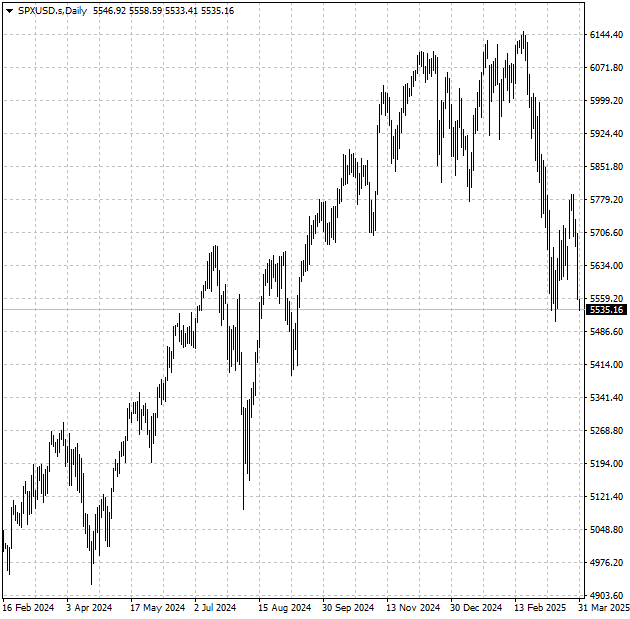

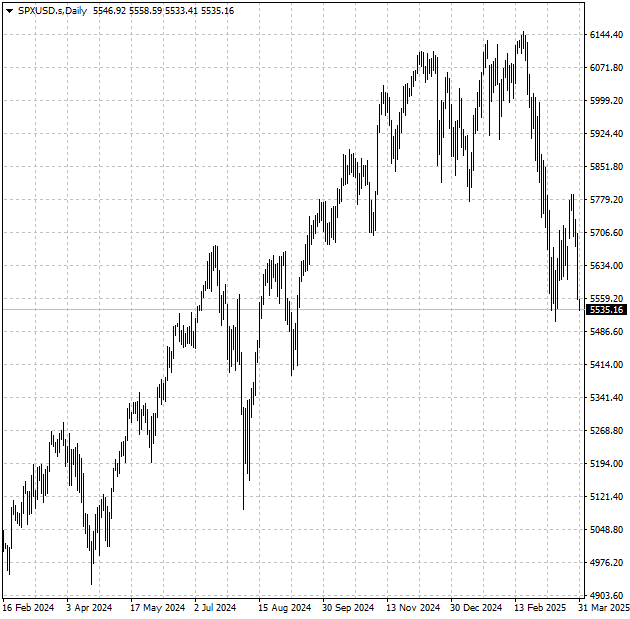

Barclays on Wednesday became the latest brokerage after Goldman Sachs and RBC Capital Markets to slash its year-end target for the S&P 500, expecting it to be at 5,900 from 6,600.

The bank's base case for tariffs assumes"no further escalation of China tariffs, Trump's aims for Canada and Mexico tariffs are primarily political"and reciprocal tariffs amount to 5% on rest of the world.

Trump said in an interview last week that he"couldn't care less"if carmakers raised prices after he announced he would impose 25% tariffs on car imports. He also said the tariffs would be permanent.

The S&P 500's rally since mid-March snapped with the support likely lying at the bottom around 5,510. If the level is breached, the index could fall further towards 5,400.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.