Asian shares and bond yields sank on Friday while safe-haven assets surged

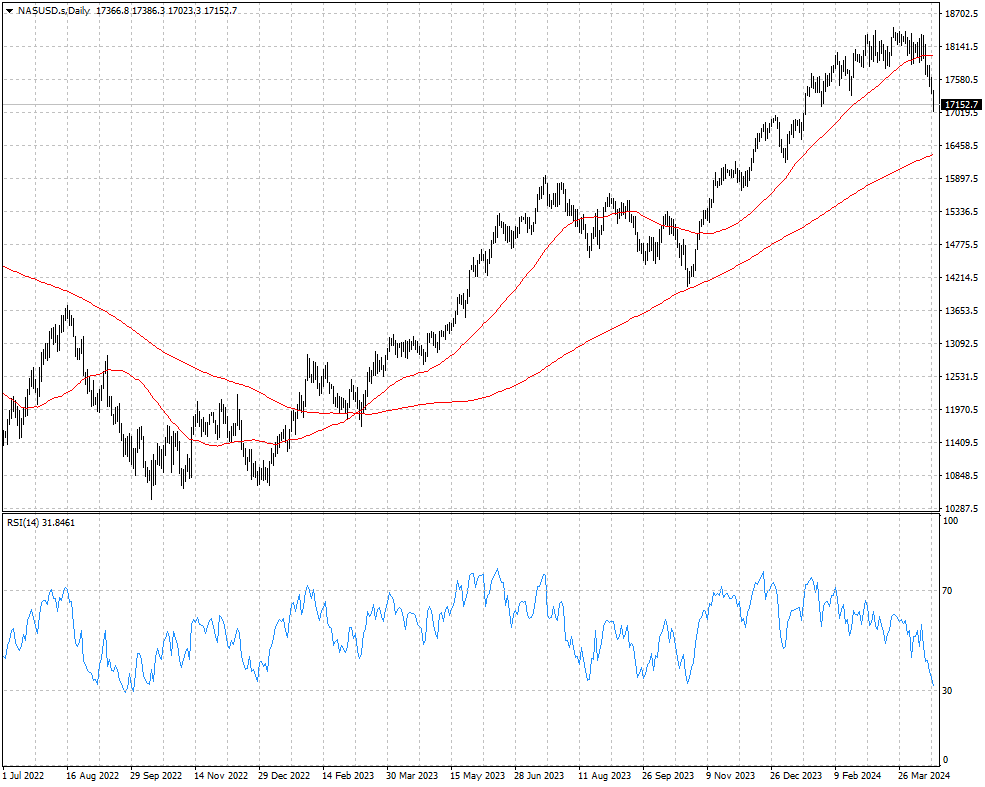

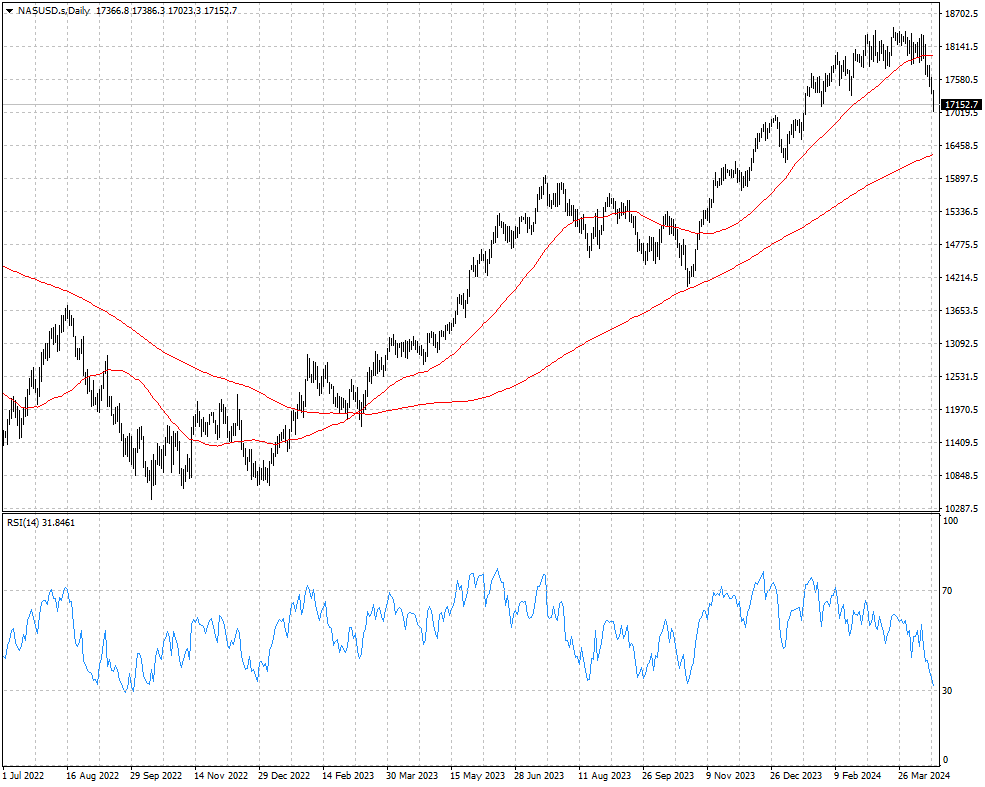

after reports of a sharp escalation in Middle East hostilities. The Nasdaq 100

fell for its fourth drop in the last five sessions.

A Reuters poll of 100 economists indicated the Fed will implement its first

rate cut in September. Fed Chair Jerome Powell declined to provide guidance on

the timing earlier this week.

The VIX index hit 19.6, its highest since20 Oct, as market has been rocked by

the confrontation between Israel and Iran. The upswing makes it costly to hedge

portfolios against gyrations.

Some investors have warned that the current level of AI chip demand is

unsustainable over the long run. The sector has been hit by concerns over

delayed interest rate cuts by the Fed.

A gauge of global chip stocks has fallen together into a technical correction

– a sign of peak AI frenzy. The Philadelphia Semiconductor was down more than 8%

in the week ending 18 Apr.

TSMC beat revenue and profit expectations in Q1, thanks to continued strong

demand for advanced chips, but the company scaled back its outlook for a chip

market expansion amid weak smartphone and PC sales.

The Nasdaq 100 has been in freefall since mid-April and closed profoundly

below the 50 SMA. The 200 SMA may provide a major support level. A slight rally

could be around the corner as RSI is close to oversold.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.